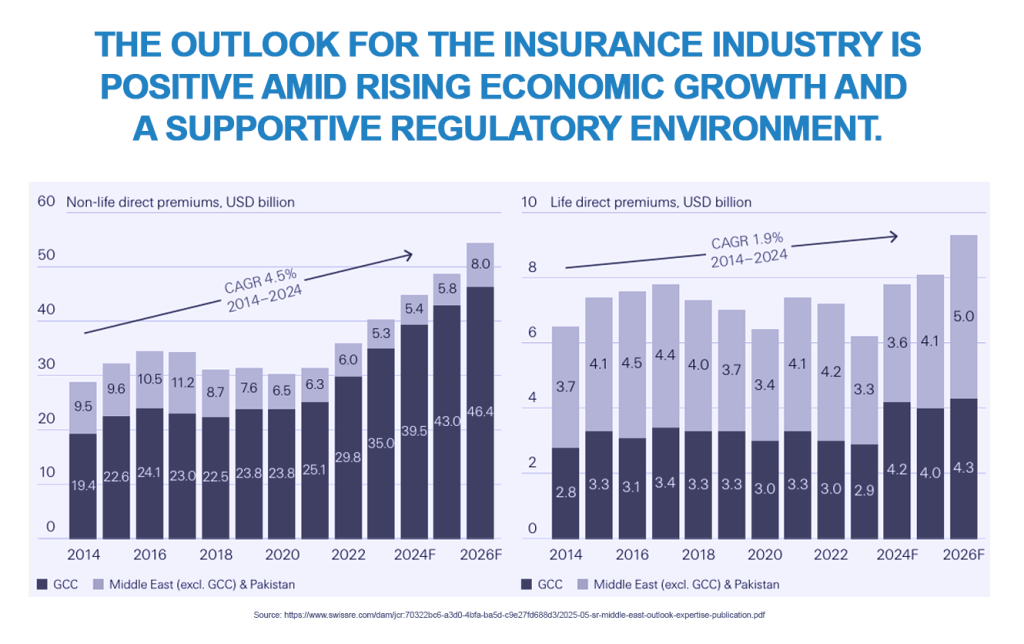

As we emerge from a year that re-awakened the region to the dangers of geopolitical and cyber risk, opportunities for Insurers, re-insurers, MGAs and brokers are nevertheless likely to increase as digitalisation and heightened data visibility give innovators a significant competitive edge. Right across the Middle East, where insurance penetration has remained stubbornly low, risk awareness is growing, and commercial lines are likely to experience growth as the SME sector increasingly wakes up to the dangers of underinsurance.

Insurtechs are likely to gain significant ground in retail consumer products, with parametric solutions beginning to show their real value across extreme-weather and travel segments. As product innovation begins to strengthen across MENA, the growth of MGAs in the region will likely help match the niche innovation in speciality lines already seen in markets that are experiencing a proliferation of MGAs, such the UK.

How will tourism & sport construction impact re-insurers?

Morocco and Saudi Arabia will play hosts to major international events from 2026 through to 2034, resulting in significant growth in the tourism market. Across the whole Middle East region, the undeniably dynamic construction market will grow by approximately 5% over the coming year. That growth will be driven primarily by sporting events and the significant international interest they attract, as well as by ongoing GCC mega-projects in luxury tourism and lifestyle hubs.

Host nations looking to de-risk capital exposures in tourism and sporting-infrastructure investment will offer the insurance industry a growing opportunities in the region, as well as a chance to demonstrate to buyers the severe risks of underinsurance. Indeed, the scope for education on the significant costs of underinsurance throughout an asset’s useful lifetime will help educate clients and investors that the completion of these projects signifies only the beginning of significant risk exposure, not the end.

Will uncertainty over US trade policy affect construction and re-insurance?

Despite lingering uncertainties over the occasionally mercurial trade policies of the current US administration, there is a degree of built-in resilience to the economies of the GCC and wider Middle East. While many Middle-Eastern countries have historically had to import steel and cement in large quantities, that, in itself, is unlikely to dramatically affect opportunities for re-insurers in the short- to medium-term – markets like Saudi Arabia are already building in some resilience as they fortify domestic supply chains on the back of mega-projects such as The Line, Diriyah and The Red Sea Project.[1][2] Many of these are financed through Saudi Arabia’s sovereign wealth fund, the PIF,[3] which offers some protection, as do new vertically integrated supply chains.

