The changing landscape in mobility, in particular the evolution of the battery electric vehicle (BEV), is bringing about significant changes and challenges in automotive insurance and is opening up new risk profiles and claims scenarios.

With plenty of exposure and ample space for innovation, how should the insurance industry approach BEV insurance? In our latest JENOA Insights article, we identify some of the emerging risk.

The rise of battery-powered mobility

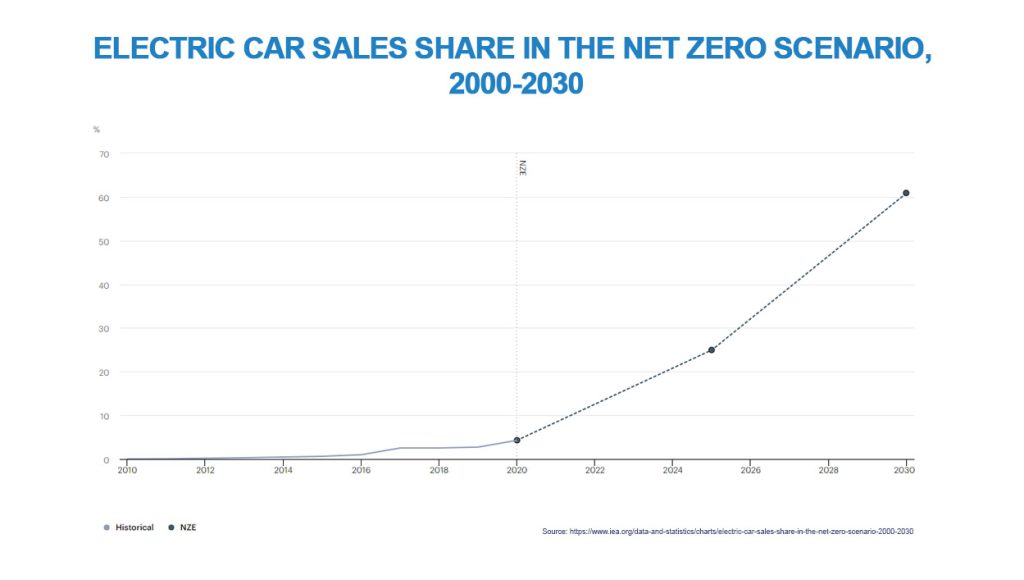

The BEV has steadily been gaining market share around the world. Indeed, 2021 saw the highest ever number of new vehicle registrations for BEVs in Europe, accounting for around 10% of all new vehicle sales during the year.[1]

According to the International Energy Agency, pure electric vehicles currently account for less than 1% of the global car stock.[2] However, sustained rapid growth is likely to characterise this market as various jurisdictions around the world implement commitments to ban the sale of new diesel and petrol vehicles during the course of the 2030s.

Safety implications of BEVs

Industry testing shows that BEV batteries are well protected and unlikely initially to be damaged by the force of a crash alone.[3] The fire risk in collision scenarios emerges when the high-voltage unit is compromised, or when fire spreads from another BEV or ICEV.

In addition, the extra weight of batteries and the protection around them – the BEV Volvo XC40 Recharge, for example, weighs 450kg more than the petrol XC40[4] – gives BEVs much greater momentum, leading to more damage to all vehicles involved, translating into further risk for insurers.

Any type of damage sustained in a crash will be more expensive to rectify due the higher cost of BEV parts and specialist repair, meaning higher insurance premiums. Insurance costs for BEVs in the UK, for example, are typically 13% higher than they are for their petrol or diesel equivalents.[5]

Current claims analysis shows, however, that BEVs are actually less likely to be involved in collisions[6], but this analysis may be influenced by their limited mileage use rather than their inherent comparative safety.[7] In fact, research carried out in the UK shows that pedestrians are 40% more likely to be struck by a BEV than by a conventional internal combustion engine (ICE) vehicle, due to reduced noise levels and increased vehicle weight.[8]

Two further independent studies in the US returned similar results.[9] One potential mitigation measure for insurers would be to insist on synthetic noise, known as Acoustic Vehicle Alert Systems (AVAS), at all speeds as a condition of insurance. Currently, EU legislation only mandates AVAS at speeds of under 12mph or when reversing.[10]

Battery fire risk

Lithium-ion (Li-ion) batteries are fast creeping up the list as a cause of fire on car carriers, and this is causing concern for the insurance industry.[11] In February, the car-carrier vessel, Felicity Ace, was lost off the Azores, prompting many marine insurers to decline cover for vehicles transported on ships carrying BEVs, and it has forced up premiums for hulls carrying Li-ion batteries.

