Carbon dioxide removal remains central to global efforts to reduce overall net greenhouse gas emissions, alongside the inevitable reality of long-term hydrocarbon use in certain sectors. Some sectors, like transport, dispatchable electricity generation and the renewable-energy industry supply chain, could take decades to truly decarbonise in an economically viable way and without potentially risking damage to biodiversity and fragile ecosystems.

Carbon removal; the market in brief

Carbon dioxide removal can be achieved through three principal routes: natural carbon sinks, carbon capture and sequestration (CCS), and carbon-scrubbing engineering technology. Nature-based carbon sinks such as forests, oceans and soil can trap and utilise CO2; in so-called ‘hybrid solutions’, emissions from bioenergy use can be captured and buried underground or undersea – for example, in depleted oil and gas reservoirs; and carbon-scrubbing engineering technology can deploy direct air capture and storage (DACS) to actively filter carbon dioxide from the atmosphere and sequester it in long-life products such as carbon fibre, aggregates and other constituents of concrete in a process known as carbon capture, usage and storage (CCUS).

Of course, investment in carbon dioxide removal projects carries inherent risk – natural carbon sinks such as ancient forests can release all of their captured CO2 in just one catastrophic fire, for example – but the re/insurance industry is in a strong position to help reverse what has so far been a poor business case for carbon removal. Although the allocation of carbon-dioxide credits is not without its vocal critics among prominent environmental organisations, the industry has begun to respond to the need for emissions reductions with carbon-credit insurance products.

