Strong market headwinds have characterised the 2022 insurance and resinsurance markets, with high energy costs, rising inflation, geopolitical uncertainty, expensive natural disasters and the threat of ongoing recession looming large. Although the industry has exhibited a degree of flexibility in overcoming the challenges of the last couple of years, success in 2023 will depend on insurers’ ability to drive innovation amidst the kind of turbulence the world has not seen since the financial crisis of 2008.

As we enter the new year, inflation combined with economic and financial-market uncertainty is causing a hardening market, with reinsurers reassessing risk appetite with a resulting imbalance between supply and demand. The regional MENA market is showing strong evidence of a strain on balance sheets as recent consolidation trends begin to emerge, with global insurers leaving the market amidst high levels of M&A activity in the region.

Core themes of 2022

Cybercrime – the threat of cyber-attacks continued to dominate the insurance landscape in 2022, and this issue remains a growing threat for businesses as well as a major opportunity for insurers in the years ahead. Cybercrime is already costing at least US$ 6 trillion every year, and by 2025, Cisco’s “2022 Cybersecurity Almanac” forecasts that the reported cost of cybercrime will top US$ 10 trillion per annum. Global premiums for cyber insurance are set to rise from US$ 9 billion in 2022 to US$ 22 billion by 2025, with some estimates predicting they could reach over US$ 60 billion by 2029.

Malware such as ransomware is the number-one cyber threat across the board. Ransomware is a fast-growing method of economic cyber-attack that effectively holds an organisation’s IT infrastructure, hardware or software hostage and renders it unusable until decryption keys are given in exchange for a ransom payment. According to MunichRe, “criminal extortion in cyberspace is becoming ever more professional and complex and is often carried out by agile, coordinated criminal networks”. Soaring premiums followed a spate of attacks in early 2021, and by September 2021, cyber premium rates had rocketed more than 170% over the previous 12 months.

As if to underline the magnitude of the growing cyber risk against the backdrop of increasing exemptions and policy exclusions – whereby insureds look set to subsume a greater proportion of losses – Zurich’s CEO recently warned that cyber-attacks could become uninsurable. With critical infrastructure facing greater exposure to cyber-attack, many insurers are now excluding attacks carried out by state actors, Given the inherent difficulty often associated with distinguishing between the criminal organisations and state actors behind such attacks, those policy exemptions are likely to be accompanied by yet further legal wrangling as insurers seek to limit theirexposure[DP1] .

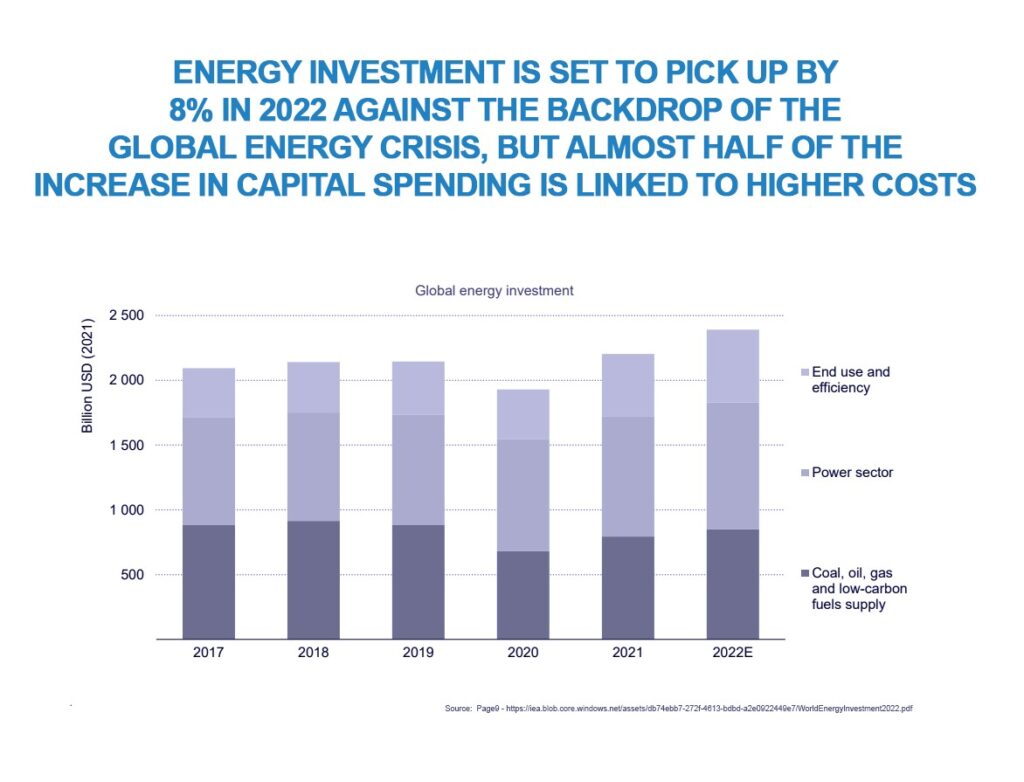

Renewable energy and parametric insurance – with renewables, grids and storage now accounting for more than 80% of total power sector investment, global energy investment growth looks set to top 8% in 2022, according to the International Energy Agency. Indeed, renewables continued to feature in the 2022 landscape as global energy production began to transition away from coal. As a result, parametric insurance has become more of a feature in the renewable insurance sector in non-damage scenarios.

