Geopolitics continues to cast a long shadow over both global and MENA supply chains, with ongoing geopolitical issues having caused a certain amount of disruption in the Red Sea and Bab-al-Mandeb Strait regions over the course of 2024. However, the fragility of supply chains is not caused exclusively by political uncertainty and conflict.

As Swiss Re notes, supply-chain business interruption continues to dominate the risk landscape for companies in 2024 and into 2025 and has been “among the top risks for most companies for over a decade”.[1] Its SONAR 2024 report identifies some of the challenges that companies will face in the coming months and years, if not decades: “Evolving geopolitical conflict and infrastructure funding gaps”, states the report, “are increasing the risk of supply chain disruptions. Governments are spending more on the military, which is curtailing budgets for civil infrastructure. Supply chains are becoming less resilient to shocks as cost reduction is taking centre stage again”.

Global risk to supply chains & business disruption:

The background in 2024

Swiss Re’s assessment seems to be reinforced by many industry voices, with global risk-intelligence organisation, Verisk Maplecroft, pointing out that “businesses should be asking whether new and incumbent governments can maintain a stable operating environment” in a year in which half of the world’s entire population, in no fewer than 77 countries, went to the polls to elect new governments.[2]

The most important of those elections, at least in economic and trade terms, was arguably the re-election of Republican US president-elect Donald J Trump, who had already served one term of office between 2017–2021. Maplecroft expects President Trump’s administration to impose trade tariffs at levels last seen in the 1930s, if the President-elect’s pre-election rhetoric is anything to go by.[3]”

Maplecroft adds that any high import tariffs imposed on the People’s Republic of China (PRC) have the potential to “upend international trade”. “Countries without free trade agreements would be particularly affected,” say Maplecroft’s global-risk experts, adding that, “the most exposed in terms of US import values are China, Germany, Japan, Vietnam, Taiwan, Ireland, India, Italy, the UK and Thailand”.

MENA: risk to a crucial trade and logistics hub

MENA’s supply chains are exposed to numerous and complex risks, but most of that risk is encapsulated within a handful of broad yet fiendishly complex and often interconnected areas of concern: shortage of manufacturing parts, shipping blockages, natural catastrophe, and unrest and conflict.

For centuries, the region’s strategic location has made it an important driver for economic growth far and wide, but its more recent evolution into a major trade, logistics and industrial hub has brought economic growth and increased risk in equal measure. As Marsh McLennan notes with terrifying understatement, “there are indications that supply chain resilience in the region has reached a low point.[4]” Earlier this year, the World Bank reported that growth in the region was being held back by supply chains that lacked resilience.