Where is the insurtech market heading in 2026?

MENA insurtechs are expected to witness around 8% growth per annum between now and [4]. This trend has largely been driven by the smartphone dividend, with the MENA region likely to onboard more and more customers through digital channels. Insurance penetration in the region sits well below 5%, but smartphone adoption has already topped 60%[5] and, in some GCC nations,[6] sits at more than 90%.

Motor and health, helped by mandatory cover regimes in the UAE and Saudi Arabia, will further increase the chances to capture insureds via digital channels. As a result, the retail segment will contribute the largest portion of premium revenues until the SME sector catches up, especially in the underinsured cyber sector. Back in the retail sector, digital embedded products such as insurance within travel purchases will further drive uptake through digital and traditional channels. After all, in a region in which Generation Z now demands 3-clicks-to-completion models, digital channels and digitally embedded products cannot be ignored.

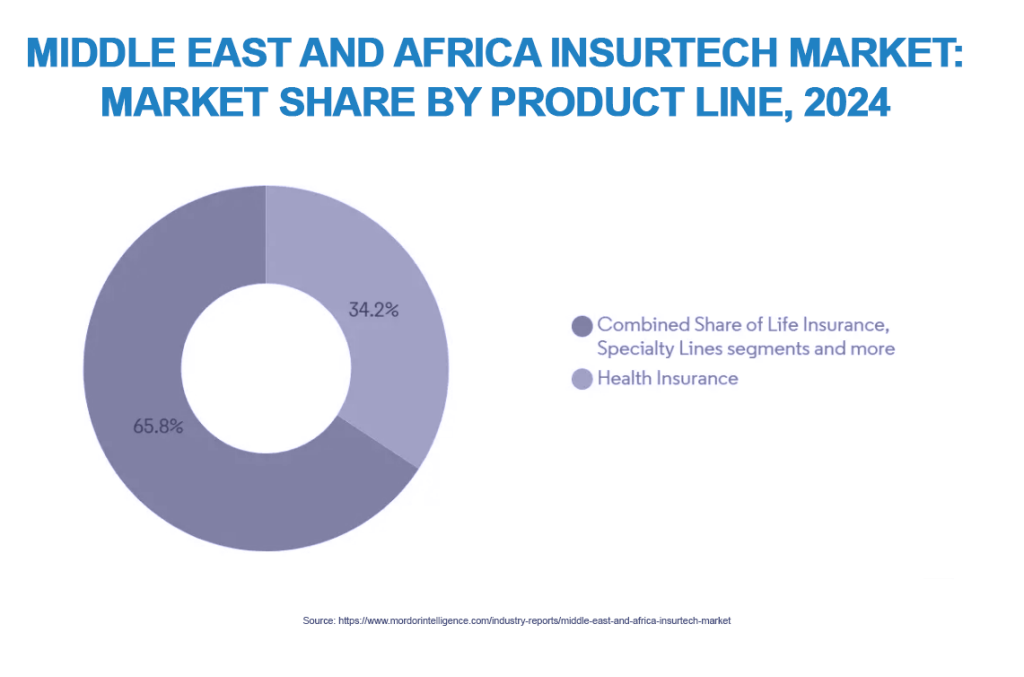

It should probably come as little surprise that the insurtech health and life markets are expected to account for over 60% of premium volumes. After all, it looks likely that mandatory expat health insurance will be introduced in Qatar, Oman, Kuwait and Bahrain,[7] with written premiums likely to rise if regulators permit nationals to freely access private healthcare under national policies whereby the government is essentially the policy holder.

Nevertheless, speciality lines are likely to experience the biggest growth over the next 12–24 months. On the back of an estimated CAGR of over 10%, insurtech speciality lines will rise to approximately US$ 2.5 billion by 2030. Cyber will help drive further growth, as a result of mandatory cyber-breach notifications in Saudi Arabia and tightening regulations in Morocco.

