Countries in the Middle East and North Africa (MENA) have made clear their plans to exploit their abundant natural resources, in a bid to make the region a major hub for renewable energy.

As these large-scale plans are implemented, they will present new challenges and opportunities for the reinsurance industry. In this latest JENOA Insights article, we take a look at a selection of the projects already well under way and examine the Insurance opportunity that they present.

Saudi swaps oil for sun and wind

Having been a key player in the international energy market for several decades, Saudi Arabia will certainly leverage its expertise and experience in infrastructure and policy development to achieve similar success from its renewable energy resources. As set out in its Vision 2030, Saudi Arabia aims to achieve net zero carbon emissions by 2060.

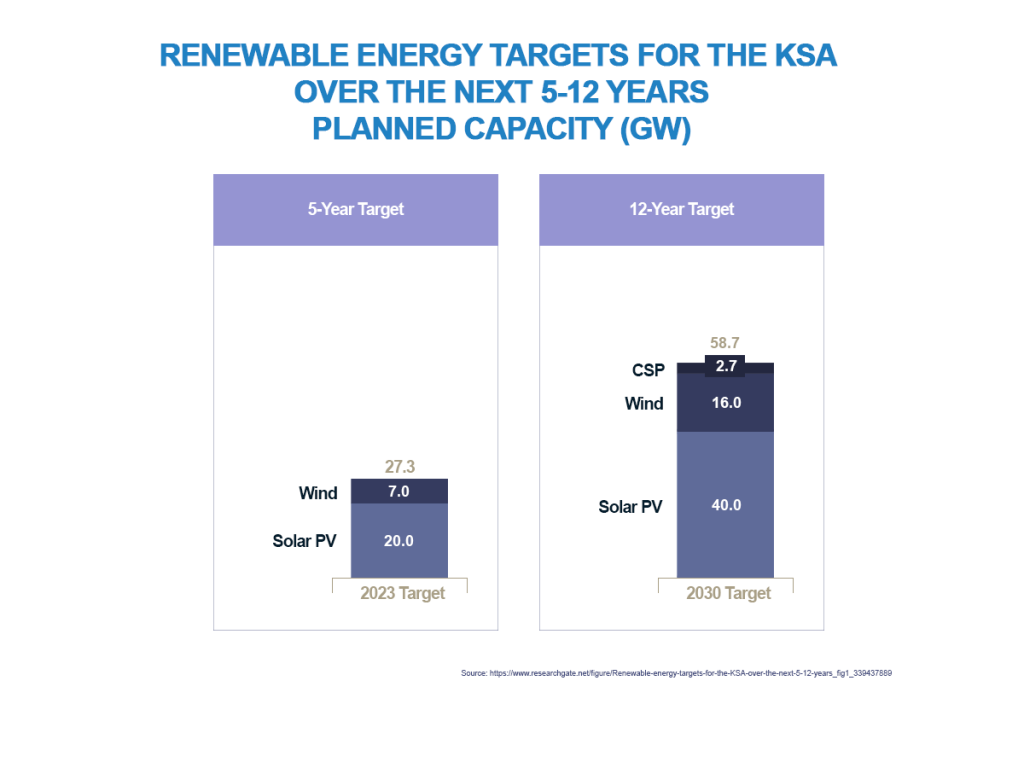

Accelerating the transition from fossil fuels to renewable energy sources lies at the heart of its strategy to attract new investment, diversify the economy, and meet its sustainability goals. With plentiful natural energy resources, including solar and wind, and ready access to cutting-edge technology and innovation, Saudi Arabia is well positioned to become a global leader in renewable energy capture and provision. Its initial target is for renewables to provide 50% of its energy needs by 2030, amounting to 58.7 GW, and it has already embarked on several landmark projects to achieve this goal. At the same time, it is investing in technology to help reduce carbon emissions and the impact of climate change on the region.

Among the country’s flagship projects, is the Sudair Solar Power Plant in the capital Riyadh.[1] Expected to become one of the world’s largest single-contracted solar photovoltaic (PV) plants, the facility will have a total generation capacity of 1.5 GW, producing enough energy to power 185,000 homes and save almost 2.9 million tonnes of carbon emissions.

Following in the footsteps of Saudi Arabia’s first utility-scale solar energy project, the 300 MW Sakaka solar plant, which was launched in April 2021, the new facility is the first of its kind to be developed under the Public Investment Fund’s renewable energy programme, worth US$ 906 million, it shows the scale of investment that will need specific, tailored coverage as more such projects get under way.