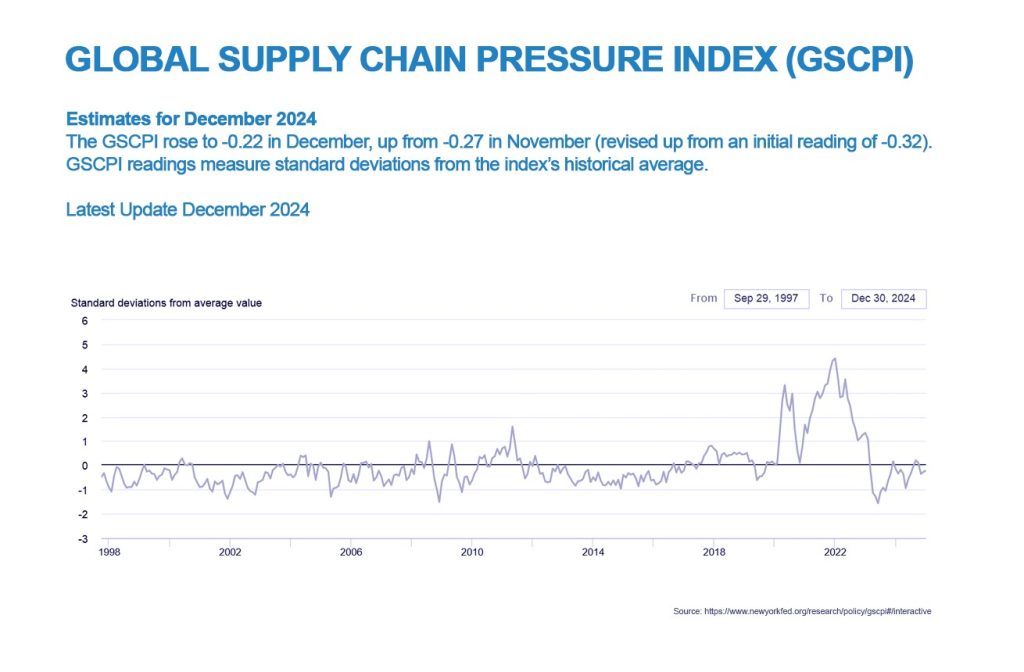

The Federal Reserve Bank of New York publishes the so-called Global Supply Chain Pressure Index (GSCPI), which has tracked manufacturing and transport data over decades[5] to give an accurate picture of global supply chains. As things stood in late October with the GSCPI’s latest available figures, the regions it tracks have been below 30-year historical averages since February 2023.

Amongst GCC countries, the UAE, in particular, has developed from a logistics hub into an important supply-chain nerve centre. Its container port is among the 10 busiest in the world, and with 2.5% of the world’s container trade transiting through UAE ports, the country and region now plays a crucial part in securing important international connectivity. Its principal airport, Dubai International Airport (DXB), is now the busiest in the world, with just under 5.3 million seats in 2024.

Parts shortages, shipping disruption and geopolitical conflict

It was a memorable effect of post-COVID economic recovery that few will forget in a hurry, but the infamous global shortage of semiconductors that scuppered a quick bounce back and recovery of the automotive industry, was symptomatic of a multi-cause wider parts shortage. The supply-chain disruptions caused by the blockage of the Suez Canal in March 2021 by the container ship Ever Given[6], was a timely reminder of the delicate intricacies of a just-in-time global supply chain. Costs mounted as perishable goods were stuck waiting for maritime authorities to free the vessel and reopen this important trade route.

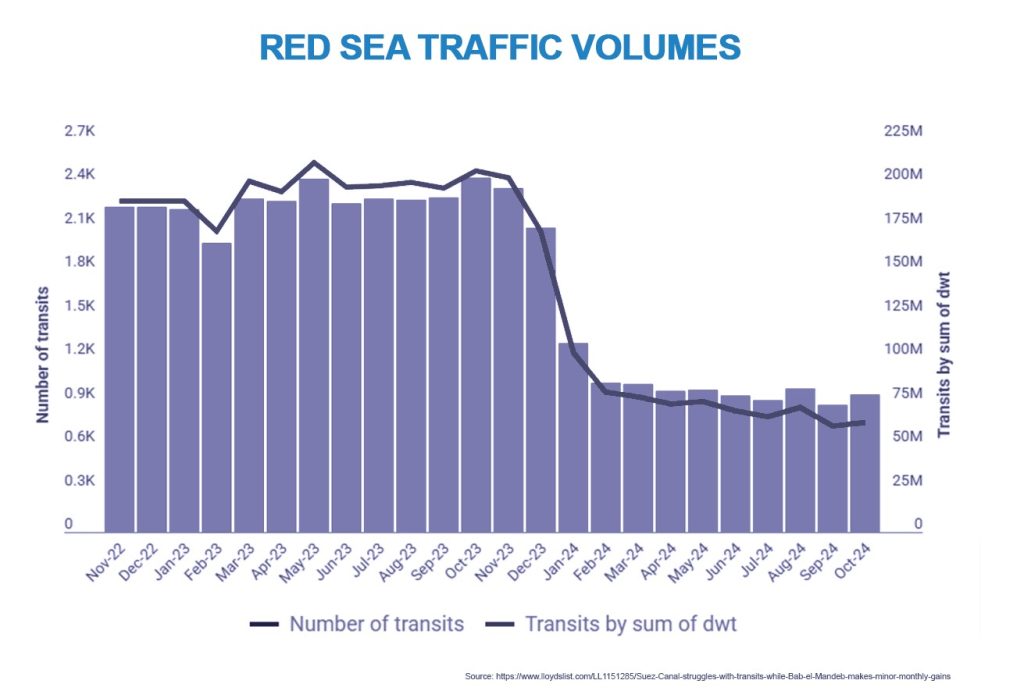

The last 12 months have seen political uncertainty and conflict in the same region spur several carriers – Maersk and Hapag-Lloyd among them – to reroute transits away from Suez,[7] which has historically carried 30% of global container-shipping volumes. As of November 2024, Lloyds List reports that transits through the Suez Canal are at their lowest capacity since tensions in the region first emerged, with a steady decrease in traffic measured by volume and total capacity[8]. The canal operator, the Egyptian government, has reportedly suffered financial losses of around US$ 6 billion from rerouted traffic.