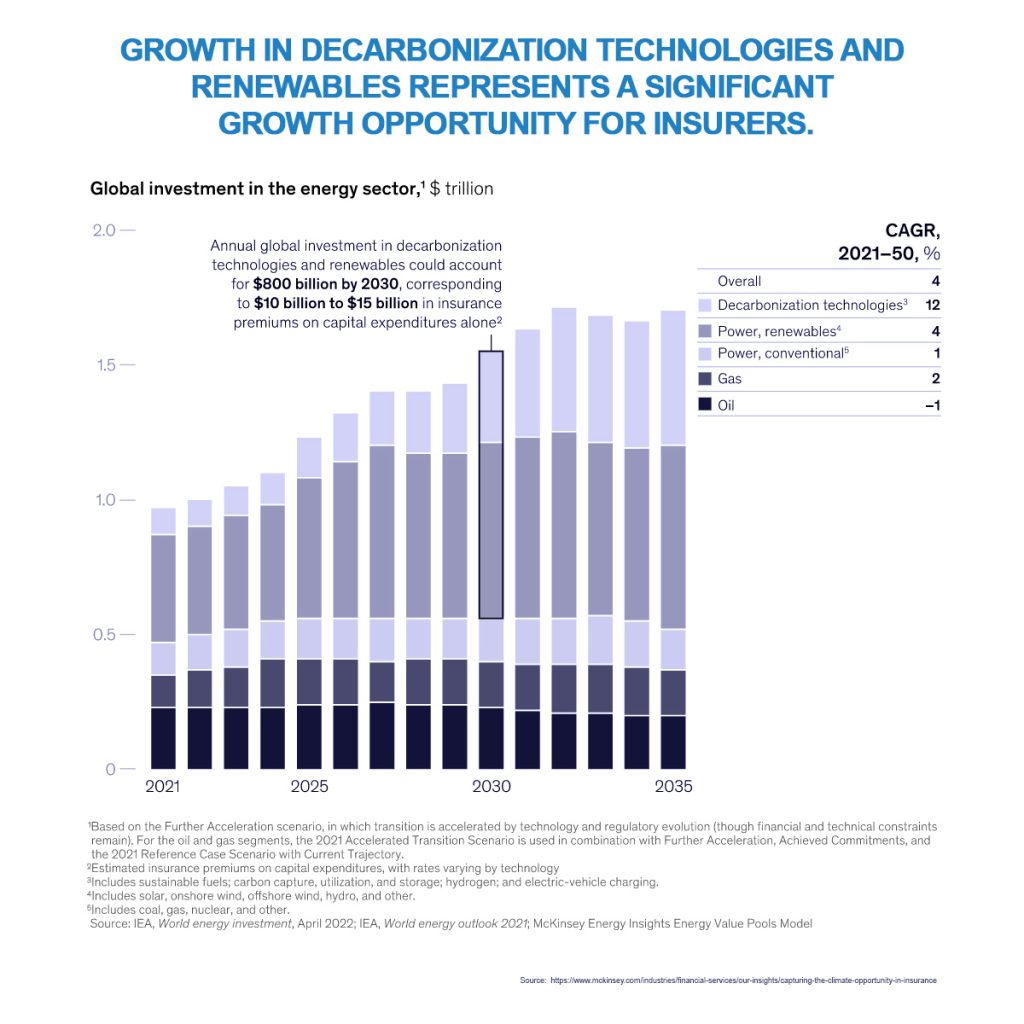

There is, however, more the insurance industry can do to help facilitate emissions reductions. Technology is a crucial tool in helping to achieve decarbonisation along with demand reduction. In the words of the McKinsey Global Institute, “By our estimates, annual global capital expenditures in the top climate technologies could account for more than US$ 800 billion by 2030”. They predict that this could be worth approximately US$ 10 to US$15 billion in insurance premiums on capital expenditure alone.

Here, we examine carbon dioxide removal technology, the expanded role re/insurers can undertake to facilitate further growth in the market and innovation in carbon-credit insurance, and the barriers, risks and potential pitfalls involved

What are the principal CO2-removal methods?

Nature-based solutions

The ability of CO2 to be converted into biomass through photosynthesis is proving vital in human efforts to lower current CO2 emissions. In plant life, all captured carbon dioxide is stored within the plant for as long as the plant is alive. The most common nature-based CO2 removal solution is afforestation, the practice of planting trees – at scale – on previously unwooded land, or reforestation, which involves replacing previously felled forests.

It can take many years for a newly planted forest to reach the maturity needed to achieve its full CO2-capture potential – typically around 20kg CO2 per tree per annum – but, once established, mixed broadleaf forests can live for between 300 years and 400 years.

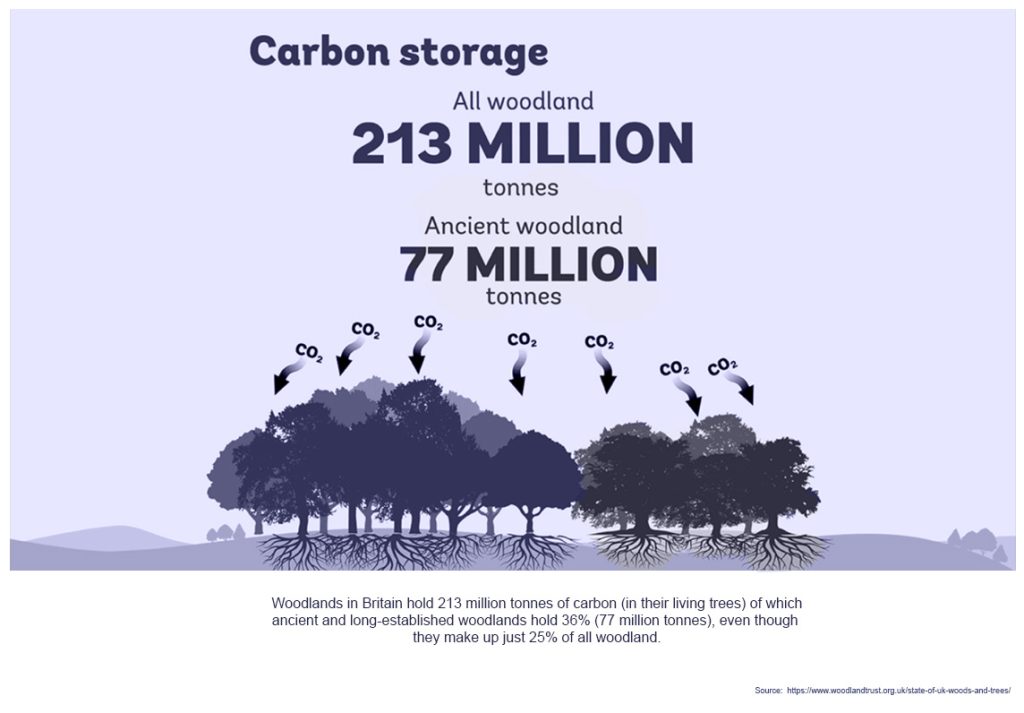

Data from the UK’s Woodland Trust suggests that ancient and long-established woodlands hold 36% of the UK’s total CO2 stock held in living trees but make up just 25% of all woodlands.

This method is not without its downsides and requires ongoing management – as soon as plant life dies, it begins to decompose and release most of its stored CO2 back into the atmosphere. However, the ongoing cycle of the inevitable death of fully mature trees can be partially offset by using woody tree biomass in long-life products such as timber for construction, thus storing their embodied CO2 for decades.

