In recent years, the Middle East and wider MENAT (Middle East North Africa and Türkiye) region has witnessed significant economic growth and development. However, it faces challenges in growing the insurance sector, which is typically measured by the insurance penetration in an economy. Across the Middle East this remains low when compared to global standards.

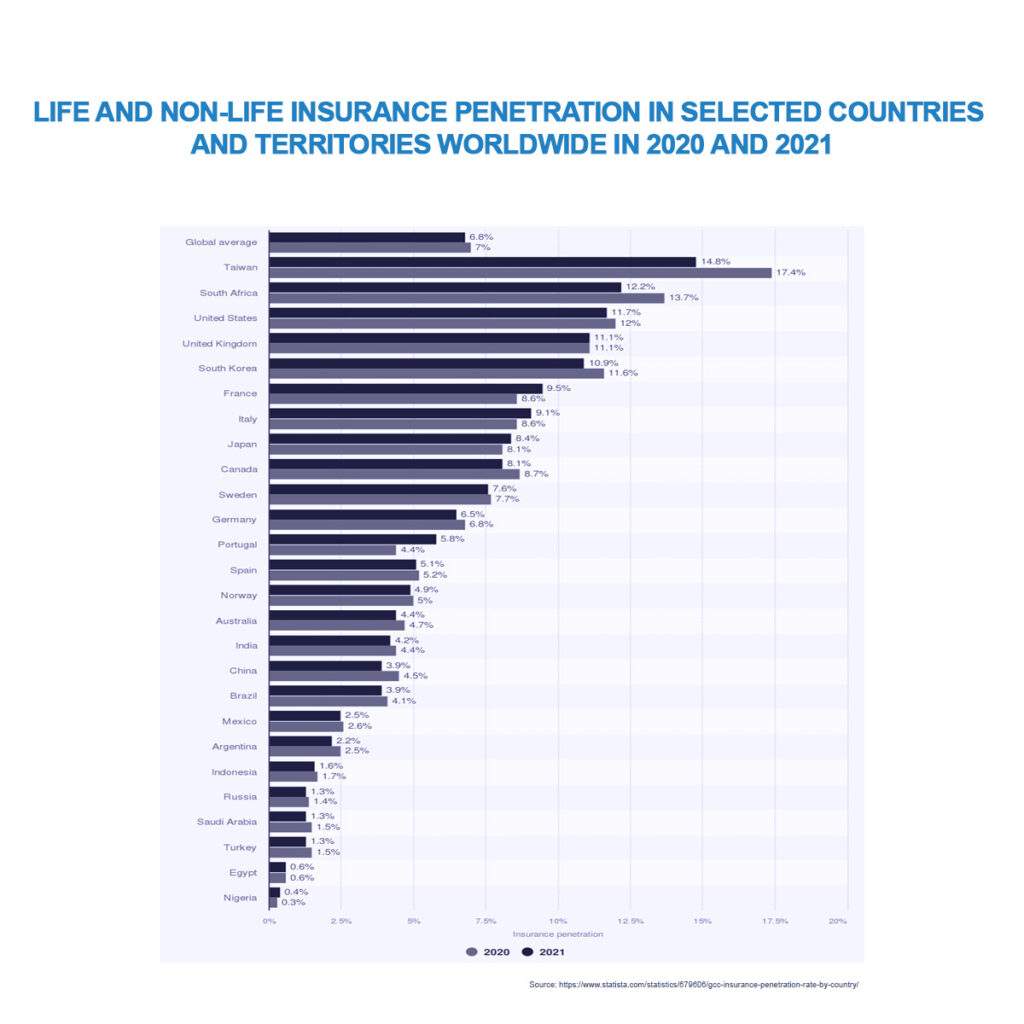

To take a few examples: insurance penetration stands at 1.5% in Saudi Arabia, around 1% for Qatar, and 3.2% in UAE (the highest penetration rate in the GCC). Meanwhile, it’s less than 1% in Egypt, and approximately 4% in Morocco. When we compare this globally, Taiwan leads the pack at 14.8% with South Africa not far behind at 12.2%. The US is at 11.7% and the UK at 11.1%. The global average in 2021 was 6.8%.

