The traditional role of brokers worldwide has always been to act in the best interests of their clients, and when it comes to Takaful insurance, brokers – with their overview of a wide range of products – have been at the forefront of its growth and sustainability. As they develop the means to further educate clients in the nuances of Takaful insurance, brokers can continue to occupy centre stage and play a leading role in growing it even further.

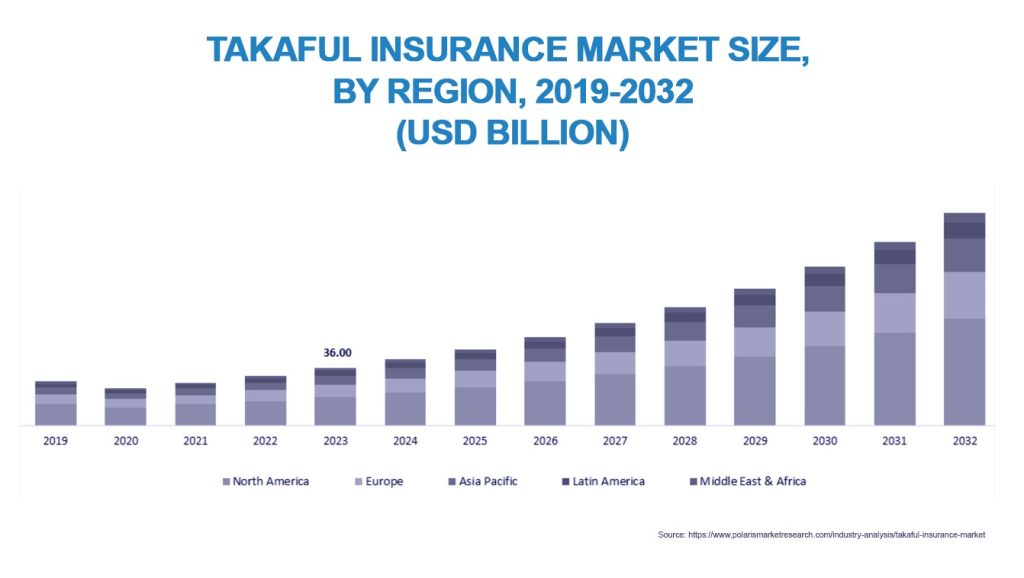

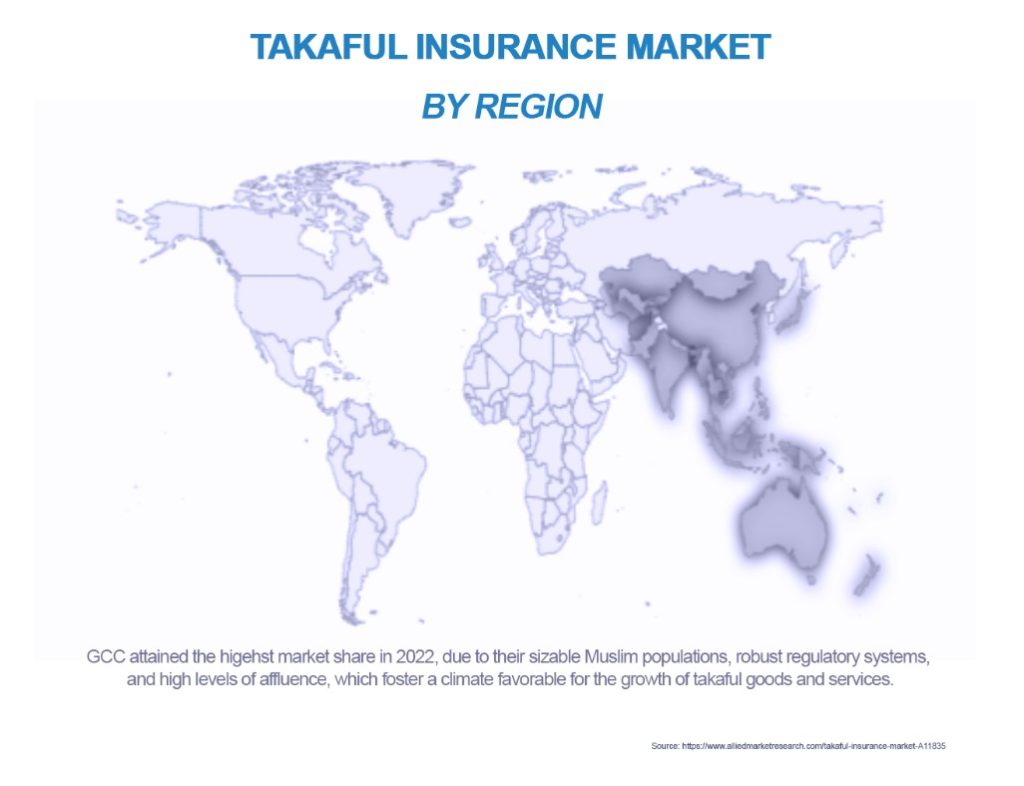

In tandem with brokers’ success, the wider insurance industry has been redoubling its efforts in recent years to increase awareness of Islamic finance and develop knowledge of Takaful products. Those efforts have been strengthened by government leadership in the GCC, where legislation and regulations in support of insurance products that comply with Islamic Shariah principles have been introduced. Providers are obliged to offer Shariah-compliant products in Saudi Arabia, and the regulatory authorities in the UAE now demand qualifications for Shariah board members in Islamic financial institutions. The quality of transactional jurisprudence is increasingly being reinforced with qualifications across the region, and this is driving growth in the Islamic insurance sector. In 2022–2023, the market grew at over 20% per annum, with Saudi Arabia contributing the majority of growth in the Region.

How does Takaful differ from traditional insurance?

Takaful first emerged as a Shariah-compliant alternative to commercial insurance to avoid some of the characteristics of conventional cover, such as interest, uncertainty and hence the perception of chance (or gambling). However, it is worth remembering that Takaful and traditional insurance are essentially risk-management tools. After all, underwriting and claims handling are identical in both – the insured receive a policy document and receive compensation in the event of a loss.

