The global health insurance market, which is estimated to have reached US $20 trillion in 2020, is expected to grow at a combined annual growth rate (CAGR) of 5.5% to 2028[1], but will do so against a continuing backdrop of flux, change and innovation. Given that the market is still repositioning itself after the upheavals experienced from the COVID-19 pandemic, it is understandable that key players are preparing agile and flexible responses to changing global dynamics in an effort to deliver improvements in patient outcomes and more personalised, consumer-friendly delivery.

Digital health, customer-centric enhancements and patient data transparency are key to enabling the necessary healthcare transformations.

As virtual delivery of healthcare sees growing demand in an era of changing risk profiles, key players in health insurance ecosystems in both developed and emerging markets will need to invest in the modern infrastructure necessary for effective patient engagement. Real-time patient data is likely to produce better health outcomes and greater efficiencies in the holistic management of patients’ healthcare journeys. In short, preventative care through the greater use of technology and interoperability of health systems is focusing on the notion of whole-patient healthcare[2].

In the emerging-markets healthcare sector, Asia Pacific is expected to see the highest growth, owing to the increasing levels of market penetration of private medical insurance providers, as well as the launch of new health schemes by state and central governments[3] in an effort to maximise population coverage.

In addition, an increase in chronic conditions in populated countries like India and China, along with their growing treatment costs, is likely to contribute to a fast-growing regional market.

Here, we take a closer look at the emerging trends in healthcare insurance, how risk profiles around the world are changing, and examine the insurance market’s risk appetite for future pandemics and the increasing attractiveness of investment opportunities in emerging-markets healthcare.

Key trends in developed & emerging markets

The recent pandemic arguably delivered the kind of rapid changes to healthcare delivery and accessibility that usually take years, if not decades, to evolve. Before we examine in further detail the key features of emerging markets, risk appetite and risk profiles, let us briefly touch on just a few of the most important trends that have been developing throughout 2022, to give a flavour of how the global healthcare market is evolving.

- Telemedicine: The pandemic drove a sudden adoption of telemedicine and digital health in response to fears of contagion from traditional, in-person, healthcare visits in clinics, hospitals and surgeries. The consequence of that necessity is that healthcare providers are adjusting to an integrated healthcare experience with a digital-first approach.

- Integrated health: Health interventions are now more focused on patients’ holistic medical history, with whole-patient data in medical records enabling more personalised healthcare plans. In addition, rather than concentrating exclusively on episodic symptoms, a patient’s holistic history is being augmented by broadening the scope of whole-patient data; approaches to treatment now take into account the social determinants of health (SDoH) including employment status, living conditions, as well as any socioeconomic, emotional or cultural factors that could determine health outcomes.[4]

- Healthcare investment in cloud and modernisation: The pandemic-fueled telemedicine revolution relied heavily on the ability to deliver virtual care through remote working, whilst simultaneously depending on increased levels of coordinated communication. The need to enhance electronic medical records as well as coordinated patient care has brought about massive investment in modern digital IT infrastructure and cloud adoption; digital customer engagement and maximum data capture and interoperability continue to transform old, traditional monolithic systems with paper records into seamless digital experiences at every touchpoint on a patient’s care trajectory.

- The Internet of Medical Things (IoMT): The market for big data medical services is likely to exceed US$ 30 billion globally in 2022. With patients demanding accurate data-driven diagnostics amidst rising costs and utilization from a predicted increase in chronic illnesses, artificial intelligence-driven predictive analytics and data is critical to enabling clinical decision-making in real time. What IoMT is ultimately moving towards is the delivery of value-based healthcare outcomes from an ever more demanding patient pool.[5]

- Non-traditional players and ‘hyperscalers’: Tech-driven players are introducing significant elements of yet more technical expertise and customer data to transform healthcare delivery. The need for patient engagement is giving non-traditional players in healthcare the leverage to enter a market in which so-called ‘hyperscalers’ can take advantage of cloud capabilities to deliver coordinated healthcare platforms that are consumer-centric and multi-disciplinary. Cloud, artificial intelligence and automation are thus delivering highly scaled, on-demand, tech healthcare systems that promote elements of collaboration and interoperability to deliver critical data at the point of healthcare treatment.