Circumnavigating Africa via the Cape of Good Hope adds 25% to transit times from Asia to the US east coast and carries increased insurance costs and additional shipping and fuel expenses. “With any service disruption”, say supply-chain experts Flexport, “global shippers should expect base rates to increase as well as additional fees such as a War Risk Surcharge, Emergency Bunker Surcharge [and] Emergency Surcharge”.[9]

Disruption to transit through Suez arguably could not have come at a worse time, as the end of 2023 saw local droughts causing low water levels in the Panama Canal. Just as tensions flared up in the Red Sea and Bab-al-Mandeb Strait regions, the drought had already led to a 50% reduction in shipping transiting the Panama Canal, itself responsible for around 5% of all global trade.

Natural catastrophe and natural climate variability

Just-in-time supply chains are exposed, quite literally, to natural catastrophe and climate variability risks, as well as to any increased weather phenomena due to climate change. As mentioned above, drought in Central America created challenging conditions for maritime traffic with plans to transit the Panama Canal. From Japan to Russia, earthquakes, wildfires, cyclones, floods and typhoons created havoc on supply chains in various parts of the world in 2024.[10]

Severe flooding in Gulf states in April this year caused significant knock-on effects on global supply chains, as both air and container-port operations suffered major disruption. Although the UAE was the hardest hit in the region, multiple Gulf locations saw over a year’s rainfall in less than 24 hours[11].