Will the Middle East markets spawn more Managing General Agents?

The MENA region will probably begin to reflect more mature markets such the UK’s, which has witnessed a proliferation of MGAs. With the ability to react more quickly to changing customer needs and opportunities, especially in niche segments too complex for large carriers, these dynamic intermediaries tend to innovate faster, offering re-insurers access to product innovation in new regions by way of the MGA-carrier partnership. Innovation like this could help close insurance gaps in the MENA region and expand revenues through digital channels.[8] It is also possible that more MGAs could become Lloyds cover holders under delegated authority, enabling them to offer policies in speciality lines across several jurisdictions. MGAs also tend to drive technology adoption in underwriting, distribution, data analysis and risk management, meaning they are often indispensable partners to large re-insurers when it comes to understanding risk exposure and the adequate pricing of risk.

Can the industry overcome underinsurance in the face of escalating cyber risk?

Automation and artificial intelligence (AI) will continue to alter the industry in the short- to medium-term, with opportunities for further efficiencies and more profitable underwriting coming from the more robust data analysis and improved risk management that technology enables. That will require the ongoing digitalisation of the retail and commercial markets, giving rise to a much larger cyber-attack surface in a region that, as mentioned above, is still bedeviled by low levels of insurance penetration.

Insurers, reinsurers, brokers and MGAs will all therefore all have a part to play, and the need to fill protection gaps to guarantee cyber resilience offers them an attractive commercial opportunity. The stakes are high, with some specialist industry insiders predicting that, without adequate cover, the global cost of cybercrime could top US$ 15 trillion by 2030.[9] As cybercrime experts, Cybersecurity Ventures, note, that would equate to the single largest transfer of economic wealth in history, and could present major economy-wide risk to commercial incentives for innovation and investment.

As US cyber-risk firm, Cyber Resilience, points out, “artificial intelligence will fundamentally reshape cybersecurity in 2026, empowering both attackers and defenders in an escalating arms race. From deepfakes that fool even close colleagues to AI agents that autonomously discover vulnerabilities, the impact will be felt across every aspect of cyber defense”.[10]

What does this mean for MENA clients and how can JENOA help?

With access to the Lloyd’s of London market, as well as major international re-insurance hubs, JENOA combines conventional Lloyd’s capabilities and global re-insurance expertise with local knowledge in speciality lines, niche segments and re-insurance capacity.

JENOA will guide and clients to provide comprehensive risk-management and risk-mitigation strategies, including alternative risk-transfer models, to help put in place effective and sustainable cover for what has become an unpredictable threat landscape.

Can Middle East markets navigate 2026 successfully?

New digital channels will drive growth in a Middle East retail market increasingly dominated by a generation that demands 3-clicks-to-completion models. Enhanced technological solutions are likely to offer agile re-insurers, MGAs and brokers the chance to innovate quickly and gain a competitive edge in speciality lines and niche segments.

The GCC’s relentless investment in tourism, technology, construction and infrastructure will continue to deepen and broaden risk pools for engineering and property, giving re-insurers ever-growing opportunities to help close insurance gaps and protect an increasing number of high-value assets.

[1] https://www.constructionbriefing.com/news/inside-saudi-arabias-construction-surge-three-key-takeways/8086777.article

[2] https://www.redseaglobal.com/en/our-destinations/the-red-sea/

[3] https://www.constructionbriefing.com/news/inside-saudi-arabias-construction-surge-three-key-takeways/8086777.article

[4] https://www.mordorintelligence.com/industry-reports/middle-east-and-africa-insurtech-market

[5] https://www.mordorintelligence.com/industry-reports/middle-east-and-africa-insurtech-market

[6] https://www.apptunix.com/blog/mobile-first-apps-powering-gcc-digital-growth/

[7] https://www.rgare.com/knowledge-center/article/new-year-to-showcase-the-middle-east-as-an-insurance-market-on-the-move

[8] https://uk.milliman.com/en-GB/insight/role-mgas-uk-insurance-market

[9] https://cybersecurityventures.com/cybersecurity-almanac-2024/

[10] https://cyberresilience.com/threatonomics/cybersecurity-and-insurance-predictions-2026/