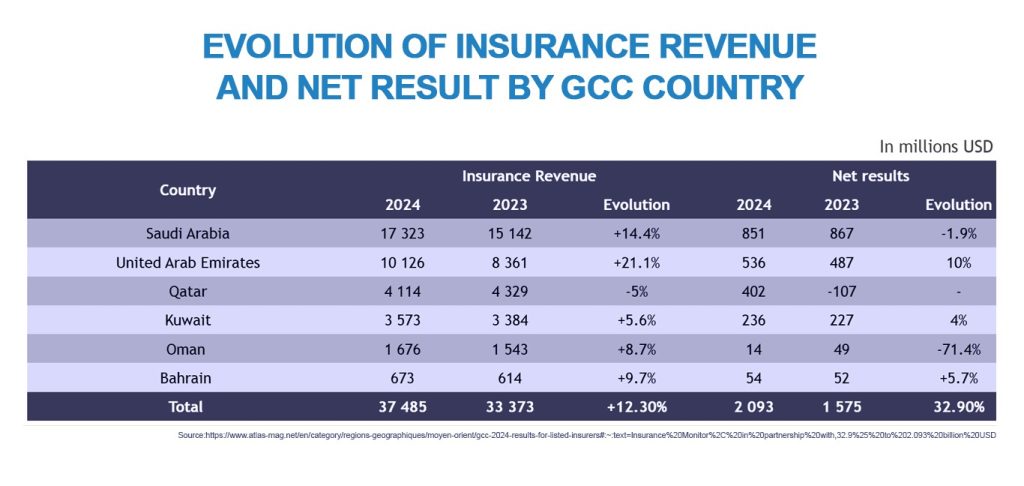

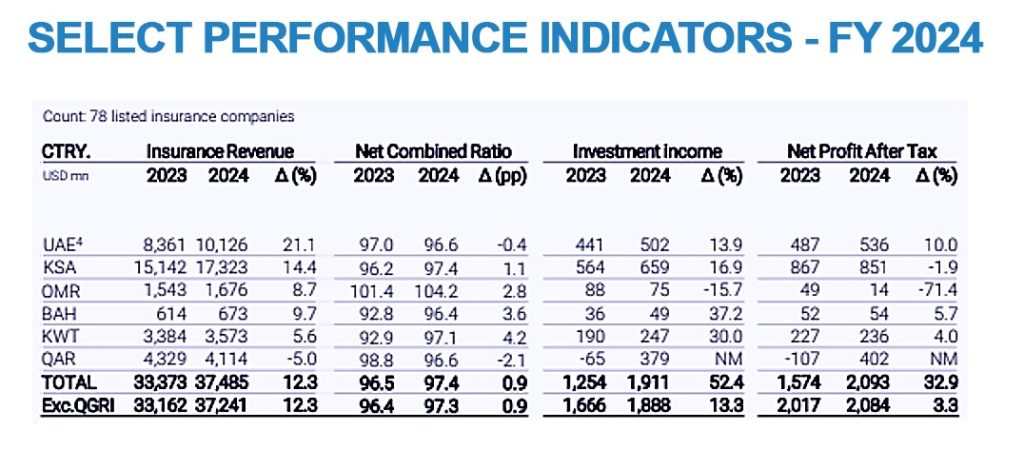

The overall picture for the insurance market across the GCC is one of growth, despite several challenges in 2024. For the full year 2024, the combined after-tax profit of around 80 listed insurers in the GCC reached US$ 2.1 billion,[1][2] with average net profits rising by over 3%[3].

Performance across the GCC’s six nations, however, remains uneven, and good top-line growth nevertheless hides a somewhat mixed bag when it comes to performance across the six national markets and within national markets.

With new products and increasing penetration rates across the region at least in part responsible for revenue growth, it is unclear how product uptake and penetration alone might drive sufficient growth for smaller players, especially those that do not innovate in product development through digital channels and artificial intelligence (AI).

Losses incurred by some UAE and Oman insurers[4] due to extreme rainfall in April 2024 underline the difficulty of quantifying and adequately pricing weather-related risk. Nevertheless, the growth opportunities continue to increase, and demand for insurance products keeps growing in a region that has historically seen lower penetration rates than in both developing and emerging markets. Mandatory cover in the UAE and Saudi Arabia is contributing to the relentless expansion in insurable risk[5], and combined with new opportunities in everything from tourism to renewable energy and major infrastructure projects underway across the GCC and MENA, these are steadily driving growth in insurers’ portfolios.[6]

What are the disparities in growth across insurers in the GCC?