Hybrid solutions

With hybrid solutions, nature and engineering meet to combine the effects of photosynthesis with the ability to convert CO2 into a form in which long-term storage is viable. As an example, biomass can be converted to heat through burning, producing biogenic CO2 that can easily be stripped from flue gases with conventional carbon-capture technology such as acid gas removal, or amine scrubbing, a technology that has long been used in the oil and gas industry to strip “sour” natural gas of its hydrogen-sulphide and carbon-dioxide content. The captured carbon dioxide can then be sequestered in geological storage or used in the manufacturing process of long-lived products such as carbon fibre.

Technological solutions

Technological solutions rely on industrial engineering processes to scrub atmospheric CO2 for use, storage or both. Typically, these industrial processes turn atmospheric CO2 at a concentration of 0.04% into 100%-concentrated CO2. Compressed, liquified CO2 can be pumped underground into geological features such as depleted oil or gas fields, where physical and chemical processes begin to stabilise the CO2. One of the upsides of storing carbon dioxide underground is that historic infrastructure associated with such oil and gas wells can be used without the need for further capital expenditure.

There are downsides, too, as these industrial processes are not only energy-intensive – the energy currently required to remove one tonne of gaseous carbon dioxide from the atmosphere releases 0.6 tonnes of CO2 from the electricity and heat needed – but they are also far more capital-intensive than nature-based solutions. As a result, technological solutions involving industrial engineering to scrub CO2 from the atmosphere are neither mature nor deployable at scale. In short, the business case for capital-intensive industrial infrastructure in CO2 removal remains poor.

The case for carbon-credit markets, and where does the insurance industry come into it?

The notion of carbon credits has been around since the Kyoto Protocol in 1997, and it establishes a market by which credit owners may emit carbon dioxide as part of so-called ‘cap and trade’ schemes. These schemes incorporate a mechanism by which the allocation of credits is reduced over time –to lower CO2 emissions over the long term – while organisations that do not use up their carbon credits are permitted to sell them on in national or international regulated or voluntary markets. With each credit equating to one tonne of carbon dioxide equivalent, credits in 2021 were trading at a little below US$ 4.75 per tonne, with one tonne representing the equivalent of driving an internal-combustion-engine vehicle approximately 2,400 miles. Nature-based credits jumped to over US$ 14 per tonne earlier this year before dropping to their current price of a little over US$ 5.

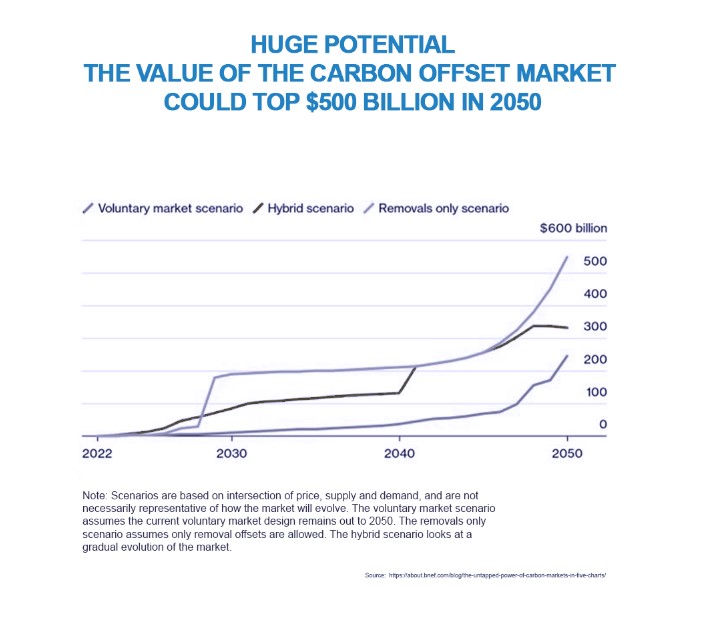

Advocates of these schemes believe that they will incentivise governments and organisations to invest in carbon-dioxide reduction projects such as natural carbon sinks or technology that scrubs CO2 from the atmosphere. Early commercial projects for CO2 removal have already been established. So, too, have the unregulated voluntary markets in which that CO2 can be commoditised and traded, with the first carbon-credit trade executed in 2019.

By developing and broadening the scope of carbon-credit insurance products that can compensate for losses from catastrophic carbon dioxide reversals in nature-based solutions, the re/insurance industry can help improve confidence in the CO2-offsetting market, leading to a growing sector that can help sequester even more carbon dioxide in the short term.