Both wind and solar-PV assets are designed to operate within site-specific limitations. When installations experience conditions outside their operating parameters, generation drops, causing revenue losses.

Solar-PV panels, for example, achieve maximum efficiency at 25⁰ C; for every 1⁰ C of temperature rise, panels shed 0.35%- 0.5% efficiency. Wind turbines can suffer from frequent and intense storms, and high winds over 55 mph usually curtail generation for a typical utility-scale turbine. Wind-farm generation is also threatened by wind droughts. Data from 2021 show that UK utility SSE’s assets provided 32% less power than modelled during the six-month wind drought experienced in Europe, where the average capacity factor dropped three percentage points to 24% in 2021, compared to 27% in 2020.

Battery Electric Vehicle Insurance – as the world looks to reduce its over-reliance on hydrocarbons, some jurisdictions are currently planning mandated prohibition of the sale of new diesel and petrol vehicles during the 2030s. The EU recently approved a 2035 ban, with many hoping that EVs will establish a foothold among motorists by 2050 to help reduce air pollution. However, the rise in the production and use of EV lithium-ion batteries comes with its own challenges. Indeed, concerns over safety, reliability, environmental impact and fire risk continued to dominate insurers’ concerns during 2022, and the total loss of just one car-carrier vessel in February with a cargo of around 300 EVs caused financial losses of more than US$ 400 million, as well as rising premiums for car-carrying hulls.

Safety for users and first responders represents a significant worry, too. Although testing shows that BEV batteries are unlikely to be damaged by a crash, fire risk is high when high-voltage units are compromised. To understand this risk, specialist advice for emergency services in dealing with compromised units is widely published on OEM websites, and it tells its own story.

Whilst BEVs are seen as less polluting in their usage phase, the manufacturing process is dependent on huge amounts of energy and vast quantities of ore to extract the rare earth minerals needed. These include lithium and cobalt, and the growing demand for ethical and traceable material sourcing exposes OEMs to potential liability and reputational risk. Insurers will have to continue innovating in this market to provide cover against the liability of environmental damage in the disposal of toxic lithium-ion batteries, reputational damage in their energy-intense production, as well as their current electricity recharging mix, which was more than 40% fossil fuel-driven in Europe during 2020. Given that the technology is relatively new, and data is therefore hard to come by, few insurers in 2022 showed much willingness to address these issues and develop profitable solutions.

Market dynamics in 2023

Technology ecosystems and insurtech – in what is undoubtedly a difficult outlook for the market in 2023, insurers will likely concentrate on reducing operating costs while focusing on long-term growth. As a result, technology ecosystems will continue to dominate and shape the insurance value chain. What exactly is a technology ecosystem? In short, it is one in which forward-thinking and digitally minded players have not only adopted modern technology in the form of digitalisation but have also incorporated emerging technologies such as AI into the technology mix to transition entire market-lifecycle processes rather than isolated digital procedures.

Indeed, as an example of what is being undertaken, Lloyd’s of London itself is already a long way down the path to transitioning the entire market to a digital ecosystem as part of its Future at Lloyd’s strategy. As Lloyd’s promises, “the comprehensive programme… will profoundly transform the way in which customers get covered, right through to recovering from loss; this will be achieved by the redesign of the entire insurance lifecycle process –from placement through to accounting, payment, endorsements, claims, renewals and reporting – offering a seamless digital service for all Lloyd’s customers and stakeholders globally”. This is quite some leap into the future for the world’s oldest insurance market, one that has traditionally been characterised by “people and paper” as a result of its reputation as an insurer of large and complex risks that individual carriers refuse to undertake. For this reason, the GBP £300-million process of digitalising operations at Lloyd’s has been an ongoing endeavour, but it is widely seen as essential to making Lloyd’s a cheaper and easier market to conduct business in. Despite Lloyd’s reputation, the future is not far off; some predict that more than 75% of risks placed in the market will be digitally enabled, beyond purely digital “bind”, within three years.

Lloyd’s CEO John Neal hopes that full adoption will see a 40% reduction in processing costs, and he recently described the latest phase of its digitalisation as a sign of “how we remain relevant, reliable and competitive in a digital world”. Added value, streamlined processing and increased profitability are the key features that make scalable and flexible technology like this increasingly attractive, and Lloyd’s strategy should encourage the wider insurance market as to the savings and opportunities for enhanced profitability offered by technology.

