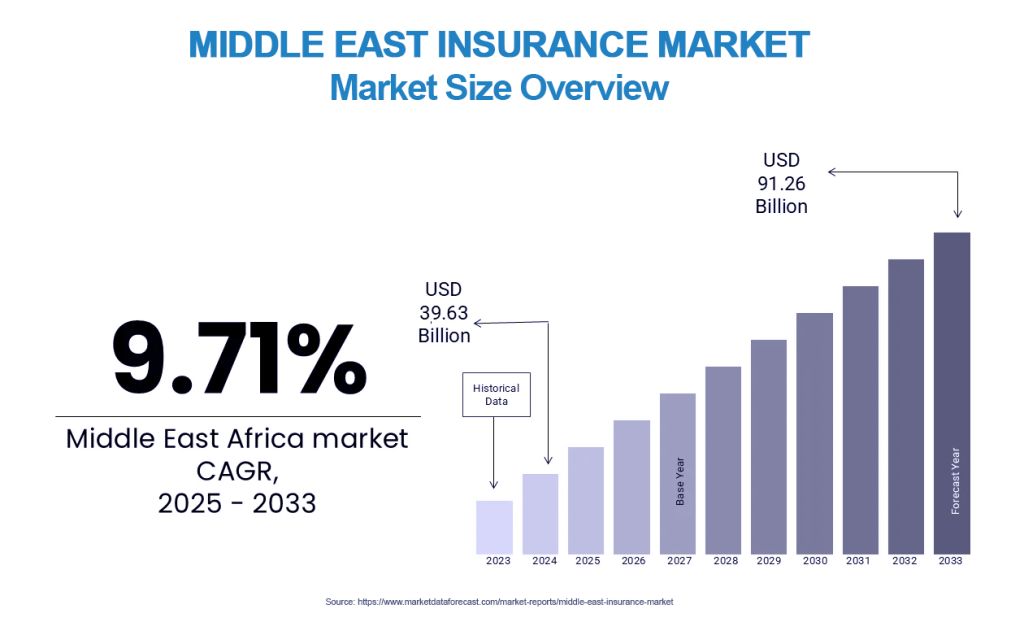

Like many insurance markets, the Middle East is facing a looming talent gap. Driven partly by demographics, a large cohort of experienced insurance professionals with career-long expertise is poised to reach retirement age as the baby-boomer generation begins to creep beyond the age of 65. In high-growth markets in particular, this talent gap needs to be addressed urgently, with a view to attracting, retaining and optimising scarce human resources with tech-enabled solutions.

Although the Middle East is not unique when it comes to the insurance industry’s talent gap – next year, the US is expected to lose around 400,000 insurance professionals through attrition alone[1][2] – the growing demand for insurance products means that a re-insurer’s competitive advantage could depend on their ability to successfully target and balance human and tech resources.

