As part of our on-going series examining the developing role and future potential of artificial intelligence (AI) in the re/insurance industry, JENOA’s team of experts continues its analysis of the broader picture across AI’s various sub-sets. In this series, they turn their eye to potential use cases for re/insurers to gain quick wins and measurable ROI, and whilst other articles will focus on longer-term use cases in underwriting, distribution, scenario planning and risk management, here we focus on the immediate value from AI automation in claims validation and claims management.

Many re/insurers are finding it hard to unlock a global potential in artificial intelligence (AI) estimated by McKinsey to be in the region of US$ 4 trillion. This is perhaps not surprising, considering that AI and all its sub-sets cover a wealth of opportunity across enterprises and business sectors.

Its potential, though often overrated in the short term, is arguably underrated in the long term. In other words, AI represents a sometimes overwhelming, often confusing and occasionally terrifying new landscape of potential risk and vast opportunity. This is leading many in the industry to question how they can move out of pilot modes that generate no value, to a position where they can scale and take advantage of the technology to work effectively and profitably across business models.[1]

The big AI quandary for industry players nevertheless remains: either with AI automation or generative AI (GenAI), how can re/insurers move from isolated pilots to profit-enhancing, enterprise-wide implementation quickly? More existentially, are re/insurers running the risk of sacrificing their competitive edge and becoming obsolete if they delay implementation of AI systems for too long?

So, what are AI automation & generative AI?

The potential for competitive disruption lies in the variety of transformative tools that the various sub-sets of AI offer. If used correctly, they will allow re/insurers the chance to rethink everything from operational process efficiency to how they approach scenario planning and manage risk. Automation from Machine Learning (ML), image recognition and Natural Language Processing (NLP) is already helping re/insurers streamline the claims validation and claims management process, as we discuss below. The AI sub-set known as Generative AI (GenAI) coupled with Large Language Models (LLM), however, is capable of producing original content[2], but its true and largely underrated potential lies in the ability of re/insurers to deploy GenAI models in tandem with more traditional AI and robotic process automation to transform areas of their business like scenario planning and risk management. As global consultancy firm McKinsey points out, “these technologies combined make the secret sauce that helps you rethink your customer journeys and processes with the right ROI.”[3]

How can AI help re/insurers? Which segments are gaining the most?

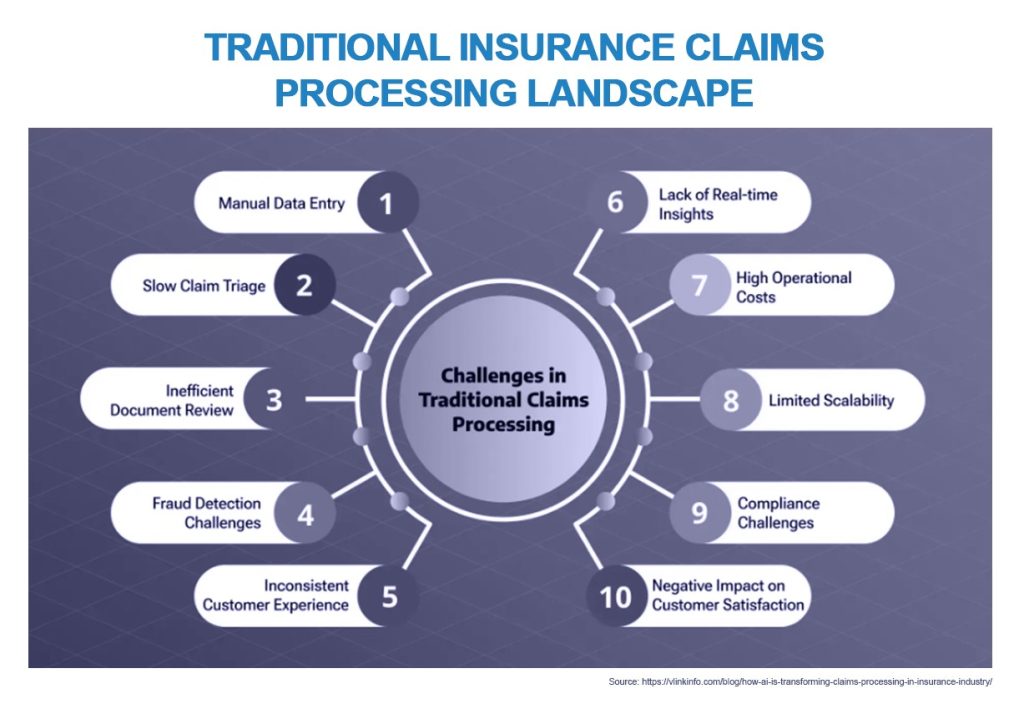

At the ‘coalface’ of carriers’ operations, growth in claims volumes often causes downstream delays. Higher submission volumes inevitably lead to higher costs and bottlenecks in environments that rely heavily on manual claims processing. Not only does it take time for human employees to detect and rectify errors in the validation process; overworked manual environments are prone to create new errors in the claims-management process.