The insurance industry has an important part to play in helping the CO2-removal projects and carbon-credit markets develop and flourish, and it seems the industry is beginning to step in to address some of these risks.

Standard property insurance is already providing cover for natural assets like forests, including losses from natural disasters, but the industry can step up its positive influence on carbon dioxide removal projects by broadening the scope of its products to both buyers and sellers of carbon credits to include losses from adverse events beyond simply natural disasters. The risk of CO2-storage reversal – whereby decades-worth of captured CO2 is quickly released back into the atmosphere – would be disastrous not only for the capture-and-storage asset itself but could undo years of trading in carbon-offset certificates. In addition, as institutional investors, the insurance industry is in a perfect position to provide finance for the development and construction of CO2 removal infrastructure. In short, it can make projects more bankable. Further, the insurance industry has an opportunity and a responsibility to help grow the carbon-credit market by buying carbon credits to reduce its own emissions.

Carbon credits; barriers, risks, opposition & lack of transparency

As noted in a recent report from SwissRe, the principal barrier to widespread use of carbon-removal technologies remains the lack of a business case. It argues that without global carbon pricing, the world will continue to emit CO2 at will. “A sufficiently high fee on emissions,” the report notes, “would internalise expected negative externalities, and foster low-carbon decision-making in production and consumption. In the absence of a fee and policy mandates, there is little incentive to cut, let alone collect and store emissions.”

There are also several risks associated with both the sale and purchase of carbon credits. These include situations where schemes fail to deliver the promised CO2 reductions; the permanent reversal and loss of captured CO2; the potential for fraud on a massive scale, whereby buyers are issued carbon certificates that have been sold many times over; and the fact that nature-based solutions are, by definition, temporary. Indeed, from an investment point of view, there remains considerable risk associated with the long-term ability of nature-based solutions to store carbon. Changes in rainfall frequency and severity, as well as higher maximum temperatures, can alter CO2 uptake from trees, and destructive wildfires can reverse decades, if not centuries, of capture in just a matter of just days.

Furthermore, carbon-removal solutions, offsetting and carbon credits are not without their vocal critics among environmental groups; Greenpeace calls them a “scam”, a “bookkeeping trick”, and “the next big thing in greenwashing”. Offsetting, according to the environmental organisation, “incentivises the commodification of nature and allows powerful corporations to take over the lands of vulnerable communities”. Friends of the Earth calls carbon markets “a con”, and a “fundamentally flawed approach to cutting carbon emissions”.

