The rising demand for Sharia-compliant financial products among the Gulf Cooperation Council’s (GCC) growing and predominantly Muslim population is forcing providers to rethink their product offerings and the channels through which customers can access them.

The GCC home and automotive-finance market has been evolving rapidly over the past few years, driven by urbanisation, population growth, and government initiatives to encourage and promote home ownership in an increasingly digital landscape. As a result, the home and automotive finance sector could see significant benefits from an increasing appetite for Sharia-compliant financial products among Muslim populations, as well as non-Muslim populations keen to buy Islamic financial products for their ethical and moral components.

The big question remains: can regional players adapt quickly enough to take advantage of these emerging opportunities?

So, what is different?

Islamic finance prohibits riba (includes both interest and usury), gross uncertainty and gambling, and promotes risk-sharing and asset-backed financing. It also prohibits non-compliant investment in assets, activities, services, usufructs or substances such as gambling, alcohol, weapons manufacturing, adult entertainment, and others prohibited in the religion.

Five principal conceptual contracts cover the vast majority of Islamic finance transactions: Musharakah, Murabaha, Mudarabah, ijara and Salam.[1]

Islamic finance products: home finance and car loans

Islamic home finance is the alternative for conventional mortgages. A mortgage is typically a type of loan used to purchase a home. The borrower agrees to repay the lender in a series of regular payments that includes the principal amount borrowed and interest. The home is used as collateral to secure the loan. On the contrary, Islamic home finance does not involve a loan or collateral. Islamic home finance often operate under the conceptual contract of Ijara, diminishing Musharakah, which comprises a contract between an Islamic financial institution (IFI) and its customer, to provide capital to enable the purchase and ownership of property or real estate (among other things). Both contribute towards the purchase of the property as partners (Shareek). The IFI leases its share of the property to the customer for which the customer shall pay a monthly rent (Ijara). The IFI also agrees to sell its share of the property to the customer over a period of time allowing the customer to become the sole owner of the entire property and effectively terminating the Musharakah agreement (diminishing Musharakah) with no further rent to pay. The Musharakah structure is also commonly used in joint ventures and joint partnerships where profits generated by any rise in real-estate value (or rental income) are shared under the terms of a Musharakah contract, whilst any losses are borne by participating partners proportionally, depending on each partner’s share of capital.[2]

Financing for assets such as vehicles is often covered under Islamic finance by Murabaha. Murabaha involves the purchase of an asset (in this case, a car or an SUV) by the bank, from the car dealer, at the customer’s behest. With the lender assuming the risk of ownership for the period between buying the asset from the dealership and selling it on to the client, the vehicle is then sold on to the customer at an agreed price, consisting of the original purchase price plus a pre-agreed mark-up, on a deferred-payment basis.[3][4] The fundamental difference between conventional car financing and Murabaha is that the mark-up is profit rather than interest.

Islamic finance, home and car finance: current state of the market in the GCC

The global Islamic finance sector surpassed the US$ 3 trillion mark in 2022, with total Sharia-compliant assets growing by nearly 10%, according to S&P Global Ratings. Similar growth is forecast for 2023/2024, underpinned by strong growth among Islamic banks in the GCC.[5]

