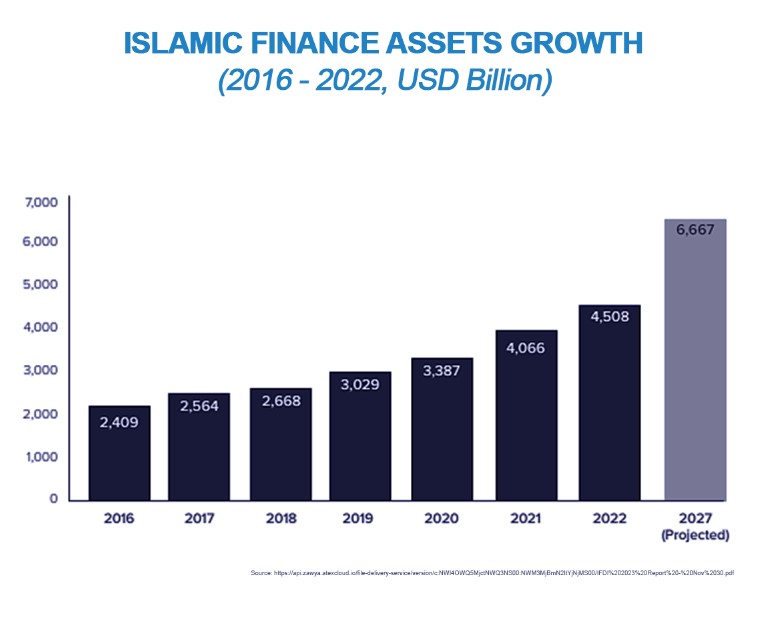

The Islamic finance industry has continued to grow steadily, and although the rate of growth has slowed slightly over the last year or two (from 17% in 2021 to 11% in 2022), it accounted for US$ 4.5 trillion worth of assets in 2022. By 2027, it is expected to top US$ 6.7 trillion in assets.[1]

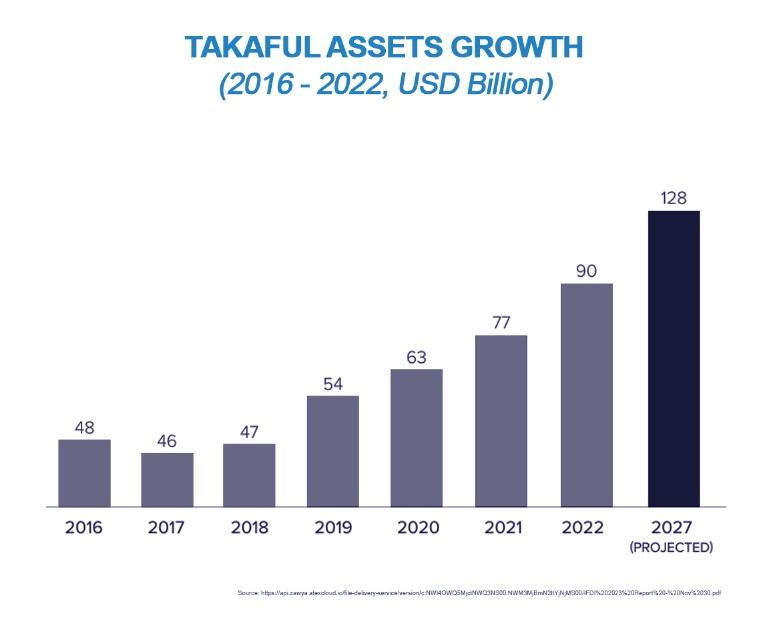

Takaful insurance and reinsurance is the third-largest contributor to the global Islamic finance industry, and yet, despite experiencing double-digit growth, it accounts for only 2% of Islamic-finance assets. This figure suggests that many Islamic-finance assets are insured with potentially non-sharia compliant, conventional, insurance.

Why is that figure so low, and what can be done to improve its market share?

