Can parametric insurance address gaps in geopolitical & agricultural risk?

Recent innovation and more sophisticated data analytics have seen the commercial insurance sector open up to a wider range of risk, in response to the dangers of an increasingly interconnected world. As a result, ‘parametric insurance’ has not only become an attractive component in mitigating risk of damage and loss caused by natural weather variability, but its innovation and increasingly sophisticated technology is opening up new-product areas such as business interruption from rising geopolitical risk, as well as cover for agricultural losses. As trade wars, resource protectionism, inflationary pressure and increasing civil unrest and activism[1] continue to characterise a new era in risk, can parametric insurance step in to offer customers enhanced and affordable mitigation against business interruption, property damage and the knock-on effects for marine, energy and logistics?

Geopolitics & agriculture – the big picture

Highly advanced globalisation – often referred to as hyper-globalisation – has a habit of throwing up unforeseen events with extreme consequences. The COVID-19 pandemic laid bare the fragility of global supply chains that prioritised value and speed but had little flexibility or redundancy to adapt to a rapid change away from services to consumer goods. It has become glaringly obvious that these supply chains are vulnerable to disruption.

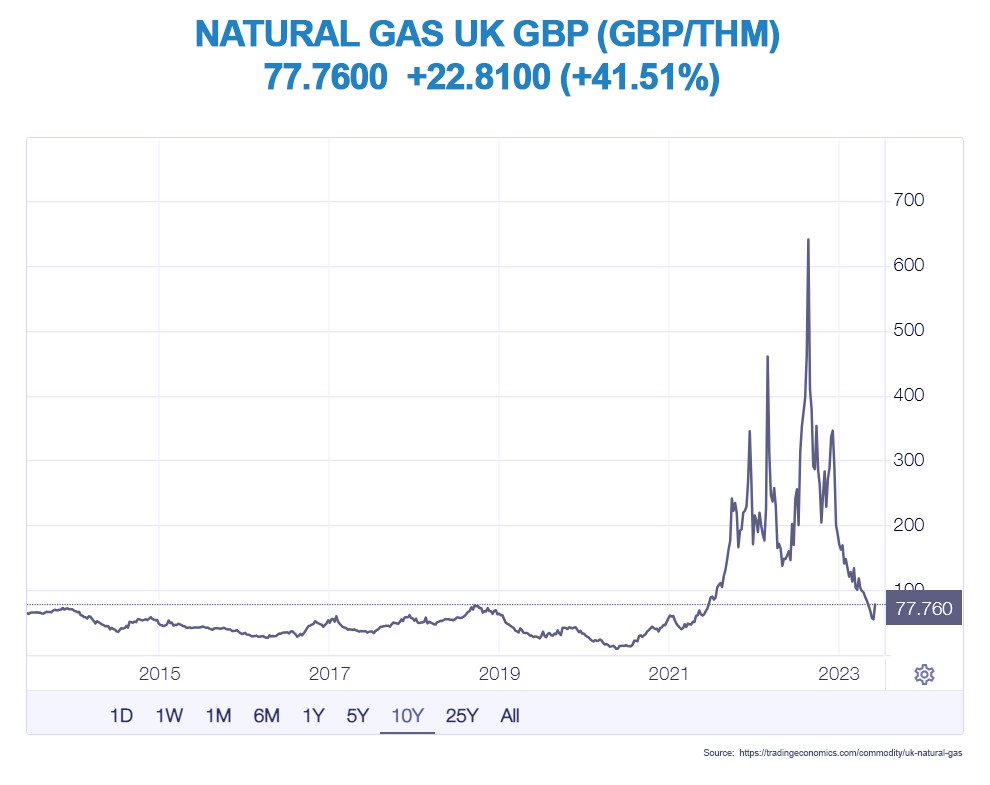

Geopolitics plays a big part in the world’s energy supply, too. International net-zero-aligned efforts to curtail access to capital and insurance to the oil and gas sector through initiatives such as ESG, are already exerting upward pressure on the cost of natural gas through a sizeable drop in investment[2]. Combined with very low European gas stocks in storage, the March 2022conflict in the middle of Europe resulted in a scarcity of cheap and reliable gas supplies for northern European economies[3]. This caused unavoidable energy inflation, with prices rocketing to a ten-year high in August 2022[4] of more than six times its August 2021 price. Inevitably, that has spread across the domestic market into the wider manufacturing sector.

