With the exception of one or two outliers[1], the North African insurance market remains chronically underdeveloped. Yet, while several historical factors in the region have contributed to this current state of affairs – legacy state monopolies, regulatory issues, the conception of a lack of Sharia compliance and an absence of retail credit markets – there remains considerable opportunity for the insurance sector. A more developed insurance sector will help contribute to and foster widespread economic and financial development through risk-management experience and expertise in long-term finance.

In addition, providing insurance in underdeveloped markets can promote and stimulate economic activity, increase well-being through invaluable peace of mind, ease and foster trade and minimise friction.

Risk pooling and effective risk management through insurance can mitigate the impact of massive losses, and with less capital needed to cover those losses, more is released for investment. This, in turn, can stimulate innovation, competition and industrial output.

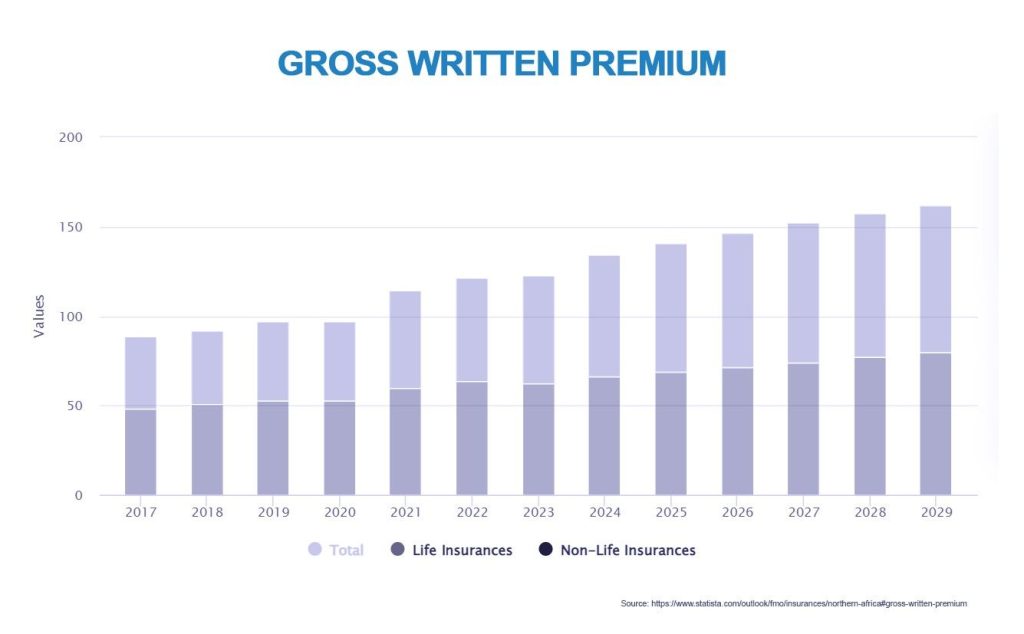

Despite North Africa’s historic levels of low insurance development and penetration, the news from the region is not all bad; there are positive signs in both the life and non-life segments, with growth in the gross written premium (GWP) in the period 2024-2028 estimated to reach over 4.5%[2]. By way of comparison, however, the value of the US insurance market in 2024 is estimated at around US$ 4.6 trillion, with North Africa trailing on a little under US$ 20 billion.[3] As a proportion of the GWP across the whole continent, North Africa represents 13% of the continent’s total.

Insurance penetration levels in both the life and non-life segments are nevertheless worryingly low when set against international and OECD standards,[4] and whilst Morocco bucks most insurance trends in the North Africa region with a penetration ratio of nearly 4%[5][6] – measured as the ratio of GWP to GDP – countries such as Algeria and Egypt have penetration levels well below even regional averages[7]. With the exception of Morocco, the region’s insurance penetration is below the emerging-market average of 3.4%[8], well below the global average of 7.4%, and around one-tenth of South Africa’s, which sits at over 12%.[9][10][11]

What is driving the current state of the insurance market in the region? How much scope is there to change the factors that influence this? And what role can the insurance and reinsurance industry play? Here, we examine the North-African market in greater detail, and look at the risks and opportunities for insurers, reinsurers and investors in the region.

Historic reasons for low penetration

A fair body of academic research goes some way to explaining the chronic low levels of insurance penetration in most North African jurisdictions, and as alluded to above, this under-development is driven by multiple factors[12]. For example, the dominance of state-owned insurance giants with government monopolies has, by definition, impacted financial development in the private insurance and reinsurance sector, as can be seen from the examples of Libya, Algeria and Egypt[13].

