Parametric, or index-based, insurance has been enjoying renewed popularity, with strong potential to open up new markets and offer wider cover for specific modelled events from which clients may want protection. A missed flight connection, for example, or a rained-off sporting event, can be covered with ease. As long as the risk can be modelled with historic data, policyholders enjoy claims-free automatic, digitalised and instant payouts whenever pre-agreed triggers or indices are met.

Recent sustained product innovation and more sophisticated data analytics have seen the commercial insurance sector open to a wider range of risk. As a result, parametric insurance has developed into a high-tech, but often misunderstood, policy option, with unprecedented ease of access for policyholders. However, many insureds seeking traditional cover for protection against, for example, weather events are still in the dark regarding its unlimited capabilities; it seems too good to be true that insureds enjoy automatic payment with no requirement to file claims, and unheard of that risk appetite can be tailored with almost limitless creativity.

Here we look at how parametric products work in practice, consider how price fluctuations depend on historic data to model quantifiable risk, and examine how index-based products might be applied in insurance lines and sectors seeking innovative insurance solutions against our old friend, natural variability in weather.

Why is parametric insurance so easy for policyholders, and how does it work?

Parametric insurance is nothing new. Developed in the 1990s to provide cover for clients whose profitability was affected by weather[1], it gave policy holders a financial instrument for mitigating the cost volatility of unusual meteorological events.

Parametric insurance relies on three elements: a specific pre-agreed parameter, or ‘index’; a measurable and pre-defined threshold level, or trigger, that can be modelled with historic data, and a pre-agreed limit.

Today, the evolution of the category is characterised by the use of parametric triggers being applied to indemnity products. These are triggers that had traditionally been used in financial derivatives, such as weather and catastrophe bonds. As such, risk was historically transferred from insurance and reinsurance markets to financial markets.

Now, increasingly complex technology and data analytics allow insurance companies not only to quantify the weather, but to automate and digitalise the entire process, so there is often little to no human interaction at all. Technologies such as Blockchain allow insurers to incorporate automatic triggers into claims-payment systems, something that has drastically shortened claims delays. Policyholders are compensated for any pre-agreed breaches of the indices against which they’re insured, with blockchain technology enabling claims payments to be transferred automatically, often straight back to the credit card used to buy their policy, within minutes of a trigger being met. The key here is the automatic element, which bears repeating: unlike traditional indemnity insurance, claims payments for agreed amounts are triggered automatically once a pre-agreed parameter or index exceeds a predefined threshold. Payment is, therefore, not dependent on an assessment by a loss adjuster, but on a pre-agreed indexed event.

Another key feature of parametric cover is that there is no limit to the creativity that can be applied; the threshold level can be binary – a payment of X in the case of Y happening – or it can be based on varying degrees of magnitude. For example, the size of a claim’s payout might increase incrementally as a pre-agreed index value changes. Double triggers and staggered pay-outs can therefore minimise basis risk, a situation where an insured can suffer loss without the policy being triggered.[2] As an example, an insurer and insured might tailor parametric cover to pay out a specific sum in the event of a Category 2 hurricane, and to a higher payment if it turns into a Category 3 hurricane. The independent variable threshold in this case remains the reported windspeed on the Saffir-Simpson scale.[3]

