The Middle East and North Africa (MENA) region is set to become one of the global hubs for renewable energy over the coming years. With a host of solar, wind and hydro power projects already planned or already under way, the region is well positioned to be at the forefront of the global drive for a transition to net zero by 2050 [1].

This presents a huge opportunity, not only for investment and employment, but also for insurers to provide coverage for this burgeoning industry.

A massive investment

For decades, MENA has been reliant on its rich oil and gas reserves. However, the impacts of climate change have been thrown into sharp focus recently, with increasing extreme weather events and heightened awareness from governments, policy makers and industry alike, who are scrambling to be seen at relevant gatherings such as COP26. The commitment at this event to keep the target for limiting global warming to 1.5˚C within reach demonstrates that the need to move to clean and renewable energy has never been greater.

Currently, renewables only account for a small part of the region’s energy consumption. However, it’s an area that is set to grow exponentially in the very near-term future.

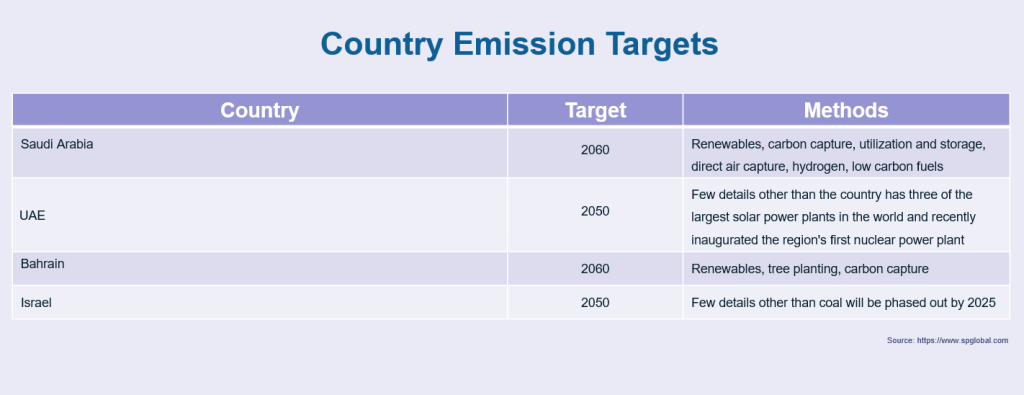

Governments across the Middle East have already started setting deadlines for their population of more than 247 million to achieve net zero emissions by 2050 or 2060[2]. However, this is no small undertaking and will cost billions of dollars. Saudi Arabia alone has committed more than US$ 180 billion to reach its target.

Powered by the sun

Partnering with experienced international developers, local private and state-backed companies have been leading the way in this regional green push.

As the cost of the technology continues to fall, more startups are coming on board to provide innovative solutions.

Solar will also be the dominant technology, given the abundance of available space for installations and the fact that the region is exposed to some of the world’s highest levels of solar irradiance.

Gigawatt scale, solar photovoltaic farms are already proliferating in the region. In fact, some of the world’s largest solar farms are already operating – or under construction – in the UAE. A recent government tender awarded a two-gigawatt project to a consortium of local and international developers. When complete, the plant is expected to provide enough energy to power 160,000 households and avoid carbon dioxide emissions up to 2.4 million tonnes annually.

The total output from solar installations in the MENA region overall is due to triple over the next three years, according to S&P Global Platts Analytics.[3]

Harnessing the wind

Wind is another viable source of renewable energy in MENA, with large pockets of strong wind to be found.

Wind farms are already being built at a fast rate across the region. Saudi Arabia, for example, connected its first wind farm in late 2021 and the UAE government has also been busy identifying wind farm sites and drawing up tenders to support new projects.

Over the next three years, the output from wind energy in the region is expected to double.

Carbon reduction technology

In addition to renewables, the Middle East is fast becoming a hub for new low carbon and decarbonising technologies, such as carbon capture and storage (CCS).

There’s also a big push towards emissions-free water desalination plants. Egypt alone has 76 of these and the overall capacity in the region is forecast to rise by 14.9% between 2020 and 2025.