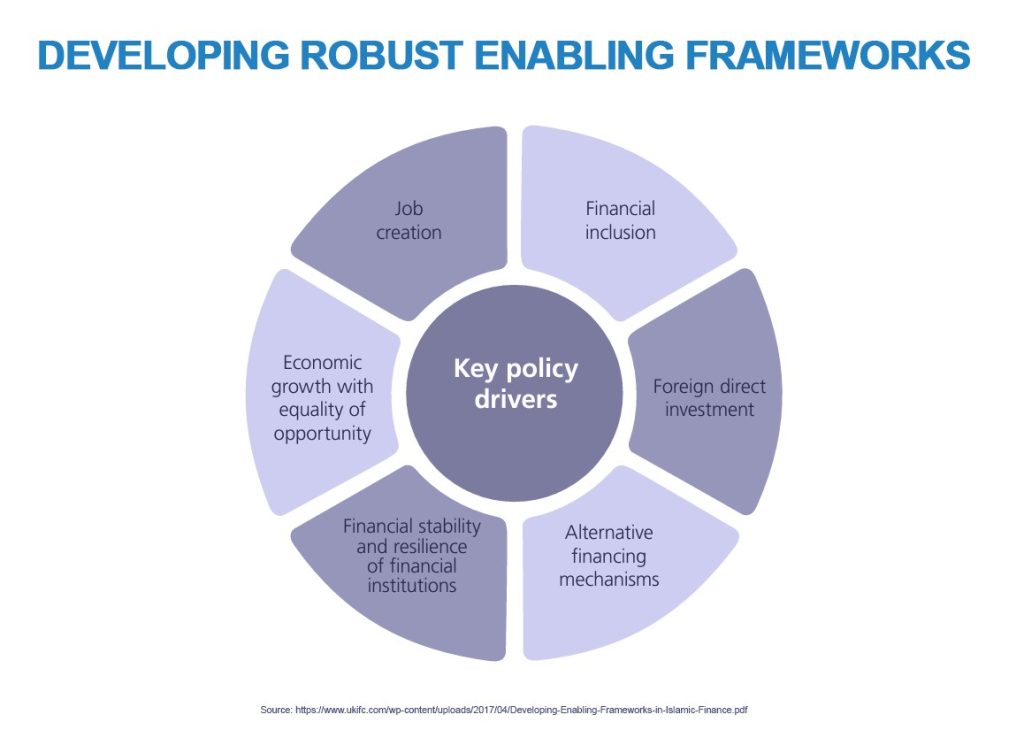

Worldwide, the insurance industry is stepping up efforts to develop knowledge and awareness of Islamic finance. For example, in the UK, the Islamic Finance Council UK (UKIFC) spearheads education efforts in Islamic finance in a country that holds the highest value of Sharia-compliant assets of any non-Muslim state, as well as the highest value in the Europe, bar Türkiye, (with around 85% of all European Islamic-banking assets). In addition, the Islamic Insurance Association of London, launched in 2015,[14] has established itself as a credible and effective international body to help promote, develop and regulate the global Islamic finance industry. That such resources to inform and clarify the role of insurance for Muslim customers is in ever greater demand is encouraging.

Those international efforts are also reinforced by government action in the MENA region, where legislation or new regulations in support of Islamic insurance are being introduced. In Saudi Arabia, for example, insurance providers are obliged to offer Shariah-compliant products. In the UAE, regulatory authorities now require qualifications for Shariah board members in Islamic financial institutions[15]. In short, Shariah qualifications in transactional jurisprudence are an important factor across the MENA region.

Which lines are growing and thriving?

Historically, in underdeveloped markets, the insurance sector’s development process tends to conform to well-defined economic realities. Traditionally, the non-life sector often dominates in the early stages of that process, and within that sector, risk associated with transport and trade features heavily. The timing of what comes next in the process depends on a number of variable factors, including the state of the economy and employment, inflation, interest rates and access to credit, but large swathes of the population will at some stage begin to acquire private automotive vehicles.

This is usually closely followed by regulatory intervention from central government in the form of mandatory third-party liability cover. Next in this sequence, retail credit and mortgage capacity begin to grow, which leads to an increase in household insurance uptake. As sure as night follows day, a distinctive middle class begins to emerge, members of which then begin to address social protection to mitigate the financial risk associated with illness and death in the form of pension provision and life insurance.

While motor is the largest contributor to the non-life segment – influenced on the whole by requirements for mandatory third-party liability insurance in Morocco, Egypt and elsewhere – accident and health have all shown impressive growth in recent years, so much so that life insurance is now the fastest-growing line on the continent.[16]

It is therefore no surprise that, whilst ‘motor’ represents the single biggest line in the non-life sector across Algeria, Egypt, Libya, Morocco and Tunisia, the majority of future growth across North Africa will most likely derive from pensions, individual life and savings protection insurance.[17]

The JENOA view: risk & opportunity

Education and awareness are key to unlocking growth in the North African retail and commercial sector; more often than not, the difference between Islamic and traditional insurance lies not in the concept of the product, but rather in the process of designing that product. Sometimes, even something as simple as the choice of words or terms on a contract can be the difference to acceptability, or not.