Heavy investment in the UAE

Another big player in the region is the UAE, which announced its ‘UAE Energy Strategy 2050’ in 2017. The strategy aims to increase the contribution of clean energy in the total energy mix from 25% to 50% by 2050 and reduce the carbon footprint of power generation by some 70%, potentially saving over US$ 190 billion, by 2050. It also seeks to increase consumption efficiency of individuals and corporates by 4%., including a commitment to achieve net zero by 2050[1]. In order to hit that target, UAE has pledged a US$ 163 billion investment in clean and renewable energy projects.

Leading the way is Dubai, whose Clean Energy Strategy aims for 75% of its total power capacity to be derived from clean energy sources by 2050.[3] Dubai’s new Integrated Energy Strategy will also set a regional benchmark for the implementation of clean energy projects.

In addition, to speed up the move towards a green economy, the government of Dubai Emirate has approved a US$ 27 billion Dubai Green Fund to support a range of projects, including solar power and building retrofitting, all of which will change the insurance and reinsurance landscape.

Among the UAE’s most significant projects are Noor Energy 1 and the Hatta Wind Power Project, both in Dubai, and the Al Dhafra Solar Project in Abu Dhabi.[2] With new projects coming online on a regular basis, the region’s renewables industry is only going to grow exponentially.

The Al Dhafra is a 2 GW PV independent power producer project, which, once fully operational, the plant is expected to potentially avoid CO2 emissions by perhaps more than 2.4 million tonnes annually.

Noor Energy 1 is the fourth phase of the Mohammed Bin Rashid Al Maktoum Solar Park. Once complete, the US$ 13.9 billion project, which produces hybrid energy sources including concentrated solar power (CSP) and PV, will be the world’s largest single-site CSP facility.

The Hatta Wind Power Project, based in the Hajar Mountains, will be the UAE’s first major utility scale wind farm. Led by the Dubai Electricity and Water Authority (DEWA), it is expected to reach a total capacity of 28 MW.

North African power

North Africa has emerged as a pioneer in the production of green hydrogen, with Egypt and Morocco at the forefront.

Driving this green hydrogen revolution is an agreement signed between Egypt and the European Union in April 2022, to ensure the supply of liquefied natural gas (LNG) and green hydrogen between Europe and Africa. By leveraging the synergies of the two different energy sources, Egypt has created a marketable electricity surplus that will only grow as more of its renewable energy projects come online.

One of Egypt’s most significant green hydrogen projects will be built on the western shore of the Gulf of Suez. Norwegian renewable energy company Scatec and Dutch-Emirati fertiliser producer Fertiglobe have partnered with the Sovereign Fund of Egypt and Egyptian construction giant Orascom to build the facility in the industrial zone of the Red Sea port of Ain Sokhna. The facility will commence operation in late 2022.

Egypt’s US$ 4 billion Benban solar park[7] ,[3] outside Aswan, is also one of the world’s largest operational PV solar parks, with an installed capacity of 1.8 GW. In addition, its largest wind power generation complex, the 262.5 MW Ras Ghareb wind farm near the Gulf of Suez, generates enough electricity to supply 500,000 homes.