Here, we look at some of the background to the industry and identify some of the misconceptions consumers may have about insurance and its place in Islam. In addition, we examine some of the key differences between Islamic and conventional insurance and show how easy it can be to design Sharia-compliant products.

Is the concept of insurance commonly accepted in Islam?

There has long been a common view among some consumers, that the very concept of insurance runs somewhat counter to the Islamic faith. In particular that fate is predetermined, and therefore the future is inescapable – so can the use of insurance be interpreted as an attempt to mitigate fate itself? This belief in fate or destiny – ‘Qadr’– is a core Islamic belief (Muslims are instructed to place complete faith in Allah and rely upon Him). However it is argued that the concept of insurance does not contradict Islam in general, nor the specific principle of reliance, as it is also commonly quoted that this principle of ‘reliance’ is based upon person doing whatever they are capable of first before relying on God. The key takeaway is that there is a personal responsibility to manage your own risks first. Personal risk management is hence an Islamic tenet, and because insurance is nothing more than a form of risk mitigation, insurance is conceptually permissible and, in fact may be desirable.

Islamic insurance and conventional insurance: what’s the difference?

The difference between Islamic and traditional insurance is often largely in the process of designing a product rather than the concept of the product itself. Sometimes, just the choice of words or written terms on a contract can be the difference between Halal (permissible) and Haram (non-permissible). That is why Islamic insurance and conventional often look the same, but there are crucial differences that distinguish them.

Both are risk management tools. From a client’s perspective, both in Islamic and traditional insurance, a specific sum of money leaves the client. In both cases, the client receives a policy document and, in case of loss, receives compensation to cover the loss. The underwriting and claims handling are identical.

Unfortunately, due to these many similarities between them, many insurance practitioners, including those working with Islamic insurance providers, are often left confused about the technicalities that differentiate the two insurance types.

Takaful came about as a Sharia-compliant alternative to commercial insurance in order to avoid some of the characteristics of conventional cover, such as interest, gambling and uncertainty. These specific characteristics go against the restrictions of Sharia law.[3]

One of the principal differences between the two is that, according to Islamic law, there cannot be any ambiguity or uncertainty. Therefore, the trading of risks is unacceptable in Islam because risk, by definition, involves uncertainty. In traditional insurance, a client pays a premium in exchange for an insurance policy, the client transfers the risk onto a third party, and the policy dictates the terms of an agreement that is characterised by uncertainty. There is no guarantee that the client will be compensated in the event of suffering a loss.

An alternative structure to traditional insurance, based on Shariah principles, was recognised by Muslim scholars in 1985, predicated on the principle of donation. The solution they came up with is as follows: if risks cannot be traded through a contract of exchange due to gross uncertainty, then the obvious solution was to discard the contract of exchange and replace it with an obligation to donate. Under the principle of donation, issues such as gross uncertainty become irrelevant. In Islamic insurance, insureds are known as Participants, who donate – pay a premium, in traditional terms – towards a pool, with the intention of helping others who may suffer loss.

So, similar to mutual insurance, takaful allows for risk sharing by pooling individual contributions for the benefit of all subscribers and adheres to the demands from Muslim jurists that insurance in Islam should be founded on the principles of solidarity, common interest, cooperation and shared responsibility.[4] As such, the insurance fund is held by policyholders.

Policyholders undertake to guarantee each other and make contributions to a mutual fund in lieu of paying premiums, which constitutes the takaful fund.[5] In effect, a mutual guarantee.

Why is takaful struggling to gain traction within the wider Islamic-finance industry?

First, it is important to note that takaful is still a work in progress, and although few things happen overnight, it is worth remembering that takaful has huge potential across the globe, in both Muslim and non-Muslim populations.

As mentioned above, takaful’s contribution to the Islamic finance industry sits at just 2% in terms of asset value. This would suggest that only a very small proportion of global Islamic assets are insured in a Sharia-compliant way, despite the fact that Islamic principles make Sharia-compliant insurance mandatory.

