How is it going & what does it mean for participants?

The first known insurance contract dates from the city of Genoa, Italy in 1347. However as a global market place Lloyd’s of London, has made its name as the world’s oldest exchange for insurer and reinsurer, to trade complex and large-scale specialist risk, that are often difficult to insure. Relying heavily on an old-fashioned ‘people and paper’ model in which humans are still the control point for quality, Lloyd’s people-intensive environment has made it an expensive and often an inefficient place to do business.

Now a long way on from its beginnings and first mention in The London Gazette in 1688 as a marine intelligence and insurance centre in a coffee shop by the River Thames[1], Lloyd’s is today in the midst of a comprehensive shake-up unprecedented in its 350-year history. This comes in the form of the Future at Lloyd’s strategy, a modernisation programme driving a £ 300 million investment[2] in a five-phase digital transformation in an attempt, according to its chief executive, to remain “relevant, reliable and competitive in a digital world”, and to introduce far-reaching cost-saving efficiencies by making the market better, faster and cheaper.

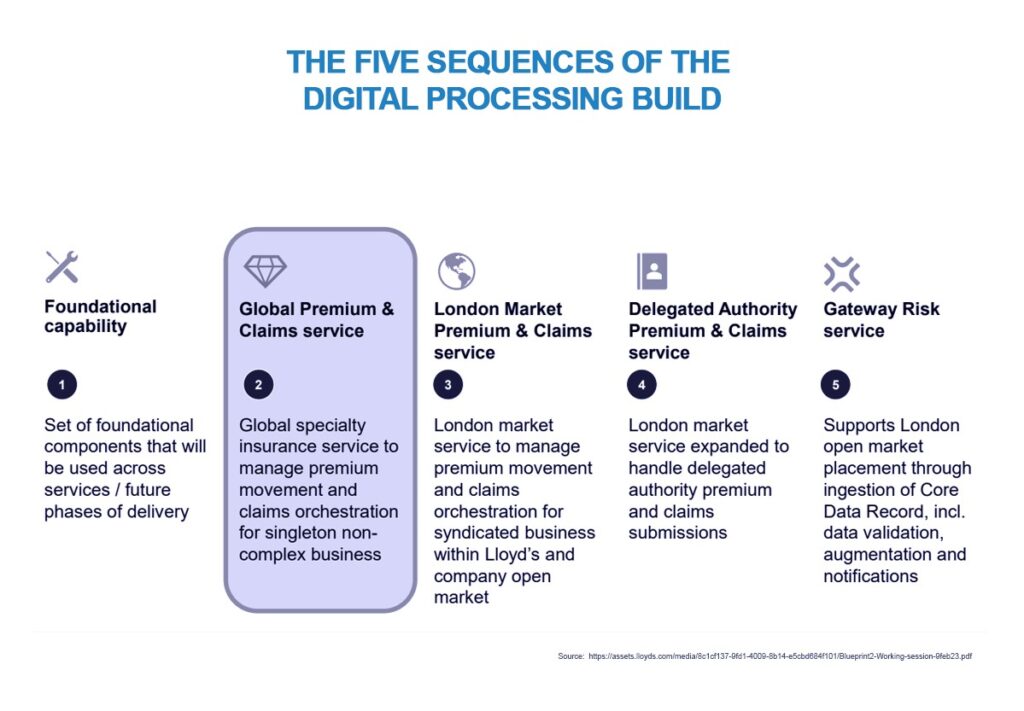

We’re currently in the second phase, or Sequence 2 as Lloyd’s calls it, covering global premiums and claims. So, what does it involve, how are things going, and what’s already been achieved? More importantly, can we expect delivery of its entire new digital gateway by Q4 2024, as promised?

Future at Lloyd’s

Transitioning the entire Lloyd’s market to a digital ecosystem was never going to happen overnight, given the complexities of the large underwritten commercial, corporate and speciality risks traditionally placed in the market. Despite the scale of this ambitious project, Lloyd’s promises that digitalisation “will profoundly transform the way in which customers get covered, right through to recovering from loss; this will be achieved by the redesign of the entire insurance lifecycle process – from placement through to accounting, payment, endorsements, claims, renewals and reporting – offering a seamless digital service for all Lloyd’s customers and stakeholders globally”. Lloyd’s CEO John Neal hopes that full adoption will see a 40% reduction in processing costs.