This article looks into the reasons behind this phenomenon, explores the government initiatives and awareness campaigns aimed at boosting insurance participation, and highlights key markets in the Middle East and wider region.

Lack of insurance awareness – and the role of education

A significant number of both private individual and business consumers, across the Middle East, remain unaware and under-informed about the availability of insurance solutions and the financial security it provides. This gap in awareness poses a material barrier to the expansion of the insurance industry in the region.

Governments have focused on public educational initiatives aimed at increasing the understanding of insurance as a concept, and its advantages in managing risk. These campaigns seek to clarify misunderstandings and motivate individuals to view insurance as a protective measure against unexpected circumstances. In the UAE, a campaign with GCC pension and social security authorities is already underway.

Government initiatives and the effect of mandatory insurance

There are several new initiatives in place across the MENAT region aimed at boosting insurance penetration, which will produce future opportunities for insurers.

As part of its Vision 2030 initiative, Saudi Arabia has placed significant emphasis on the development of its insurance industry. The government is actively promoting insurance as a key driver of economic diversification.

In Egypt, government-led initiatives aimed at promoting insurance and the rise of a burgeoning middle class are fuelling heightened interest in insurance products. As Egypt’s economy continues to expand, it holds the potential to emerge as a major player.

In Morocco, the government has implemented measures to promote insurance, including mandatory motor insurance and efforts to enhance insurance awareness. The nation’s stable economy and the growing middle class are contributing to an increasing demand.

In Türkiye, the government has implemented regulatory reforms and introduced mandatory insurance policies, such as earthquake insurance, which have spurred growth within the industry. Türkiye’s strategic geographical location further enhances its significance in the insurance sector.

Cultural factors and the rise of takaful as a solution

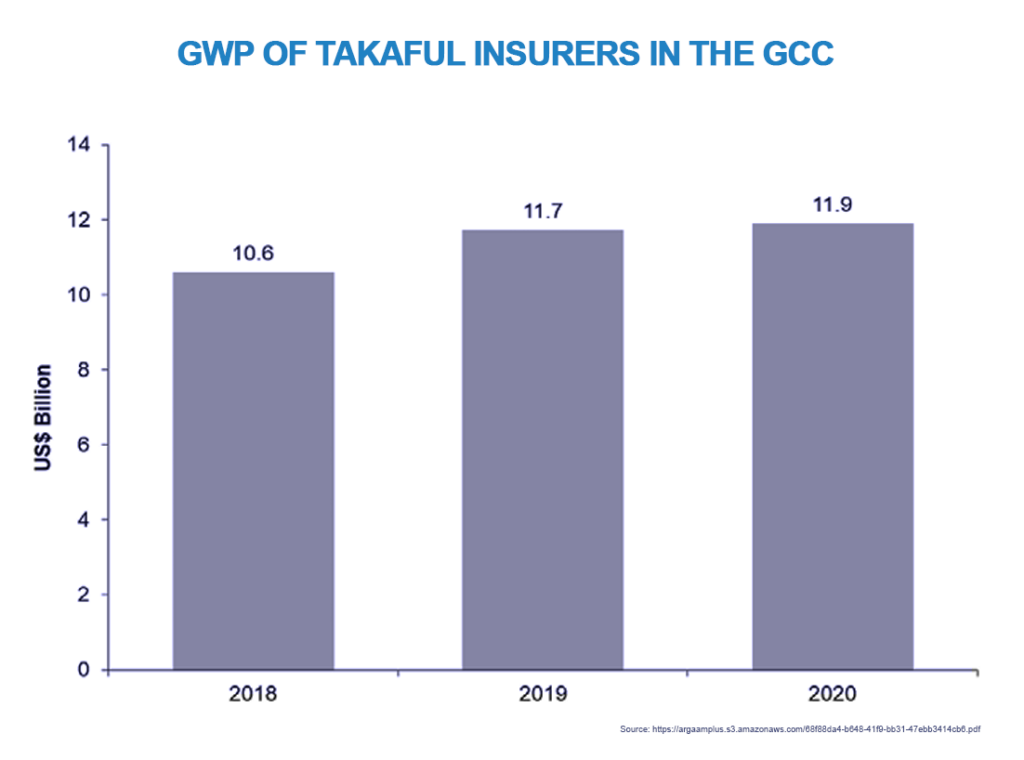

Cultural and religious beliefs in the region play a significant role in the low insurance penetration rates. However, the emergence of insurance firms offering Sharia-compliant Takaful products has injected fresh dynamism into the market.

