The risk of underinsurance for tourism/sports assets in GCC & MENA

As countries hosting large international sporting events start to de-risk capital exposures relating to investment in tourism and sporting infrastructure, the opportunity for re-insurers is substantial. After all, several major infrastructure projects are in the pipeline or under construction to accommodate the influx of spectators for World Expo 2030 and the FIFA World Cup 2034 in Saudi Arabia.

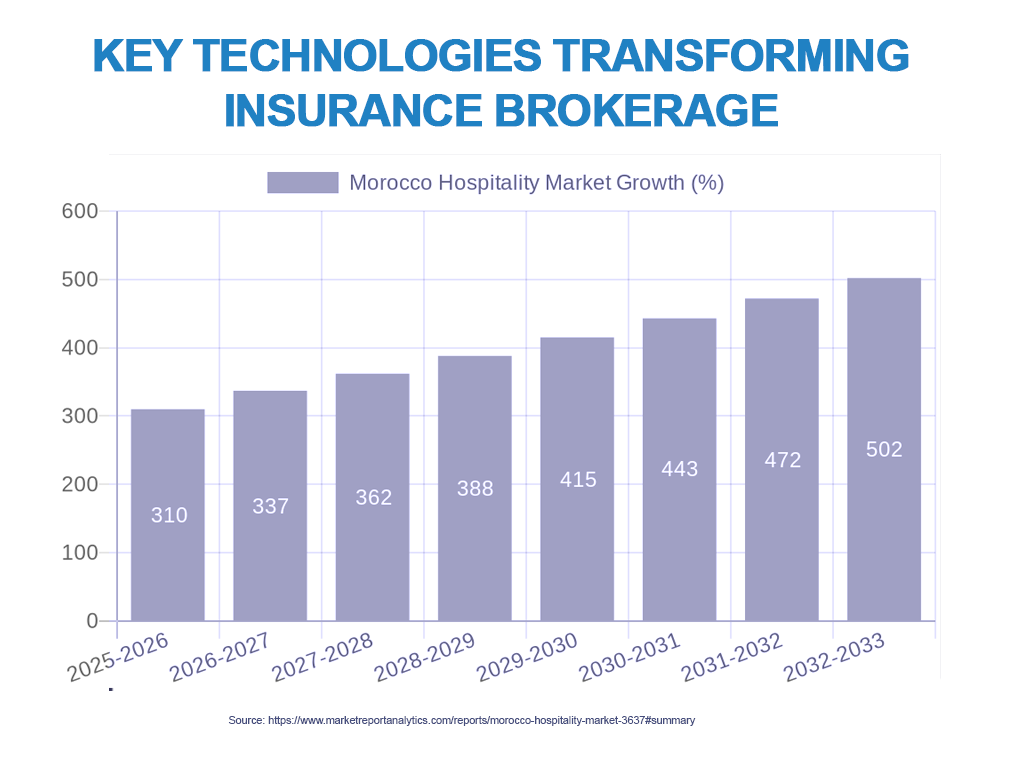

Elsewhere in the MENA region, in preparation for the Africa Cup of Nations (AFCON) 2026 and the FIFA World Cup 2030, Morocco is investing heavily in significant tourism assets and accompanying infrastructure. Alongside sports tourism, many GCC jurisdictions are pressing ahead with mega-projects to develop luxury tourism and lifestyle hubs.