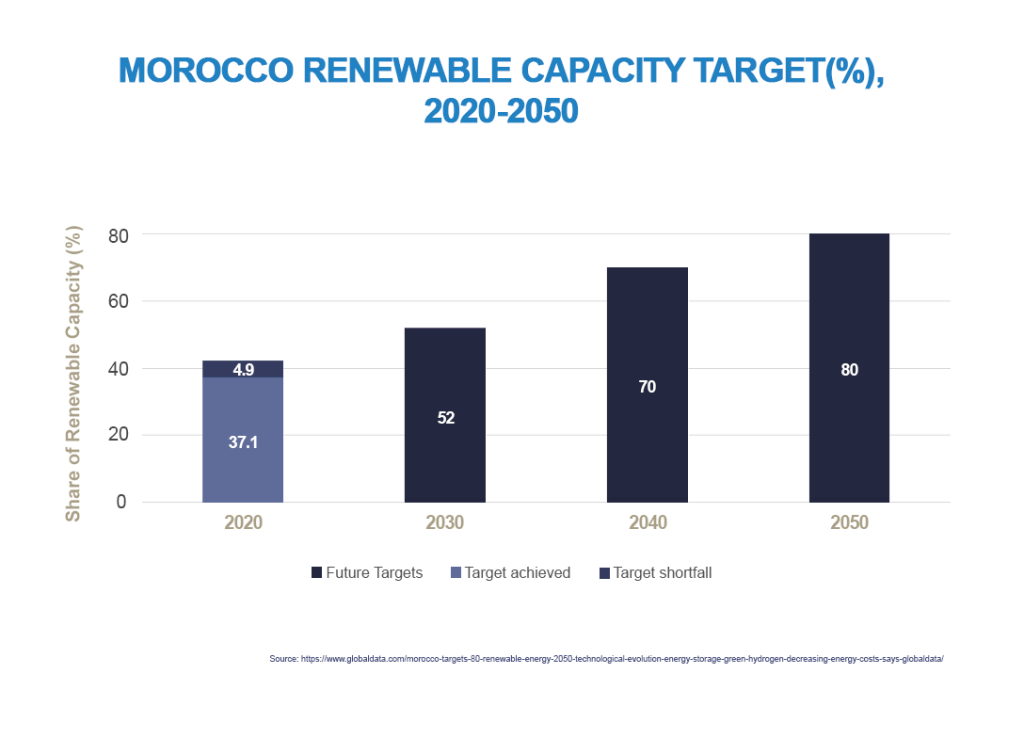

Morocco has also achieved significant progress in its wind and solar expansion, as well as being on track to substantially reduce its reliance on thermal sources such as coal and oil. In its new low greenhouse gas emission strategy to 2050, submitted to the United Nations, the country has outlined plans to raise the share of its renewable capacity within the overall power mix to 80%[4].

Turkey is also meeting the needs of its ever-growing energy demands by increasing renewable energy production. With a target to reach net zero by 2053, its renewable energy capacity has already increased by 50% over the last five years,[5] driven by hydropower, solar and wind.

The Insurance implications

This proliferation of renewable energy projects presents both huge challenges and opportunities for reinsurers in MENA.

Given that the renewable energy industry is relatively nascent, many of the risks are not yet fully understood. Added to that are the large losses already suffered as a result of increasingly unpredictable and catastrophic weather events, which have prompted reinsurers to harden rates.

Among the key risks associated with renewables are: quality and contractors’; technology and innovation; extreme weather events; cyber; political; policy and regulatory; and supply chain. The rapid expansion of supply chains, contractors and subcontractors has resulted in equipment supply bottlenecks, while construction and new quality standard risks are also starting to emerge.

The increasing use of new equipment types and technologies with little historical or no data is also making it harder for insurers to assess their reliability and price the risk. Therefore, it’s key for insurers to work with their clients to understand the design and test history of these new technologies.

Storms, high winds and flooding are among the most prevalent weather-related perils that renewable energy projects are exposed to, particularly given the large land masses they are required to be built on and the fact they are often more remote.

Renewable facilities also face the growing threat of cyber attacks, with the business interruption costs and reputational damage caused as a result often significant for both insurers and their clients. Thus, standalone cyber policies have a key role to play in providing protection against such attacks.

In addition, supply chains are targets for cyber attacks and data breaches, while they can also be subject to unplanned IT or telecommunications outage and transport network disruptions. Losses can be severe if there’s a knock-on effect where loss or damage to one component of a structure damages other parts, equipment or structures, causing secondary losses.

Amendments to government policy and regulation can also create policy risks, including subsidies being stopped or changes to tax relief. Additionally, future renewable market developments could result in increased curtailment risk, with projects not being fully compensated for changes to funding mechanisms.

On the positive side, new capacity is coming into the market in an effort to support insurers’ ESG initiatives and credentials. This should begin to create new competition and also meet the growing demand for capacity across this rapidly expanding sector.

There is also an opportunity for insurers to help renewable energy companies improve their risk management practice in the long term. That includes assessing and quantifying critical risks and putting the right infrastructure defences and insurance coverages in place to protect their key assets.

Risk consulting and engineering is also required to keep pace with the rapidly evolving technologies such as the development and upgrade of wind turbines. In addition, reinsurers have to constantly stay abreast of the latest international engineering standards and project and equipment certifications.

As the MENA region moves towards a greener future with the increased investment in renewable energy, so reinsurers should be seeking to capitalise on the many opportunities it brings. By doing so, they can play a key role, not only helping to drive the region’s sustainable economic growth and development, but also in mitigating against climate change.

[1] https://www.nesfircroft.com/blog/2021/12/major-renewable-energy-projects-happening-in-the-middle-east

[2] https://www.nesfircroft.com/blog/2021/12/major-renewable-energy-projects-happening-in-the-middle-east

[3] https://www.mei.edu/publications/egypts-synergy-between-natural-gas-and-green-energy-transition-cairos-advances-lng-and

[4] https://www.globaldata.com/morocco-targets-80-renewable-energy-2050-technological-evolution-energy-storage-green-hydrogen-decreasing-energy-costs-says-globaldata

[5] https://www.iea.org/news/turkey-s-success-in-renewables-is-helping-diversify-its-energy-mix-and-increase-its-energy-security