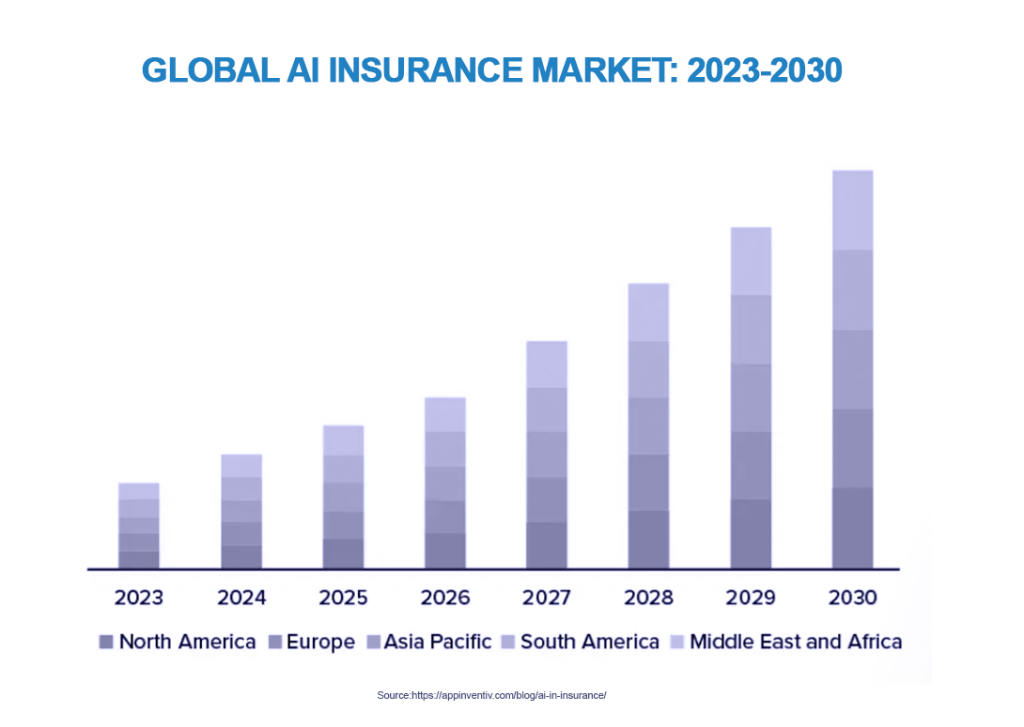

Interim measures to plug the risk-professional talent shortage, such as proposals in the Asian market to move to remote hiring for regional talent hubs to unlock scale[3], might also benefit Middle Eastern markets in the short term. However, effective longer-term solutions to the region’s talent shortage are urgently needed, and AI-enabled hiring processes, as well as automated decision-making and risk management within re-insurers’ operational processes, will be central to those solutions.

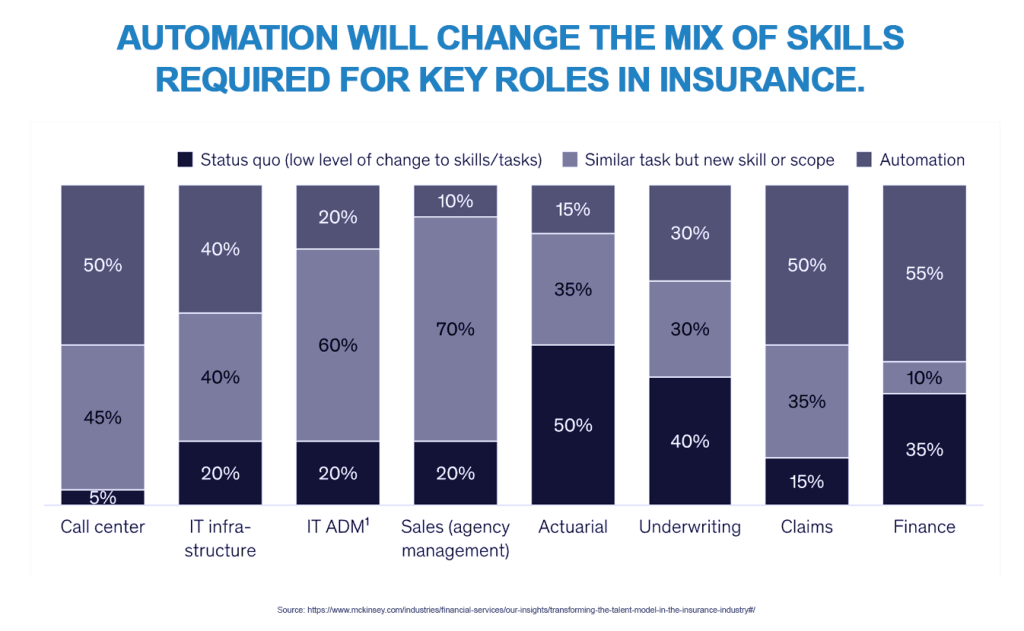

The industry is looking for ways to ensure the impact of its scarce human talent is maximised, while streamlining and automating labour-intensive processes to free up more bandwidth for complex human analysis and decision-making for higher-value tasks. How can artificial intelligence (AI) help in this process?

Using AI to alleviate the skills gap

As GCC economies continue to invest heavily in diversifying their economies away from a reliance on hydrocarbons, re-insurers must prepare their organisations to grasp the wealth of emerging opportunities and respond to growing demands for insurance through digitalisation, AI adoption and innovative product-development and risk-management strategies.

AI can help re-insurers in three crucial areas. Firstly, it can streamline and improve the recruitment process by targeting and attracting professionals who understand the growing complexity of risk management in a dynamic market, and by identifying looming gaps in skills or expertise. Secondly, AI can help support human insurance professionals as organisations look to pass off as many decisions as possible to AI-enabled systems. Thirdly, it can further reduce the workload on scarce human resources by taking on more labour-intensive tasks such as scenario analysis and risk management at a fraction of the cost and speed of its human counterparts.

However, technology alone cannot address the very real shortage of human expertise. An HR platform incorporating AI can significantly improve strategic talent acquisition by using data-driven approaches to identify the correct skill profiles and target recruitment efforts that proactively address upcoming skills or knowledge gaps. As the HR enterprise AI platform, Workday, notes, “technology can evolve roles and training approaches, which ultimately improves the employee experience and helps to attract promising new talent.”[4] In short, AI can help re-insurers upskill precious human resources to deploy to where they are most needed, as flagged by AI-enabled HR platforms.