The differences between the two are most apparent in Takaful’s principle of making a contribution rather than paying a premium, which underlines the concept of ‘risk sharing’ as opposed to ‘risk transfer’. In Takaful, participants contribute to a common fund to cover potential losses, whereas insureds with conventional cover pay a premium or fee for another to take the risk on their behalf. Broadly similar to mutual insurance, Takaful allows for risk sharing by pooling individual contributions for the benefit of all subscribers and underscores the principles of cooperation, solidarity, common interest and shared responsibility by which policyholders undertake to guarantee one another.

Raising awareness: Is the broker’s role now more crucial than ever?

Whilst some brokers may still be on a learning curve regarding the many nuances of Takaful and its broad appeal to non-Islamic populations, they can at least harness the growing number of resources available to raise awareness of Takaful products. Outside the GCC region, overseas initiatives to increase awareness are gaining ground, despite Takaful’s currently modest contribution to the overall Islamic finance industry. The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) provides education in Islamic finance, whilst the Islamic Financial Services Board’s global reach has become effective at promoting, developing and regulating the global Islamic finance industry. Increased awareness could be driven further through deeper engagement with Takaful experts and qualified Shariah scholars.

To further grow the Takaful market, brokers have immense power to transform how clients see Takaful. They are well positioned to drive growth by helping clients understand that, to many people of faith, or indeed of no faith, all across the world, Takaful represents more than pure risk management. In short, the principles of mutual care, responsibility and assistance have no barriers.

Nevertheless, other constraints to growth must be addressed to increase Takaful’s 2% share of Islamic finance assets. Brokers are best positioned to assess market capacity for demand and reinsurance, but education and awareness among consumers are the principal barriers, along with instances of Islamic reinsurance (Retakaful) capacity shortages.

