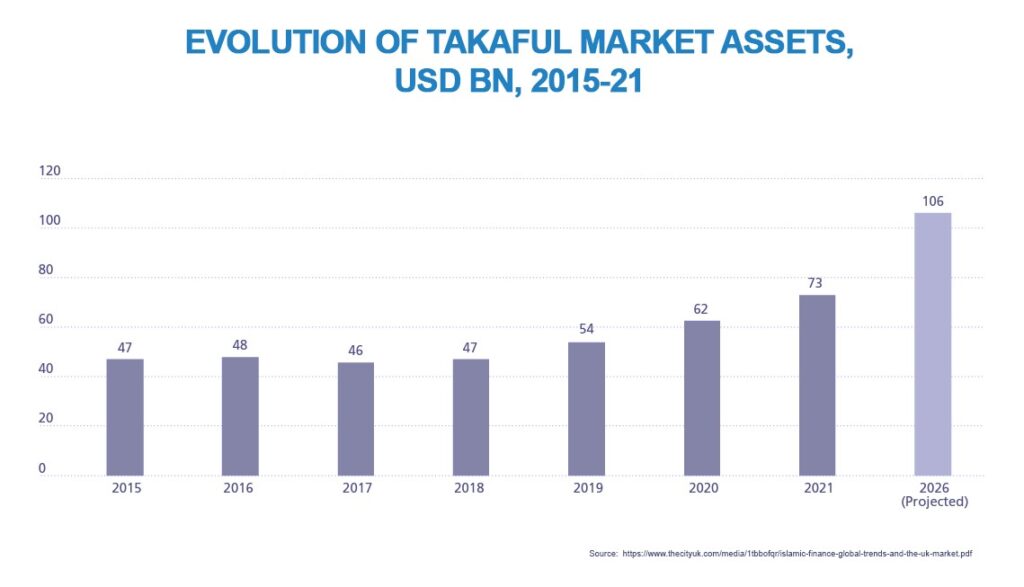

The Islamic finance industry, and in particular, the Islamic (takaful) insurance industry have shown signs of extraordinary growth over the last two decades. Between 2006-2011, it saw a compound annual growth rate (CAGR) of 20%, way above that of conventional insurance, and between 2015-2021, global takaful assets saw annual average growth of 8%, from US$ 47 billion in 2015 to US$ 73 billion in 2021. Global assets grew quickly in 2021, rising +17% year on year, and the market is expected to top the US$ 100 billion asset mark in 2026.

The UK is the principal centre for Islamic finance in the western world, and as the industry’s growth gathers momentum – the UK market now has at least 10 commercial insurers offering Shariah-compliant products – takaful (Islamic insurance) is a product-development opportunity with excellent potential both for the UK and other notable Islamic-finance centres.

So, what exactly, is takaful insurance, what are the trends, and where are the opportunities?

Islamic (takaful) insurance: what is it?

Takaful came about as a Sharia-compliant alternative to commercial insurance to avoid certain characteristics of conventional cover, such as interest, gambling and uncertainty, that go against the restrictions of Sharia law. Similar to mutual insurance, takaful allows for risk sharing by pooling individual contributions for the benefit of all subscribers. In short, it’s dependent on a cooperative principle, adhering to the demands from Muslim jurists that insurance in Islam should be founded on the principles of solidarity, common interest, cooperation and shared responsibility. As such, the insurance fund is held by policyholders. Policyholders undertake to guarantee each other and make contributions to a mutual fund in lieu of paying premiums, which constitutes the takaful fund.