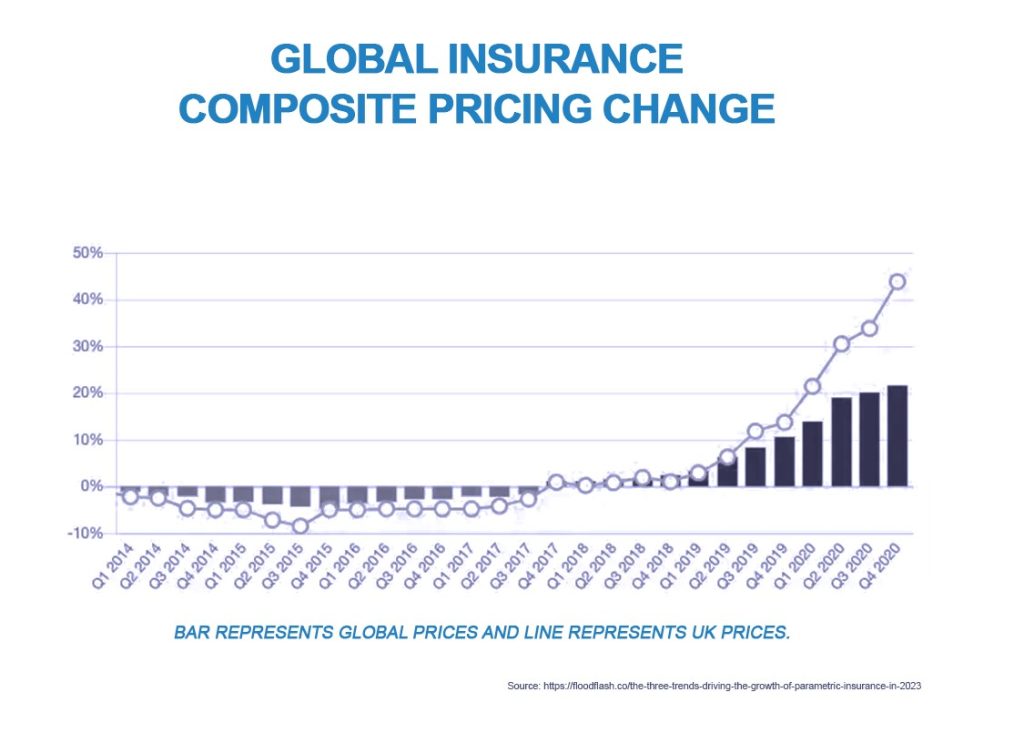

Why are parametric products so price sensitive?

Traditional indemnity pricing is very closely correlated to an insured’s overall loss history; if your business premises has suffered from flooding for five consecutive years, it is likely that future premiums will be adjusted to reflect your claims history and future risk. Conversely, the pricing of parametric cover concerns itself exclusively with the modelled or indexed loss experience linked to a specific peril and historical location averages. In short, the key proviso that governs index-based cover is that the risk can be modelled with historic data.

As discussed above, once a trigger is reached, claims are settled more quickly than with any other type of cover. Dependent on their complexity, traditional indemnity policies can often take months or even years to settle. Parametric policies are now set up to pay out within a matter of seconds, minutes or days, depending on the complexities of multiple indices, because predefined and transparent indices lead to much quicker settlement without the need for loss adjustment.

The flexibility and creativity that parametric cover allows means that, with its tailor-made nature, thresholds can be designed to align with an insured’s risk appetite and business-continuity plan. An insured’s business might be able to survive X risk, for example, but its inability to function under Y risk can be complemented by alternative parametric policies. Policies cover perils at specific locations, divorced from underlying assets. It is a client’s risk appetite and business objectives that dictate the policy’s profile[4]. In other words, the index values, triggers and limits are designed around a client’s budget and appetite for risk. Typically, they can incorporate multiple triggers and incremental pay-outs unique to a client’s specific risk profile.

