Whilst the abbreviation stands for Environmental, Social and Governance, its overriding aim is to put conservation of the planet, consideration of people, and minimum standards for running an organization at the heart of investment decisions. In short, it is a tool that allows investors to develop a set of metrics to benefit from the overlap between corporate purpose and profit.

The explosion in ESG awareness came hot on the heels of COP26, where UN Special Envoy for Climate Action and Finance, Mark Carney, managed to talk nearly 500 financial institutions into aligning US$ 130 trillion worth of global assets with climate goals set out in the Paris Agreement.

Why? Simply put, the threat of environmental risks has gripped the business world, and as the Harvard Business Review notes, investment funds that have trillions of dollars under management – firms that have no hedge against the global economy – have become “too big to let the planet fail”[1].

How does ESG affect the insurance sector?

Pressure on insurance companies to act on ESG, however, is not driven exclusively by environmental issues; good governance and transparency, often accompanied by sector regulation, is another important element in a corporation’s drive towards openness and benefiting the common good. This links neatly into the social aspect; protecting capital is often dependent on community support, rather than simply doing what the law allows you to do. For example, companies that employ legal, but unsavoury or dubious practices can expose themselves to a different sort of risk.

Given that the insurance industry itself is defined by risk, it arguably has an interest in some of the issues covered by ESG. Mitigating against potential losses associated with social issues such as gender, diversity and human rights, for example, or weather-related damage attributed to climate change, goes to the very heart of insurance and re-insurance.

In short, quantifying risk better enables companies to mitigate against it. Furthermore, the effect of spreading climate wariness in the business world is undeniably good for the insurance sector.

UNEP Principles for Sustainable Insurance

The United Nations Environment Programme Finance Initiative (UNEPFI) has produced a guide for the global insurance industry to help it address sustainability risks – the Principles for Sustainable Insurance (PSI). This policy guide is designed specifically to assist insurers and guide their self-alignment with ESG practices and to better understand vulnerabilities, risk and mitigation in a more risk-aware world.

The United Nations Environment Programme Finance Initiative (UNEPFI) has produced a guide for the global insurance industry to help it address sustainability risks – the Principles for Sustainable Insurance (PSI). This policy guide is designed specifically to assist insurers and guide their self-alignment with ESG practices and to better understand vulnerabilities, risk and mitigation in a more risk-aware world.

The PSI guide covers four key principles:

- that insurers will incorporate ESG issues relevant to their business in their own decision making; this covers everything from corporate strategy, risk management and underwriting, claims management to educating the personnel at the sales and marketing client interface.

- that insurers will work actively with clients and partners to raise awareness of ESG issues, manage risk and develop practical solutions;

- that insurers will work with governments, regulators and stakeholders to “promote widespread action across society on ESG issues”; and

- that they will publicly disclose progress in implementing these principles in a transparent and accountable way.

Regulators’ influence on ESG in the Middle East

Sustainability issues and net-zero ambitions in the United Arab Emirates (UAE) fall within the ambit of the Ministry of Climate Change and Environment (MOCCAE). Even if it is The Central Bank of the UAE (CBUAE) that acts as insurance regulator, sustainability issues will no doubt be driven by a multi-agency approach.

Sustainability issues and net-zero ambitions in the United Arab Emirates (UAE) fall within the ambit of the Ministry of Climate Change and Environment (MOCCAE). Even if it is The Central Bank of the UAE (CBUAE) that acts as insurance regulator, sustainability issues will no doubt be driven by a multi-agency approach.

With that in mind, the UAE Sustainable Finance Working Group[2] has already expressed its commitment to sustainability objectives and the UAE’s ambition[3] of net zero by 2050.

In the first half of 2022, the authorities will look at what is already in place by way of sustainability disclosures and seek to promote industry-wide standards that are compliant with national and international practices.[4]

Throughout this year, authorities will continue to review corporate governance standards and practices. In doing so, they hope to later incorporate the theme of sustainability across corporate governance structures in the UAE, through both legislative and non-legislative methods.