While top-line growth suggests stability, a more nuanced picture is emerging. Although GCC revenue growth, at over 12%[7], was strong in 2024, the market’s overall profit performance, helped along by new mandatory insurance cover, has been driven by only a small handful of the biggest players in each jurisdiction.

Total revenue for the year reached US$37.5 billion, with the vast majority of listed insurers reporting a rise in revenue. However, with many smaller players delivering lacklustre and, in some cases, negative results, the same small handful of dominant players accounted for the growth in profits, too.[8] Thirteen UAE insurers reported either losses or a drop in earnings compared to 2023 performance. As credit-rating agency AM Best reports, “the results of the [UAE’s] top five insurers account for over 85% of the market’s total earnings, further exacerbating the divide between the largest and smallest players.” Across three of the GCC’s six nations (Kuwait, Qatar and Bahrain) just one insurer reported a loss. In Saudi Arabia, a fully profitable 2023 gave way to full-year 2024 results that saw 19 insurers move toward or into negative territory.[9]

The JENOA view

With negative results from some of the small to mid-sized players across the GCC, the question inevitably arises: how can smaller insurers remain viable and sustainable in the long term? As re/insurers look to diversify and pursue opportunities for growth in other MENA countries, can product innovation and development alone drive sufficient revenue growth to keep smaller players viable in the long term without necessitating consolidation?

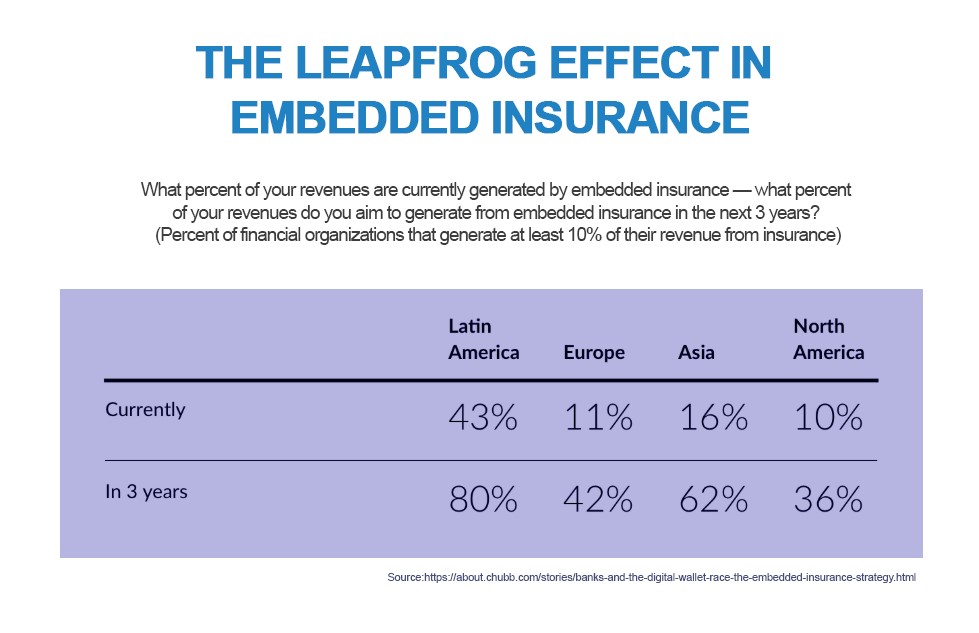

What is likely is that technology will give these smaller, nimbler and more reactive re/insurers the chance to deliver increased growth and revenue through digital innovation. Among the avenues for potential revenue growth and enhanced profits, the expansion of Insurtech and embedded digital insurance features heavily, alongside tech-enabled parametric solutions.

There is growing demand, especially across emerging markets, for insurance products that are embedded in purchases for other goods and services on a ‘3-clicks-to-completion’ model via mobile phones. As noted in Chubb’s 2023 survey on banks, fintechs and consumers, the excitement for digital insurance is matched only by its potential[10]. Embedded digital insurance owes its success to the widespread adoption of smartphone usage across the MENA and Latin America regions, as well as to a growing demographic that demands ‘3-clicks-to-completion’ insurance models.

In emerging markets, it has given millions of unbanked and uninsured consumers access to products that might previously have been denied for lack of a computer device or home telephone line.

