Grid-scale battery energy storage systems (BESS) are becoming an increasingly common feature in renewable-site design, grid planning and energy policy as a means of smoothing out the intermittency of renewable energy technologies such as wind and PV solar – they are, in fact, one solution to the ‘missing link’ problem of making renewables a viable 24/7 sustainable energy solution.

We have seen the rate of commercial deployment of BESS rapidly increase, but as with all fast-developing nascent and emerging markets, historical loss data is hard to come by. This presents problems for insurers looking to quantify risk. Is battery energy storage a significant risk? Or is our understanding of this new technology maturing sufficiently?

Why is battery storage a big issue?

International agreement on reducing CO2 emissions has driven wide-scale deployment of renewable-energy technologies such as grid-scale wind and solar photovoltaic (PV) to provide low-carbon power in an effort to reduce greenhouse gas (GHG) emissions. Global capacity in renewables stands at approximately 3,400 GW[1], around ten times the capacity of existing nuclear production[2]. Renewable energy consumption is likely to rise by around 11%[3], overtaking coal-generated power by 2025, with the world set to add as much renewable energy capacity in the next five years as it has in the last 20 years[4].

There is, however, a material disparity between capacity and final consumption; electricity is a service, not a commodity. Most national grids rely on ageing infrastructure, and many suffer from distribution bottlenecks. That means that, at the moment, power cannot be easily stored or transported, and the intermittency of renewable energy is such that ‘clean electricity’ cannot always be guaranteed when consumers need or want it most. This is where grid-scale battery storage comes in; it is designed to smooth out the peaks and troughs of natural intermittency and provide local and regional grid-balancing and grid-stability services when other sources are unable to meet demand[5].

Trends in the BESS insurance market

BESS is still a nascent technology, but the overall trend seems to be one of falling insurance costs for battery storage. This situation has arisen from a combination of improving loss experience and a growing understanding of the risk involved, according to specialist battery insurers Altelium[6]. Considering the rising costs of raw materials in renewable energy manufacturing[7], there is pressure to keep infrastructure costs as low as possible to make renewable projects financially viable. Although there is some potential to reduce insurance costs with existing international standards on storage sites, these are regarded by many industry insiders as inadequate. The current standard most common in BESS projects, known as NFPA855, is widely thought to be inadequate as it defines only minimum standards for BESS sites. In addition, industry experts view these standards as inappropriate for markets with land limitations, such as the UK, because they do not cover the practice of stacking containers, something demanded by commercial considerations of the realities of limited space.

Standardisation is, according to those same industry experts, a long way off. The market is in a phase of rapid growth, and the current trend is towards diversification in the technologies rather than any globally agreed standardisation[8]. For example, capacity per unit is not standardised, and is growing on the back of commercial pressures; gravity energy storage systems are now part of the mix, as well as lithium-ion and vanadium technology, and multiple use cases such as grid balancing and stability, or reactive power and load shifting, are common. In short, the sector comprises multiple functions deploying a range of technologies, all with differing insurance risk profiles.

Nevertheless, global cooperation on agreed standards is the likely way forward as the market begins to mature with a data-driven approach, and the insurance and reinsurance industry make further progress in identifying patterns of loss data based on use cases, build quality, power capacity and fire safety. Given the diversity of deployed technologies and of use cases, it is perhaps not surprising that insurers have been hesitant when it comes to establishing risk profiles. Minimum global standards on construction and maintenance will help, and growing loss data will also assist the industry in pricing risk once the diversity in the BESS market has been fully factored in.