Since 2000, the Islamic insurance sector has experienced robust annual growth rates exceeding 15%. However, it is important to note that the market is still in its early stages. Notably, there is a growing interest among international firms in introducing similar products, with opportunities for both local and international insurers.

The problem of limited regulation – and new strategies for the future

Several countries in the region are revising their regulatory frameworks to create a more favourable environment for the expansion of the insurance industry. Let’s now look at a selection of key countries in more detail.

UAE insurance overview

The UAE[1] has one of the earliest developed regulatory framework for the insurance market within the GCC. These financial regulations for insurance organisations were established in 2015. They encompass the financial, technical, investment, and accounting activities of both conventional and takaful insurers.

The DIFC (Dubai International Financial Centre) bolsters the emirate’s status as a worldwide centre for the insurance and reinsurance sectors. With the recent issuance of licenses to numerous insurance and reinsurance companies, the sector is poised for an annual growth rate of 20%.

Almost 10,000 individuals are employed in the insurance sector in the UAE. It is perhaps the key GCC market for insurance opportunities.

Saudi Arabia insurance overview

The Saudi Arabia[2] market is one of the most sell developed regulatory frameworks within the Middle East. In order to focus on the development of the sector the ‘Insurance Authority’ (IA) has been established to replace SAMA (Saudi Arabian Monetary Agency) as the insurance regulator in KSA. Its mandate includes restrictions on new licenses and increasingly stringent requirements related to balance sheet strength. Health insurance is subject to regulation by the Council of Cooperative Health Insurance, and SAMA follows a risk-based supervision framework.

Health and motor insurance accounted for 60% and 19% of gross written premiums (GWP), respectively. Life insurance constitutes a smaller portion of the market. Growth in this segment is constrained by the presence of generous social security arrangements for the local population and the ability of non-Saudi employees to purchase life insurance from other countries in the region.

Egypt insurance overview

The Financial Regulatory Authority is responsible for overseeing and regulating non-banking financial markets and instruments, encompassing capital markets, futures exchanges, insurance, mortgage finance, financial leasing, and securitisation. The insurance market operates under a framework in line with Solvency I. Solvency I is a regulatory framework in the EU that governs the capital requirements and risk management for insurance companies and other financial institutions. It was implemented to ensure that insurance companies have sufficient capital to cover their liabilities and provide financial security to policyholders. It has now been succeeded by Solvency II – a more comprehensive and risk-sensitive approach for insurance regulation in the EU.

Due to its substantial population and growing economy, Egypt[3] represents a significant untapped market for insurance. The majority of insurance offerings consist of straightforward products. In 2019, property and casualty premiums accounted for 56% of the GWP in the Egyptian insurance sector, with life insurance premiums comprising the remaining 44% in 2019.

Morocco insurance overview

The regulatory authority overseeing the insurance market is the ACAPS (Control Authority, Insurance and Social Provision). The prudential framework known as SBR is anticipated to align the Moroccan solvency regime closely with Solvency II standards.

The implementation of SBR is a positive step for regulatory oversight, given that the existing regulatory solvency requirements are not risk-based. The regulator is actively promoting enhanced levels of market discipline within the Moroccan insurance sector, as evidenced by recent initiatives aimed at standardising selling requirements for products marketed online.

Türkiye insurance overview

The Türkish insurance market’s regulatory authority is the Insurance and Private Pension Regulation and Supervision Agency, established in 2019. Capital requirements for regulation are determined using the more conservative of two methods: a Solvency I approach and a risk-based method.

Turkey boasts a relatively mature insurance market when compared to its regional counterparts. In Q1 2020, it generated a total premium of around US$ 6 billion. In 2022, non-life net premiums were primarily composed of MTPL (28%), which is largely mandatory, motor damage (22%), accident and health (17%), and property and general losses (24%). The life insurance segment in Turkey is still in its early stages of development.

