The ‘Capacity Challenge’

Emerging markets present challenges for intermediaries as well as for re-insurers, especially in North Africa and the wider African continent. With those challenges, however, come opportunities to tap into and grow new market segments. After all, hurdles can often act as catalysts for innovation, especially in product development, the deployment of new technology and the formation of meaningful commercial partnerships.

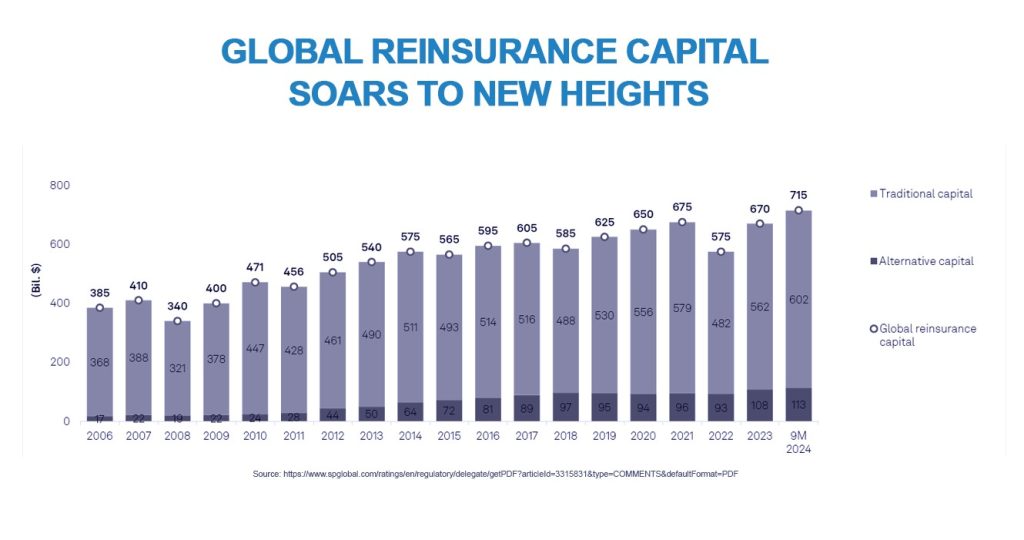

For brokers, one of the biggest challenges in emerging markets is the growing scarcity of suitable re-insurance support for new products, precisely at a time when demand for those products is rising. In short, despite a record volume of global re-insurance capital, re-insurance capacity is not always readily available to support demand or growth.

Brokers play an essential role in the insurance ecosystem and are key to the successful development of new products because of their ability to evaluate the capacity needed to support those products. However, there are ways that brokers can overcome the scarcity challenges and support growth in emerging markets as they navigate challenging market conditions with a changing appetite for some lines of business.

Why is capacity tightening in some areas?

Despite S&P Global reporting that combined re-insurance capital from traditional and alternative markets topped new heights in 2024, a lower appetite for unfamiliar risk has seen traditional re-insurers retreat into sectors they know inside out, and sectors they also know are profitable in the long-term. Risk appetite has been accompanied in H1 2025 by strong capital returns from some of the largest global re-insurers, with Europe’s largest four reporting unprecedented average returns on equity of more than 21%.[1]

According to consultancy firm McKinsey, structurally higher interest rates have dramatically increased the cost of capital, resulting in a lower risk appetite and a reduction in available capacity from alternative re-insurance markets, such as private equity (PE), despite reports of high global capital availability. As McKinsey reports, in 2024, “[PE] fundraising across all asset classes fell to its lowest level since 2016”.[2]

Re-insurance capacity in emerging markets is also hindered, in part, by regional regimes that impose compulsory local retention rates across MENA. Designed to help national re-insurers thrive, regulators often impose such restrictions to protect national capacity providers from being edged out by larger, more established global re-insurers. However, in the past, some regulators had changed their position based on market dynamics. Although this was some time ago, Morocco, for example, started reversing local cession regulations in 2006, as high local compulsory cession to Société Central de Réassurance (SRC) – now rebranded as Atlantic Re[3] – was seen to be a drag on healthy competition in the Kingdom. In most categories, the legal requirement for compulsory cessions has been removed, and in categories where they are still imposed, the percentages have been reduced.[4]

In other emerging markets, however, they are still on the rise. Algeria, for example, continues to increase its local cession rates to help protect the country’s national re-insurer, the Compagnie Centrale de Réassurance (CCR), and has progressively raised local cession rates from 5% to 50%.[5] Saudi Arabia currently has a 30% cession for local reinsurers, and it is anticipated that this will continue to increase.

What can brokers do?