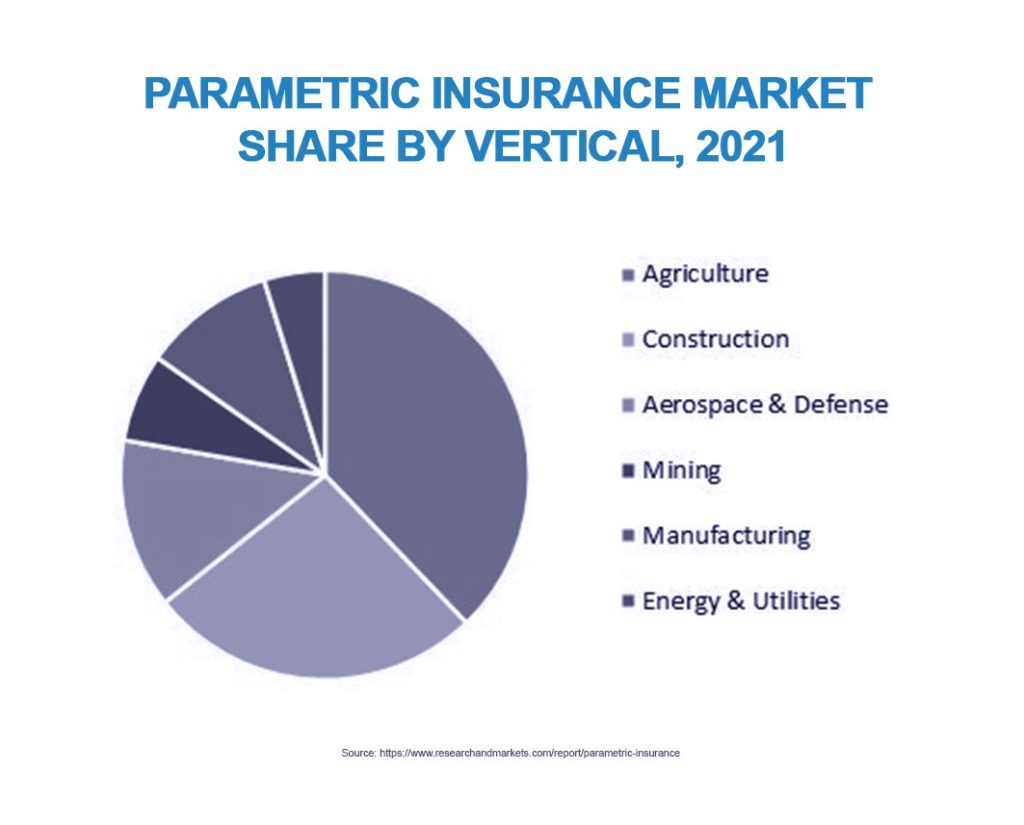

Which sectors stand to gain the most from parametric?

Our fascination – and fear – of rare, extreme or unseasonal weather is woven into the very fabric of life. That’s largely because the evolution of the human race on a hostile planet has arguably flourished despite the weather, not because of it. In other words, Mother Nature has always had a propensity to be wicked, mercurial and capricious.

Nevertheless, extreme weather as a feature of either natural variability or climate change, increases risk and severity and creates new risk.

Index-based cover, however, offers protection against any unforeseen weather that carries the risk of extreme losses, and provides an indispensable tool in building resilience. As the pace of innovation quickens, digital technologies and artificial-intelligence systems are already spawning the development of smart ecosystems and connected insurance models. The availability of granular data is now allowing insurers to place those risks in microsegments and innovate new indices to deal with them in creative ways.

Retail sector

Imagine flying, for example, from London Heathrow to Cancun, Mexico via a connecting flight in New York, possibly with a different carrier whose obligations to passengers do not cover missed flights because of another carrier’s late arrival. Whilst code-share and alliance carriers will usually move passengers onto later flights with no charge in the event of a missed connection, with parametric insurance, travellers can rest easy knowing that they can design cover to specifically address a missed connection; the likelihood of arriving in late from London on British Airways and having to pay twice for a second flight on Aero México through no fault of their own means that travellers can be compensated immediately, according to their pre-agreed cover and triggers.

Similarly, honeymooning newly-weds seeking a few weeks in the sunshine can use parametric insurance to cover against a wash-out of a vacation. Insureds can receive an automatic payout in the event that too much rain, for example, ruins their plans for fun in the sun. This notion can be applied to all kinds of holiday activity: surfers could use index-based cover to insure against weather-related eventualities that affect their ability to surf. Through automated index monitoring, linked to automatic Blockchain technology, payouts occur without any further action from the holiday maker.