Qatar insurance overview

Qatar’s insurance sector comprises 26 entities regulated by the Qatar Financial Centre Regulatory Authority (QFCRA) and the Qatar Central Bank (QCB). Among these are domestic and foreign insurance firms, along with takaful providers. Qatar has witnessed significant growth in its insurance market, driven by increased infrastructure development, government support, and a growing population.

Kuwait insurance overview

Kuwait has enhanced its insurance regulatory framework by introducing comprehensive regulations, which came into effect in 2022. These complement the recently enacted Insurance Law of 2019, marking the repeal of the outdated insurance legislation in place since 1961.

The JENOA view – market growth and opportunities

We believe the insurance markets will continue to grow due to several key dynamics:

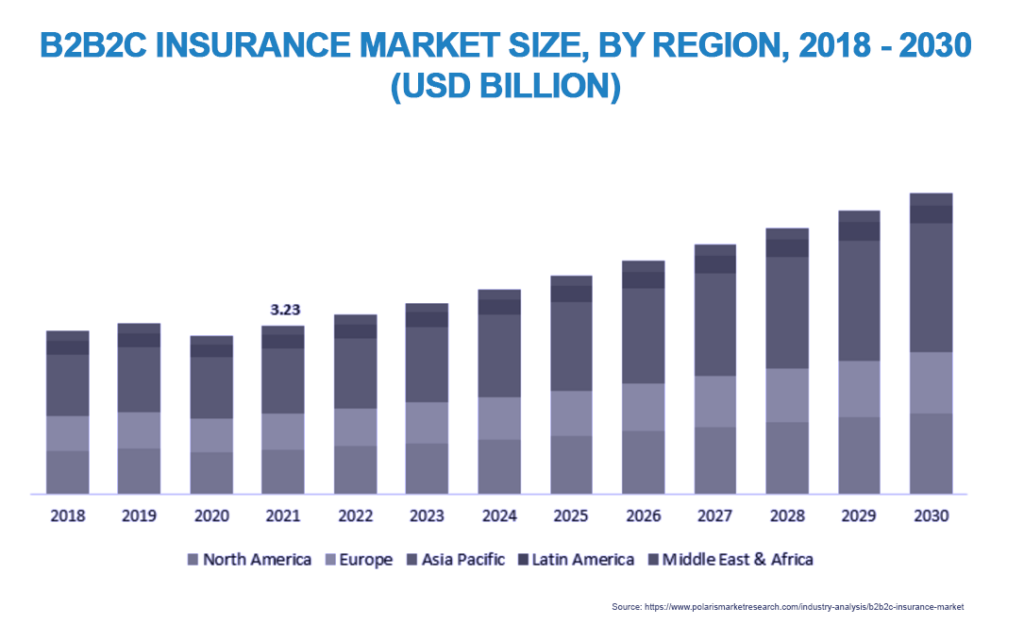

The first is the changing demographic profile – a growing population with a longer life expectancy, plus a substantial foreign workforce. This is paired with the rising income levels of this relatively young local and foreign population. As we have seen, there are already several mandatory health insurance requirements in place in many of the MENAT countries, with more to come in the future. There is also a heightened awareness of the benefits of insurance – partly through education and awareness campaigns but also due to recent global events, including political instability, the Covid-19 pandemic, and natural disasters.

Economic diversification led by governments is a major focus by GCC countries, and with those investments comes a greater need for insurance and more innovative products to support that growth.

Investments made by each economy into infrastructure and development projects are significant macro economic tool. On such example is Vision 2030 in KSA which has announces hundreds of billions of dollars of project investments.

Combined with product innovation and enhanced insurance awareness we expect that this will contribute to be a sharp increase in the penetration rate in the short and medium term.

As a GCC owned & represented company, JENOA is ideally positioned to connect this developing market penetration with the product innovation and capacity available in the global insurance market place. You can contact Mahboob Khan, khanmma@jenoa.com, to discuss how we can support your market strategy as you explore this regional opportunity.

[1] https://www.fitchratings.com/research/insurance/industry-profile-operating-environment-uae-insurance-21-03-2023

[2] https://www.fitchratings.com/research/insurance/industry-profile-operating-environment-uae-insurance-21-03-2023

[3] https://www.fitchratings.com/research/insurance/industry-profile-operating-environment-uae-insurance-21-03-2023