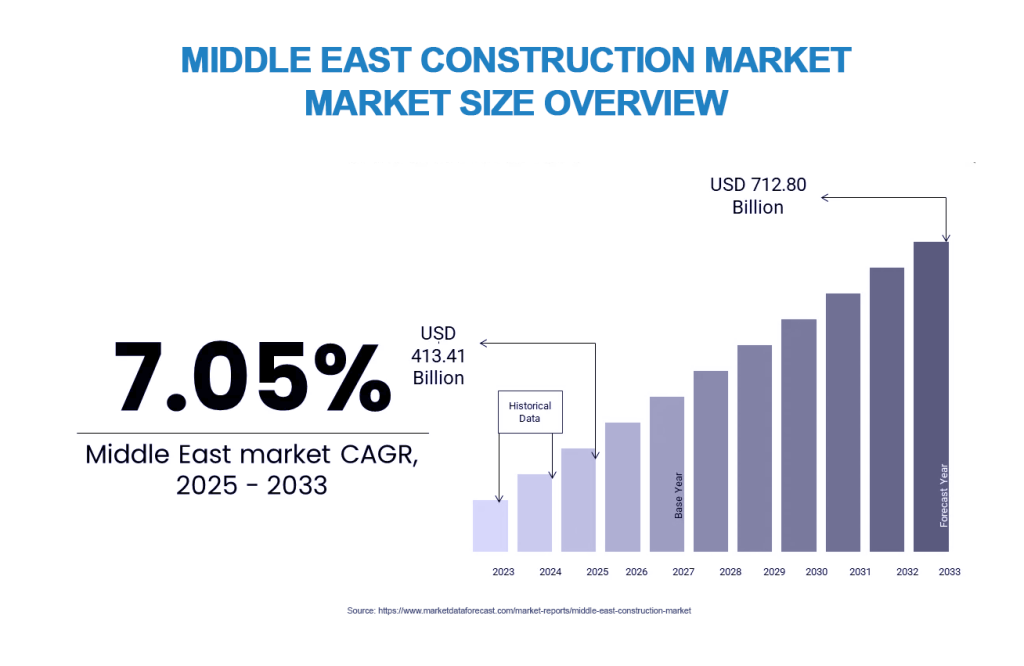

De-risking MENA’s ongoing capital exposures in the tourism and sport segments offers brokers and re-insurers growing opportunities in the region, as well as a chance to demonstrate to buyers the severe risks of underinsurance. After all, the completion of these projects marks the beginning of significant risk exposure, not the end. The entire construction market in the MENA region is expected to grow by around 5% to 7% between now and 2033, making it one of the world’s most dynamic markets. The tourism sector represents a significant portion of that growth.

Growth in insurable assets: what is at stake?

Contributing the strongest growth in the region, Saudi Arabia’s progress continues apace as it fulfils the ambitions of its Saudi Vision 2030. Major tourist and sporting events with huge international interest are helping to drive the Saudi Arabian construction market, with the FIFA World Cup 2034 and World Expo 2030[1] contributing to the speed and scale of construction. It is estimated that Saudi Arabia’s investment in sporting events will add over US$ 13 billion to its GDP, with the Kingdom’s sports market expected to triple in size to more than US$ 22 billion by 2030.[2]

In the UAE, the themes of sustainable growth and diversification into large-scale international tourism are driving tourism mega-projects, such as the Palm Jebel Ali development, which is poised to become the next major tourism and lifestyle hub, with development costs estimated at between US$ 12 billion[3] and US$ 20 billion.

Egypt has grown to be the third-largest construction market in the region. The value of projects under construction is estimated to be around US$ 120 billion, with pipeline projects spanning residential, utilities, and transport,[4] valued at over US$ 550 billion.

Elsewhere in the region, Morocco’s preparations for AFCON 2026 and the 2030 World Cup are providing further impetus to the growth in tourism assets, adding to the significant opportunities for brokers and re-insurers. In preparation for these events, Morocco is constructing a new 100,000-seat stadium in Benslimane and refurbishing and upgrading several existing football stadiums.

Risk & opportunity: can better risk management protect future ROIs?

Preparations for these two major events alone necessitate over US$ 20 billion in capital investment to develop the infrastructure required for the expected 26 million-plus tourist visits by 2030. The Kingdom plans to create 40,000 additional hotel rooms while funding the refurbishment of 25,000 existing rooms through public financing schemes. From hotels and football stadiums to road transport and airport expansion, the capital exposures are significant.

Despite the obvious need for all-risk construction cover in the development phase, the most significant risk exposure to tourism assets comes after construction. After all, ROI is modelled over years and decades, and the requirement to protect the enduring ROI and legacy of new luxury tourism and sporting infrastructure assets – on which the success of diversifying economies will depend – requires adequate cover with an eye on the risks of underinsurance through standard policies.