Political instability has also ignited anxiety around overreliance on the centralised production of certain commodities. New clean-energy sectors remain vulnerable to extreme volatility in mineral resources needed for the proposed energy transition. The Democratic Republic of Congo produces a staggering 70% of the world’s cobalt and sits on more than 50% of the world’s cobalt reserves[5]. China, the world’s single biggest consumer, now dominates the local market,[6] but is also responsible for 60% of the worldwide production of rare earth minerals. In addition, China controls the lion’s share of global mineral processing, accounting for 90% of rare earth minerals, 70% of lithium and cobalt, and 35% of nickel.[7]

As we have seen this year, inflation and rising interest rates are already showing knock-on effects for the cost of capital across a variety of sectors; in the UK, for example, a 2.8GW offshore windfarm in the North Sea looks set to be abandoned after its developers claimed rising costs would see it shelved without further taxpayer support.[8] Across the wider economy, the growing risk of corporate and sovereign defaults increases the chances of political instability, recession and social unrest. At the time of writing, the US Congress was offering to raise the US debt ceiling by USD $1.5 trillion, in return for USD $4.8 trillion in spending cuts over the next decade. The US Government has, so far, refused to accept those terms, and threatens an unprecedented default, bringing the US economy to the brink of long-term disaster.

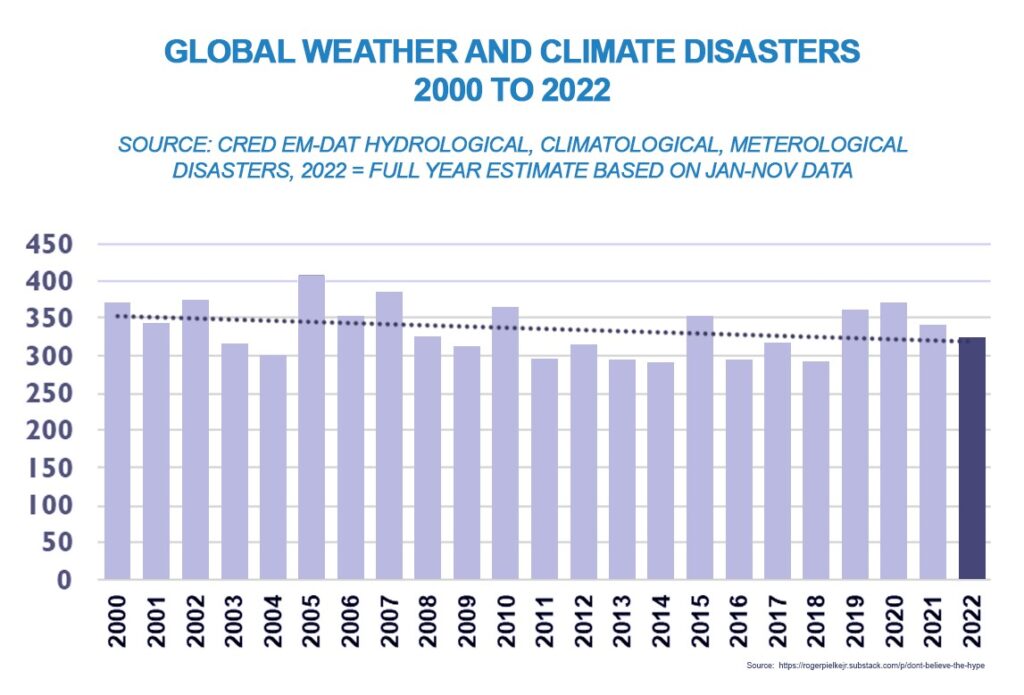

As the world’s population continues to grow, our ability to feed growing populations will come under greater pressure, exacerbated by increased extreme weather from climate change. Already, the IPCC has stated that it detects anthropogenic signals in the five climate areas that have so far seen increases in occurrence and severity (heat waves, heavy precipitation, ecological drought, agricultural drought and fire weather).[9] Currently, the Centre for Research on the Epidemiology of Disasters (CRED) EM-DAT database shows no increasing trend in the number of global weather and climate disasters in the last 20 years. If, however, we see detectable climate-change increases in frequency or intensity of other weather phenomena such as flooding, hail or tropical storms in the future beyond natural variability, this could pose significant risk to global agricultural production.

Parametric insurance: what is it, and what are the trends?

Parametric, or ‘index-based’, insurance is designed to work alongside rather than replace traditional indemnity insurance. It has been used to fill risk gaps arising from exclusions and deductibles characterised by such cover. Parametric insurance relies on index values from independent third-party data and is therefore more objective. As a result, insureds are aware of future pay-out values in the event of an index passing the threshold or trigger and are not reliant on subjective interpretation.