Opportunities & risk

Much of the industry’s approach to BESS has been informed by the growing market in battery electric vehicles (BEVs), given that the technology used in these (lithium-ion batteries) is similar to many of the BESS deployments. So, what’s the problem with lithium-ion? In short, volatility, flammability and thermal runaway. The oxides in the chemical makeup of li-ion cells mean that once a thermal runaway point is reached, the cells produce large amounts of oxygen which feeds fire, they burn more intensely than internal-combustion-engine vehicles[9], and they are extremely difficult to extinguish. Burning li-ion cells can also emit toxic gases such as hydrogen cyanide, hydrogen chloride and ammonia[10], which are harmful to human health and can form highly explosive vapour clouds that can produce rocket-like flames[11] when they vent, adding an extra dimension to the overall risks associated with fire. High-profile fires at BESS installations in South Korea, the US, the UK[12] and Australia have focused minds on the need to assess emerging risks and the role the insurance industry can play in incentivising mitigation.

In addition, by their very nature, grid-scale renewable-energy installations tend to be located in remote rural areas adjacent to renewable-energy sites. These areas are often characterised by limited and distant emergency-service response, meaning that adequate fire crews will typically not be close enough to respond to incidents involving catastrophic battery failure. Even installed fire-suppression systems designed to mitigate risk can create dangerous overheating when they malfunction, as happened at a large installation in California when batteries were accidentally sprayed with water[13].

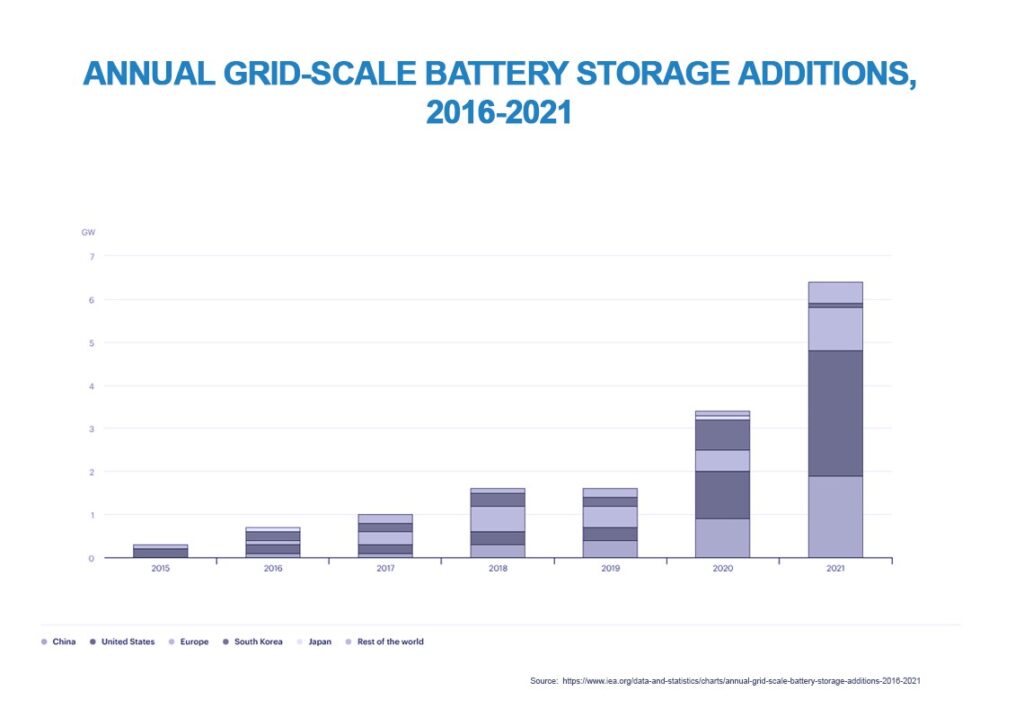

Despite chequered loss data, development is nevertheless continuing apace, with both the total storage capacity and individual plant capacity growing fast. This represents a growing opportunity for insurers, with UK capacity set to grow to ten times its current size[14]. Globally, installed capacity needs to grow from 16 GW to 680 GW by 2030[15], or growth of more than 40 times existing capacity, to meet the International Energy Agency’s (IEA) global energy roadmap.