As Moroccan economist and economic analyst[5], Mohammed Jadri, notes of Morocco’s investment, “we’re not just building stadiums; we’re developing entire ecosystems. This includes public transportation, healthcare facilities, telecommunications infrastructure, and hospitality services. The real beneficiaries are the Moroccan people, who will inherit this modern infrastructure.[6]”

In other words, it is about protecting the future and enduring legacy of major investments such as those being made by countries across the MENA region. Tailored products based on a comprehensive risk analysis of insureds’ unique risk profiles are better placed to protect exposed assets than standard policy cover. Whether through standard or tailored cover, however, one significant and ongoing problem facing brokers and re-insurers is that, owing to a lack of underlying data, risk visibility can be patchy. If operators are in the dark as to where the risk lies, re-insurers cannot adequately quantify and price risk. As Swiss Re points out, business interruption (BI) and contingent business interruption (CBI) can to a degree protect companies, but “a lack of connected, reliable data, can make costing these products challenging”.[7]

Re-insurers in the MENA region should therefore look to address data gaps in risk exposure with added layers of technology and data analysis, allowing re-insurers to quantify risk in this asset class and adequately price cover.

Natural catastrophes, weather events & cyber risk

Morocco suffered a devastating and costly earthquake in September 2024, with an epicentre around 75km southwest of Marrakesh. However, thanks to its modern construction methods, the city suffered only minor damage. The economic loss was not as bad as originally feared, given that it struck in a relatively remote and sparsely populated area. That said, according to risk-transfer analysts, Artemis, total losses from the earthquake are thought to equate to around 8% of GDP, amounting to approximately US$ 12 billion,[8] “but with insurance and reinsurance penetration limited, the protection gap from this quake in Morocco was wide.”

In April 2024, the typically arid Gulf region experienced extreme rainfall in the UAE, with the average annual rainfall falling in just one day, resulting in an estimated US$ 13 billion in insured economic losses. As Swiss Re notes, a large proportion of what is an increasing loss burden is the result of “value concentration in urban areas, economic growth, and increasing rebuilding costs.” That is why Swiss Re sees investing in adequate risk mitigation as an overriding priority.