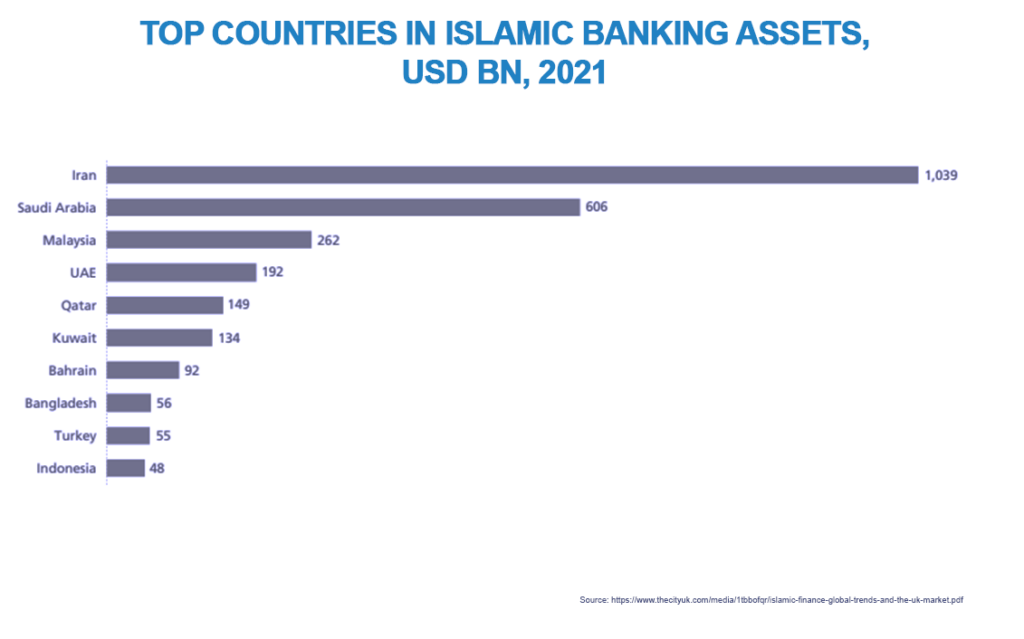

As if to underline the influence of the GCC in the global Islamic-finance sector, just ten countries – including Saudi Arabia, UAE, Qatar, Kuwait and Bahrain – accounted for 95% of global Islamic banking assets in 2002,[6] and GCC countries alone accounted for over 90% of the growth in Islamic-banking assets last year.[7]

In Saudi Arabia, the period 2018–2022 saw Islamic home finance products outpacing corporate loan growth, rising at around a 40% compound annual growth rate (CAGR).[8] Much of this growth has been driven by Saudi Vision 2030, which incorporates the Saudi Housing Program Delivery Plan, an initiative designed to increase home ownership to 70% of the population.[9] In addition, the drive towards a significant increase in home ownership, known as the Sakani Program, has been helped by targeted funds that make it easier for Saudi citizens to obtain home finance, such as the Real Estate Development Fund (REDF). These initiatives and funds are having a major effect on real-estate mortgages; home ownership in Saudi Arabia has risen from 47% in 2017 to 60% in 2020.[10][11]

A similar initiative was undertaken in UAE under the auspices of the Ghadan 21 program. In 2021, Abu Dhabi’s government granted US$ 2 billion in homes, land and home finance to more than 6,000 citizens in the Emirates, as well as exempting a number of retired Emiratis from home finance repayments.[12]

The home finance market in the UAE, however, is not primarily driven by government subsidies and initiatives; the UAE has enjoyed rapid growth in the services sector, and the country is anticipating long-term growth as a result of a diversified economy and robust cash inflows from expats[13], who make up around 90% of the population.[14]