Changing risk profiles

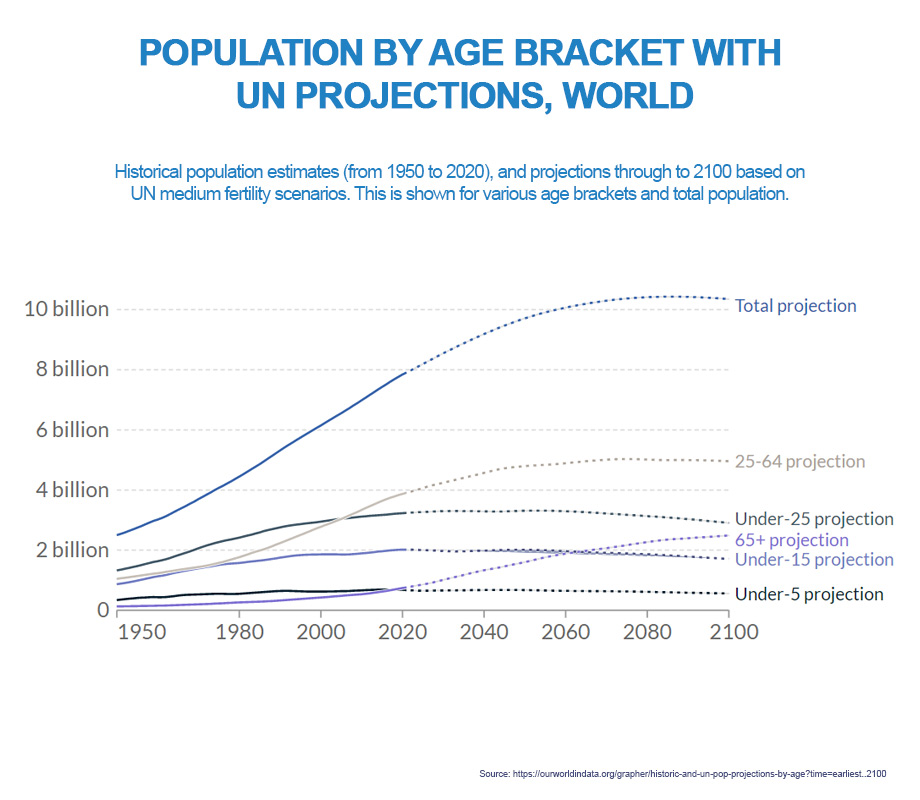

The growing geriatric population, coupled with rising levels of obesity and increasingly sedentary lifestyles, are changing the risk profiles faced by insurers.[6] It is estimated that by 2050, 1 in 6 people, or 16% of the world’s population, will be over the age of 65.[7]

As the elderly continue to adopt more sedentary lifestyles, we will see a large increase in the patient pool living with chronic diseases. In the US alone, over 1.8 million new cases of cancer were diagnosed in 2020, with more than 600,000 going on to die from the disease, according to the US National Cancer Institute.

In addition, a large number of the geriatric population suffers from one or more chronic diseases such as heart disease, type-2 diabetes and arthritis, which is forecast not only to change risk profiles as the proportion of geriatrics grows, but also to drive growth in the future.

Medical insurance, rather than critical illness cover, is likely to dominate this growth and account for the largest market share because of increasingly sedentary lifestyles. Resulting obesity can lead to hyper-tension, diabetes and heart disease, a chronic illness from which some 18 million worldwide are currently suffering, according to the World Health Organization.[8]

In emerging markets, non-communicable diseases (NCDs) have overtaken infectious diseases such as polio and malaria to dominate treatment.[9] Hypertension, cancer, diabetes and cardiovascular diseases have been driven by rapid urbanisation, lifestyle and diet.[10] This trend is especially noticeable in Asia, where 80% of deaths are now attributed to NCDs. As the UN forecasts massive urbanisation over the coming decades – it predicts nearly 70% of the world’s population will live in cities by 2050[11] – it is likely that this figure will soon match the 87% of people who die from NDCs in developed markets.

