Recent conflicts around the world have heightened political risk for insurers and policyholders alike. In this article we examine how such geopolitical events impact the risk landscape in general, and how they potentially affect the insurance market in the long term.

New exclusions

Notwithstanding the sanctions imposed on Russia, such are the current insurance sector fears over the political unrest and the credit rating for Ukraine, that most market players have added exclusions, or in many cases, stopped writing political risk insurance (PRI) policies in these two countries altogether.

This in turn has limited available coverage and pushed up rates at renewal for insureds with exposure in those jurisdictions. There have also been significant delays in coverage binding as a result of increased due diligence being required and performed. All this, at a time when there has been a surge in demand. Premiums and capacity may be further adversely affected if the current conflict causes major insurable losses.

Despite uncertainty, some insurers are still willing to help their loyal existing clients, or support deals, involving the largest Russian based corporations or banks, albeit proceeding cautiously . . . one transaction at a time.

Multi-country policy requests also continue to be considered by some insurers as the focus has switched to analysis of specific situational exposures.

Aircraft losses

Among those worst affected by political risk are aircraft owners, who are unable to repossess or salvage the 500-plus Airbus SE, Boeing and other jets, worth approximately US$ 10 billion according to some estimates, that were leased to Russian carriers.[1]

Changes to domestic legislation have enabled Russian airlines to keep foreign airplanes and use them on domestic lines, making it increasingly difficult for owners to protect the value of their assets in the face of international sanctions.

Even where sanctions have not prevented firms from operating in Russia, many have voluntarily withdrawn from the market . As a result, their Russian counterparties have held them in breach of contract, refusing to pay accounts receivable to these companies. Whether these losses can be recovered under a PRI policy depends largely on contract interpretation.

Energy challenges

Another area that has come into sharp focus is energy. Many countries have been looking to decrease their dependence on oil and gas and move towards more sustainable options since the Paris Agreement COP26. However, inherent legacy reliance on Russian reserves over the last decade, particularly in Europe, has made this commercially difficult. This current situation will surely re-galvanize with efforts to accelerate the transition to renewables and alternative sources of fossil fuels – but such a switch is not quickly achievable.

At the same time, global wholesale energy prices continue to soar, with suppliers being forced to pass on the costs to their consumers. This has been exacerbated by limited supply growth since the pandemic; a trend which has only been accelerated by the current political climate.

Coverage variation

The overall situation remains highly volatile. Businesses with interests in the conflict region face the potential for damage to assets through political violence and broader expropriation measures against foreign interests in, should further sanctions be imposed.

As well as actions that could jeopardize the safety and security of a firm’s people, assets and supply chains, the withdrawal of aid packages to Ukraine from Russia, as well as other economic issues, could result in a country rating downgrade and payment difficulties for creditors of domestic businesses.

Added to that, with the ever-changing and complex nature of the situation on the ground, many grey areas about precisely what is covered, and nuances between different policies, mean that some risks are catered for whilst others are not. For example, many losses to businesses’ due to geopolitical issues are excluded under traditional property policies, yet PRI policies provide coverage for certain types of political events. These range from significant changes in governmental policies, laws or regulations to government unrest, instability, revolution, coups, or war.

More specifically, such policies may cover:[2]

- Physical damage or destruction to property or assets due to acts of war, including lost profits

- Expropriation or nationalization of factories and machinery

- Forced divestiture or abandonment of property or assets

- Selective discrimination by government authorities against a business

- Cancellation of permits or licenses needed to operate

- Blocking or limiting imports and exports

- Seizure or other restrictions on movement of foreign currency

The losses covered by PRI policies typically include compensation for the value of lost or damaged property, assets, or investments.[3] They also extend to certain business interruption losses, such as loss of profit.

Essential coverage

Despite potentially large losses and insurers pulling coverage, the political risk market remains well capitalized.[4] The signs are that that won’t change any time soon.

Before the conflict, PRI was viewed by many as an expensive luxury. Now, in an increasingly unstable world, as more companies have carried out cost-benefit analyses to determine its value, such policies have become somewhat more essential coverage.

This is evidenced by the fact that firms are buying policies with longer terms, typically between three and five years. Given the speed and regularity at which events can occur and how long and drawn out they can become, it makes sense to have coverage in place that will address the long-term risk issue.

PRI impact in MENA

This growing demand for PRI is also having a knock-on effect in the Middle East and North Africa (MENA) region. Given the variation in available coverage, investors in the region need to ensure that they choose the right policy, based on premium, capacity, and response times to losses. As well as variation between policies, there are differences between what is available in different countries. As we emerge from the pandemic, some insurers are offering different rates and capacity to others, in response to demand and investment.