Brokers are competing for tightening capacity among traditional re-insurance markets and in alternative markets such as PE; players in both markets are highly selective regarding which risks they are prepared to underwrite. Brokers must therefore offer clear, demonstrable value to compete for dwindling capacity at a time when even private-equity capital is drying up.

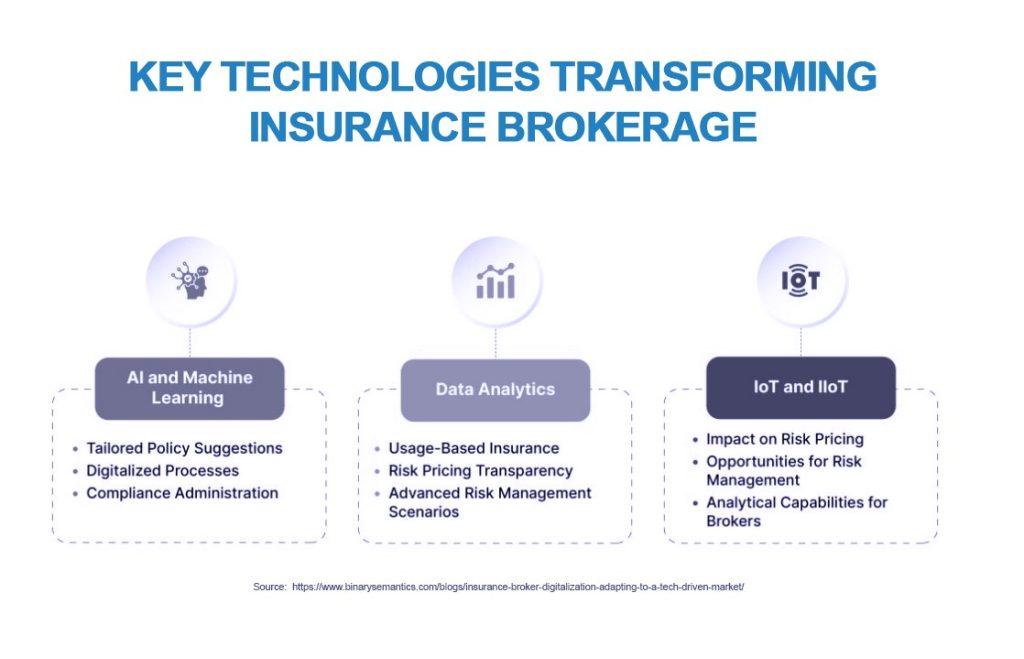

To help overcome re-insurers’ risk aversion, brokers are well placed to get across two crucial elements to risk-averse capacity providers: potential profitability in new segments and product lines, and a tech-enabled and fully digitalised approach to enhanced visibility on all risk.

To achieve a better understanding of risk, successful brokers will be the ones who embrace automation, digitalisation and AI to deliver a combination of lower risk and higher profit in emerging markets, and will help align new business with re-insurers’ particular risk appetite. Better risk analysis powered by generative AI (GenAI) will allow brokers to satisfy re-insurers that their submitted risk profiles are reliable, comprehensive and fully understood, with no hidden surprises. This will offer brokers, and in turn re-insurers, greater confidence in the visibility of risk,[6] thereby unlocking capacity.

How can brokers evaluate capacity and secure support?

Affinity programs and specialist risk cover offer tangible examples of a dynamic already in place across many emerging markets, especially in North Africa, whereby brokers can evaluate capacity and risk appetite before new products are brought to market.

Typically offered by organisations operating as third-party providers of insurance – in other words, where insurance is not their core business – affinity insurance is often offered to an organisation’s customers at the point of sale. In emerging markets, these programmes can vary from consumer goods and appliances to agricultural insurance. Bosch partnered with Morocco’s Atlanta Assurance a few years ago to extend warranties on its appliances,[7] and in agri-businesses, affinity programmes serve to strengthen the relationships between suppliers and farmers. Insurance products can be embedded into products such as chemical inputs or machinery and offered for free or with major discounts to agribusinesses and farmers. Not only does this strengthen relationships and loyalty between suppliers and farmers, it also incentivises agri-businesses to purchase more products at lower risk. For insurers, affinity channels pool risk and therefore allow for diversification as well as high volume.[8][9]