This is reflected in other parts of the GCC, too. Under Saudi Arabia’s Vision 2030, the country has announced bold ambitions to expedite an energy transition away from a previously oil-dependent economy. Vision 2030 is driving its sustainability agenda towards an ultimate ambition to reach net zero by 2060. From the launch of its National Renewable Energy Program in 2017, to the establishment of the Sakaka solar power plant in 2021, followed by the Dumat Al Jandal wind farm, Vision 2030 projects reflect how Saudi Arabia is placing sustainability at the heart of everything it does.

Rating agencies’ views on ESG in insurance

In order to better determine an organisation’s risk profile, rating agencies have, themselves, begun to embed ESG metrics in their ratings. As you might expect, this has drawn attention to certain vulnerabilities in the sector, but the reliability of the data, as explained in more detail below, is far from guaranteed. Nevertheless, agencies are continuing to pressure insurers to incorporate a wide range of ESG issues to satisfy financial objectives.[5] Some of these ratings agencies are claiming that these new methodologies are improving transparency, highlighting how ESG risks are accounted for when producing a credit rating. What is clear is that a higher visibility of ESG factors can indeed make it easier to spot risks that might have previously escaped conventional financial metrics.

Adoption and barriers to adoption by the insurance sector

Back in 2018, according to one London-based global analyst industry survey, over half of global asset owners were already implementing or considering the UN Principles for Responsible Investment, in their investment strategy.[6] A growing number of insurers are placing more emphasis on ESG practices, and a scan of insurance company reports from this year shows an increase in time and effort spent demonstrating ESG credentials.

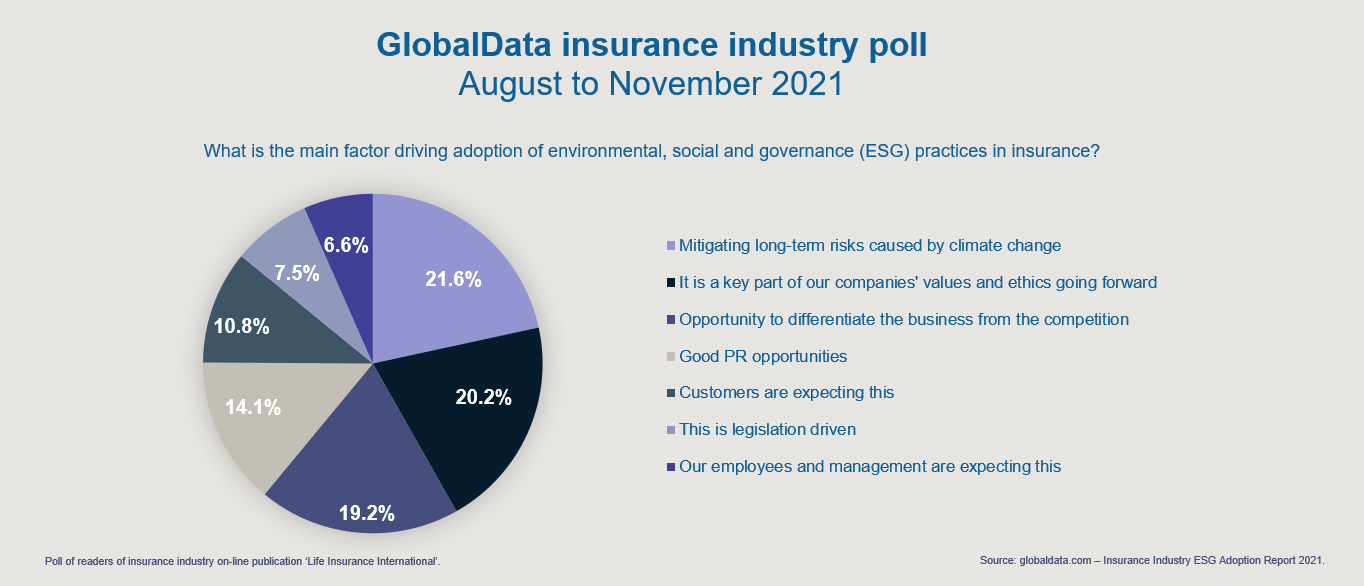

An insurance industry poll from December 2021, shows that just over one fifth of respondents (21.6%) see the risks of climate change as the main incentive for incorporating ESG practices.[7] Worth noting is that only 7.5% of insurers see ESG adoption as being dependent on legislation.[8]