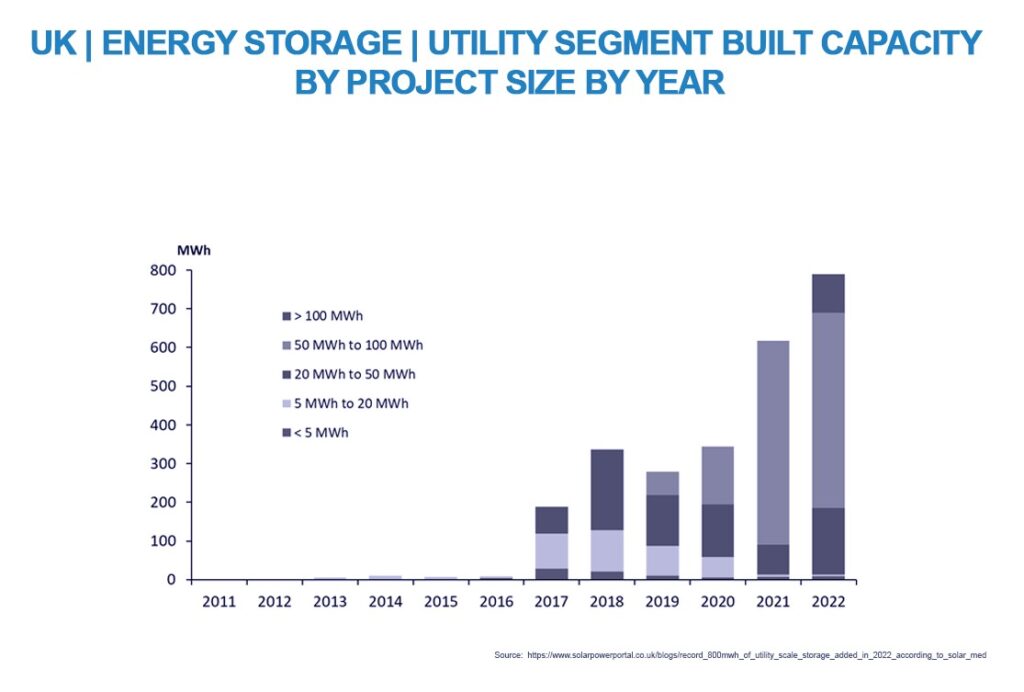

The UK’s battery storage capacity has grown to around 2 GW, and the capacity of individual installations has also grown in the last few years. More than half of the capacity submitted for planning permits in late 2022 (4.4 of 7GW) consisted of individual applications of more than 100 MW capacity, and the vast majority of the capacity submitted via the planning process during this period (6.5 of 7 GW) came from sites of more than 50 MW.

As if to demonstrate the speed of development and growth in capacity per unit, a new installation on the Thames estuary in the UK will be amongst the world’s largest[16], with a capacity of 1.3GW. This could provide a short-term supply equivalent to 2 hours of production at Scotland’s Torness nuclear facility[17].

What does this mean for insurers?

We see a more stable market developing, but this will be contingent upon rapid and effective global cooperation on standards to mitigate risk. Mitigating risk is strongly associated with renewed efforts in four specific areas (design, construction, fire protection and maintenance[18]), which will give insurers the information they need to assess risk and manage risk profiles.

- Design: Firewalls should be a prerequisite for BESS design. Usually made of concrete, they are located between battery storage containers and will allow insurers to lower the estimated maximum loss for battery installations, meaning operators can install higher capacity with more competitive premium rates. In addition, increased clearance between containers will translate into lower premiums because failures can be isolated to avoid single thermal runaways engulfing entire installations, thereby limiting losses.

- Construction: Insurers will respond favourably to operators choosing construction partners that are familiar with BESS technology. This includes other important considerations such as the use of non-combustible materials in the insulation of the battery containers and knowledge about the adequate and suitable ventilation and fire-suppression systems for the installation.