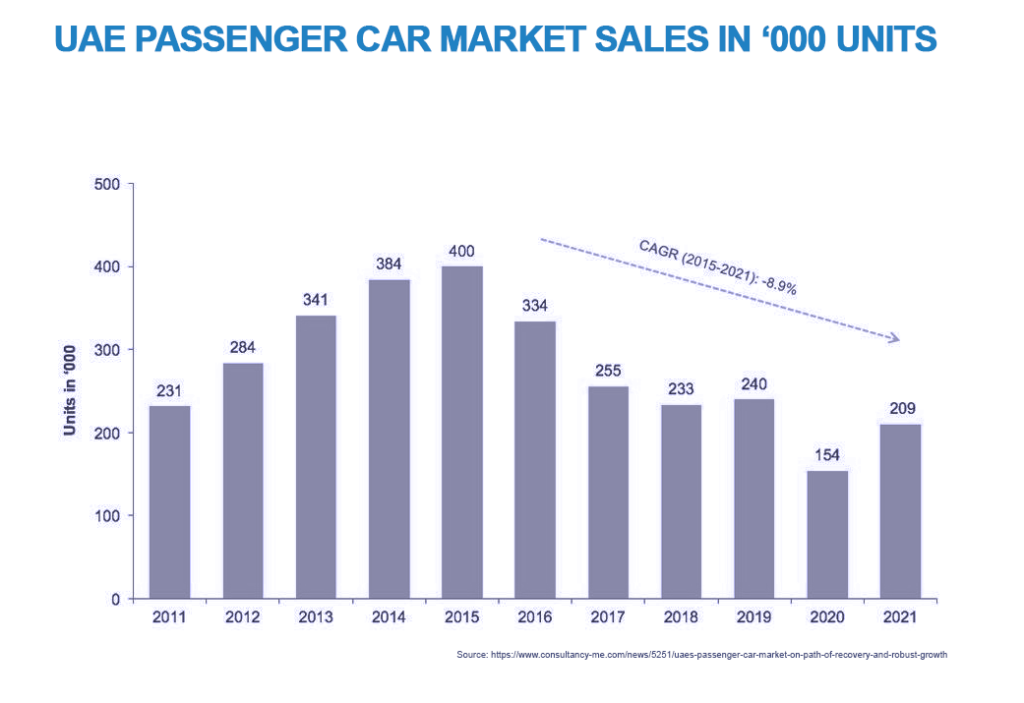

The picture for automotive finance, however, is somewhat mixed in GCC. Volumes in Saudi Arabia are expected to remain low over the next few years, influenced by a variety of VAT increases and the global semiconductor shortage, leading to reduced supplies.[15]

Elsewhere in the GCC, jurisdictions such as the UAE have shown strong year-on-year growth (see below), with banks keen to promote easier access and more favourable terms in a competitive auto-finance market.

The JENOA view: opportunities & risks

Opportunities exist for finance providers to diversify their product portfolios with Islamic finance products in both the Muslim and non-Muslim demographics. They are also in a strong position to further embrace the charge towards digitalisation and fintech.

Unlike populations in most Western countries, 60% of the global Muslim population is under 25 years of age.[16] Growing affluence and social mobility among these young populations offer finance providers a long-lived customer base for Sharia-compliant products to tap into. While Islamic financial products naturally appeal to the GCC’s predominantly Muslim population, there is also a growing appetite for Sharia-compliant products among a broader non-Muslim customer base due to the guiding ethical and moral principles underpinning Islamic finance.

In the home finance market, possible cuts to Saudi Arabia’s government subsidies for affordable housing in the low-income sector represent a potential risk to home finance growth in the country. The nation’s Housing Program Delivery Plan,[17] the second phase of which concentrates on affordable housing for the underprivileged, will run until 2025. So far, the Real Estate Development Fund’s aim to support almost half a million home finance contracts is expected to deliver a CAGR in home finance of over 16%, but strong demand from the low-income sector could evaporate with the withdrawal of existing government subsidies. [18]

In the UAE and particularly the Emirate of Dubai, however, strong demand for home finance and car loans is driving growth. This is not entirely unexpected, given that new auto sales in the UAE in the first half of 2023 were up nearly 6% on the previous year.[19] Strong sales figures have been buoyed by a more aggressive banking sector that now offers automotive loans with zero down payment and deferred repayments. In addition, as the UAE continues to enjoy strong immigration, automotive dealerships are reporting that 40% of buyers are newly arrived expats.

One potential risk for the growing automotive-loan sector under Murabaha structure is that additional charges cannot be imposed after the Murabaha due date, making loan default a real concern among Islamic lenders, with no broad consensus emerging yet on how to deal with it.

Various possible solutions to above concern are being introduced which can be explored. For example, the lender could charge an administrative and processing fees for late payments. The conditions are that these fees should be reasonable and not excessive and pre agreed with the client.

Alternatively, the car dealer could enter into a Tawar’ruq (Commodity Murabaha) agreement with the purchaser in addition to the car-finance agreement. The value of the Tawar’ruq would be owed by the purchaser to car dealer. Every time the purchaser defaults in payment, the car dealer would demand an amount that is owed via the Tawar’ruq agreement. Once the car-finance is fully paid, then the car-dealer would waive the outstanding amount owed on the Tawar’ruq facility and terminate the agreement.