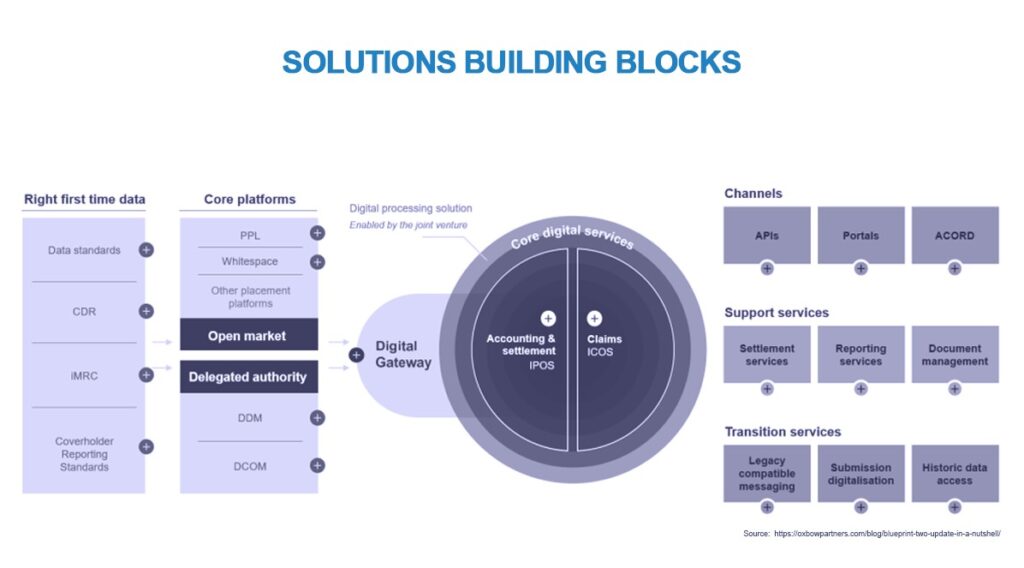

Broadly speaking, the Future at Lloyd’s strategy for a digital gateway is designed to introduce revolutionary changes that will make the insurance market entirely digital from start to finish, with data at its core. It aims to improve Lloyd’s by re-engineering market transactions, covering all aspects of placement and processing of premiums and claims. It hopes to make doing business at Lloyd’s faster by completing processing transactions within placement and claims in minutes and hours rather than weeks, and market participants stand to gain from the cost savings available through digitalisation of the whole marketplace, thereby designing out errors and rework.

What is Sequence 2, and how does it build on Sequence 1?

Sequence 2 of this 5-sequence digitalisation concentrates on the global premium and claims service, covering premium movement and claims orchestration for singleton non-complex business. It supports peer-to-peer premium and claim submissions and agreements, delivering fast, accurate premium and claims payments in various currencies. Faster claims payments rely on new automated claims recognition, routing and orchestration, whilst high-speed processing means cover can be evidenced and issued within minutes, simultaneously generating technical accounting records. This moves the Lloyd’s claim orchestration platform from one that historically did not allow for electronic notice of loss, claim triage and routing, or electronic settlement, to a digitalised system that can electronically place loss notices, triage claims, route them to the correct adjuster, and settle payments in hours and days. Customer systems can be integrated with the Lloyd’s platform using ACORD standard messaging.

Features such as these help to progress the overall aim of the Future at Lloyd’s strategy: to make major operational savings that will allow participants to trade more efficiently. Lloyd’s estimates an aggregate reduction of £ 800 million in operating costs for brokers, underwriters and partners. It is hoped that, in turn, operating efficiencies will drive product development, innovation and risk mitigation, and build on Lloyd’s existing insurtech accelerator, the Lloyd’s Lab.

At a technical level, this will all be driven by data and technology, but to understand the background so far, it is worth taking a quick look at Sequence 1, its aims and its achievements to date. As mentioned earlier, the Future at Lloyd’s digitalisation programme relies on data and technology at its core, with an important alignment of data with global data standards (ACORD[i]). Traditional ways of conducting business at Lloyd’s – where incomplete data with high error rates was part of the course, was never going to be adequate for any kind of digitalisation.

This is what Sequence 1 was designed to address, with what Lloyd’s calls its ‘foundational capabilities.’ These feature all the essential components that will be used across all services – and at every stage of the five sequences involved in the eventual delivery of the complete digital gateway – and include core platforms such as open market placement and delegated authority platforms.

One of the major features underpinning the entire move to a seamless digital service is the Core Data Record (CDR) which, according to Lloyd’s, forms the “critical transactional data which needs to be collected by the point of bind to drive downstream processes: premium validation and settlement; claims matching at first notification of loss; tax validation and reporting; and regulatory validation and core reporting.”