The JENOA view

Although Islamic finance today involves over 80 countries, only a small number of markets account for the vast majority of this US$ 4 trillion industry. What’s more, with Muslims making up around 25% of the world’s population, just 1% of global financial assets qualify as Sharia-compliant.

The lack of awareness and education surrounding insurance is not limited to Takaful. Poor insurance penetration across GCC and MENA countries blights conventional and Takaful insurance alike, and this is partly responsible for restricting a faster uptake of Takaful. In GCC countries, the insurance penetration rate – the gross written premium (GWP) as a percentage of GDP – remains low, well below the emerging-market average of 3.4% and the global average of 7.4%.

In addition, considering the simplicity of Takaful-product design, one of the current and often confusing stumbling blocks for Islamic markets is why Takaful providers are often forced to reinsure in the conventional insurance and financial markets despite a clear preference for Shariah-compliant reinsurance. To address that conundrum, insurers must acknowledge and address the shortage of Islamic reinsurance (Retakaful) capacity.

Takaful potential

With 95% of the world’s Shariah-compliant assets concentrated in 10 countries, the potential for Takaful to make inroads into under-penetrated markets and developed markets hungry for ethically minded insurance is considerable. The ethical components of a Takaful – for example, Takaful does not invest in gambling, alcohol or weapons manufacturing – hold a certain appeal outside of the Islamic world. So, too, do its underlying principles of fairness, transparency and mutual assistance. In fact, Takaful represents a compelling proposition for ethically minded customers worldwide, regardless of race, faith or lack of faith. For millions and possibly billions of people, Takaful’s environmental, ethical and moral dimensions can profoundly impact their lives and societies. After all, it promotes shared responsibility and mutual support to achieve happiness and success.

Islamic finance accounts for only 1% of global financial assets in a world in which 25% of the population is Muslim, and as one UK Government Minister noted as far back as 2019, “It is clearly evident that this sector has extreme latent potential”.

The landscape, thankfully, is beginning to shift. The Saudi Arabian market saw the establishment of the Insurance Authority in September 2023, a move that is likely to further develop and strengthen Insurance product innovation, particularly in the retail sector, as the country focuses on the goals of Vision 2030. The potential to design new Sharia-compliant products for this developing sector is a clear opportunity for brokers and Insurers.

What does this mean for MENA clients, and how can JENOA help?

At JENOA, we are well placed to share knowledge and advice on Takaful across a spectrum of products and cover.

As far as our clients are concerned, JENOA is keen to help them understand the importance of a strategic approach to risk management through insurance and reinsurance solutions. We are experienced in designing ethical, Shariah-compliant products suited to our clients’ needs in compliance with the requirements of their faith, and such ethical products are, of course, available to all.

We are keen to help institutions meet the regulatory requirements from a Shariah-compliance point of view and can advise on various Takaful models and help implement the most financially viable solutions. We are adept at implementing the processes and design of Shariah-compliant policy wording, and we will guide clients towards understanding the core principles of Takaful that distinguish it from conventional insurance.

Broker-driven solutions

Brokers serve as an essential conduit between the consumer and insurance provider and will therefore play a crucial role in the growth of Takaful by educating and informing clients of its major benefits and principles. In doing so, they can reinforce trust and encourage more informed decision-making, leading to improved customer relationships. This will enable them to better serve their clients, help bridge the gap between conventional and Takaful insurance, and keep providers abreast of evolving consumer demand. In short, it is a route to better business outcomes for everyone in the market.

Further rapid growth in the Takaful market and the wider Islamic finance industry is possible. However, with most Islamic finance assets covered in the conventional markets, billions of dollars in premiums leak from the industry every year. Those funds trickle through to traditional insurers, who then reinvest in conventional markets. Sustainable growth will largely depend on a better understanding and awareness of the capabilities and nuances of highly ethical cover solutions such as Takaful and expansion in Retakaful capacity, where premiums could then be reinvested in a stronger and ever-growing Islamic market.