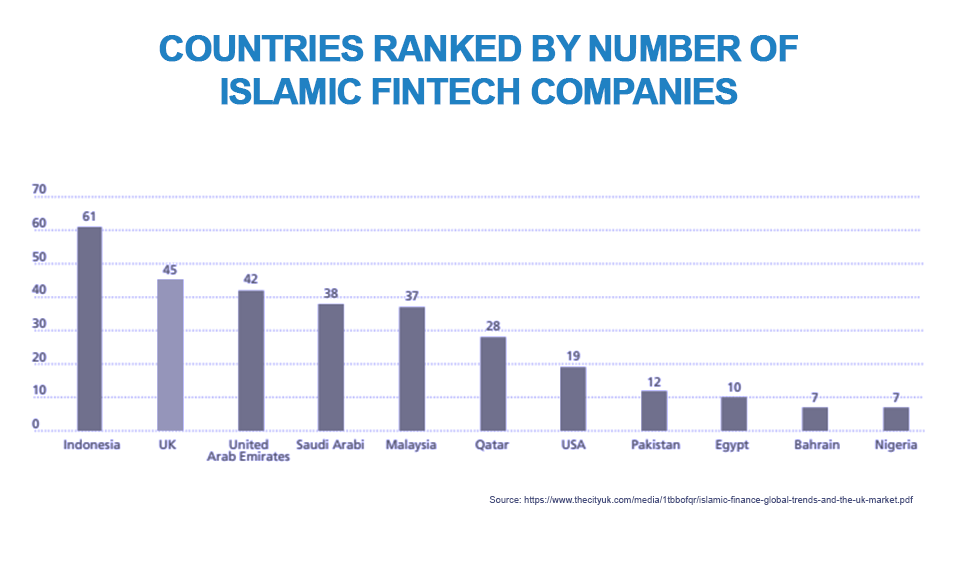

Despite these potential risks, it is highly likely that enhanced digitalisation and fintech collaboration will open up new avenues for growth, allowing the region’s young populations to embrace a digital-finance revolution as finance providers find new and innovative ways to deliver products to satisfy home- and automotive-loan demand in a digital landscape. The region’s high smartphone penetration, coupled with its large digital-native millennial and generation-Z demographic, offers huge potential for mortgage and automotive loan providers to grow their business in the GCC and also provides a platform from which to further expand into digital cross-border growth in the wider, and currently under-served, MENA region.

The rapid growth of fintech in the GCC offers yet more potential for Islamic finance to grow and thrive. Whether through digital banking, insuretech or blockchain, the GCC has been at the forefront of developing open financial ecosystems that continue to attract world-class innovators in fintech. The region enjoyed a quadrupling of funding for fintech startups in 2022 compared to 2020, up from US$ 200 million to almost US$ 900 million,[20] and the MENA region saw startup funding in fintech top US$ 2.5 billion in 2021.[21]

This sort of growth has been predicated on sufficient attention to the necessary regulatory frameworks, as well as physical infrastructure, which S&P Global Ratings describes as “a prerequisite for fintech’s ability to enrich the Islamic finance industry”. Regulators and authorities have responded favourably, with the GCC now hosting several fintech incubators and regulatory sandboxes where fintech can test and thrive. Fintech hubs in the region, including Fintech Saudi and Abu Dhabi Global Market (ADGM), numbered at least four by the close of 2022, mirroring the extraordinary growth of the market in the region.

What does this mean for MENA clients?

By offering enhanced access to Sharia-compliant financial products, we can meet clients’ increasing needs for ethical investment both inside and outside the Muslim world, as the broader global Islamic-finance industry grows to over US$ 5 trillion in assets by 2025. We are able to leverage an array of Sharia-compliant financial products to meet emerging opportunities in the Islamic finance sector.

Integrating digital solutions into Islamic finance allows us to offer an enhanced customer experience and improved efficiencies. In short, customers can access a greater range of mortgage and vehicle loans via digital platforms in an integrated digital financial ecosystem.