While it has not been proven conclusively that Li-ion batteries actually started the Felicity Ace fire, there is no dispute that the batteries of around 300 BEV[12] among some 4,000 cars on board[13] acted as an accelerant once the fire took hold. This resulted in the loss of vehicle cargo alone estimated at over US$ 400 million.[14]

The oxides in the chemical make-up of Li-ion cells mean that once a thermal runaway point is reached, the cells produce vast amounts of oxygen to fuel a fire. Furthermore, they burn more intensely than ICE vehicles;[15] the blaze aboard Felicity Ace lasted a week before the vessel sank in deep water.[16]

Until vessel carriers are able to mitigate and control the perceived fire risk associated with Lithium batteries, Insurance capacity will continue to be constrained & premiums will remain high for car carriers transporting such vehicles.

Longevity & replacement

A number of manufacturers currently offer guarantees for battery longevity of eight years or 100,000 miles.[17] This is a key factor, given the high cost of replacement. In the UK, for example, the average cost of a replacement BEV battery in March 2022 was estimated at £87 per kWh,[18] averaging over £5,000 per unit.[19] This is due to limited supply, high demand, international shipping and expensive mining and manufacturing processes for the minerals that make up a Li-ion cell.

As one example of how the Insurance industry can assist in developing solutions, JENOA has worked with Abdul Latif Jameel Motors to be the first vehicle retailer in Saudi Arabia to include an eight-year warranty on all new Toyota Hybrid vehicles purchased in the country.

Manufacturer guarantees, however, simply indemnify owners against loss; they do not guarantee that the battery will perform as stated, or that it will never need replacing. This is an area where insurers will have to innovate and provide cover for manufacturers.

Such innovation already exists in Battery Energy Storage System (BESS) technology, designed to ensure utility scale power grid stability or cover peak demand. Cover in the BESS market allows manufacturers to insure customer warranties.[20] Whilst the cover is currently designed for large renewables projects, providers are likely to introduce new products like this in the future to cover the mobility market and BEV battery performance, thus capping manufacturers’ potential losses.[21]

From insurance & claims complexities . . .

to innovation

Unlike ICE vehicles, BEVs are more sophisticated and connected, carrying sensors and a host of embedded software for driver assistance and vehicle management systems. These are often sourced through complex and sometimes opaque supply chains.[22] How these components interact, and how liability is established among suppliers for defects or chains of faults, is likely to create new risks and exposure for insurers and re-insurers.

Insurers also need to start assessing risk from a battery versus car point of view. In a market likely to see insurers offering products for vehicle-only cover to keep premiums down, it will be up to owners to purchase separate cover for batteries, whether purchased or leased. This is likely to lead to claims complexities and split liabilities, and battery insurers will need to establish limits on their exposure to possible total loss of the vehicle.

Further collateral damage to property from high-voltage fires also carries some risk,[23] as many BEVs are charged overnight in underground or adjacent parking.[24]

Collisions involving damage to an ICE vehicle from a BEV could be complex to resolve too, conceivably resulting in higher claims values. As BEVs gain greater market share, replacement parts and repairs for ICE vehicles will become harder to come by and, therefore, more expensive.

Potential defects and recalls

The automotive manufacturing sector is experiencing increasing pressure to hasten the transition to BEVs, even though the EU has voted not to ban the sale of diesel or petrol vehicles for another 13 years.[25] This technological shift, combined with much shorter development and testing cycles owing to increasing pressures to accelerate speed to market, are likely to cause recall risks.[26]

As it stands, the automotive sector already accounts for more than 70% of the value of all recall losses,[27] and in a sector that uses many components common to many manufacturers, a product recall could have an impact across the entire industry.