The risk of renewables

While renewable energy is clearly a force for good, it is not without its risks.

Many of the solar, wind and hydro power installations are in large and remote open spaces, exposed to damage caused by fluctuations in weather and natural catastrophes such as hurricanes, wildfires and floods.

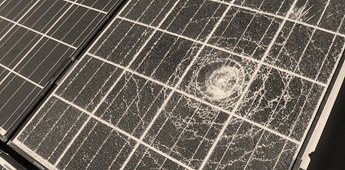

With increasingly unpredictable weather events occurring more severely and frequently than ever, the potential for severe structural damage is on the rise. Components can be damaged by long-term exposure to the elements, too. For instance, micro cracks caused by wind and snow can form in solar cells, reducing their efficiency and power generation, and ultimately resulting in malfunction.

An obvious risk is a lack of natural resource to produce sufficient energy, whether that’s sun, wind or water, caused by a sudden weather change. For example, higher air temperatures result in lower air density, thus reducing wind power.

In addition, there is the alleged impact of wind turbines on human health. If claims are upheld by the courts, as was the case in France[4] last year when a judge awarded a couple €100,000 in compensation, operators could find themselves facing very expensive liability payments.

A major insurance opportunity

With so many risks to consider, renewables present a major opportunity for insurers and reinsurers to provide innovative coverage solutions, particularly given that insurance is often a prerequisite for securing finance for a project.

(Photo credit © Enid News & Eagle/Billy Hefton).

Previously coverage was provided by only a select few managing general agents, but limits have been lifted due to capacity being eroded by a spate of losses from severe events. In response, insurers have brought their underwriting authority in-house and have been hiring specialist renewable energy underwriters to write the business.

The market has attracted significant capital as it has grown, leading to a market softening. Yet, due to large losses from severe weather events, rates have increased in recent years. Given the increasing frequency of these events, they only look likely to rise further in the future.

Building the risk picture

The main challenge is that, because the green energy industry is still in its relative infancy, there is a lack of data and claims – so the true extent and complexity of the risks are still relatively unknown.

Among the key risks that need to be considered are construction and operation of installations, advanced loss of profits, delays in start-up, machinery breakdown, environmental liability and business interruption.

It goes much deeper than just the immediate risks associated with installations, however. There are also supply chain risks inherent in providing the energy, such as network disruptions and outages to consider.

Then there is the potential for cyber-attacks and the deep operational, financial and reputational damage they can cause. Therefore, renewable infrastructure operators need to ensure they have comprehensive property and cyber policies in place to guard against any attacks or to mitigate the problem should the worst happen.

Insurers and brokers need to work closely with underwriters to explain their risk as clearly as possible, so they can provide them with the best cover. As insurers build up a greater depth of data history, so they will be able to more accurately price the risk.

Preparing for a rainy day

Parametric insurance has a big role to play too, with payments being triggered if it is determined that a financial loss was sustained due to a lack of weather resources. Indeed, many banks that finance green projects are already making parametric insurance a condition under their loan terms to protect their credit risk; for example, when energy production is lower than 90% of expected output because of unfavourable weather conditions.

As well as providing coverage, though, insurers need to help green energy companies improve their risk management practices. That involves selecting the right sites and putting defences in place to protect installations from weather damage, as well as reducing the noise and vibrations caused so they do not affect local communities.

As the need for renewable energy becomes ever greater, so does the opportunity to provide effective and affordable insurance – that is why now is the optimum time to come on board with this green energy revolution and JENOA can help.

[1] https://www.iea.org/reports/net-zero-by-2050

[2] https://www.spglobal.com/commodity-insights/en/market-insights/latest-news/electric-power/122421-commodities-2022-middle-east-in-uphill-battle-to-meet-net-zero-as-emissions-set-to-rise

[3] https://www.spglobal.com/commodity-insights/en/market-insights/latest-news/electric-power/122421-commodities-2022-middle-east-in-uphill-battle-to-meet-net-zero-as-emissions-set-to-rise

[4] https://www.theguardian.com/world/2021/nov/08/french-couple-wins-legal-fight-wind-turbine-syndrome-windfarm-health