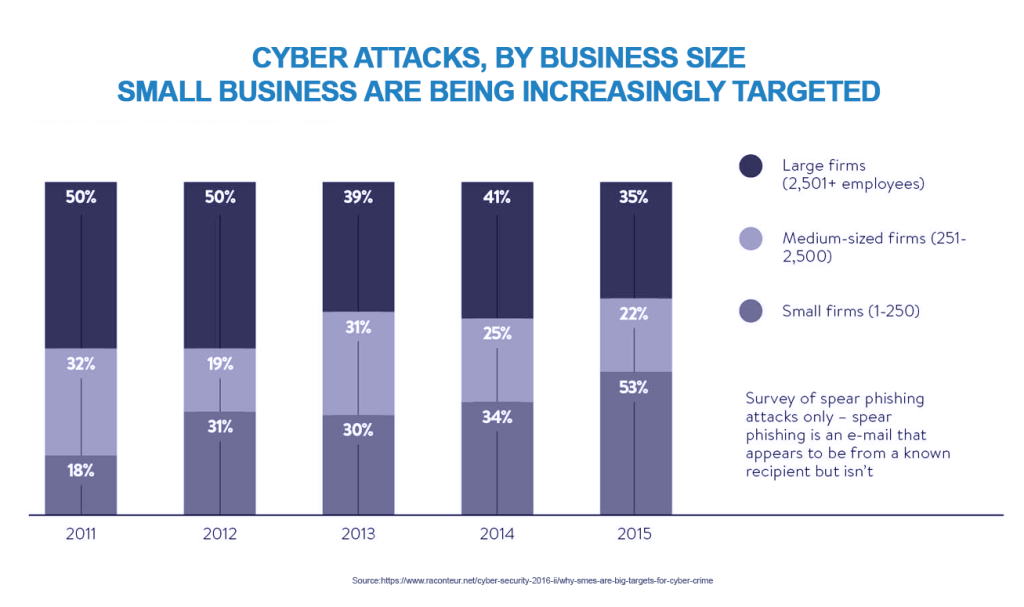

Despite widely available data indicating that much of the cyber-attack surface originates from under-insured SMEs, large corporate entities are not immune to attack, as the recent and costly cyber-attack on Jaguar Land Rover demonstrates. As Allianz Commercial notes, exposure to weaknesses, themselves potentially exacerbated by developing AI capabilities, can pile an aggregation of risk on insureds and re-insurers, especially if risk-exposure data is patchy among second-, third- and fourth-tier suppliers and contractors.

What does this mean for MENA clients & how can JENOA help?

From an investment-exposure perspective, the rapid pace of development in both sporting and tourism assets means significant opportunities exist to tailor specialised cover for these assets. Protecting their enduring legacy and ongoing ROI requires an intelligent and often innovative approach to re-insurance solutions, where brokers, MGAs and re-insurers can help clients improve resilience and risk awareness.

Access to both Lloyd’s of London and re-insurance hubs around the world makes JENOA a reliable and experienced partner when it comes to advising clients on insuring niche segments and pockets such as sporting events and tourism assets, in what is fast becoming a complex risk landscape across the GCC and MENA.

Can closing insurance gaps protect ROIs?

The opportunity for the re-insurance industry to support long-term infrastructure, luxury tourism and sporting assets is significant and growing rapidly. Sports tourism has become an integral part of the hospitality value chain and makes a major contribution to overall tourism yields. Insurance gaps created by underinsurance of those assets mean that, following business interruption or major losses due to natural disasters or extreme weather, asset owners will be unable to fully recoup the significant economic damages incurred.

Five Fast Facts

- How does MENA’s construction market compare to the rest of the world?

The region’s construction market is expected to grow by 5%, whilst the global picture sees real-term growth at just over 2%. - How many extra hotel rooms will Morocco need to build for the 2030 World Cup?

Morocco is pressing ahead with the construction of an additional 40,000 hotel rooms to accommodate the expected influx of visitors for AFCON 2026 and the 2030 World Cup, in addition to the refurbishment of 25,000 existing rooms. - What is the GCC’s current share of the global sports-tourism market?

The region’s share of global sports tourism stands somewhere between 5% and 7%, leaving considerable room for growth. - What natural disasters threaten Morocco’s new tourism assets?

More than drought, and more than extreme rainfall, the biggest threat to Morocco’s growing sports and tourism assets is earthquakes. In 2024 alone, the kingdom experienced over 1,000 quakes of varying magnitude. - What’s the value of Saudi Arabia’s sporting market to its GDP?

It is estimated that sports tourism in Saudi Arabia alone will contribute USD 13 billion to its GDP.

[1] https://www.constructionbriefing.com/news/inside-saudi-arabias-construction-surge-three-key-takeways/8086777.article?zephr_sso_ott=nMEDYK

[2] https://www.pwc.com/m1/en/publications/2025/docs/how-can-the-gcc-turn-its-sports-vision-into-year-round-tourism.pdf

[3] https://www.apilproperties.com/question/communities/how-much-did-it-cost-to-build-palm-jebel-ali

[4] https://www.meed.com/middle-east-to-be-a-growth-leader-for-global-construction

[5] https://www.middleeasteye.net/news/eid-al-adha-moroccans-asked-abstain-sacrifice-faith-meets-financial-reality

[6] https://www.moroccoworldnews.com/2024/12/166801/2030-world-cup-is-moroccos-economy-ready-for-a-5-billion-event/#:~:text=Tourism%20infrastructure%20is%20receiving%20particular,lasting%20benefits%20for%20local%20communities

[7] https://www.swissre.com/institute/research/topics-and-risk-dialogues/economy-and-insurance-outlook/complex-supply-chains.html

[8] https://www.worldeconomics.com/GDP/Morocco.aspx#:~:text=By%20adjusting%20for%20these%20factors,in%20current%20prices%20for%20202