Last year in the US, General Motors was forced to extend a recall to cover more than 140,000 of its Chevrolet Bolt BEVs from model years 2017-2022 due to potential manufacturing defects in the batteries.[28] Although the issues are now solved, a number of fires may have been caused by the battery. In some cases, these proved harmful to humans and caused damage to real estate, and the recall is estimated to have cost GM approximately US$ 1.9 billion.[29]

Environmental concerns

Potential liabilities exist for both manufacturers and suppliers around the sourcing of materials for production, and the ethical disposal of used batteries. Whilst BEVs are seen as environmentally friendly in application, battery manufacture requires the mining of large quantities of ore from which to extract the rare minerals required, including lithium and cobalt.[30]

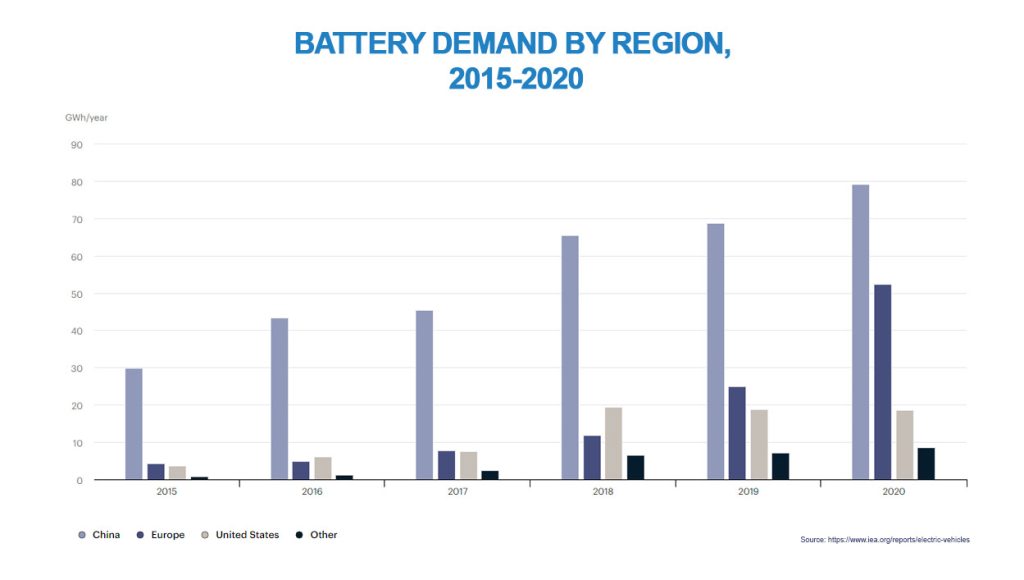

Demand for these two elements is set to spiral, but as mining and processing companies struggle to keep up with growing demand (lithium production alone will need to triple by 2026), so too will the industry’s environmental and social problems.

This opens up potential liability and reputational risk as consumers become more aware and more concerned about ethical purchasing decisions. That risk can perhaps be mitigated by the sustainable sourcing of minerals, or by pursuing recent OEM policies of either buying the mineral ores direct, or investing in mines themselves, as have Tesla, GM, VW and BMW.[31]

This is likely to increase visibility and traceability in the supply chain and presents auto-OEMs with both an opportunity and potential risk; as direct parties to mineral mining, they will become responsible for working conditions, and have a chance to make a positive social impact in many parts of the world. On the flip side, they also run the risk of massive reputational damage if they fail to clean up.

Given that the technology is relatively new, and data is therefore hard to come by, few insurers are currently willing to develop solutions to cover this potential environmental and repetitional damage. As the technology becomes more prevalent, however, a solution will need to be found.

For example, OEMs that join initiatives such as the Responsible Minerals Initiative, as VW[32] has done, can help maintain human and environmental rights by developing a certification system for cobalt smelters and keeping small mining operations out of the supply chain. Insurance products that recognise this kind of certification offer insurers the chance to support their ESG objectives.

With the changing risk profile that electric mobility brings, insurers and re-insurers are well advised to assess risk conservatively where little usage data is available. The growing need for sustainability, however, demands that ordinary motorists are not priced out of a market.

