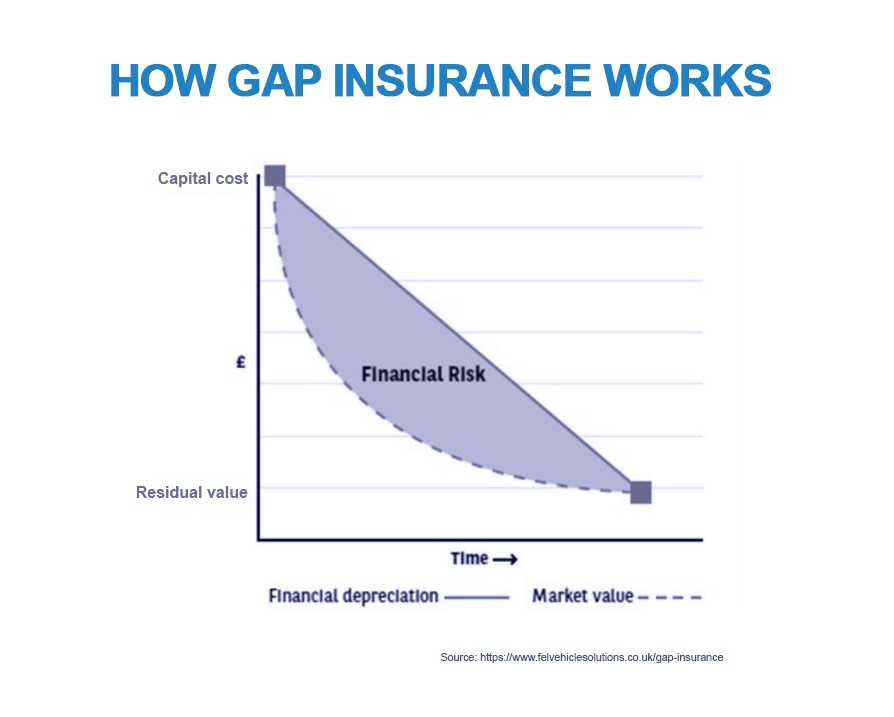

The Financial Conduct Authority (FCA), the regulatory body tasked with policing the UK’s financial services industry, has been in the spotlight recently for its focus on motor GAP insurance. GAP (Guaranteed Asset Protection) insurance, known in the US as Guaranteed Auto Protection, is an adjunct to motor cover that insures the difference between a vehicle’s purchase price or outstanding finance, and its market value at the time of being written off.

However, it has recently come to the attention of the FCA that GAP insurance might not be giving consumers fair value. One of the reasons GAP insurance has attracted the regulator’s attention is that it has discovered a sizeable discrepancy, from the FCA’s perspective, in the ratio of claims value to premium income. Its data claims to show that only 6% of premiums revenue is paid out in claims, compared to a figure of around 65% for motor insurance. According to professional services firm Grant Thornton, the FCA also claimed last year that some firms paid almost three-quarters of the value of premiums revenue as commission to third-party brokers.[1] As a result of the FCA’s investigation, some 8 in 10 firms involved in the sale of IGAP insurance were given little option but to pause sales in February 2024 at the FCA’s request.

Increasing regulation and closer scrutiny

New powers for the FCA derived from the Financial Services & Markets Act 2000 (FSMA) include the so-called Consumer Duty, which compels providers to deliver good outcomes for retail customers. As the FCA notes, “firms are required to comply with the Duty’s cross-cutting rules by acting in good faith towards customers…This requires firms to be proactive in delivering good customer outcomes – rather than waiting for us to intervene”.[2]

The GAP market, it should be noted, has likely not been singled out for special attention. All financial services firms will be subject to increased levels of scrutiny under the FCA Consumer Duty, and as Grant Thornton points out, this heightened level of scrutiny will not begin and end with GAP insurance; excess protection and other adjuncts to traditional cover are also attracting the attention of the FCA’s Supervision teams.

The JENOA view

The UK market is estimated to be worth around GBP 150 million to GBP 200 million annually, which represents a small portion of the total value of the UK’s GBP 27 billion motor insurance market. Nevertheless, there is clearly room for growth. In fact, according to data from Intelligent Motoring from March 2025, 90% of dealers no longer offer GAP cover for sale.[3]

The FCA’s investigation may have been based on an incomplete analysis of available data. As discussed above, according to the FCA, only 6% of premiums were returned in claims, but that figure appears accurate only for year one of a policy that is, in reality, often a three, four or five-year policy. As managing director of GAP provider AMS Insurance, Paul Fuller, notes, “as you roll [GAP policies] out, there will be more claims to pay”. In fact, the GAP provider’s own data shows that for stand-alone GAP insurance, the figure was not 6%, but over 63%, with the average claims payout some 8x higher than the FCA claimed in its ‘fair value measures[4]’ report. Whilst it is important to note that these figures are from just one provider’s performance, Fuller claims that after consultation with a number of other GAP providers, “their numbers are aligned to ours”.

It is fair to say that, despite last year’s furore and risk to industry jobs, the FCA investigation has resulted in some positive outcomes. Underperforming GAP providers are now more transparent in commission disclosures, and the industry as a whole now offers consumers even better value.[5] Nevertheless, as Paul Fuller notes, just because some distributors may have been receiving high commission rates, the FCA’s sledgehammer to the GAP market’s nut was unnecessarily excessive. “There are numerous distribution channels, “Fuller said, “why close the whole market?”. High commission rates and skewed figures, he argues, were no justification for shutting down an entire market, putting people’s jobs at risk, businesses at risk and ultimately leaving consumers with no GAP protection.