The big picture: trends in the UK Islamic-finance market

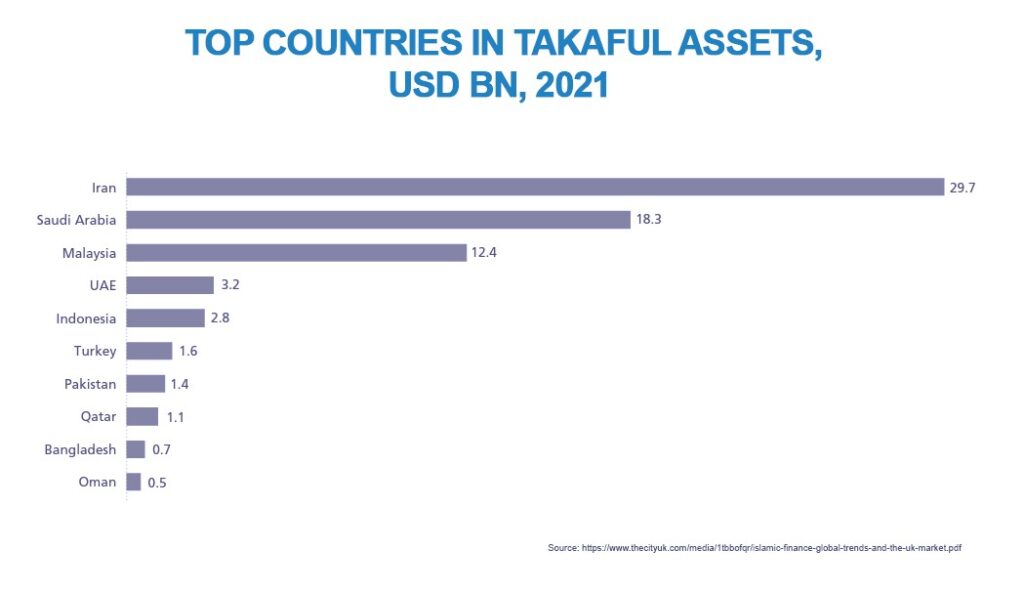

Currently, 95% of global takaful assets are concentrated in just three regions: non-GCC/MENA countries, the GCC and Southeast Asia. Iran dominates the global market, with approximately US$ 30 billion in assets in 2021, followed by Saudi Arabia (US$ 18 billion) and Malaysia (US$ 12 billion). The global takaful market is still immature, and takaful is the smallest major component of the Islamic finance industry. As such, there is great potential for development, as significant segments of the market in key Islamic finance centres remain underdeveloped.

As one of the largest insurance markets in the world, and a major centre for wholesale insurance and reinsurance, the UK has the potential to tap into even higher growth in takaful business in the future. The UK provides vital support for the global Islamic finance sector, with the Islamic Insurance Association of London, launched in 2015, providing an international body to help develop and regulate the global Islamic finance industry. The UK’s mature supporting infrastructure – from accountancy and legal services to asset managers and insurers – underpins the growing provision and capacity for Shariah-compliant insurance in the UK.

London is home to many established players that can access its vast commercial insurance and reinsurance market, and a number of its mutual insurance companies are naturally well-positioned to develop and offer takaful and re-takaful products.

In 2014, the UK government became the first Western government to issue a sovereign sukuk, or Islamic bond. In 2021, it issued its second note. At more than twice the value of its 2014 issuance, this GBP 500 million note, sold to institutional investors in the UK and in other Islamic-finance hubs in the Middle East and Asia, increased the supply of Sharia-compliant liquid assets, which will further strengthen the development of Islamic finance in the UK.

The UK is also home to one of the world’s largest providers of Islamic finance education and coupled with the established preference for English common law as the basis for Islamic-finance transactions, the UK is likely to play an increasing role in developing and operating the global Islamic finance industry.

Future opportunities & risks

Only few insurers keen to achieve growth can ignore the potential customer base that the world’s 1.5 billion Muslims represent. Unlike most Western countries, 60% of the global Muslim population is under 25. With growing affluence and social mobility, these young populations represent a long-lived customer base if insurers can tap into them.

Given the low penetration of traditional cover in some of the wealthier GCC countries such as Saudi Arabia (1.5%), the UAE (3.2%) and Qatar (1%), takaful could also be seen as a way to increase awareness of the importance of insurance in strong, dynamic economies in the Gulf Region, thereby increasing local and regional penetration, as well as cementing the UK’s supportive and enabling insurance and reinsurance sector. As things stand, the region’s insurance penetration is below the emerging-market average of 3.4%, and well below the global average of 7.4%.

In addition, the ethical component of takaful – consisting of a ban on investment in, for example, gambling, alcohol, adult entertainment and weapons manufacturing – has some appeal outside the Muslim world and represents a compelling business proposition for offering takaful to populations with ethically minded non-Muslim customers as of the profile of ESG continues to rise. Indeed, in more mature Islamic-finance centres, takaful is competitive with conventional insurance, and is already attracting growing numbers of non-Muslim customers.