The JENOA view: Efficiencies through innovation

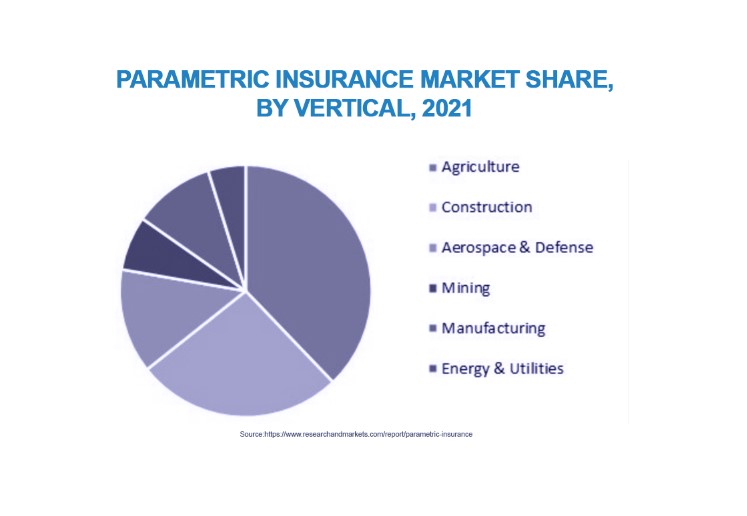

When it comes to some of the biggest insurance gaps in emerging markets, extreme weather features high on the list, with agriculture and food security at particular risk from catastrophic weather-related failures.

Given its labour-intensive nature and the requirement for regular loss adjustment, indemnity-based crop cover is becoming unaffordable for many agribusinesses, and for small-scale farmers in particular. In a country where drought has wiped out around 25% of rain-dependent crops and placed the remaining 75% under severe water and heat stress[10], the need for brokers to secure re-insurance capacity in a way that can support crucial industries like farming in the economies of emerging markets is more urgent than ever.

Brokers are well-placed to introduce more viable alternatives to prohibitively expensive indemnity-based cover. Parametric cover, for example, allows insurers to quantify weather, with the widespread adoption of new technology leading to a full automation of the process through digitalisation. Technologies like blockchain enable insurers to embed automatic triggers into claims-payment systems. This accelerates claims payments for weather-related losses, with payouts often transferred within minutes of a parametric trigger being breached.

What does this mean for MENA clients and how can JENOA help?

By offering access to the Lloyd’s of London market in addition to re-insurance hubs around the world, as well as to North Africa’s major re-insurance market, JENOA leverages conventional Lloyd’s capabilities alongside international capacity providers to maximise re-insurance support for product and segment development in emerging markets. Our focus on data-driven solutions offers broad access to emerging markets in North Africa and beyond.

JENOA’s access to tailored, specialist-risk solutions helps clients meet multiple and complex requirements. Our expertise can help independent brokers establish and maintain meaningful, data-driven commercial relationships to help fill insurance gaps and secure sustainable and affordable re-insurance capacity in essential sectors across many emerging markets.

How can capacity scarcity be overcome?

Brokers have a crucial role to play when it comes to securing re-insurance capacity for cover holders, and digitalisation and AI will play a big part in the battle for tightening capacity in a risk-averse landscape. When coupled with innovation and intelligent product development, brokers will be better positioned to gain a more comprehensive understanding of risk and communicate it to prospective capacity providers, ensuring that submissions align more closely with providers’ risk appetite and capacity.

[1] https://www.fitchratings.com/research/insurance/european-reinsurers-report-record-profitability-revenue-growth-slows-19-08-2025

[2] https://www.mckinsey.com/industries/private-capital/our-insights/global-private-markets-report

[3] https://www.insurancebusinessmag.com/reinsurance/news/breaking-news/societe-centrale-de-reassurance-rebrands-as-atlantic-re-532708.aspx

[4] https://www.bsalaw.com/insight/compulsory-retention-rates-across-the-mena-region/#:~:text=Insurers%20need%20to%20cede%2050,monopoly%20and%20free%20market%20practices.

[5] https://www.bsalaw.com/insight/compulsory-retention-rates-across-the-mena-region/#:~:text=Insurers%20need%20to%20cede%2050,monopoly%20and%20free%20market%20practices.

[6] https://www.wtwco.com/en-gb/insights/2024/05/beyond-our-imagination-how-generative-ai-promises-to-reshape-scenario-analysis-in-the-insurance

[7] https://www.atlas-mag.net/en/article/the-first-affinity-insurance-to-be-launched-in-morocco

[8] https://greco.services/affinity-insurance-and-better-agreements-between-farmers-and-partners/

[9] https://www.wtwco.com/en-gb/solutions/affinity

[10] https://www.swissre.com/reinsurance/insights/morocco-crop-reinsurance.html#:~:text=Farmers%20are%20mainly%20covered%20with,Mutual%20Insurance%20Company%20(MAMDA).