The biggest barrier to adoption, however, was the unreliability of the very data that underpins ESG ratings, as reported in another survey. More than half (53%) reported that discrepancies from ratings agencies in ESG scores presented a major barrier to incorporating ESG data into investment decision making.[9]

In addition, as several industry insiders report, ESG can be a double-edged sword for insurers. For some, revenue from fossil fuels can be significant and material, and major players in the market will feel disinclined to divest from these industries – and relinquish this revenue – without the impetus of legislation.[10] By way of an example, a 2021 investigation into the top 20 players with exposure in the oil and gas sector solicited only seven responses; of those, none said it was willing to commit to exiting the sector by the end of last year.[11]

How is ESG driving insurance for renewables?

With restrictive ESG pressure on investment and insurance in fossil fuel industries, coal generation is expected to shrink to just 12% by 2050, when it is hoped that renewables will meet 35% of the global energy requirement.[12] The growth in renewables brings a corresponding growth in renewables assets, increased demand for insurance, an increase in risk and a demand for innovative solutions for the sector.

Insurance companies have begun to tailor products specifically aimed at renewables assets and operations. Why? The main driver is a realisation that the operational life of such assets is characterised by a wide range of risk.

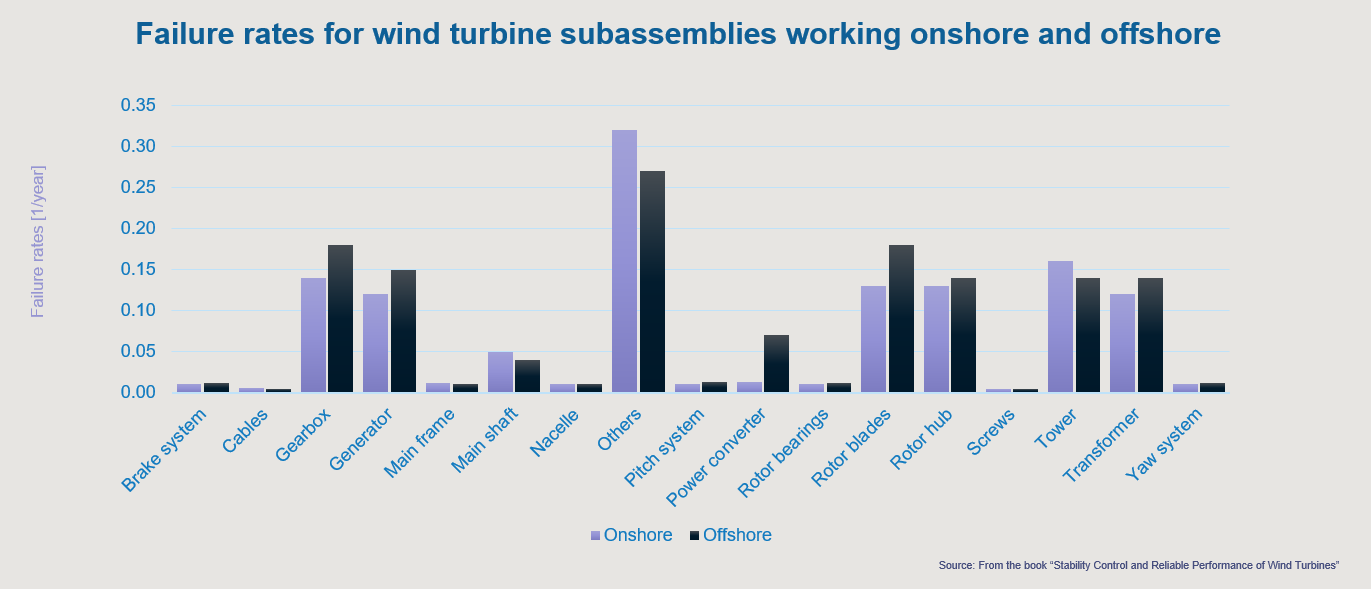

With wind power, the turbine, rotor, gears and blades make up about 50% of claims both in number and value.[13] Insurance demand, however, is driven not just by owner/operators; turbine manufacturers are also insuring risk during warranty periods, as well as suppliers of high-value components such as gearboxes.