The JENOA view: can we maximise scarce human capital?

Although AI will increasingly take on more of the insurance tasks historically performed by human professionals, it cannot solve all the industry’s deficits, and a deeper understanding of the kind of talent needed today and, in the future, will better equip re-insurers as competition for diminishing levels of expertise intensifies.

Strategic direction is – for better or worse – still outside the scope of AI systems, and zeroing in on which skills will be needed in the future will be critical to competitiveness and profitability. It is becoming increasingly clear that re-insurers will need experts with subtly distinct skillsets, professionals who must nevertheless be able to interact and collaborate across these disciplines to make sure that recruitment for human talent is focused precisely on where it will be needed.

Firstly, the industry needs professionals with the expertise and knowledge to operate in today’s market. These will be experts who can also envisage how emerging trends might alter the traditional insurance industry. In addition, re-insurers need to attract expertise that clearly understands how the market is evolving and developing when it comes to risk in areas like cyber, extreme weather and autonomous vehicles. Finally, there’s a growing need for experts who can help those two distinct skill sets work together effectively, to bring about the necessary organisational changes that address re-insurers’ strategic visions in a dynamic growth market.[5]

As risk-management firm, Aon, notes, “re-insurers must first be clear on their strategic direction and growth plans before they get into scaling talent activity. Otherwise, it’s like preparing for a journey without knowing the destination.”[6]

The onboarding and claims processes, however, are not the only areas where human talent can be replaced by AI and redirected to higher-value tasks. As re-insurers assess which operational processes could in future be handled by AI to free up human judgement and time, the labour-intensive and costly process of human-led scenario analysis and risk management will inevitably need to be considered.

In its early stages of development, generative AI (GenAI) is poised to deliver time-saving and money-saving benefits to re-insurers as they undertake the complex task of assessing and managing risk. Regarding scenario analysis, Generative AI (GenAI), powered by its Large Language Models (LLMs), can process vast quantities of textual data to rapidly generate potential scenarios at a low cost. This capability provides reinsurers with a much wider and deeper understanding of possible risk for final human analysis.

According to Aon’s commercial risk chief broking officer, it is often hard for potential hires to take in the advances in analytics and risk management. He notes, “many potential entrants do not fully comprehend the value and complexity of our work… Attracting and retaining talent is not merely about filling positions; it is about supporting the next generation of professionals who can adeptly navigate this dynamic environment.”[7]

What does this mean for MENA clients & how can JENOA help?

As organisations look to optimise the value of scarce human resources, the ability to identify future skills gaps and plan the often-fraught process of upskilling or reskilling existing talent will be key to success. When it comes to automation, despite AI’s huge potential, the process of integrating existing re-insurance applications with AI automation is complex, and the further integration of advanced GenAI systems to assist human expertise in risk management and scenario analysis requires careful navigation.

A strategic approach helps maximise AI’s potential benefits, and JENOA is well placed to help its clients in the MENA region navigate these challenges to achieve the best possible outcomes and ROI. Our experience and coverage across multiple re-insurance markets make JENOA a reliable partner to guide clients through the integration of AI-enabled HR platforms, automated claims processing and settlement, and risk management. Partnering with an organisation that can provide a combination of global reach with local knowledge and expertise gives clients the chance to incorporate risk resilience into their strategic growth plans.

Do re-insurers understand how to combine humans & technology?

As natural attrition and growing competition for scarce human capital intensifies, re-insurers that successfully combine innovative product development, digitalisation and AI with a clear strategic plan for growth will be the ones best placed to take advantage of the growing demand for insurance products in the Middle East and MENA regions.

[1] https://blog.workday.com/en-us/how-ai-can-help-solve-insurance-industrys-talent-crisis.html

[2] https://insurancenewsnet.com/innarticle/insurance-industry-retirement-exodus-creating-a-talent-gap

[3] https://asianbusinessreview.com/insurance/exclusive/insurers-may-need-hire-remotely-bridge-talent-gap

[4] https://blog.workday.com/en-us/how-ai-can-help-solve-insurance-industrys-talent-crisis.html

[5] https://www.aon.com/en/insights/articles/5-top-trends-risk-capital-2025#rte-445938913

[6] https://www.aon.com/en/insights/articles/5-ways-artificial-intelligence-can-boost-claims-management

[7] https://www.aon.com/en/insights/articles/5-top-trends-risk-capital-2025#rte-445938913