The uptake of travel-insurance products in the Middle East and North Africa (MENA) remains subdued compared to other regions, but the global outlook for emerging markets, including MENA, remains, overall, very positive. In fact, both the MENA and Latin American markets look set to become the most lucrative for travel insurance in the near future. In 2022, the MENA travel insurance market was estimated to be worth over US$ 700 million[1], and by 2030, it will grow to nearly US$ 3.5 billion[2], with an anticipated 80 million outbound travellers from the region by the end of the decade.[3]

Increasing travel rates are likely to boost demand for travel insurance via a new digital insurance ecosystem. European Union destinations within the Schengen area – a border-free zone for the free movement of people, goods and services within the wider EU – have become popular with MENA travellers. In fact, it is estimated that Schengen-compliant policies – insurance cover that fulfils the EU’s visa requirements for Schengen destinations – accounted for as much as half of all products sold in the region in 2018.[4]

As shifting demographics drive change and innovation in the sector, is the travel insurance market moving from siloed products to a digital-insurance ecosystem, in which digital-native consumers demand tailored ‘3-clicks-to-completion’ cover embedded in other products and services they buy? After all, a seamless, technology-enabled experience linking all touchpoints on a digital journey through an insurer’s organisation is increasingly attractive to a growing demographic of tech-savvy consumers.

Here, we examine the possible development of the travel insurance market in developing economies in the near to medium term.

MENA and African travel trends: the last five years

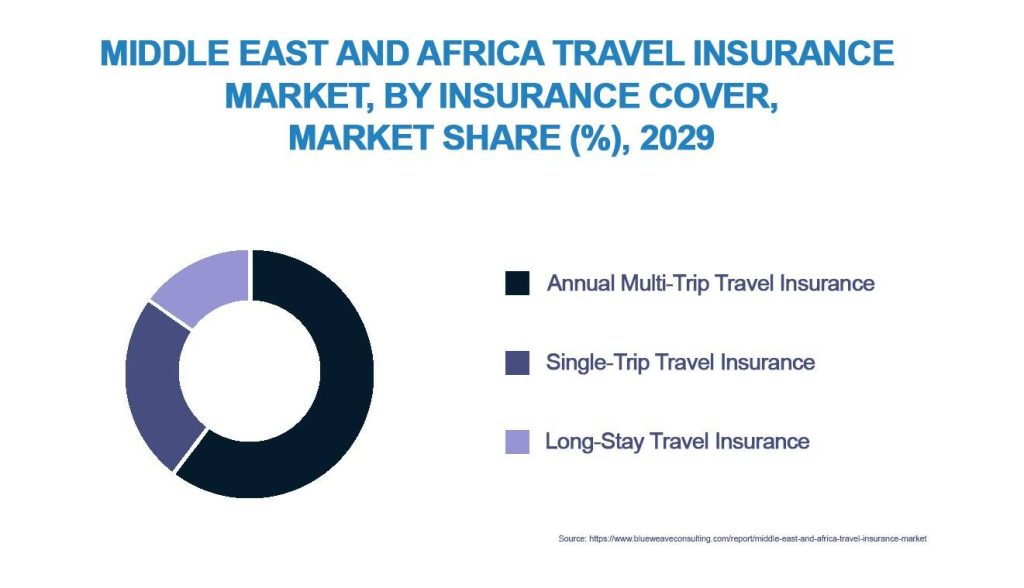

In 2018, around 25% of all outbound travellers from the MENA region travelled to destinations in the EU, making single-trip travel insurance products the most popular. Yet by 2023, the annual multi-trip travel-insurance segment emerged as the biggest,[5] suggesting a growing demand for insurance that caters to frequent outbound travellers. Given that the family traveller segment now dominates the market when looking at end-user data for travel insurance in MENA, it would seem that comprehensive cover for multiple trips is becoming as important to family insureds as it has been for frequent business travellers.