Emerging markets

The stark reality is that essential healthcare services are not universally available or accessible, especially in emerging markets. In order to fulfil one of the UN’s Sustainable Development Goals (SDGs) – to “ensure healthy lives and promote well-being for all at all ages”[12] – major private investment is needed alongside public and international financing in these markets to grow sufficiently to achieve that goal by 2030.

Emerging markets including Brazil, India and China account for nearly half the world’s population.

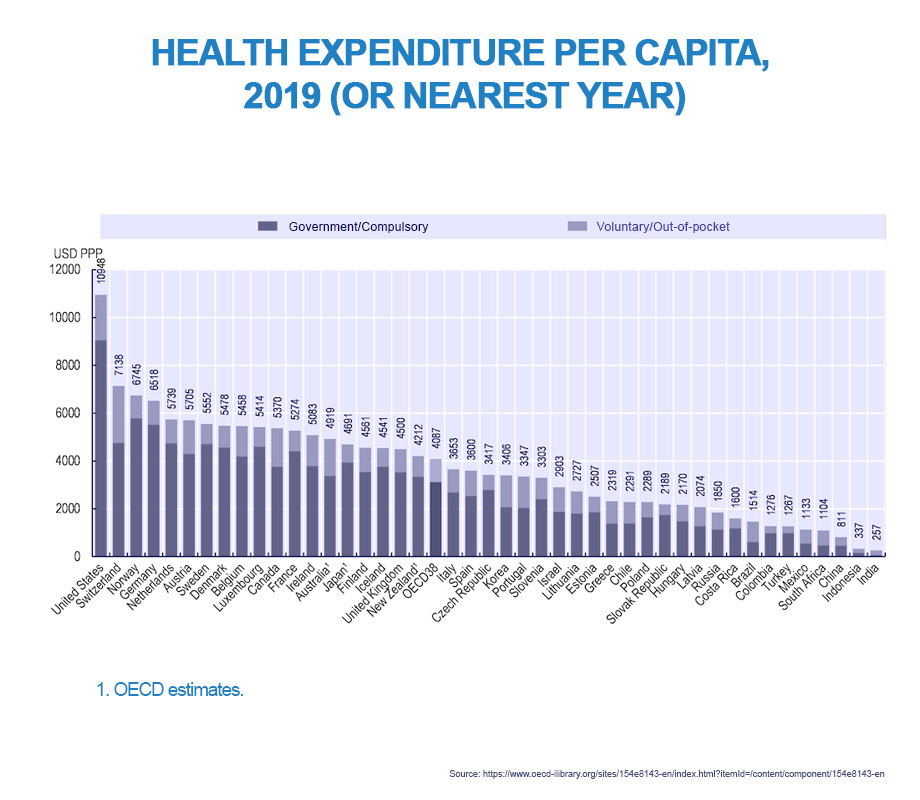

There is, however, a large gap in per-capita healthcare spending; the value of the entire emerging-markets sector is under half that of US spending alone,[13] and in Asia and Africa, under 50% of the population enjoys health cover.

Even where private healthcare is available, emerging market spending accounts for over half of annual incomes in low-income populations.[14] Largely due to long periods of underinvestment, it is likely, however, that emerging-market investment will grow rapidly over the course of the next decade as a result of ageing populations and increasing demand for healthcare from a fast-growing urban middle class. After all, emerging markets are set to face many of the same problems already evident in developed markets, yet healthcare spending in emerging markets is only around 5.5% of GDP on average, compared to approximately 17% in the US and an average of about 15% in developed markets.[15]