Damage insurance for some renewable energy assets is vulnerable to a high ratio of claims as a percentage of premium income. The biggest influence on that vulnerability is the nature of the facility’s operator. Where assets are operated and maintained by non-traditional, new investor-operator claims as a percentage of premium income – by comparison to large, established energy corporations – can be up to six times higher.

When looking at innovative, tailored solutions, the inability to discharge electricity into the transmission and distribution grid remains a difficult risk to mitigate. Although these types of claims account for less than 3% of the total number, they make up about 20% of the total value.

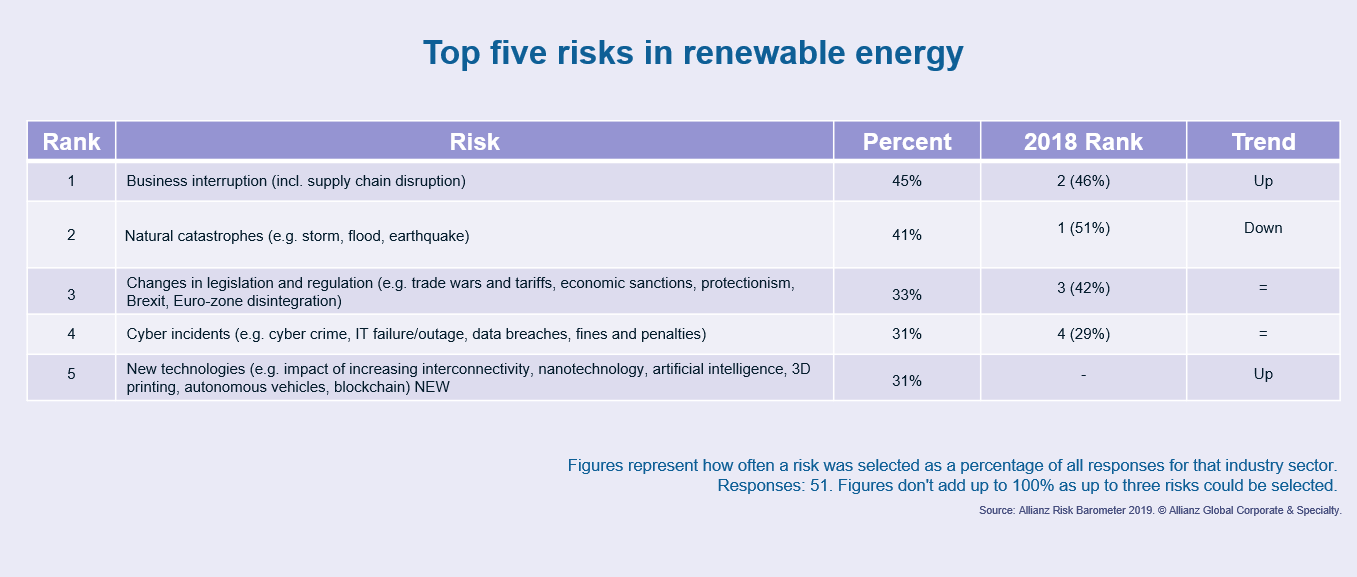

The inability to discharge power also feeds into to the broader problem of business interruption; this could result from unplanned downtime, unscheduled maintenance from parts failure or damage, or transmission and distribution issues. As these assets are often financed using complex leveraged structures, loss of revenue resulting from business interruption is a major risk to insurers. It is not surprising, therefore, that in a recent survey of insurance professionals on the top five risks in renewable energy, business interruption came top.[14]

Hydropower – the unsung hero of renewable energy – is projected to account for 28% of the world’s power by 2028.[15] Its contribution to the world’s energy is bigger than all other renewables combined. It is estimated that there are over 800 large-scale hydro projects in planning or under construction, but hydro insurance is not without its complexities. Hydro projects, given the combination of complex civil engineering on remote sites and seasonal weather variations, are always subject to a high degree of risk assessment by insurers.