Parametric cover can also be cost-effective. Traditional indemnity pricing is related to an insured’s overall loss history. By contrast, the pricing of parametric cover looks exclusively at the modelled or indexed loss experience linked to a specific peril. This is helped by the fact that parametric cover no longer depends on loss adjusters; observation satellites can now access weather data or index values across the world, and agricultural cover can be designed for clients in any location, with agreed triggers dispensing with the need for a loss adjuster.

Finally, parametric insurance pays out quickly. Once a trigger is reached or surpassed, claims are settled more quickly than with traditional policies that can often take months or years to settle. Parametric policies usually pay out within weeks or months, because predefined and transparent indices lead to quick settlement with no need for loss adjustment. The arrival of technologies such as Blockchain are likely to help insurers build automatic triggers into payment systems with the potential to further shorten claims delays.

New parametric products are already covering weather losses, and look set to extend their reach to non-weather-related risks such as political unrest, trade sanctions, supply-chain disruptions and cyber-attack.

Growth in this area will rest on the continued transparency and simplicity of products, as well as improved speed and efficiency in claims processing and pay-outs. As insuretech’s current impact remains minimal in this space, further growth for all players will also rest on the ability to attract new customers from underserved and uninsured markets with the help of major efficiency drives to reduce operational costs through technology.[10]

Opportunities and risks

Geopolitical risks & uncertainty

Against hardening trade and technology blocs, particularly in semiconductors, as well as unreliable supply chains, the global investment dynamic has changed, too. Trillions of dollars are currently at stake in a global economic power play. Meanwhile, several nation states are investing more in self-sufficiency and resilience, whilst investment initiatives such as the EU’s Global Gateway look to strengthen cooperation with developing countries through international investment as an alternative to China’s Belt and Road Initiative. The global economic focus is shifting eastwards to the Regional Comprehensive Economic Partnership (RCEP), an Asia-Pacific free-trade agreement that could account for 50% of global GDP by 2050.[11] Resource protectionism, sanctions and disrupted supply chains seriously threaten world economies with unpredictable shocks, and where these features would normally be considered an uninsurable risk of doing business under traditional cover, individual business-interruption risks can be identified and targeted with parametric cover and pre-agreed triggers.

Agriculture

Early examples of parametric insurance include public programmes in India and China to cover risk of crop failure for small-holder farms. Whilst micro-insurance using index-based policies for small-holders is likely to be attractive in developing markets, agribusinesses are already benefitting from parametric policies to cover crop failure risk across the globe today.

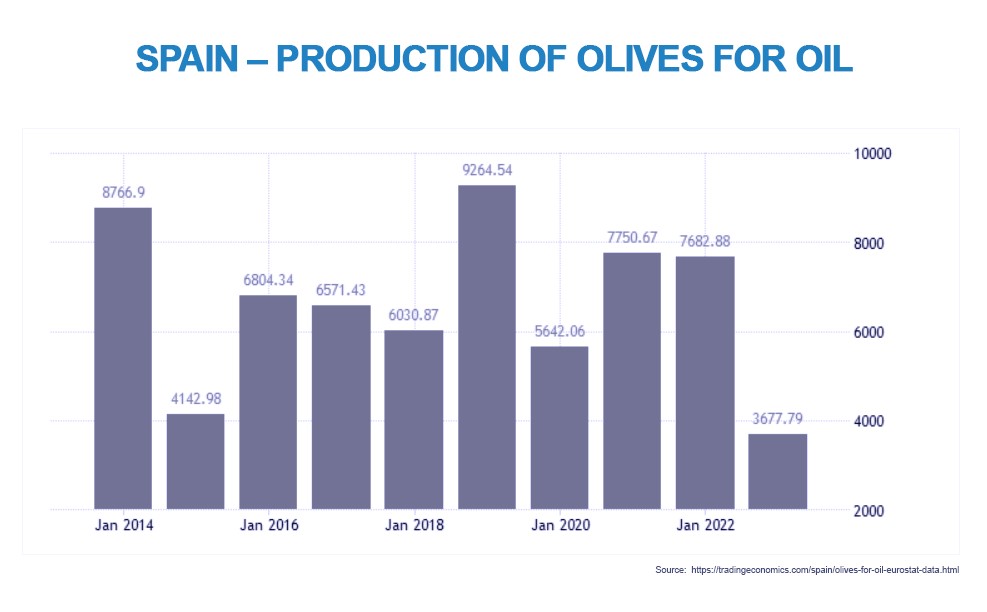

In Spain, for example, where olive trees are susceptible to heat and water stress, parametric policies are helping the Spanish olive-oil industry[12] – producing nearly 60% of the world’s olive oil – to mitigate depleting yields caused by drought. This allows olive farmers to tailor policy specifications by geolocation, coverage period and weather parameters. In 2022, drought and high temperatures caused a 55% drop in production.[13] This year, as much of southern Europe endures another long drought, olive-oil prices continue to rise as production drops.