Given the simplicity of product design in takaful, one of the biggest conundrums for Islamic markets is why quite so many Islamic assets are more likely to be covered by conventional insurance than by Islamic takaful. To address that problem, we need to accept that there is a chronic shortage of Islamic reinsurance (retakaful) capacity, which gives rise to a scenario whereby even takaful providers are forced to reinsure in the conventional insurance and financial markets, despite their clear preference for Sharia-compliant reinsurance. Conventional insurers will then inevitably reinvest in conventional, not takaful, markets.

A degree of geopolitics is also in play when it comes to global finance and development across the continent, and future economic development in North Africa should be seen in the broader context of ongoing pan-African development. Whilst cultural and linguistic ties have indeed strengthened bonds between North African states and neighbouring nations in the Gulf over many years, collaboration is now beginning to gravitate south into continental sub-Saharan Africa.

The rush to fill investment gaps in Africa is perhaps not surprising, given that the whole African continent, including supra-Saharan nations, boasts the lion’s share of the world’s critical minerals,[18] has around two-thirds of the world’s prime solar-energy resources, and is home to 60% of the planet’s unused arable land. In addition, Africa hosts six of the world’s ten fastest-growing economies on a continent where 70% of the population is below the age of 30.

To call Africa the world’s largest consumer-growth market is no exaggeration. Africa’s huge potential is matched only by the scale of inward investment needed on the continent. With an existing finance gap now further exacerbated by a 35% drop in inward investment from China, many sovereign wealth funds and other influential investors in the MENA region are beginning to refocus their sights on emerging opportunities presented by this funding vacuum. The finance gap is likely to be filled, at least in part, by investment that looks to strengthen existing trade corridors with the ultimate aim of extending long-term financial interests, soft power, and influence on the continent.

However, focusing exclusively on emerging opportunities in sub-Saharan Africa could endanger the effective and timely development of North African insurance and financial markets, and investors would do well not to overlook development in supra-Saharan nations in favour of sub-Saharan growth markets.

Why?

This is principally because, despite the continent’s massive potential and impressive speed of growth in sectors like fintech and energy, a host of sub-Saharan nations are facing significant challenges in the form of sizeable sovereign debt. The International Monetary Fund (IMF) and World Bank report that, in 2021, the average sovereign national debt across all African nations stood at no less than 68% of GDP.[19] Nine of Africa’s 54 countries were in debt distress in 2021, 15 were at a dangerous risk of debt distress, and 14 at moderate risk.[20] In other words, 70% of African nations are exposed to moderate-to-dangerous risk of sinking beneath their debt obligations.

How can JENOA help MENA clients in the North African insurance sector?

By offering access to the London market in addition to reinsurance hubs around the world, we leverage conventional Lloyd’s of London capabilities as well as international reinsurance expertise to maximise opportunities in emerging markets. With a strong focus on technology solutions we offer clients a broader reach into markets in North Africa, where the migration to a digital model is underway. With rising customer demand for easy, digital solutions, some insurers in the region have begun to digitalise policyholder journeys, but there is no shortage of opportunity to expedite this move. JENOA’s experience in support of the ongoing digitalisation of product sales and claims processing for clients can help insurers establish a strong and attractive digital presence in target markets.

Access to Lloyd’s of London and large commercial reinsurers is likely to feature as prominently for the takaful market as it always has for the conventional market, given the need to redesign many product offerings to establish bona fide Sharia-complaint credentials. As discussed above, the rapid development of the UK’s Islamic finance industry will provide the critical global regulation and risk-management support that takaful requires. After all, the combination of London’s long-established insurance and reinsurance capabilities, coupled with a credible and respected body in the form of the Islamic Insurance Association of London,[21] is a very powerful one.

With support like that, retail and commercial markets still suspicious of or indifferent to insurance, are likely to become more accessible, so long as the industry continues to pursue a combination of credible and authoritative regulation and widespread education across jurisdictions offering Islamic finance.

At JENOA, we are committed to providing education, training and advice on takaful insurance. We understand the value and importance of insurance, and we are keen to help Muslims understand that the concept of insurance is not contrary their faith, if done correctly. We are well positioned to innovate and design insurance products around our clients’ needs in compliance with Islam, products that will be ethical, Shariah-compliant and available to those of all faiths or none.