The JENOA view

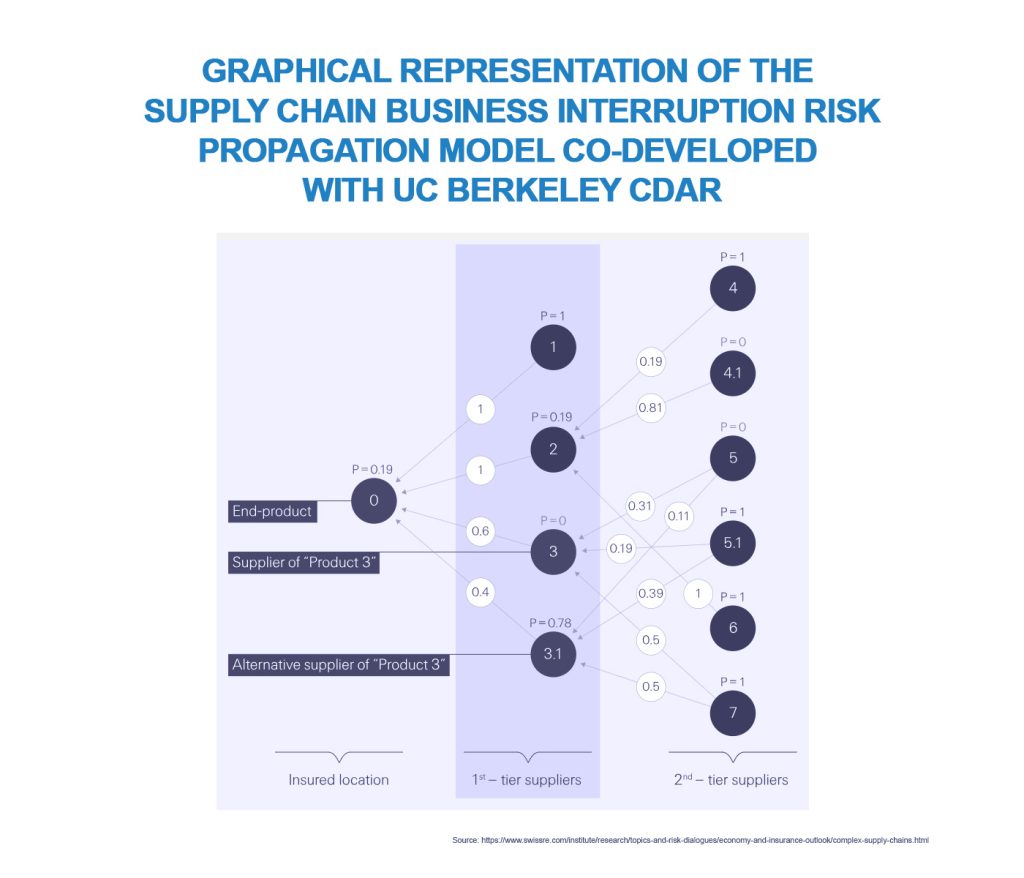

One of the biggest and most persistent problems facing global supply chains is that risk visibility continues to suffer from a lack of data beyond first-tier suppliers. In short, if most operators are in the dark about where the true risk lies, insurance and reinsurance companies cannot quantify risk adequately. As Swiss Re correctly notes, business interruption (BI) and contingent business interruption (CBI) can, to a certain extent, protect companies against risk in the supply chain, but “a lack of connected, reliable data, can make costing these products challenging”.

Supply chains are still far too complex, with just-in-case mindsets and models always trumped by just-in-time supply chains, and although there have been some changes in how goods and raw materials are sourced, the appetite for so-called re-shoring and friend-shoring of manufacturing, production and raw materials has either had limited success or has taken second place to economic considerations. As discussed above, supply-chain risk exposure has arguably increased since the COIVD-19 pandemic and the Ukraine conflict. “Stretched supply chains,” notes Swiss Re, “are more vulnerable to natural catastrophe risks”.

Re-insurers would do well to address data gaps in risk exposure beyond first-tier suppliers in order to uncover and quantify more effectively true risks in the supply chains, as well as potential impacts across multiple tiers. This would mean that re-insurers could in turn quantify risk – something that is hard to do without data – which would allow them to adequately price cover.

What does this mean for MENA clients and how can JENOA help?

JENOA offers experience and expertise in helping insurance and reinsurance clients in the MENA region adapt to supply-chain disruption and build structural resilience in the global movement of goods.

With access to the Lloyd’s of London market and reinsurance hubs worldwide, JENOA leverages global insurance innovation in tandem with reinsurance capacity to mitigate supply-chain risk and provide strategic advice to clients. JENOA’s particular focus on developing solutions means we are in a position to support clients in designing and implementing new revenue streams in developing markets in MENA and emerging markets.

Supply-chain visibility through technology

With supply-chain disruption likely to characterise the foreseeable future when it comes to global trade, insurers and re-insurers can help clients move toward a technology-enhanced digital approach to exposing, understanding and quantifying the full extent of exposure in organisations’ increasingly complex supply chains.

Visibility will ultimately lead to more affordable cover for business interruption arising from this pervasive risk.

[1] https://www.swissre.com/institute/research/topics-and-risk-dialogues/economy-and-insurance-outlook/complex-supply-chains.htm

[2] https://www.commercialriskonline.com/political-risk-signals-heating-up-for-2025/

[3] https://www.commercialriskonline.com/political-risk-signals-heating-up-for-2025/

[4] https://www.marsh.com/en-gb/services/trade-credit/insights/how-to-enhance-supply-chain-resilience-in-mena.html

[5] https://www.newyorkfed.org/research/policy/gscpi#/overview

[6] https://www.artemis.bm/news/ever-given-blocking-of-suez-canal-adds-further-pressure-for-reinsurers-fitch/

[7] https://container-news.com/major-box-carriers-pause-container-ship-traffic-through-red-sea/

[8] https://www.lloydslist.com/LL1151285/Suez-Canal-struggles-with-transits-while-Bab-el-Mandeb-makes-minor-monthly-gains

[9] https://www.flexport.com/blog/global-ocean-carriers-halt-red-sea-transits-what-to-expect/

[10] https://www.randtech.com/navigating-the-impact-of-natural-disasters-on-global-supply-chains-lessons-from-recent-hurricanes-and-earthquakes/#:~:text=Disruption%20of%20Production%20Facilities&text=Natural%20disasters%20such%20as%20earthquakes,schedules%20a.

[11] https://www.ajg.com/gallagherre/news-and-insights/2024/june/arabian-gulf-floods/