Due to its size, prices in Spain strongly influence the price in international markets, and according to oil brokers Baillon Intercor, the price per tonne has risen from €3,500 in January to €5,800 in April. Italian extra-virgin oil has reached almost €7 per kg (€7,000 per tonne) and Greek oil is over €6 per kg.

In Australia, parametric solutions are providing grain farmers, wine producers and orchard owners with cost-effective mitigation against spring frosts, with the option to tailor cover periods that adequately reflect the different stages of maximum vulnerability in a crop’s development. This gives insureds the freedom to set cover periods and temperature indices according to their individual exposure, budget and risk appetite.[14]

The JENOA view

The growing frequency of extreme weather and geopolitical tension not only increases risk and severity but also creates new risks. Index-based coverage will prove to be a vital tool in building resilience against unforeseen events with extreme consequences and losses. Digital technologies and artificial-intelligence systems will drive the development of smart ecosystems and connected insurance models. The availability of granular data will allow insurers to place those risks in microsegments and innovate new indices to deal with them.

Whilst parametric products currently focus more on mature markets, index-based products are likely to gain wider traction in developing markets such as India and Africa; micro-insurance to mitigate crop failure and poor yields for small-scale farmers could become more widespread as ever cheaper technology is expanded to monitor triggers.

As smart digital ecosystems mature, future coverage is likely to become embedded, invisible, and parametric. Connected ecosystems could lead to a redefinition of payouts, where value-added services could conceivably substitute financial compensation. As parametric insurance blends with new models such as on-demand, use-based and peer-to-peer cover, insurers are likely to see opportunities for product-innovation. To take advantage of developments like this, insurers should be prepared to look again at their portfolios and identify gaps in cover. In addition, their ability to keep innovating will also rely heavily on their ability to leverage new technologies. As digital technology and the Internet of Things (IoT) becomes more embedded in economies, innovations such as machine sensors, 5G edge computing, artificial intelligence, machine learning and geolocation technology will give increasing access to accurate real-time data. The vast amounts of data collected from universal digitalisation will enable more sophisticated and sensitive indices and triggers to be established with accuracy, reliability and confidence. This will likely encourage the development of a growing number of reliable third-party indices, and will lead to innovative pricing and customisation in both the commercial and consumer markets.

What does this mean for MENA clients?

By offering access to the Lloyd’s of London market in addition to all reinsurance hubs around the world, we are able to leverage conventional Lloyd’s capabilities as well as international reinsurance capabilities to meet emerging challenges in the geopolitical and agriculture sectors.

With a strong focus on innovation, our brokerage platform gives clients a much broader reach into markets across MENA and further afield. This offers enhanced access to data-driven and tailored insurance products to meet clients’ multiple needs in a sector whose expansion depends on reliable, independent data-backed indices and triggers.

Closing the gaps through innovation

Parametric insurance has re-established itself as both a useful complement to traditional indemnity products and as a viable alternative for customers facing a hardening primary market. For clients who need to recover immediately from a loss, quick and automatic settlement of parametric cover is essential to mitigate cash-flow losses.

Digital insurance ecosystems will help parametric innovation across consumer and commercial markets, as more sophisticated and reliable indices become established to offer clients reliable and cost-effective cover.

[1] https://kennedyslaw.com/media/8090/insurance-forecast-2023-claims-trends-and-future-risks-january_2023.pdf

[2] https://www.gecf.org/events/expert-commentary-the-impact-of-environmental-social-and-governance-esg-measures-on-natural-gas-upstream-sector

[3] https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/natural-gas/062722-eu-council-adopts-new-minimum-gas-storage-rules-in-final-step-of-approval

[4] https://tradingeconomics.com/commodity/uk-natural-gas

[5] https://www.nsenergybusiness.com/features/top-cobalt-producing-countries/

[6] https://www.nsenergybusiness.com/features/top-cobalt-producing-countries/

[7] https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/executive-summary

[8] https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/executive-summary

[9] https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/executive-summary

[10] https://dxc.com/us/en/insights/perspectives/paper/parametric-insurance-a-disruptive-solution

[11] https://internationalfinance.com/rcep-impact-global-trade/

[12] https://www.reinsurancene.ws/spanish-farmers-renew-meteo-protect-weather-cover-following-2017-heatwaves/

[13] https://www.oliveoiltimes.com/business/climate-disasters-drive-prices-higher/120006

[14] https://www.descartesunderwriting.com/descartes-insurance-australia-launches-parametric-frost-cover/