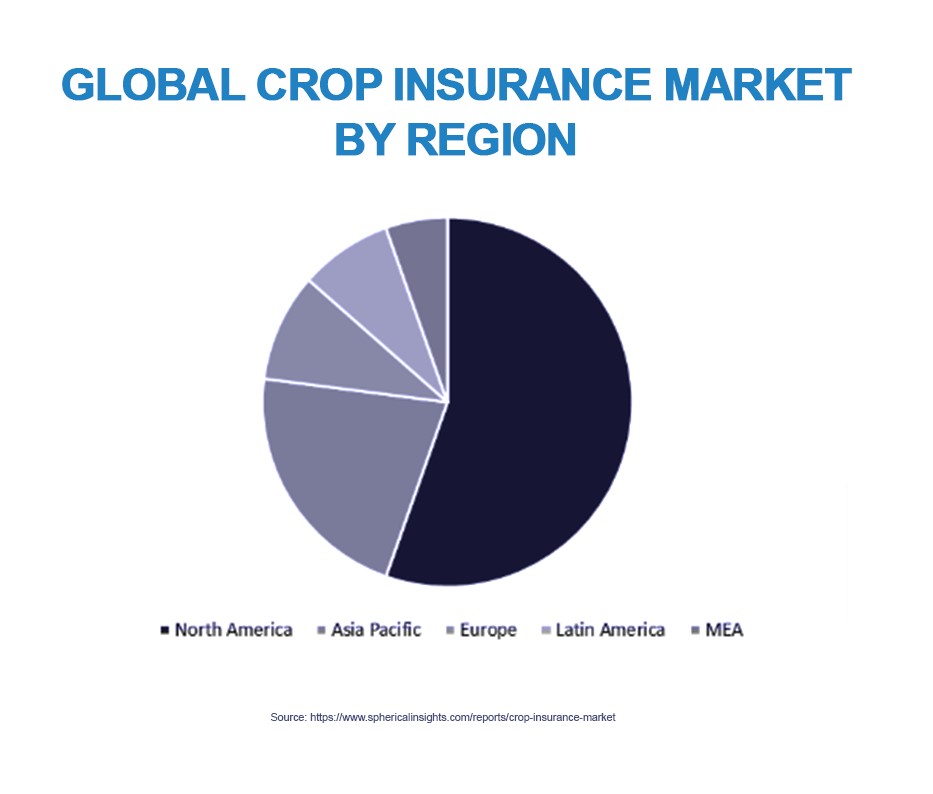

Agriculture

Whilst parametric products currently focus more on mature markets, index-based products are now gaining traction in markets such as India and Africa. Micro-insurance to mitigate against poor agricultural yields or total crop failure for small-scale farmers is now more widespread as ever-cheaper technology is expanded to monitor triggers or establish new indices.

Early examples of index-based insurance include micro-insurance delivered through public programmes in India and China.[5] These were designed to address the risk of crop failure for smallholder farms. Whilst such policies for smallholders will attract customers in developing markets in the future, large global agribusinesses are already benefitting from parametric policies to cover crop-failure risk due to extreme or unseasonal weather across the world.

The government of Malawi this year received almost USD $12 million in parametric insurance payouts after the president declared a national emergency in March, triggered by an El Niño-induced drought across the country that has devasted its maize harvest and placed almost half of its population under severe risk of acute hunger. The price of maize is now 40% higher than this time last year.

This follows a 2022 payout of US$14 million under parametric cover aimed at mitigating the risk of drought across multiple regions of the country. Designed as a climate insurance product, the Malawi government chose to structure its cover with a series of cluster policies – in essence, a policy that encompasses a series or ‘cluster’ of individual contracts – with an eye on the risks of localised drought. Provided by African Risk Capacity (ARC), which offers parametric disaster insurance and risk pooling across the African continent, the policy was structured under a sub-national triggering model that has been tripped by one or more of the 4 cluster policies covering its varied geographical regions (the East African Rift Valley, the central plateaus, the highlands and the mountains). Quick payouts under Malawi’s parametric drought policies will improve the country’s recovery time and provide vital assistance to humanitarian efforts to combat the effects of its ongoing drought.