For Islamic finance practitioners, JENOA aspires to lead the way in Shariah-compliant insurance and reinsurance solutions for our clients worldwide. We have experience helping clients appreciate the core Islamic insurance requirements that distinguish Islamic from conventional products. We can also assist clients as they move beyond an understanding of the core beliefs that guide takaful, to then help them successfully meet the regulatory requirements from a Shariah perspective.

Unleash your potential

Few insurers keen to achieve growth can ignore the potential customer base that the world’s 1.5 billion Muslims represent if they can be persuaded of the place of insurance in Islam; unlike most developed nations, 60% of the global Muslim population is under 25 years of age.

Neither should they dismiss the huge potential that exists right across Africa. The continent represents a full 20% of the world’s consumers and is therefore impossible to ignore. With 70% of Africans under the age of 30 constituting the world’s largest and youngest working population, the potential of the entire continent is impressive. There is, however, some important and potentially tricky overlap with North Africa’s largely Muslim nations, in the sense that development opportunities should not be seen as a binary choice. That is because North Africa’s Muslim populations form just under 20%[22][23] of the world’s 1.5 billion Muslims, 60% of whom are under the age of 25[24]. As discussed above, the growing affluence and social mobility that usually follow the development process of insurance markets in underdeveloped regions will likely offer insurers a long-lived customer base.

Can insurers successfully tap into and harness the true potential of both markets? With the right approach and advice, a digital mindset and an eye on the dual opportunities of North Africa as it straddles the full potential of both the takaful market and the African growth phenomenon, players who get it right are likely set for extraordinary penetration.

[1] https://www.commercialriskonline.com/morocco-top-of-the-rankings/

[2] https://www.statista.com/outlook/fmo/insurances/northern-africa

[3] https://www.statista.com/outlook/fmo/insurances/northern-africa

[4] https://documents1.worldbank.org/curated/en/191531468110930768/pdf/WPS5608.pdf

[5] https://www.sanlam.com/downloads/capital-market-days/2023/Morocco-deep-dive.pdf

[6] https://www.statista.com/statistics/502797/gross-domestic-product-gdp-in-morocco/

[7] https://documents1.worldbank.org/curated/en/191531468110930768/pdf/WPS5608.pdf

[8] https://argaamplus.s3.amazonaws.com/68f88da4-b648-41f9-bb31-47ebb3414cb6.pdf

[9] https://www.mckinsey.com/featured-insights/middle-east-and-africa/africas-insurance-market-is-set-for-takeoff

[10] https://assets.kpmg.com/content/dam/kpmg/za/pdf/insurance-survey-2023.low%20res.sml.pdf

[11] https://tradingeconomics.com/south-africa/gdp

[12] https://documents1.worldbank.org/curated/en/191531468110930768/pdf/WPS5608.pdf

[13] https://documents1.worldbank.org/curated/en/191531468110930768/pdf/WPS5608.pdf

[14] https://www.thecityuk.com/media/1tbbofqr/islamic-finance-global-trends-and-the-uk-market.pdf

[15] https://api.zawya.atexcloud.io/file-delivery-service/version/c:NWI4OWQ5MjctNWQ3NS00:NWM3MjBmN2ItYjNjMS00/IFDI%202023%20Report%20-%20Nov%2030.pdf

[16] https://www.mckinsey.com/featured-insights/middle-east-and-africa/africas-insurance-market-is-set-for-takeoff

[17] https://www.mckinsey.com/featured-insights/middle-east-and-africa/africas-insurance-market-is-set-for-takeoff

[18] https://www.thenationalnews.com/opinion/comment/2024/02/26/a-gcc-africa-corridor-makes-logistical-sense/#:~:text=Africa’s%20significant%20economic%20potential%20%E2%80%93%20including,funding%20gap%20exceeding%20%24200%20billion

[19] https://www.institute.global/insights/economic-prosperity/reset-and-revitalise-uk-africa-trade-and-investment

[20] https://www.institute.global/insights/economic-prosperity/reset-and-revitalise-uk-africa-trade-and-investment

[21] https://www.thecityuk.com/media/1tbbofqr/islamic-finance-global-trends-and-the-uk-market.pdf

[22] https://www.worldometers.info/world-population/northern-africa-population/#:~:text=Countries%20in%20Northern%20Africa&text=The%20current%20population%20of%20Northern,of%20the%20total%20world%20population

[23] https://www.pewresearch.org/religion/2009/10/07/mapping-the-global-muslim-population10/#:~:text=More%20than%20half%20the%20countries,Tunisia%2C%20Western%20Sahara%20and%20Yemen.

[24] https://www.meinsurancereview.com/Magazine/ReadMagazineArticle/aid/46315/Are-the-stars-starting-to-align-for-takaful-