Our commitment to ethical and sustainable practices is a natural fit for Sharia-compliant finance options, and our collaboration and partnerships with regional success stories such as ride-hailing business Careem,[22][23] is testament to our continued commitment to supporting self-employed customers in line with Saudi Vision 2030. Our flexible financing program for Careem drivers helps support and increase employment rates, as well as helping Saudi nationals achieve fulfilling and healthy lives.

A digital future for Sharia-compliant products

The GCC’s Islamic-finance sector for home finance and car loans is enjoying healthy growth and offers significant potential for regional players. Providers in the region are in a strong position to strategically diversify financial services offerings by incorporating Islamic finance options into their digital offerings, and vice-versa.

In a competitive landscape, finance providers must find new ways to tap into the growing demand for Sharia-compliant financing. By doing so, they can position themselves for further cross-border growth in preparation for the wider MENA region outside of the GCC to relax its conservative approach to alternative financing and digitalisation and take advantage of the inevitable deeper penetration of smartphone technology in the future.

This article has been co-authored by Sheikh Zubair who is a Sharia Scholar, active in Islamic insurance within the London insurance market since 2013 and helped to set London’s first ever Shariah compliant MGA. He has worked closely with Lloyd’s of London and Lloyd’s Syndicates and has overseen risks being written in accordance with the principles of Islamic insurance, for the very first time in its illustrious history.

Sheikh Zubair is the co-author of the study text book ‘Principles of Takaful’, commissioned by the Chartered Insurance Institute (CII). Sheikh Zubair is based in London and newly joined JENOA in 2024.

[1] https://islamicmarkets.com/education/five-main-contracts-in-islamic-finance#:~:text=There%20are%20five%20main%20contracts,profits%20by%20certain%20agreed%20proportions.

[2] https://www.imf.org/external/pubs/ft/wp/2015/wp15120.pdf

[3] https://uk.practicallaw.thomsonreuters.com/6-500-6961

[4] https://uk.practicallaw.thomsonreuters.com/6-500-6961

[5] https://www.thebanker.com/Islamic-Banking-Awards-2023-1685604285

[6] https://www.thecityuk.com/media/1tbbofqr/islamic-finance-global-trends-and-the-uk-market.pdf

[7] https://fastcompanyme.com/news/gcc-countries-fueling-global-islamic-finance-industry-growth/

[8] https://www.bcg.com/publications/2023/performance-of-banking-sector-in-saudi-arabia

[9] https://www.vision2030.gov.sa/media/lfcfdvl0/2021-2025-housing-program-delivery-plan-en.pdf

[10] https://www.bcg.com/publications/2023/performance-of-banking-sector-in-saudi-arabia

[11] https://www.vision2030.gov.sa/media/lfcfdvl0/2021-2025-housing-program-delivery-plan-en.pdf

[12] https://www.arabianbusiness.com/politics-economics/466259-abu-dhabi-grants-2295m-grant-in-housing-loans-waivers-for-803-emiratis

[13] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/uae-banks-set-for-fy-2023-loan-growth-profit-uptick-77319635

[14] https://u.ae/en/information-and-services/social-affairs/preserving-the-emirati-national-identity/population-and-demographic-mix

[15] https://www.bcg.com/publications/2023/performance-of-banking-sector-in-saudi-arabia

[16] https://www.meinsurancereview.com/Magazine/ReadMagazineArticle/aid/46315/Are-the-stars-starting-to-align-for-takaful-

[17] https://www.vision2030.gov.sa/media/lfcfdvl0/2021-2025-housing-program-delivery-plan-en.pdf

[18] https://www.bcg.com/publications/2023/performance-of-banking-sector-in-saudi-arabia

[19] https://www.focus2move.com/emirates-automotive-market/

[20] https://www.al-monitor.com/originals/2023/09/fintech-digital-sukuk-could-spur-islamic-finance-growth-middle-east

[21] https://www.strategyand.pwc.com/m1/en/strategic-foresight/sector-strategies/financial-sector-consulting/fintechbuildingmomentum.html

[22] https://alj.com/en/news/abdul-latif-jameel-finance-launches-car-financing-program-for-careem-captains/

[23] https://alj.com/en/perspective/sharing-the-ride-with-careem/