Insurance penetration across all categories in many Gulf Cooperation Council (GCC) States has consistently been seen to lag behind global norms. This represents a material opportunity for regional players to tap the latent potential for growth in the region; however, overcoming under-penetration involves a number of challenges too. The recent introduction of mandatory lines and increasing regulation, as well as population growth and infrastructure development, is likely to drive regional demand growth.

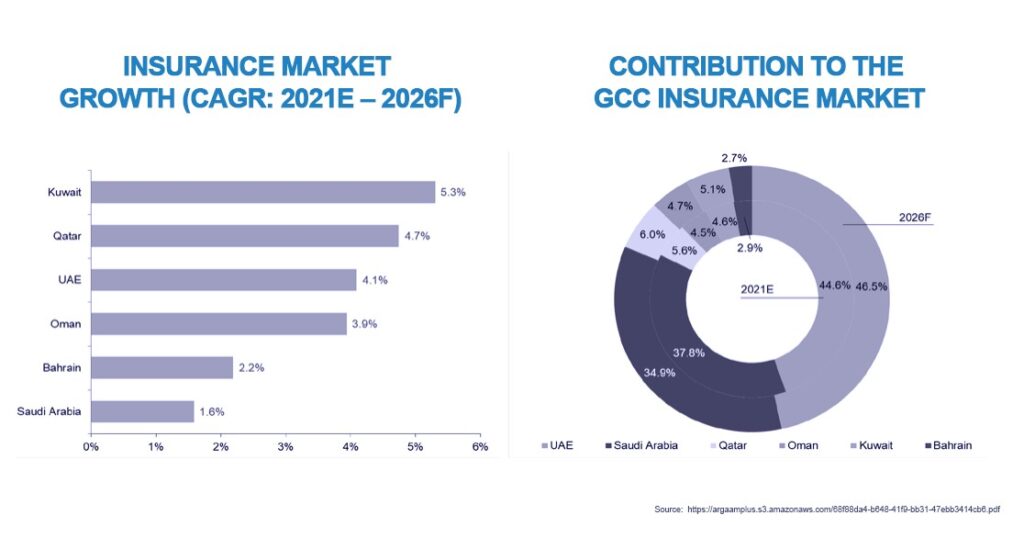

The GCC market is expected to grow from US$ 26 billion in 2021 to over US$ 31 billion in 2026, and whilst the UAE and Saudi Arabia are the two largest markets in the region, with 44% and 40% of the region’s gross written premium (GWP) respectively, it is Kuwait, Qatar and the UAE that are expected to outperform regional growth by between 4% and 6% over the next five years.

Hydrocarbon-exporting economies are thriving thanks to net-zero energy crises in western economies, and have benefited from higher oil and gas prices as economies scrambled to acquire hydrocarbon-based fuels to strengthen domestic energy security. Although this has seen GCC countries experience an average growth in GDP in 2022 of more than 6%, GDP growth in 2023 is estimated to fall to around 3.6% as regional jurisdictions press ahead with long-term economic development plans to diversify their economies away from hydrocarbons. Economic development strategies to accomplish this such as investment in major – or often termed “mega” – infrastructure projects, will increase the number of insurable assets across much of the GCC. In addition, government-backed strategies to attract foreign direct investment; promote SME, and increase industry’s contribution to the economy will further broaden demand for cover.

For GCC insurers, focusing on the likely drivers of growth and trends in the region is key to understanding the challenges of increasing penetration. Under-insurance is a major issue, and perhaps one not realised and understood until the damage is done and the need arises, but what can insurers expect, what can they influence, and what is the likely direction of travel for under-insurance in the GCC?