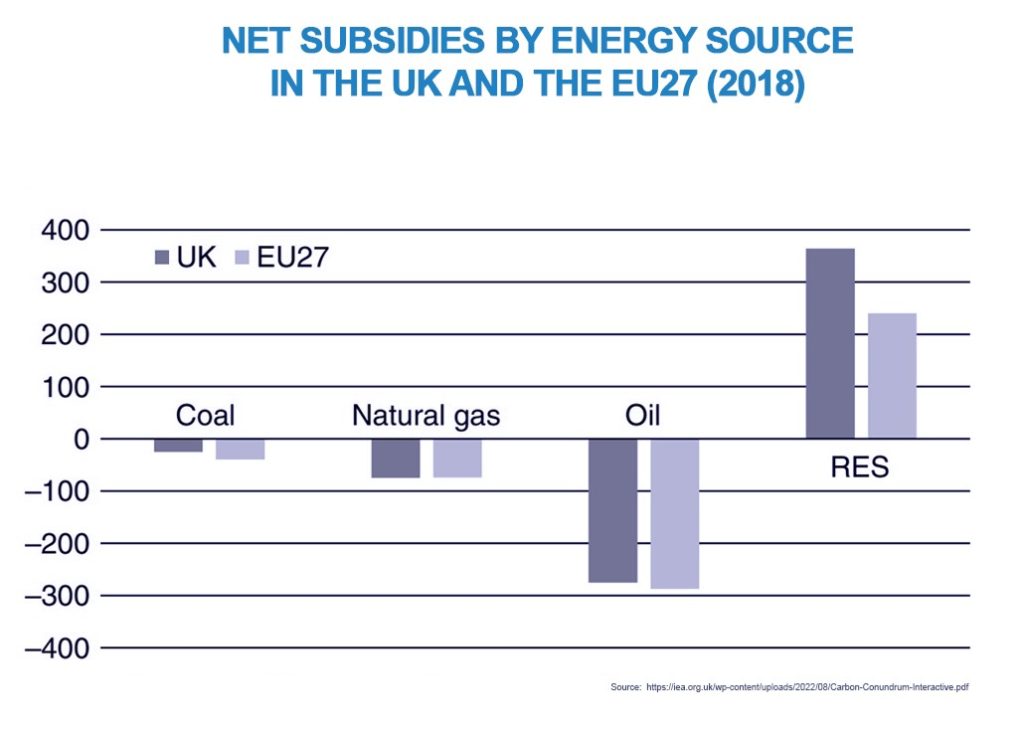

Despite the hyperbole, it is true that carbon-credit schemes are far from perfect; as opposed to a fair and transparent carbon tax on polluters, carbon-credit cap-and-trade schemes are open to abuse, whereby lobbying can exercise undue and opaque influence on the allocation of certificates to emit CO2. As the UK’s Institute of Economic Affairs (IEA) pointed out in its report, Carbon Conundrum, “Once those rights are allocated, if estimates of the cost of global warming reduce, the holders of rights to emit might resist the creation of further rights because it will cause the value of existing allocations to fall”.

As the Institute of Economic Affairs report goes on to note, the correlation between environmental damage and energy taxation is tenuous, and the same can be said for credits on emissions where taxes and subsidies are not netted out. “The same energy source is often taxed differently depending on how it is used,” says the IEA’s Professor Philip Booth, “even though the social costs arising from… carbon emissions will not depend on how the energy source is used. For example, in nearly every country, burning kerosene in an aeroplane attracts no tax, but burning closely related diesel in a car attracts excise duties in the UK and the equivalent in most other countries.”

When you consider that the carbon-credit markets view the true carbon ‘cost’ of driving approximately 4,000 Kms and producing about one tonne of CO2 (the equivalent of driving from Finland’s capital, Helsinki, to the Iranian capital, Tehran) to be a little under US$ 5, it is clear that there will need to be some major adjustments to existing and unfair green penalties already imposed in the name of emissions across disparate sectors and usages. Using the Helsinki to Tehran trip as an example, whilst the carbon-credit markets believe one tonne of CO2 emitted over a distance of 4,000 kms currently produces a negative externality worth ~US$ 5, central government tax regimes in the UK and several EU countries consider that cost to be over forty times greater, at around US$ 220.

Why is this important? Principally because penalising, banning or promoting certain technologies in respect of carbon pricing and credit markets gives an inaccurate picture of their relative social costs; such schemes can be far more opaque than alternatives such as a carbon tax, ultimately making them counter-productive. According to the IEA report, “Taxing carbon emissions [as opposed to creating carbon credits] allows individuals and businesses to reduce emissions in the manner cheapest for them… subsidising renewables and nuclear power or banning or promoting particular technologies leads individuals and businesses to reduce carbon emissions in ways that will be less efficient”.

The report argues, for example, that British households already pay an implicit carbon price of £150 per tonne of CO2 on their electricity consumption, and UK drivers pay an implicit carbon cost of £200 per tonne. A fairer direct carbon tax on the social costs of pollution, however, would see lower costs for road users and electricity consumers, and higher costs for gas consumers. “What is clear is that the current pattern of taxes and subsidies is arbitrary and totally unrelated to any rational assessment of social costs,” says the report. “This is harmful because it means that any attempt to reduce carbon emissions comes at a greater economic cost (or, equivalently, for a given economic cost, there will be less of a reduction in carbon emissions)”.

A lonely market for now

Despite the potential of CO2 removal and carbon credits to make a significant contribution to emissions reductions, the immaturity of the market remains a major barrier to progress. The lack of performance data and loss history makes it hard for insurers to innovate in this market, despite early signs of progress, and the slowness of the insurance market to respond with dynamic innovation, in turn, increases risk and suppresses investment from the asset-management and investment side of the insurance industry.

As the SwissRe report notes, “[Insurers] may increase their understanding of the new carbon removal risk landscape by offering standard products for the easy-to-cover exposures, by investing at a small scale and by entering long-term offtake agreements with select carbon removal providers”.

As the report observes, investors are currently unlikely to enter the CO2-removal market alone, making the rapid growth of carbon-credit insurance problematic. Indeed, those taking early risks in the carbon-removal and carbon-credit insurance market might find it a lonely market to begin with, even if those investments end up being handsomely rewarded.

Once the market begins to mature, scaling of the industry will need de-risking and finance, but insurers first need to appreciate the scale of the challenge. As SwissRe notes, “The carbon removal industry will have to scale from some 10,000 tonnes of negative emissions today to around 10 billion tonnes by 2050 [at] a compound annual growth rate… of close to 60%.”

The task is enormous, but so are the rewards.