The Middle East was by far the favourite destination for MENA travellers in 2023, with Egypt and Saudi Arabia the most popular. However, this spike in domestic or intra-MENA travel does not appear to herald an end to international travel. Despite the rise in intra-MENA travel – the tourism sector in the region experienced growth of more than 130% in the first quarter of 2023[6] – international destinations are still popular, with Asia and Europe still the most desirable among UAE and Saudi Arabian travellers.[7]

When it comes to Africa-specific travel trends, the tourism sector accounted for around 8% of the continent’s combined GDP in 2021, roughly the equivalent of USD $170 billion. South Africa, Kenya, Egypt and Morocco have been popular destinations for travellers both from within and outside Africa, but other countries such as Tanzania and Botswana are successfully showcasing their natural resources to promote ecotourism, alongside Kenya and Rwanda, and as a result, the ecotourism sector is experiencing growth of around 20% per annum.

Intra-African travel continues to grow, helped by developments such as the Single African Air Transport Market (SAATM) and the African Continental Free Trade Area (AfCFTA), which have both seen expanded intra-African flight connections with new regional routes. South Africa, Ghana and Egypt have dominated the intra-African market, and in the last 5 years, intra-Africa travel has reached almost 50% of total tourist arrivals across the continent,

Growth has been helped significantly by the revolution in tourism marketing that digital platforms now enable; African nations can now market their offerings to a global audience affordably, effectively and with relative ease. Digital marketing has been a runaway success in South Africa, for example, where social-media campaigns have successfully promoted its rich diversity of wildlife and varied landscapes.

Digitalisation in its broader sense is allowing Africa’s tourism sector to offer a more accessible and streamlined experience for travellers. Mobile payment options and digital passport and visa solutions make tourists’ lives much easier, and virtual tours allow potential tourists to get a glimpse of the sheer wealth of tourist treasures on offer to whet buyers’ appetites.

Digital embedded insurance in emerging markets

Developing countries in Latin America and Southeast Asia were predominantly cash societies before widespread digitalisation took hold. Cash-driven economies usually reflect large numbers of unbanked, but it is worth remembering that the unbanked also tend to be the uninsured, or certainly the underinsured.

To put that into perspective, Latin America is on a par with the GCC for insurance penetration, but for very different reasons; in both regions, the insurance penetration index is below the emerging-market average of 3.4% and the global average of 7.4%[8]. In the GCC, the ratio of gross underwritten premiums (GWP) as a percentage of GDP is 1.9%[9], and in Latin America, around 2%[10].