Automation driven by AI, Machine-Learning (ML), Natural Language Processing (NLP), image-recognition and Optical-Character-Recognition (OCR) technology, can help achieve meaningful and impactful levels of automation. After all, AI validation and claims management will greatly enhance the speed, accuracy and efficiency of these crucial processes, and those improvements will all have a direct and measurable influence on important metrics such as settlement, customer loyalty and satisfaction.

These improvements will also free up human resources to perform more strategic and revenue-generating tasks for re/insurers., and some of their most impactful benefits are already evident from the auto-insurance segment.

Use Case: Auto-insurance claims:

Motor claims can constitute a large proportion of an insurer’s overall payouts, and the high volumes of claims in auto-insurance make the sector a prime candidate for AI-driven automation. Speed, accuracy and validation are all important components when it comes to customer satisfaction as well as compliance with the terms of auto policies. As one industry insider notes, “extended timeframes frustrate policyholders and erode trust in the insurer’s ability to efficiently manage claims”[4]. Simultaneous manual processing of high volumes of auto claims often leads to errors, inaccuracy, poor response times, longer claims cycles and, as a result, much higher operating costs. In addition, these deficiencies often come with the damaging realities of diminishing levels of trust and customer loyalty.

Quicker pay-outs through more efficient and more accurate claims processing could reverse that trend, whilst offering re/insurers the opportunity to minimise losses and enhance financial performance. AI-driven automation can do away with manual review by analysing claims data and suggesting resolutions to claims, and process improvements offer the chance to reduce delays by automatically requesting the documentation necessary to assess or complete any claim without human intervention.

The JENOA view: adoption & novel perspectives

Re/insurers that can underwrite risk profitably, in tandem with and assisted by an ability to implement enterprise-wide AI-automation and GenAI solutions, stand to generate considerable value in the medium to long term. Yet despite its truly transformational potential, barely 15% of re/insurance carriers have managed to define target use cases and get buy-in from the business.[5] This might be down to the fact that few re/insurers can readily identify quick wins with ROI from artificial intelligence, even though Price Forbes Re reports that around three-quarters[6] of re/insurers have earmarked US$ 5 million or more to take AI capabilities forward.

Speed seems to be the watchword with early adopters. After all, 30% of re/insurers report that they are prioritising use cases that offer short-term value, against the 17% that report long-term value as their sole focus.[7] As re/insurers try to achieve the right balance between speed of adoption, grass-roots innovation and the need to develop an enterprise strategy, one inescapable fact remains: a carrier’s competitive advantage is predicated on its ability to underwrite risk profitably, not necessarily on its talent for designing AI systems. This is where specialist vendor technology can offer a route to short-term early wins and demonstrable ROI.