Where is the evidence of a return to growth? Intelligent Motoring’s chief executive, Duncan McClure Fisher, argues that the “critical protection” that GAP cover provides is amply demonstrated by the fact that claims payouts are now back to GBP 20,000 – GBP 30,000, with evidence of new consumer demand for GAP products as consumers search for a much-needed financial safety net.

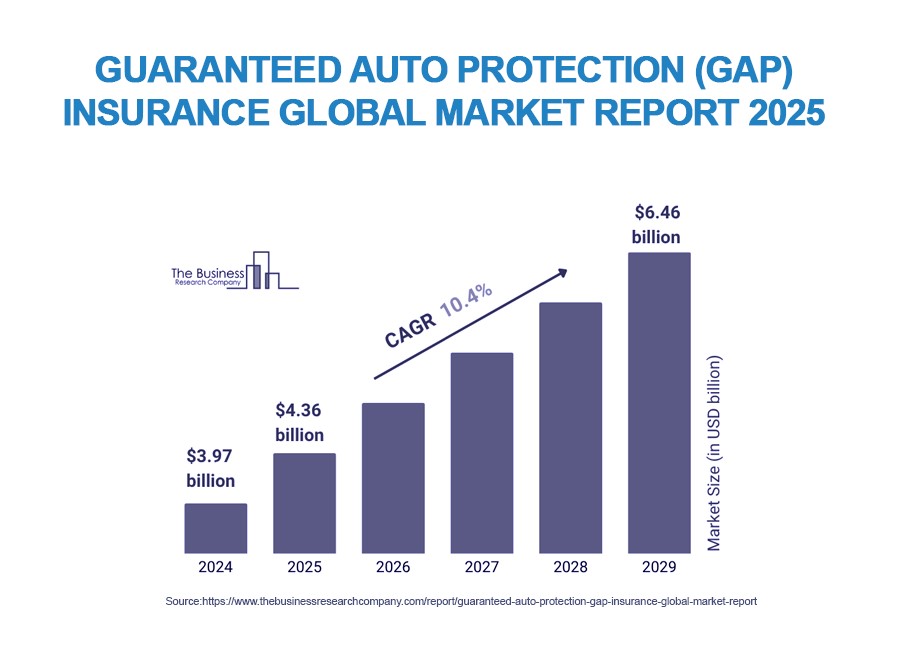

With fewer than 2.5 million GAP policies currently in force, it is not so much the sluggish growth in new-car retail sales[6] that is likely to drive increased demand for GAP protection, but rather the staggering inflation in the cost of new vehicles. Since 2018, prices for popular internal-combustion-engine (ICE) vehicles like the Nissan Qashqai have risen by 51%, and the Vauxhall Corsa by 72%.[7] Contributing to that inflationary pressure, EVs currently command a price premium of 27% over and above their ICE counterparts. Globally, the GAP insurance market is currently worth over US $4 billion, and is set to keep rising at an annual rate of over 10%.[8]

How can JENOA help?

With a large majority of retailers currently unwilling to resume sales of GAP products after the FCA’s investigation,[9] there is still a massive gap in protection that continues to harm consumers, with around one in ten retailers advertising the product. That leaves 90% of distributors that offer no GAP cover whatsoever for motor vehicle purchases.

While the consumer GAP-insurance market remains under-served, this situation has created a vacuum for new market entrants or insurtechs willing to fill an unarguably large hole. With access to global re/insurance markets, JENOA’s strong focus on data-driven insights allows us to help clients gain a better understanding of risk and opportunity in the UK’s under-served GAP market. JENOA’s long experience in the motor insurance and auto markets makes it an ideal partner for insurers looking to establish or re-establish themselves in a new GAP landscape characterised by greater transparency.

A clean slate for growth

With sluggish wage growth since 2018 and widespread inflation fueling a cost-of-living crisis, protecting valuable assets like new vehicles is becoming increasingly crucial. Buyers are looking to de-risk an asset that’s ever more expensive relative to earnings, a trend likely to continue.

Providers who deliver flexible, fairly priced solutions offering essential consumer protection are on track to gain substantial growth and increased revenue.

[1] https://www.grantthornton.co.uk/insights/what-do-gap-insurance-suspensions-mean-for-the-industry/

[2] https://www.fca.org.uk/publications/good-and-poor-practice/consumer-duty-implementation-good-practice-and-areas-improvement#:~:text=Outcome%20we%20want:,explain%20the%20Duty’s%20monitoring%20requirements

[3] https://www.insurancetimes.co.uk/analysis/in-focus-was-gap-insurance-unfairly-targeted-by-the-fca/1454825.articl

[4] https://www.fca.org.uk/news/press-releases/fca-calls-insurers-demonstrate-fair-value-good-customer-outcomes

[5] https://www.intelligentmotoring.com/thought-leadership/gaining-ground-with-gap-insurance

[6] https://www.autotraderinsight-blog.co.uk/auto-trader-insight-blog/looking-ahead-our-forecasts-for-2025

[7] https://www.autotraderinsight-blog.co.uk/auto-trader-insight-blog/looking-ahead-our-forecasts-for-2025

[8] https://www.thebusinessresearchcompany.com/report/guaranteed-auto-protection-gap-insurance-global-market-report

[9] https://www.insurancetimes.co.uk/analysis/in-focus-was-gap-insurance-unfairly-targeted-by-the-fca/1454825.article