In Spain, for example, parametric policies are helping the Spanish olive oil industry[6] – which accounts for nearly 60% of the world’s olive oil production – to mitigate depleting yields caused by excessive heat and water shortages. Olive trees, despite being native to dry, hot southern-European regions, are particularly susceptible to extreme heat and prolonged water stress. In Australia, the option to tailor cover periods that reflect the stages of maximum vulnerability in a crop’s development is helping arable and fruit farmers, as well as wine producers, with cost-effective mitigation against spring frosts.[7]

The JENOA view

Parametric insurance has established itself as a useful complement to traditional indemnity products. Businesses that rely on the ability to bounce back from a loss in order to survive, will increasingly come to depend on the quick and automatic settlement of parametric cover to protect themselves against potential cash-flow losses in extreme-weather situations.

As digital ecosystems mature, coverage is becoming increasingly embedded, invisible and parametric. Connected ecosystems that encompass service partners are redefining payouts, where value-added services are likely, in some situations, to substitute financial compensation. As parametric insurance incorporates new models such as on-demand, use-based and peer-to-peer cover, insurers’ ability to keep innovating will depend on their willingness to leverage new technologies.

As digital technology and the Internet of Things (IoT) becomes more embedded in economies, artificial intelligence, machine sensors, geolocation technology, machine learning and 5G edge computing will increasingly offer access to accurate real-time data. Universal digitalisation and its accompanying data sets will lead to the growth of ever more sophisticated and sensitive indices whose accuracy and reliability will enjoy high levels of confidence among both insurers and insureds. Product pricing is likely to be influenced heavily by innovations such as these, because it will spawn the growth of reliable third-party indices.

Index-based policies are ideal for covering financial losses that affect businesses without causing physical damage to assets. This opens up opportunities for parametric insurance to take on new risk areas. With increasing digitalisation, the means to collect accurate and reliable data are likely to spawn new and more complex third-party indices for use in future parametric products.

Digital insurance ecosystems will help parametric innovation across consumer and commercial markets, as more sophisticated and reliable indices become established to offer clients reliable and cost-effective cover.

What does this mean for MENA clients?

By offering access to the Lloyd’s of London market in addition to all reinsurance hubs around the world, we leverage conventional Lloyd’s capabilities as well as international reinsurance capabilities to maximise emerging opportunities in parametric capabilities. With a strong focus on Insurtech and data-driven solutions we are able to offer tailored insurance products, to meet clients’ needs in an evolving sector which depends on reliable, independent data-backed indices and triggers modelled on reliable historical data.

The growth in popularity of parametric insurance has been accompanied by massive growth in the Insurtech landscape. Insurtech platforms offer flexible options for automatic parametric products that require no further effort; no claims filing, no phone calls, no waiting, no out-of-pocket expenses. Unsurprisingly, this is one of the reasons why this type of insurance is becoming increasingly attractive for both the consumer and commercial market.

Quick & easy: the benefits of parametric

With increasing digitalisation, accurate and reliable data will lead to a proliferation of more complex third-party indices for use in future parametric products. Digital insurance ecosystems will help parametric innovation across consumer and commercial markets, as more sophisticated, reliable and interactive indices become established to offer clients dependable and cost-effective cover and quick payouts.

Growth in this area will rest on the simplicity of parametric products, improved speed and efficiency in automatic claims processing and pay-outs, and insurers’ ability to attract new customers from underserved and uninsured markets.

[1] https://axaxl.com/fast-fast-forward/articles/lets-talk-axa-global-parametrics

[2] https://axaxl.com/fast-fast-forward/articles/lets-talk-axa-global-parametrics

[3] https://www.nhc.noaa.gov/aboutsshws.php#:~:text=The%20Saffir%2DSimpson%20Hurricane%20Wind,Scale%20estimates%20potential%20property%20damage

[4] https://www.descartesunderwriting.com/descartes-insurance-australia-launches-parametric-frost-cover/

[5] https://axaxl.com/fast-fast-forward/articles/lets-talk-axa-global-parametrics

[6] https://www.reinsurancene.ws/spanish-farmers-renew-meteo-protect-weather-cover-following-2017-heatwaves/

[7] https://www.descartesunderwriting.com/descartes-insurance-australia-launches-parametric-frost-cover/