All of which begs the question: Why are Islamic assets more likely to be covered by conventional insurance than by Islamic insurance?

One of the major reasons is a distinct lack of available Sharia-compliant products, especially commercial products. On top of this, there is a shortage of Islamic reinsurance (retakaful), so even takaful providers are being forced to reinsure in the conventional markets despite their preference for using Sharia-compliant reinsurance.

On top of that, takaful is struggling to gain market share among high-net-worth individuals, because this sector usually demands high-rated, good quality and reliable insurance products from well-established, recognised and proven conventional providers. So, even though takaful is price-competitive with equivalent conventional insurance products in the more mature Islamic-finance economies, this sector tends to be far less sensitive to price.

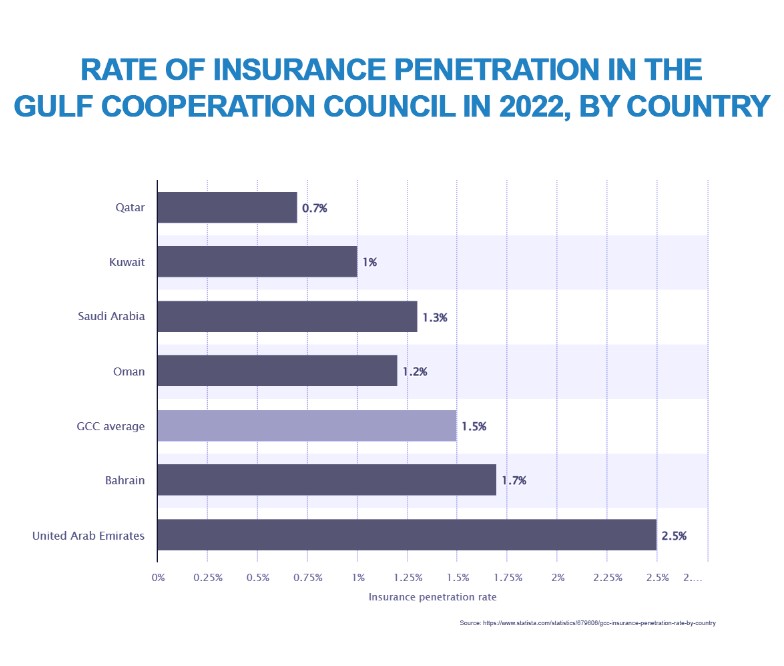

Finally, poor insurance penetration across both GCC and MENA countries for conventional and Islamic insurance is restricting the spread of takaful. In GCC countries, the insurance penetration rate – the gross written premium (GWP) as a percentage of GDP – remains low. In 2020, the average GCC penetration level stood at 1.9%.[6] This is well below the emerging-market average of 3.4% and the global average of 7.4%.[7] The UAE at 3.2%, and Bahrain at 2.1%, have the highest penetration rates across GCC states.

That said, takaful represents a huge potential, and the landscape is beginning to shift. The Saudi Arabian market saw the establishment of the Insurance Authority in September 2023, a move that is likely to further develop and strengthen the takaful sector as the country strives to meet the goals of Vision 2030.[8]

Given the low penetration of traditional cover in some of the GCC countries such as Saudi Arabia, the UAE and Qatar, takaful could be seen as an effective way of increasing awareness of the importance of insurance in strong, dynamic economies in the Gulf region, thereby increasing local and regional penetration.

In addition, the ethical component of takaful – consisting of a ban on investment in gambling, adult entertainment and weapons manufacturing among other things – has some appeal outside of the Muslim world, as do its underlying principles of fairness, transparency, mutuality and certainty. Indeed, takaful represents a compelling proposition for offering Sharia-compliant cover to populations with ethically minded non-Muslim customers, over and above the 2 billion Muslims around the world. That 2 billion are likely to begin to recognise the importance of taking responsibility for their own risk management with the ongoing evolution in the insurance sector, giving rise to further penetration for the takaful market.