New parametric products that successfully leverage digital technologies and AI capabilities can also open up new avenues for growth for smaller players across the GCC and MENA regions. Parametric insurance has developed into a high-tech policy option, with its ability to offer a wider range of cover. Its potential for weather-related cover will offer unprecedented levels of protection from financial loss due to its ability to cater to all levels of risk appetite that can be tailored with almost unimaginable creativity.

Tech-driven risk management: enough to improve margins for smaller players?

Expanding insurable risk is one way to drive revenue growth, but can smaller insurers improve underwriting performance through better, technology-enabled risk pricing?

With losses from extreme rainfall in the UAE last year still fresh in everybody’s minds, weather-related risk is a clear candidate for leveraging enhanced data analytics and artificial intelligence. Although only 40% of losses from natural disasters were insured in 2023, they nevertheless cost insurers US$ 280 billion, according to Swiss Re.[11]

Inadequate risk management is an inevitable consequence of inaccurate predictions, particularly when it comes to weather forecasting. Re/insurers that can make more accurate predictions and therefore better assess risk with the help of AI-enhanced catastrophe modelling will be able to better predict the outcome of weather events and therefore mitigate risk more cost-effectively.

As smaller players seek to enhance their risk management, scenario analysis can benefit in terms of effectiveness and streamlined costs and human resources. Traditionally a resource-hungry exercise with a propensity to introduce yet more risk through human cognitive bias, the development of generative artificial intelligence (GenAI) and its large language models now means that re/insurers can potentially process huge quantities of textual data quickly, enabling them to discover hidden risk[12] and avoid the natural human weakness of predicting future events based solely on past events.[13]

What does this mean for MENA clients & how can JENOA help?

With access to global re/insurance markets, JENOA’s strong focus on data-driven insights allows us to guide clients towards an enhanced analysis of risk exposure to help improve underwriting margins and manage risk more effectively.

Integrating existing re/insurance applications with AI automation and GenAI systems presents challenges that require a strategic approach, especially when it comes to parametric insurance and digitally embedded insurance products. JENOA is well placed to help its clients navigate these challenges as small to mid-sized players explore viable routes to revenue and profit growth.

Technology, speed & agility

As the GCC’s insurance markets deal with new regulatory frameworks and merger activity into 2025 and beyond, many insurers will need to innovate with agility to achieve growth[14].

Headline figures might suggest overall resilience in the GCC market, but the reality behind those top-line figures indicates that without digital innovation and agility, some of the smaller and mid-sized re/insurers in the region risk a combination of rising operating costs, growing regulatory burdens, and dwindling underwriting margins.

[1] https://www.luxactuaries.com/gcc-insurance-performance-in-fy-2024-key-insights-and-emerging-trends

[2] https://www.atlas-mag.net/en/category/regions-geographiques/moyen-orient/gcc-2024-results-for-listed-insurers#:~:text=Insurance%20Monitor%2C%20in%20partnership%20with,32.9%25%20to%202.093%20billion%20USD

[3] https://www.luxactuaries.com/gcc-insurance-performance-in-fy-2024-key-insights-and-emerging-trends

[4] https://www.guycarp.com/content/dam/guycarp-rebrand/insights-images/2025/05/05_20_2025_GC_Gulf_flooding_20may_final.pdf

[5] https://argaamplus.s3.amazonaws.com/68f88da4-b648-41f9-bb31-47ebb3414cb6.pdf

[6] https://www.reinsurancene.ws/stable-outlook-for-gcc-insurance-market-am-best/

[7] https://www.insurancemonitor.ae/publications.php?e=ODI=#

[8] https://www.luxactuaries.com/gcc-insurance-performance-in-fy-2024-key-insights-and-emerging-trends

[9] https://www.insurancemonitor.ae/publications.php?e=ODI=#

[10] https://about.chubb.com/stories/banks-and-the-digital-wallet-race-the-embedded-insurance-strategy.html

[11] https://www.swissre.com/reinsurance/insights/europe-global-natcat-losses-2023.html#:~:text=In%20what%20was%20the%20hottest,average%20of%20USD%2089%20billion

[12] https://www.wtwco.com/en-gb/insights/2024/05/beyond-our-imagination-how-generative-ai-promises-to-reshape-scenario-analysis-in-the-insurance

[13] https://www.wtwco.com/en-gb/insights/2024/05/beyond-our-imagination-how-generative-ai-promises-to-reshape-scenario-analysis-in-the-insurance

[14] https://www.luxactuaries.com/gcc-insurance-performance-in-fy-2024-key-insights-and-emerging-trends