The key to accessibility to this new market is sustained growth and higher volumes. As more data becomes available and as unit costs fall, insurers will see a corresponding growth in opportunities for innovation, making both battery and vehicle insurance affordable and profitable.

[1] https://www.iea.org/reports/electric-vehicles

[2] https://www.iea.org/reports/electric-vehicles

[3] https://www.agcs.allianz.com/news-and-insights/news/electric-vehicles.htm

[4] https://www.greencars.com/post/why-evs-weigh-so-much

[5] https://www.nimblefins.co.uk/largest-car-insurance-companies/average-electric-car-insurance-cost-uk

[6] https://www.agcs.allianz.com/news-and-insights/news/electric-vehicles.html

[7] https://www.agcs.allianz.com/news-and-insights/news/electric-vehicles.html

[8] https://publications.parliament.uk/pa/cm201719/cmpublic/automated/memo/aevb25.htm

[9] https://frankellawfirm.com/are-electric-vehicles-leading-to-more-pedestrian-accidents/

[10] https://ec.europa.eu/growth/news/electric-and-hybrid-cars-new-rules-noise-emitting-protect-vulnerable-road-users-2019-07-03_en

[11] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/scorched-cars-burn-insurers-facing-higher-risks-from-electric-vehicle-transport-69252443

[12] https://www.autoevolution.com/news/felicity-ace-fire-may-make-cargo-ships-wary-of-transporting-evs-185896.html

[13] https://www.insurancejournal.com/news/international/2022/02/26/655847.htm

[14] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/scorched-cars-burn-insurers-facing-higher-risks-from-electric-vehicle-transport-69252443

[15] https://www.autoevolution.com/news/felicity-ace-fire-may-make-cargo-ships-wary-of-transporting-evs-185896.html

[16] https://www.insurancejournal.com/news/international/2022/02/26/655847.htm

[17] https://www.bmw.co.uk/en/topics/owners/service-workshop/warranties.html https://www.tesla.com/en_GB/support/vehicle-warranty https://www.volkswagen.co.uk/en/owners-and-drivers/my-car/warranties.html

[18] https://bookmygarage.com/electric-vehicles/how-much-does-an-electric-battery-cost-uk/

[19] https://bookmygarage.com/electric-vehicles/how-much-does-an-electric-battery-cost-uk/

[20] https://www.munichre.com/en/company/media-relations/media-information-and-corporate-news/media-information/2019/2019-03-07-battery-performance-now-insurable-innovative-munich-re-coverage-paves-the-way-for-renewable-energy.html

[21] https://www.munichre.com/en/company/media-relations/media-information-and-corporate-news/media-information/2019/2019-03-07-battery-performance-now-insurable-innovative-munich-re-coverage-paves-the-way-for-renewable-energy.html

[22] https://www.agcs.allianz.com/news-and-insights/news/electric-vehicles.html

[23] https://www.insurancebusinessmag.com/ca/news/breaking-news/gm-recalls-all-chevy-bolt-model-years-over-electric-fire-risk-303175.aspx

[24] https://www.insurancebusinessmag.com/ca/news/breaking-news/gm-recalls-all-chevy-bolt-model-years-over-electric-fire-risk-303175.aspx

[25] https://www.politico.eu/article/european-parliament-votes-to-ban-combustion-engine-cars-from-2035/

[26] https://www.agcs.allianz.com/news-and-insights/news/electric-vehicles.html

[27] https://www.agcs.allianz.com/news-and-insights/news/product-recall-risks-growing.html

[28] https://www.insurancebusinessmag.com/ca/news/breaking-news/gm-recalls-all-chevy-bolt-model-years-over-electric-fire-risk-303175.aspx

[29] https://www.insurancebusinessmag.com/ca/news/breaking-news/gm-recalls-all-chevy-bolt-model-years-over-electric-fire-risk-303175.aspx

[30] https://www.fleeteurope.com/en/manufacturers/global/features/where-do-ev-battery-minerals-come

[31] https://www.fleeteurope.com/en/manufacturers/global/features/where-do-ev-battery-minerals-come

[32] https://www.volkswagenag.com/en/news/stories/2019/04/our-batteries-last-the-life-of-a-car.html