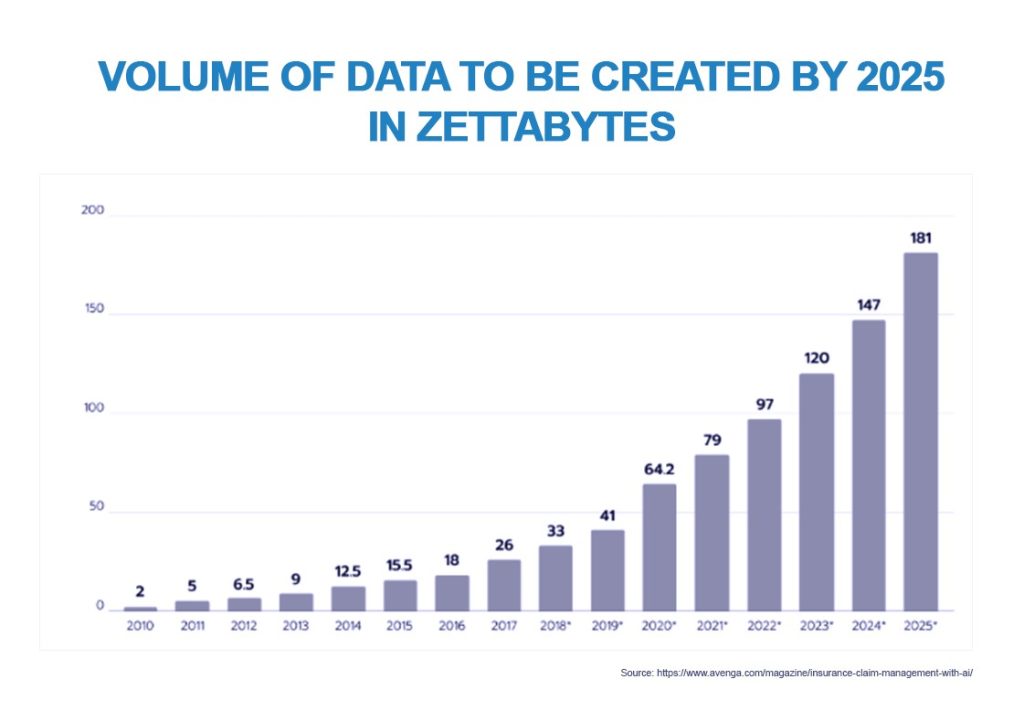

Although in its early stages of development, Generative AI (GenAI), another sub-set of artificial intelligence, promises to deliver unimaginable benefits to re/insurers as they navigate the complex task of assessing and managing risk. Given its time-consuming and resource-hungry nature, scenario analysis, for example, could benefit significantly from GenAI. Crucially, the technology has the potential to remove what Willis Towers Watson describes as “failure of imagination”[8] in human scenario analysis and planning as it prepares for future disasters. Risk blind spots can emerge from a narrowing of the human mind, whereby human analysis ends up “sticking too closely to the beaten track of past experiences”[9]. In other words, the unprecedented is often ignored or dismissed as fanciful by humans with cognitive bias, exposing re/insurers to unforeseen risk. With GenAI and its large language models processing vast quantities of textual data to generate potential scenarios at speed, re/insurers will have at their disposal a much wider and deeper understanding of possible risk for human analysis. “This not only streamlines the scenario development process,” says Willis Towers Watson, “but also introduces novel perspectives that might be missed by human analysts.”

What does this mean for MENA clients & how can JENOA help?

The process of integrating existing re/insurance applications with AI automation and GenAI systems is not only fraught with complexity but can also prove a resource-hungry exercise.

The challenges that these integrations pose often call for a strategic approach, and JENOA is well placed to help its clients in the MENA region and further afield navigate these challenges to deliver successful outcomes and ROIs. Coupled with data-security and data-privacy issues, our experience and coverage across multiple re/insurance markets make JENOA a reliable partner to guide clients and insurers through complex integrations to achieve their desired outcomes in automated claims processing and, as technology develops further, into other crucial areas of re/insurance.

So, what is the real ‘secret sauce’?

As McKinsey notes, “the long-term effects of gen AI are underrated, and the short-term effects are overrated. And that’s the dilemma many insurance companies…find themselves in”.[10]

The various sub-sets of AI are not technological innovations in isolation but deploying them in conjunction with more traditional AI and robotic process automation could deliver significant benefits and ROI for re/insurers in the short, medium and long term. As ever, the pace of strategic adoption will dictate carriers’ relative competitiveness and overall financial performance, but as AI begins to sweep across and transform all areas of business operations, this technology will become an integral part of a re/insurer’s ongoing digitalisation programme.

[1] https://www.mckinsey.com/industries/financial-services/our-insights/reimagining-insurance-with-a-comprehensive-approach-to-gen-ai

[2] https://www.ey.com/en_uk/insights/insurance/how-to-revolutionize-the-insurance-value-chain-with-generative-ai

[3] https://www.mckinsey.com/industries/financial-services/our-insights/reimagining-insurance-with-a-comprehensive-approach-to-gen-ai

[4] https://fintech.global/2024/05/31/how-generative-ai-is-transforming-motor-insurance-claims/

[5] https://www.priceforbesre.com/news-and-views/ai-in-reinsurance-2024

[6] https://www.priceforbesre.com/news-and-views/ai-in-reinsurance-2024

[7] https://www.ey.com/en_uk/insights/insurance/how-to-revolutionize-the-insurance-value-chain-with-generative-ai

[8] https://www.wtwco.com/en-gb/insights/2024/05/beyond-our-imagination-how-generative-ai-promises-to-reshape-scenario-analysis-in-the-insurance

[9] https://www.wtwco.com/en-gb/insights/2024/05/beyond-our-imagination-how-generative-ai-promises-to-reshape-scenario-analysis-in-the-insurance

[10] https://www.mckinsey.com/industries/financial-services/our-insights/reimagining-insurance-with-a-comprehensive-approach-to-gen-ai