Protection gaps – the current state of play in GCC

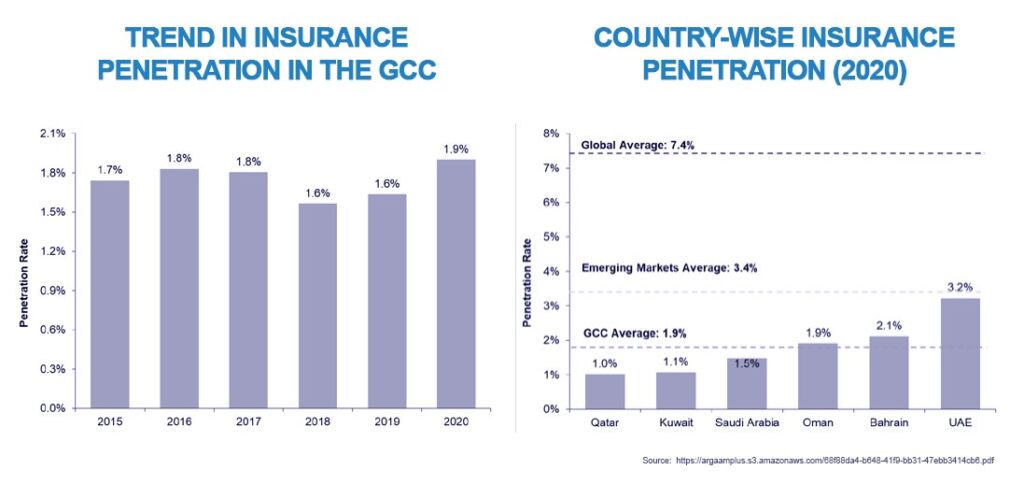

The insurance penetration rate – the gross written premium (GWP) as a percentage of GDP – in GCC countries remains low. In 2020, the average GCC penetration level stood at 1.9%. This is well below the emerging-market average of 3.4% and the global average of 7.4%. Across GCC countries, the UAE, at 3.2%, and Bahrain, at 2.1%, have the highest penetration rates. Given the gap between GCC rates and global averages, potential growth in the region is clear to see.

Increasing awareness with mandatory lines

The increased awareness of the importance of insurance achieved through mandatory lines across jurisdictions, from motor to health, is a self-evident truth. During the last few years, GCC members have introduced mandatory health cover for foreign expatriates. This serves to increase awareness of the benefits of insurance, especially as Dubai, Abu Dhabi, Saudi Arabia and, to a certain extent, Oman and Kuwait, have moved or are moving away from the expensive and unsustainable welfare-state healthcare model for their citizens in favour of mandatory health insurance schemes. Favourable growth in health insurance is, hence, not limited to foreign tourists, foreign workers and businesses; if the example of Dubai, Abu Dhabi, Saudi Arabia and Oman is followed across the region, others may develop universal health insurance requirements for their nationals and dependents. This alone could address low penetration and coverage rates in other GCC countries that could otherwise be explained by low demand resulting from their historic welfare-state healthcare systems.

Key growth drivers

Population growth across the region is expected to result in more than 64 million residents by 2026. As GCC countries continue to press ahead with social reforms, SME growth, diversification and stronger participation from the private sector, a large part of that population growth is expected to come from increasing numbers of young professionals in the expatriate community, a demographic that is likely to continue to drive demand for insurance products and growth in the insurance industry. Further, concerted efforts from individual countries to boost SME participation – development funds and agencies such as Dubai SME, Dubai Future Accelerators and the Khalifa Fund for Enterprise Developers offer support for SME across all phases of development – will likely add to a growing pool of business talent. This, in turn, will drive local growth in insurance penetration. The expansion of mandatory lines is likely to see growth driven by increasing populations and the expansion of mandates to nationals and expats. In other words, insurers stand to gain from growth in both the breadth and depth of mandatory lines.

Changing attitudes and tech development

The COVID-19 pandemic has undoubtedly changed people’s appetite for insurance, especially for financial-protection products. And, as the spectre of a distant infectious disease turned into a painful reality for many, a heightened awareness of health risks led many to alter their priorities and reassess their attitudes to insurance products that might previously have been thought of as either frivolous, expensive or unnecessary. This increase in health awareness across the population has also been accompanied by higher healthcare costs, which in turn is driving demand for extended coverage, particularly in critical illness cover.