Nevertheless, it is worth exercising some caution when it comes to relying on appeals to customers’ ethics; whilst takaful may attract Muslim MENA citizens in strict Sharia-compliance terms, many aspects of Western social liberalism remain taboo under Sharia law in many Muslim jurisdictions. In short, the term ‘ethical’ in the EU and the US, for example, has a very different meaning for consumers in the GCC and MENA regions.

The JENOA view

Access to Lloyd’s of London and large commercial reinsurers will become as important for the takaful market as it is for the conventional insurance/reinsurance markets, and this will underpin the importance of the UK insurance market for worldwide growth in takaful insurance.

The rapid development of the UK’s broader Islamic-finance industry owes some of its success to the supportive environment provided by the UK government. As a case in point, the UK was home to the first-ever standalone Islamic financial institution in the EU. Not only does the UK hold the highest value of Sharia-compliant assets of any non-Muslim country, but it also has the highest in the EU barring Türkiye, holding around 85% of all European Islamic banking assets.

Despite the relatively small size of the sector, its importance to the UK continues to grow because the UK’s insurance and reinsurance sector provide the critical risk-management support that takaful requires across various markets offering Islamic finance services.

London’s role as a supportive ecosystem for greater insurance penetration in the MENA region and Muslim world, as well to non-Muslim customers, will likely depend on the extent to which governments, regulators and the insurance industry are able to distinguish between the dominance of Sharia law in takaful on the one hand, and the promotion of progressive western values sold as ethical investments, on the other.

Muslim customers are unlikely to be misled by insurance products labelled as ‘ethical’ that, whilst appealing to niche segments of Western populations demanding environmental, social and governance (ESG) – aligned investments, may be anathema to stricter Muslims. The principal reason for this is that Islamic finance is based on objective screening criteria rooted in Sharia principles. ESG, on the other hand, is entirely subjective and often unreliable; as has been widely reported recently, electric-vehicle maker Tesla scored 37/100 on ESG ratings, while tobacco manufacturers Philip Morris International and British American Tobacco scored 84/100 and 94/100 respectively. With such public uncertainty in ESG ratings, it is perhaps not surprising that major US oil and gas corporation Exxon Mobil made it into the top ten for ESG ratings in the S&P 500 ESG Index? No such subjectivity exists in takaful, because of its fundamental Sharia principles. This suggests that, far from having common ground, Islamic finance, UN sustainability development goals (SDGs) and ESG, can often be mutually exclusive.

The chief sustainability officer for CIMB bank said last year that the moral precepts of Islam shared common ground with global standards like the UN’s sustainable development goals. Whilst acknowledging that Islamic finance has always considered the importance of its social impact, he went on to claim that: “in essence, the SDGs are aspirations towards meeting the higher objectives of [Shariah law]: whether that’s eradicating poverty or ensuring the sustainability of life on earth”.

It remains to be seen, however, exactly what effect appeals to subjective goals like the SDGs and ESG, sustainability and ethics will have on takaful growth.

What does this mean for MENA clients?

By offering access to the Lloyd’s of London market in addition to all reinsurance hubs around the world, we are able to leverage conventional Lloyd’s capabilities and an array of Sharia-compliant financial products, as well as international reinsurance capabilities, to meet emerging opportunities in the Islamic finance and takaful sectors.

With a strong focus on the MENA markets, and those further afield, JENOA offers an opportunity to address low penetration rates in the region by addressing accessibility to takaful where conventional insurance has struggled to break through.

By offering enhanced access to Sharia-compliant insurance and other financial products, we can meet clients’ increasing needs for ethical investment both inside and outside the Muslim world, as the broader global Islamic finance industry grows to over US$ 5 trillion in assets by 2025.

Tapping future potential

Regional takaful potential in MENA is clear from the historically low levels of penetration that we can see for conventional insurance. Coupled with increasing demand for digitalisation and ease of access to insurance products in the retail life and health segments, the promotion of more ethical, Sharia-compliant financial products like takaful insurance can help tackle that insurance gap.

From a UK perspective, regulators and industry should continue to cooperate to grow the Islamic-finance sector and maintain the UK’s position in Islamic finance as the world’s leading supportive ecosystem. The UK is uniquely placed to further enhance that position, and to help other Islamic-finance centres to achieve the potential growth that takaful offers.