The CDR comprises 45 fields consisting of mandatory pieces of information to be collected without fail “at the point of bind” – a legal agreement issued by an insurer to provide temporary evidence of cover until a policy is issued – and 80 conditional mandatory fields. The intention is that the CDR will constitute an “irrefutable record” to drive forward automation of all downstream processes described above, with a focus on CDR accuracy with a “get it right first time” approach. This was an essential part of establishing global data standards that meet the automation requirements for direct insurance and facultative reinsurance for a variety of processes across company and Lloyd’s markets.

Progress so far

So, what has Sequence 1 achieved, and how is Sequence 2 going? The necessary foundational data components that formed the basis of Sequence 1 are more or less on track. These include the CDR, Lloyd’s new delegated authority (DA) system, DCOM, and a new market reform contract (MRC v3) that will enable digital processing. We have also seen some delays: MRC v3 was rescheduled from last year to Q1 2023, and the application programming interface (API) that will allow participants to connect to the digital gateway has experienced a setback due to a delay in the release of the API specs.

As part of the Blueprint Two roadmap, the release of enhanced delegated authority data reporting and Faster Claims Payment (FCP) was delivered on track, but the Digital Gateway sandbox test environment has been postponed because, among other reasons, Lloyd’s did not initially factor in the complexities inherent in turning CDR standards into international data standards set by the Association for Cooperative Operations Research and Development (ACORD).

Overall, delivery of the entire digital gateway looks set to be postponed from its original live date of Q2 2024 to the end of that year, with some predicting delays extending into 2025. As a result, it looks increasingly unlikely that Lloyd’s CEO’s statement last year that the “end of 2023 is when you should start to see a fundamental difference in the way in which the market acts and transacts” will still stand.

The Middle East perspective

The delay in the launch of the Lloyd’s digital gateway is just that – a mere delay, not a failure or a change of track. Tech-based insurance is a paradigm shift that all areas of the insurance industry will follow as the challenges of the modern world continue to call for innovation.

For example, businesses’ increasing reliance on technology and the corresponding risk of cyber-attacks and data breaches has in turn resulted in a cyber insurance bubble. Although this bubble is predicted to burst,[3] according to a recent survey 63%[4] of MEA companies purchased cyber insurance in 2022, and 73% of those had experienced some kind of cyber attack.

Climate change is continuing to disrupt the Middle East market, too, with the recent uprise in parametric and weather insurance packages reflecting the demand for weather protection and natural-disaster products. Parametric insurance has embraced machine learning models and real-time weather data to predict the likelihood of such claims, as far as possible.

This rise of parametric insurance is aligned with a general upsurge in insurtech, a term that covers technological innovations created to improve the insurance industry’s efficiency and forecasting powers. Insurtech increasingly underpins the insurance industry, and the rise in insurtech startups reflects a general shift towards preventive insurance using weather, health or behavioural data to predict the likelihood of particular events (such as floods) and behaviours (such as fraud).

Another relatively new area for insurance is FemTech, a general term encompassing the health and well-being of women. The FemTech industry in the MENA region is predicted to be worth around US$ 3.8 billion by 2031. Allied to the emergence of female-led startups in the UAE and the push for the further financial and business education and advancement of women, female-focused insurance is set to grow.

The dominance of tech and data analysis in the insurance industry is something that the rapidly modernising Middle East region is taking in its stride. The pending changes at Lloyd’s will speed up and streamline the processing of premiums and claims and act as a flagship for digital change across the industry.

Lloyd’s – fit for another 350 years?

Lloyd’s is not only a broad market, but also a complex one. It comprises both simple and complex risks, has different distribution technologies, and has to function with various channel segments in the form of brokers, carriers and market. It is therefore not surprising that a comprehensive digitalisation of a highly complex market such as Lloyd’s will throw up a few surprises along the way. That said, despite possible delays to the final delivery of the Future at Lloyd’s digitalisation, many predict that by 2026, around three-quarters of risks placed in the market will be digitally enabled with seamless straight-through processing (STP), beyond the rubber stamp of digital binds alone.

The speed, cost and ease of doing business at Lloyd’s will vastly improve with digitalisation, and while there is little doubt that progress through sequences 3-5 will present yet further challenges, modernisation is a crucial step in ensuring Lloyd’s’ future competitiveness and relevance.

[1] https://www.lloyds.com/about-lloyds/history/coffee-and-commerce

[2] https://www.slipcase.com/view/insider-in-full-blueprint-two-in-2022-unwinding-the-lloyd-s-rhetoric

[3] https://www.securitymiddleeastmag.com/5-cybersecurity-trends-for-the-middle-east-in-2023/

[4] https://www.marsh.com/bw/services/cyber-risk/insights/using-cyber-insurance-to-bolster-cybersecurity-in-mea.html

[i] https://www.acord.org/standards-architecture/acord-data-standards