As for insurtech, only two years after investment reached an all-time high, Forrester is predicting that more than 25% of insurtechs will exit the market in 2023, with funding anticipated to dry up due to high inflation, recession and more profit-driven investors. Some will wind down, according to the author of Forrester’s report, but private equity firms and insurers are likely to pick up viable insurtechs, with strong insurers poised to profit from the insurtech downturn by acquiring digital technology assets “on the cheap”.

Energy – few sectors demonstrate the dynamics of transition more than energy. Willis Towers Watson report that a major bifurcation is developing in the upstream (exploration and production) energy sector, with an abundance of capacity for the most attractive risks and no sign of any withdrawal. In fact, they report that realistic capacity stands at over US$ 7 billion for businesses such as fixed offshore assets and well-engineered risks, underlining the widely held view that the prospect of high premium income trumps all other considerations.

Meanwhile, less profitable businesses such as small land-rig fleets and sub-sea construction are experiencing the effects of insurers’ withdrawal from this less profitable market, severely restricting capacity. Whether MunichRe Syndicate 457’s premature withdrawal from oil in January 2023 has any significant effect remains to be seen, especially as it will continue to support long-term midstream and downstream gas projects. While they cite ESG as the reason for withdrawal, Willis Towers Watson reports that ESG is now being questioned in more and more quarters, highlighting the increasing inconsistencies of the ESG framework. The renewed focus on hydrocarbon production, including increased LNG exports from the US to Europe to soften the energy crisis around the world, is further adding to these growing inconsistencies, resulting in a lack of consensus on the correct approach across the market.

This is further evidenced by a softening of ESG anti-hydrocarbon positions from certain players; for example, Allianz has limited its withdrawal of support only to new single-site/ stand-alone policies for upstream exploration and Arctic and Antarctic exploration, and has announced that from 2025, it will have an “expectation of a commitment to net-zero GHG by 2050” from only the “largest hydrocarbon producers” (those producing more than 60 million barrels) to secure company-level insurance coverage and investments for hydrocarbons. Like MunichRe Syndicate 457’s exclusion clauses, Allianz makes special provision for the exclusion of new upstream gas exploration from its widely reported withdrawal from oil and gas.

Property – property markets are also in a state of flux, with reduced capacity and lower risk appetite leading to an extended hardening market. Last year, insured losses from natural disasters hit US$ 130 billion, up nearly 20% on 2020. It is not a lack of capitalisation, however, that is leading to loss of appetite, despite foreign-exchange impacts between dollar and euro – unmodelled and hard-to-predict losses such as worsening economic conditions, high inflation, rising interest rates and intermittent natural disasters with limited loss history or data are adding to balance-sheet volatility, and that is something insurers are keen to limit. Although a hardening market impacts all areas of property insurance, the irony is that it is likely to particularly affect disaster-exposed properties experiencing climate-change damage from named windstorms and floods. As Willis Towers Watson report, “premium increases for most insureds will be driven by inflationary construction costs, heightened reinsurance pressures and catastrophe capacity constriction, while valuation of assets will be the key topic of conversation in 2023”.

Reinsurance renewals – in Saudi Arabia, the 2023 reinsurance renewals are up by around 15 percentage points, broadly in line with increases globally. Willis Towers Watson report that reinsurance capital declined by around US$ 40 billion during the year and expects higher treaty costs to be passed to insureds as investors focus on profitability. That said, Forrester is predicting a push-back from customers and is forecasting a 20% increase in policy lapses for 2023 as budgets are tightened. With a significant withdrawal of capacity from catastrophe lines, the industry consensus predicts a drawn-out hardening of the market for at least the next 18 months.

“The retrocessional market has seen significant rate increases primarily due to a lack of capacity as demand clearly outweighs supply,” report Willis Towers Watson, “adding further pressure on the re/insurance marketplace”. The Swiss Re Institute estimates that there has been a 30% decline in reinsurance capital in the first three quarters of 2022.

Stronger headwinds for 2023

Digital technologies could help the industry navigate the turbulent outlook for 2023 and beyond. As insurtechs begin to exit the market, it is uncertain whether tightening budgets will allow for the sort of technologies that are most likely to keep insurers profitable.

In an industry characterised by its slowness to change, insurers will have to rely heavily on the momentum gained from rapid change over the last few years, in order to address increasing cybercrime, shrinking reinsurance capital and the chance of increased natural disasters, at the same time that customers and businesses face unimaginable pressures on cash flow, with policy lapses estimated to grow by 20%.

A global recession, coupled with a worsening net-zero energy crisis and fast-moving geopolitical developments, could well throw up yet more unforeseen obstacles towards a profitable future. At the same time, unmodelled and hard-to-predict losses will continue to challenge the industry’s stated goal of enhanced social purpose as demand begins to rapidly outstrip supply.