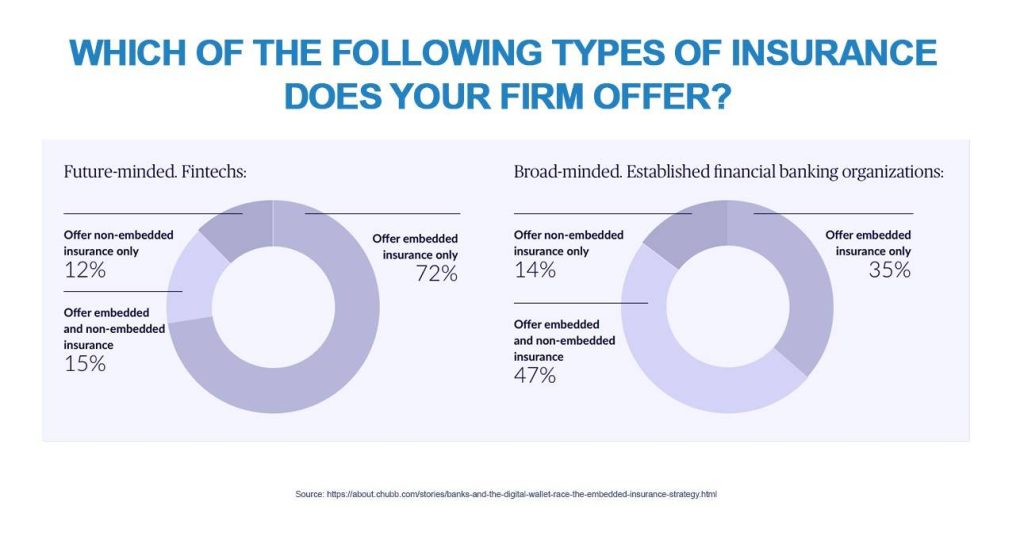

Emerging markets and underinsured regions elsewhere are increasingly bypassing legacy banks and insurers as the unbanked and the underinsured begin to adopt insuretech digital insurance, where many products are embedded in other purchases on a ‘3-clicks-to-completion’ model via mobile phones. As noted in the property and casualty insurer’s Q2 2023 survey[11] on banks, fintechs and consumers, Chubb concludes that the rate of growth and potential for the future is gripping insurers in underdeveloped regions with an enthusiasm for digital insurance yet to be seen in Europe or the US. Why? Largely because the spread of smartphone usage has facilitated access for millions of unbanked and uninsured consumers who previously may not even have had access to a landline or online device. “The adoption of embedded insurance follows the global arc of the adoption of mobile phones,” the survey reports. “Emerging markets, lacking adequate traditional communications infrastructures, and facing a scarcity of landlines, were quicker to adopt mobile phones than the developed economies”.

How does embedded digital travel insurance work?

If there is an associated risk with any kind of product or service, financial or otherwise, insurance products can be digitally embedded into those products or services to offer consumers a degree of protection. Typically, these are available to buy at the point of sale, provided as an add-on to high-value products or services as a premium perk, or integrated as part of added-service value. It is not just travel insurance that can be embedded, either; device protection, bank cards, loan repayments, airline tickets and live events can all be covered by digital embedded insurance. Integrated or as add-ons, many banks and credit card companies automatically offer complimentary travel insurance the moment a cardholder makes any travel-related purchase, for example.

Many players in the airline industry now offer embedded cover as an integral part of the payment process, cover that is often tailored to the specific needs of the traveller[12]. For example, a traveller buying a package holiday for extreme sports could be offered cover tailored to sky-diving, mountain biking or bungee jumping, or the purchase of a flight to Geneva, Innsbruck, Zurich, Salzburg or Vienna might automatically trigger an offer of tailored cover for a skiing holiday. Using digitally enabled parametric insurance also protects travellers against a wide range of eventualities. Parametric insurance – a product that delivers cover through pre-agreed indices and triggers – is now using technologies such as Blockchain. This allows insurers to incorporate automatic triggers into claims-payment systems, and for consumers, it offers a further degree of tailoring to a customer’s needs and significantly reduces claims delays; claims payments can now be paid automatically, directly to the credit card used to purchase the policy, within just minutes of an index being exceeded.

Weather-dependent travel, for example, now comes with the option of cover that seamlessly offers automatic payouts for unwanted extreme weather without ever having to file a claim. Through automated index monitoring, linked to Blockchain technology, payouts can be made without any further action from the traveller. Innovations like this now allow travellers to opt for integrated digital embedded insurance products to cover eventualities like missed flight connections. They can have claims settled automatically and almost immediately, according to pre-agreed cover, indices and triggers.

The JENOA view

Looking at the broader digital embedded picture, of which a new dawn in travel insurance is just a part, the regional MENA Insurance market is thought to be worth around US$ 160 billion today and growing rapidly. Indeed, it is likely that if it can sustain current growth, it will reach approximately US$ 700 billion by 2030[13]. By 2028, more than 30% of all insurance transactions will likely be carried out through embedded channels as clients and consumers embrace digital platforms that sidestep the time and effort that often characterise the process of finding insurance suitable for a wide range of tastes and needs.