After a string of recent claims, some major players have pulled out of the sector. Many consider it too high-risk. Some report loss ratios – the proportionate relationship between incurred losses and premiums earned, expressed as a percentage – of between 100%-300%. That leaves developers with limited options when it comes to project protection. If insurers restrict cover further, developers will have to proceed with severely limited protection, or re-assess the viability of individual projects.

Solar photovoltaic (PV) parks are enjoying a similar level of tailored service as wind generation. For example, cover can hedge risk at the time of project financing or during module procurement. In the event of manufacturers becoming insolvent, or technology underperforming, claims are paid directly to investors. Furthermore, indemnification can be customised according to risk and investor needs. From a risk perspective, theft, technology and mechanical breakdown, combined with extreme weather events associated with climate change, are the biggest risk factors in PV solar parks.[16]

What’s next?

Looking to the future, renewables insurance will become increasingly driven by data. Losses over the last 10 years have had an impact on the renewables insurance market,[17] driving the need to integrate data to better understand claims scenarios. Insurers that undertake digital transformations are more likely to be able to interrogate data successfully. This pace of technological change can be difficult to keep up with, especially as insureTech innovation itself gathers pace, but it will deliver better intelligence and better results.

It’s worth sounding a minor note of caution here as the industry adapts to producing improved data behind ESG ratings. As the industry divests from fossil fuels, reflecting society’s wish to clean up the planet, shielding investments from the effects of climate change is not necessarily a substitute for fighting climate change itself, even if imposed by regulatory obligations. The transparency required by sustainable insurance principles (above) will, however, make it easier to fulfil those social responsibilities in the future.

On balance, a renewed focus on social and governance, with its emphasis on the natural world, people and standards, can help organisations take advantage of the overlap between purpose and profit. In addition to good returns on ESG investments, that emphasis also improves the environment and, ultimately, the planet.

[1] https://hbr.org/2019/05/the-investor-revolution

[2] https://www.wam.ae/en/details/1395302989236

[3] https://www.moodysanalytics.com/regulatory-news/nov-05-21-cbuae-outlines-key-deliverables-in-sustainable-finance-roadmap

[4] https://www.moodysanalytics.com/regulatory-news/nov-05-21-cbuae-outlines-key-deliverables-in-sustainable-finance-roadmap

[5] https://www.meinsurancereview.com/Magazine/ReadMagazineArticle?aid=44332

[6] https://hbr.org/2019/05/the-investor-revolution

[7] https://www.globaldata.com/insurance-industry-adoption-environmental-social-governance-practices-driven-long-term-climate-change-says-globaldata/

[8] https://www.globaldata.com/insurance-industry-adoption-environmental-social-governance-practices-driven-long-term-climate-change-says-globaldata/

[9] https://www.bestexecution.net/lack-of-robust-data-biggest-barrier-to-esg-adoption/

[10] https://www.globaldata.com/insurance-industry-adoption-environmental-social-governance-practices-driven-long-term-climate-change-says-globaldata/

[11] https://capitalmonitor.ai/asset-class/alternative-assets/no-more-oil-and-gas-how-insurers-are-responding-or-not-to-the-ieas-landmark-report/

[12] https://www.agcs.allianz.com/news-and-insights/expert-risk-articles/green-energy-Insuring-a-renewables-future.html

[13] https://www.mapfreglobalrisks.com/en/risks-insurance-management/article/renewable-energy-insurance-are-they-all-equal/

[14] https://www.agcs.allianz.com/news-and-insights/expert-risk-articles/green-energy-Insuring-a-renewables-future.html

[15] https://www.marsh.com/uk/industries/construction/insights/are-hydropower-projects-uninsurable.html

[16] https://www.marshcommercial.co.uk/articles/risks-and-insurance-solutions-for-solar-farms/

[17] https://www.postonline.co.uk/market-access/technology/7904946/spotlight-why-esg-and-digital-transformation-are-inextricably-linked-for-the-insurance-industry