- Fire protection: Operators that apply best-in-class fire protection and testing for BESS systems will ultimately see that investment back in reduced insurance costs. A combination of international design standards and testing certification means operators will be able to demonstrate to insurers heightened risk awareness, analysis and mitigation that will lead to greater insurability. This would include plans that recognise the remote nature of many renewable-adjacent BESS systems in rural locations, as well as early engagement with fire services to plan access and emergency response to potentially devastating and costly thermal runaways.

- Maintenance: Every BESS site should be able to demonstrate maintenance schedules that include regular preventive checks and thermographic testing. An adequate inventory of replacement parts should also be maintained to reduce business interruption losses.

Electrifying futures

The millions of battery cells currently in operation today are all, as we speak, contributing to a growing body of loss data that will quickly turn what many are treating as a nascent market with emerging risks into an established one. Its growing maturity will in turn translate into affordable insurance based on tailored risk profiles, depending on technology type, use case and standardisation in design, construction and fire-suppression.

The fastest route to reducing insurance costs will be the adoption of a global standard on the regulations of batteries used in BESS sites. Tightening up safety issues will improve insurability, and safety features that form part of internationally recognised and respected global standards will give the insurance industry the confidence it needs to widen and deepen access for this important sector in our energy transition.

JENOA’s experience with this technology and access to reinsurance hubs around the world including the Lloyd’s of London market, means that we are able to take advantage of conventional and evolving international reinsurance capabilities to meet these developing challenges. Our strong focus on innovation and technology allows us to broaden our reach into developing markets in the Middle East, North Africa and further afield enabling us to offer the broadest possible access to data-driven and tailored insurance products to meet clients’ multiple needs in the emerging energy storage sector.

[1] https://www.irena.org/News/pressreleases/2023/Mar/Record-9-point-6-Percentage-Growth-in-Renewables-Achieved-Despite-Energy-Crisis#:~:text=Abu%20Dhabi%2C%20United%20Arab%20Emirates,year%20was%20produced%20by%20renewables.

[2] https://pris.iaea.org/PRIS/WorldStatistics/WorldTrendinUnitCapabilityFactor.aspx

[3] https://www.undp.org/energy/blog/three-trends-will-shape-energy-sector-2023

[4] https://www.undp.org/energy/blog/three-trends-will-shape-energy-sector-2023

[5] https://www.marshcommercial.co.uk/articles/battery-energy-storage-fire-risks-explained

[6] https://www.energy-storage.news/battery-storage-insurance-costs-are-falling-as-understanding-of-risks-grows/

[7] https://www.iea.org/articles/what-is-the-impact-of-increasing-commodity-and-energy-prices-on-solar-pv-wind-and-biofuels

[8] https://www.energy-storage.news/battery-storage-insurance-costs-are-falling-as-understanding-of-risks-grows/

[9] https://www.autoevolution.com/news/felicity-ace-fire-may-make-cargo-ships-wary-of-transporting-evs-185896.html

[10] https://ttu-ir.tdl.org/bitstream/handle/2346/86372/ICES-2020-433.pdf?sequence=1

[11] https://internationalfireandsafetyjournal.com/ifsj-exclusive-tackling-thermal-runaway/

[12] https://www.marshcommercial.co.uk/articles/battery-energy-storage-fire-risks-explained

[13] https://www.energy-storage.news/battery-storage-insurance-costs-are-falling-as-understanding-of-risks-grows/

[14] https://www.edisongroup.com/thematic/battery-energy-storage/

[15] https://www.edisongroup.com/thematic/battery-energy-storage/

[16] https://www.edie.net/uks-largest-battery-storage-project-receives-planning-consent-in-essex/

[17] https://www.edfenergy.com/energy/power-stations/tornes

[18] https://www.marshcommercial.co.uk/articles/battery-energy-storage-fire-risks-explained