How Can JENOA help?

At JENOA, we are committed to providing education, training and advice on Islamic insurance across the entire spectrum.

As far as our clients are concerned, JENOA is keen to help them understand the importance of insurance, and we want Muslims to understand that the concept of insurance is not contrary to slam, if done correctly and sensitively. We are committed to designing new products that fit our clients’ needs in compliance with their Sharia law. Our products will be ethical, Shariah-compliant and available to all, not exclusively to Muslims.

For Islamic insurers, it is important to understand that more and more Islamic countries are introducing legislation in support of Islamic insurance. In Saudi Arabia, insurance providers must conduct business and offer products in a Shariah-compliant manner. The industry is also seeing increased efforts towards developing knowledge and awareness of Islamic finance. In the UAE, the authorities now require qualifications for Shariah board members in Islamic financial institutions, and the UAE represents just one jurisdiction where Shariah qualifications, particularly in jurisprudence in transactions, are becoming increasingly important.

At JENOA, we are keen to help institutions meet the regulatory requirements from a Shariah perspective. We can advise on various Shariah-compliant insurance models and help to implement the most financially viable and suitable ones. We can assist in implementing the processes, designing Shariah-compliant policy wording, and advising on underwriting. We can also guide clients towards an understanding of the core Islamic insurance requirements that distinguish Islamic from conventional insurance.

For Islamic-finance practitioners, JENOA aims to lead the way to Shariah-compliant insurance and reinsurance solutions for our clients worldwide. As discussed above, because the vast majority of Islamic-finance assets are covered in the conventional markets, billions of dollars in premiums leave the Islamic finance industry and end up in the hands of conventional insurers who reinvest in the conventional market. If, however, these Islamic assets were to be insured Islamically, premiums collected by Islamic insurers would be available to reinvest in the Islamic market, as they would be Shariah-compliant.

This would allow rapid growth in both the takaful market and the wider Islamic-finance industry.

Looking ahead

We have established that Islamic insurance products are not difficult to design, and that the underlying concept of insurance is not incompatible with Islam. Indeed, minimising risk aligns with Islamic doctrines

Takaful contributions are projected to grow to US$ 128 billion by 2027. Regional takaful potential in MENA is therefore clear; the historically low levels of penetration for conventional insurance, as discussed above, will prove fertile ground for takaful growth. Coupled with increasing demand from a youthful global Muslim population for access to insurance products in the retail life and health segments, the promotion of ethical, Sharia-compliant financial products like takaful can help close that insurance gap and vastly improve takaful’s contribution to the global Islamic finance industry.

[1] https://api.zawya.atexcloud.io/file-delivery-service/version/c:NWI4OWQ5MjctNWQ3NS00:NWM3MjBmN2ItYjNjMS00/IFDI%202023%20Report%20-%20Nov%2030.pdf

[2] Sunan al-Tirmidhī 2517

[3] https://www.investopedia.com/terms/t/takaful.asp

[4] https://www.islamic-banking.com/explore/islamic-finance/islamic-insurance-takaful

[5] https://www.islamic-banking.com/explore/islamic-finance/islamic-insurance-takaful https://www.investopedia.com/terms/t/takaful.asp https://www.pwc.com/bm/en/services/assets/takaful_growth_opportunities.pdf https://www.iial.co.uk/IIAL/Publications/IIAL/Publications.aspx

[6] https://argaamplus.s3.amazonaws.com/68f88da4-b648-41f9-bb31-47ebb3414cb6.pdf

[7] https://argaamplus.s3.amazonaws.com/68f88da4-b648-41f9-bb31-47ebb3414cb6.pdf

[8] https://api.zawya.atexcloud.io/file-delivery-service/version/c:NWI4OWQ5MjctNWQ3NS00:NWM3MjBmN2ItYjNjMS00/IFDI%202023%20Report%20-%20Nov%2030.pdf