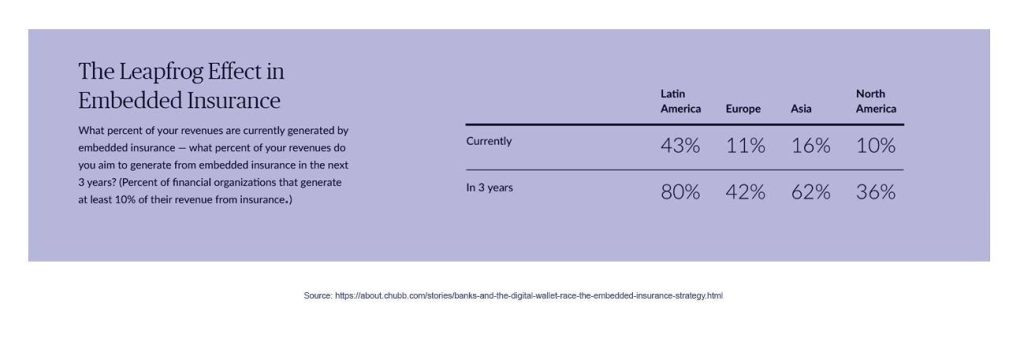

In Asia, embedded digital products account for around 15% of insurers’ total revenue compared to Europe’s 11%, but Asian insurers are set to gain over 60% of revenues from digital products within just three years[14]. Most of the growth in embedded digital products comes from the Latin American market, with embedded insurance revenue now accounting for more than 40% of insurers’ total revenues in the region.

The North American, European, Asian and Latin American markets will all see growth by the end of this decade, but Latin America’s share of revenue from embedded digital products is estimated to reach an impressive 80% within the next three years. For MENA and other underdeveloped travel insurance markets, the pathway to a digitally embedded future offers insurers that can put themselves ahead of the digital curve the potential for significant growth and new revenue streams.

What does this mean for MENA clients and how can JENOA help you?

JENOA offers experience and expertise in helping insurance and reinsurance clients in the MENA region face a broad range of challenges. With access to the Lloyd’s of London market and reinsurance hubs worldwide, JENOA leverages global insurance innovation in tandem with reinsurance capacity to mitigate risk and provide strategic advice to clients, as they prepare for rapid change through digitalisation. JENOA is currently working on a number on new embedded insurance products for Financial Institutions in developing markets, Our strategic partnerships exploit joint ventures in the march toward a fully digital travel insurance sector. With a strong focus on developing digital solutions, we support our clients to establish new revenue streams in untapped developing markets in MENA and developing markets.

Future growth markets

To chase growth in the digital travel insurance sector, insurers are likely to focus as much on changing consumer preferences within shifting demographics as they do on developing regions such as MENA, Asia, and Latin America. No demographic is more crucial for growing this sector than Gen Z, which tends to stay loyal to brands that treat them as individuals. Ease of use is an expectation, not a nice-to-have, with seamless digital experiences now a top priority for them.

Insurers that design products with this in mind will increase the potential for unrivalled growth in the future.

[1] https://www.itij.com/latest/long-read/outbound-travel-trends-middle-east-and-africa

[2] https://www.itij.com/latest/long-read/outbound-travel-trends-middle-east-and-africa

[3] https://www.itij.com/latest/long-read/travel-insurance-mena-region

[4] https://www.itij.com/latest/long-read/travel-insurance-mena-region

[5] https://www.blueweaveconsulting.com/report/middle-east-and-africa-travel-insurance-market

[6] https://www.itij.com/latest/long-read/outbound-travel-trends-middle-east-and-africa

[7] https://www.itij.com/latest/long-read/outbound-travel-trends-middle-east-and-africa

[8] https://argaamplus.s3.amazonaws.com/68f88da4-b648-41f9-bb31-47ebb3414cb6.pdf

[9] https://argaamplus.s3.amazonaws.com/68f88da4-b648-41f9-bb31-47ebb3414cb6.pdf

[10] https://about.chubb.com/stories/banks-and-the-digital-wallet-race-the-embedded-insurance-strategy.html

[11] https://about.chubb.com/stories/banks-and-the-digital-wallet-race-the-embedded-insurance-strategy.html

[12] https://about.chubb.com/stories/banks-and-the-digital-wallet-race-the-embedded-insurance-strategy.html

[13] https://www.vegaitglobal.com/media-center/business-insights/how-embedded-insurance-creates-seamless-experiences-for-consumers

[14] https://about.chubb.com/stories/banks-and-the-digital-wallet-race-the-embedded-insurance-strategy.html