More investment opportunities may open up as European countries seek to find alternative commercial corridors with trading partners in regions including MENA. While this enables insurers to extend their coverage to new parties, so stability in the area may also come under greater pressure. This is mainly due to rising energy and cost of living prices, as well as shortages or disruption to the food supply chain, caused by the double whammy of the pandemic and the conflict.

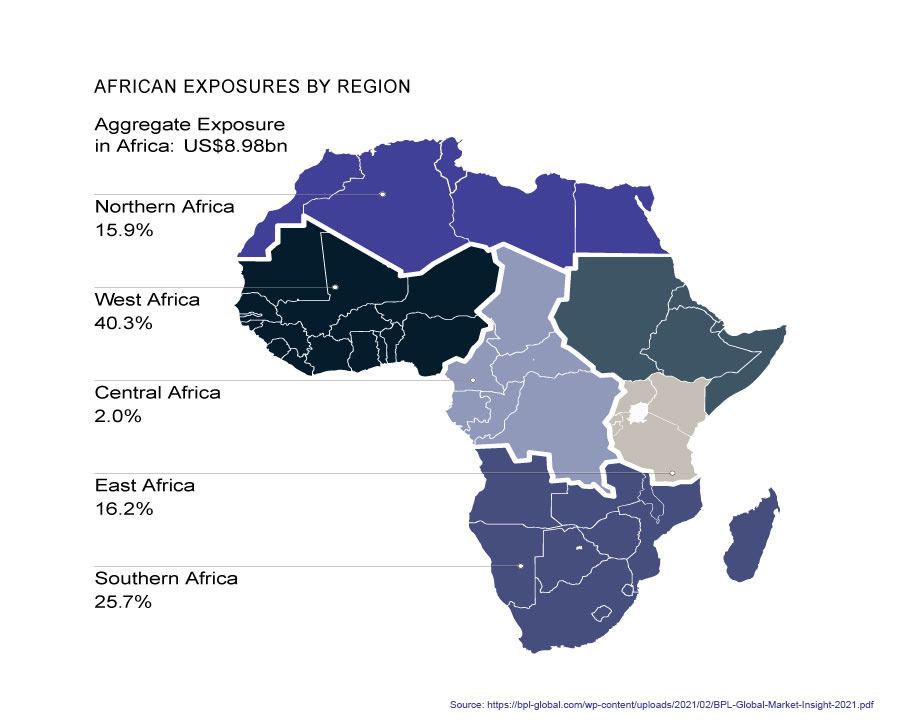

As a region, Northern Africa accounted for 15.9% of the continent’s US$ 8.98 billion aggregate exposure to credit and political risk in January 2021, according to BPL Global. Egypt alone made-up US$ 1.08 billion of that total.

Time to review policies

Given the current political environment, companies should review their political risk policies and understand their exposures, such as operations, assets, payrolls, and shipments.[5] They also need to scrutinize their policy terms, limits and sub-limits, deductibles and shared losses, loss-reporting requirements, covered perils, and other restrictions.

The risks are continually changing and new ones emerging all the time. It is vital, therefore, to work with a specialist broker to gather the necessary information to secure the best policy and ensure it is kept regularly updated. In addition, it is important to document losses and prepare and provide claims in a detailed and timely fashion.

Finally, policyholders need to have a robust risk management strategy[6] to mitigate against the threat of political risk and minimize any operational disruption and financial damage. As current events illustrate, it has never been more vital to have the right type and level of protection in place.

[1] https://www.reinsurancene.ws/re-insurers-could-face-10bn-in-claims-from-stranded-planes-fitch/

[2] https://www.natlawreview.com/article/russia-s-invasion-ukraine-maximizing-insurance-coverage-to-mitigate-financial-losses

[3] https://www.reinsurancene.ws/political-risk-policies-may-cover-business-losses-from-russia-ukraine-jones-day/

[4] https://www.businessinsurance.com/article/20220414/NEWS06/912349227/Be-proactive-on-political-risk-coverage-Experts,-Debbie-Gramer,-Laura-Burns

[5] https://riskandinsurance.com/welcome-to-the-roaring-20s-managing-political-risk-in-changing-times

[6] https://www.wtwco.com/en-GB/Insights/2022/04/political-risk-insurance-and-ukraine-pouring-oil-on-troubled-water