As if to show the direction of travel, the results of a Zurich Middle East survey in the UAE last year, conducted with polling company YouGov, revealed that over 63% of people in the 18–34 age bracket had purchased life insurance since the beginning of the COVID-19 pandemic. The survey also revealed that across all age groups, over 50% of those questioned said that COVID-19 made them likely or extremely likely to take out life or critical illness policies.

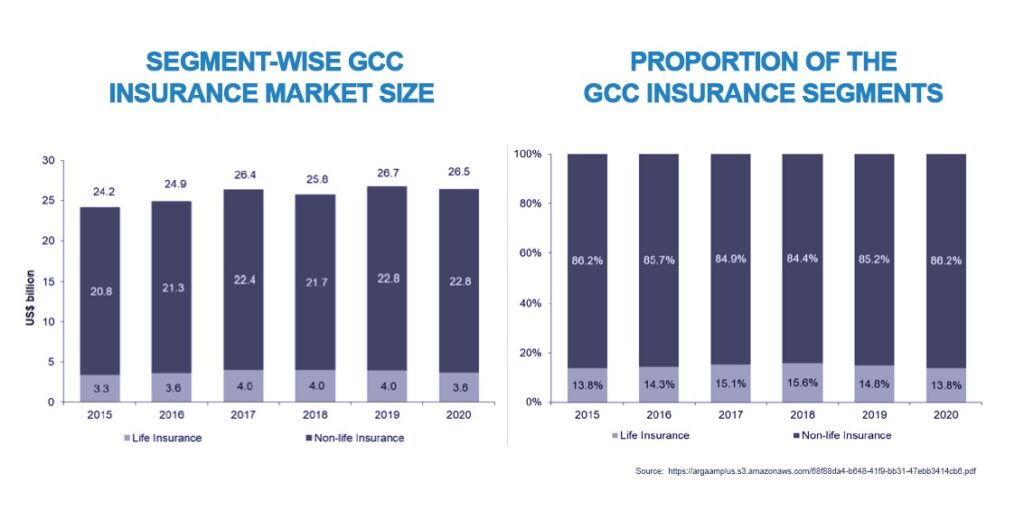

Traditionally, the lack of awareness of the benefits of life cover has been blamed for the lagging maturation of the life segment. Indeed, the regional trend in the last couple of years can be seen in life’s market share: non-life segments accounted for 90% of total GWP in the GCC, or around US$ 23 billion in 2020, with life insurance making up just 10%. However, signs that this trend is beginning to reverse can clearly be seen in the changing attitudes and behaviours of GCC residents, as evidenced by the Zurich Middle East survey mentioned above, with life insurance expected to grow with a compound annual growth rate (CAGR) of nearly 4% between now and 2026, compared with a more modest 3% CAGR for the non-life market.

Tapping the potential

The digital preferences emerging from changes in consumer behaviour are creating an environment likely to stimulate further financial inclusion. Restrictions imposed as a result of COVID-19 have already brought about significant changes in the processes behind distribution, payment and claims. This trend will not only facilitate distribution and improve customer service, but will also offer more efficient pricing through increasingly data-driven risk assessment.

Regulatory support for the development of the insurtech industry can be seen throughout the GCC under much broader fintech development plans. For example, in Qatar, the government provides incentives for international investment in the Qatar Financial Centre (QFC) and Qatar Fintech Hub (QFTH) to stimulate insurtech development and support the fintech ecosystem with accelerator and incubator services for fintech, an ever-growing proportion of which focuses on insurance.

Despite the various challenges, the huge opportunity to tap into the region’s potential is evidenced by the hitherto limited growth in historically low levels of penetration. Awareness and accessibility limitations will gradually be removed as the demand for digitalisation and ease of access to insurance products in the retail life and health segments increases. As technology delivers more accurate and efficient data-driven risk assessment and loss history, a combination of increased awareness, changing behaviours and mandatory health regulations will help drive growth closer to world averages through sustained higher demand for products.