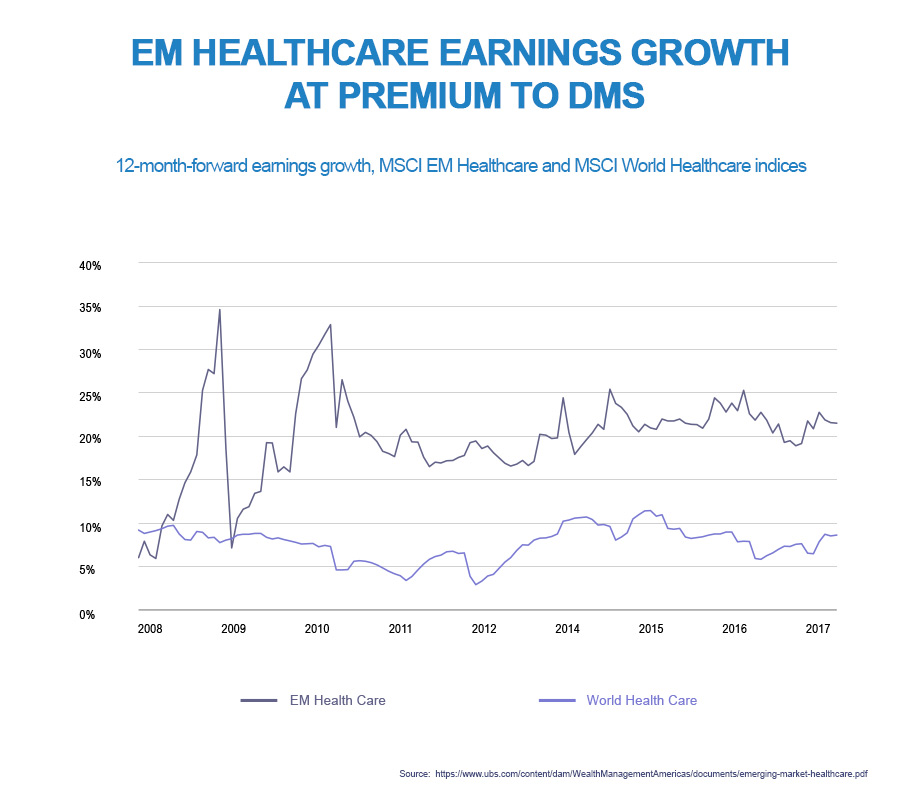

Quite how quickly the emerging markets will develop is a moot point, but demographics alone suggest emerging-markets healthcare could grow at double the rate of global growth, and even outstrip economic growth in emerging markets to experience annual growth to 2028 of over 6%.

This is down to a variety of factors. As mentioned above, ageing populations around the world will place increasing demands on healthcare systems whichis likely to lead to growing numbers of NCDs, and as the cost of treating NCDs continues to rise, so too will the spending pressure on healthcare systems. The trend towards rapid urbanisation, coupled with ageing populations as well as changing lifestyles and diets, has already seen deaths from NCDs emerge as the major cause of mortality across all emerging markets.

Substantial investment opportunities in emerging-markets healthcare are likely to be found in three areas: physical delivery infrastructure, services and new technologies. The provision of modern hospitals, pharmacies and speciality clinics will improve the effectiveness and efficiency of services such as timely diagnostics, emergency care and chronic disease management, whilst new technologies in medical-device, drug and procedure innovation could help drive better outcomes and availability across emerging healthcare markets.

A combination of these factors means that it is likely investment earnings in emerging-markets healthcare will continue to outpace earnings from developed-market investments.

Appetite for pandemic risk

Is the wider insurance and reinsurance market a good indicator of pandemic risk appetite in health insurance? In general, the industry adopts a risk-averse view of broader interconnected pandemic risks such as health, economic and financial factors, viewing them as largely uninsurable. After all, under-estimated and unforeseen risk makes it hard for insurers and reinsurers to price appropriately, as they need to be able to cost coverage before something happens.[16]

Why are pandemics uninsurable in the wider insurance and reinsurance market? As one European chief underwriting officer notes, “pandemics are considered by the insurance community as hardly insurable or even uninsurable… because the principle of insurance is based on risk pooling and diversification (in terms of space and time). When the economy is collapsing everywhere, you cannot address the issue”.

Despite pandemic risk being an important factor in risk-management policy for reinsurers – the first pandemic catastrophe bonds were issued in 2003[17] – experiences from a health point of view look somewhat different. Health insurance subscriptions experienced significant growth amid a positive demand for insurance as a result of COVID-19, and it is likely that the its lasting effects will be characterised by increased awareness of the need for medical insurance.

Indeed, despite the implications for the broader insurance and reinsurance markets, health insurance providers seem to be more sanguine on the risk posed by future pandemics. This is partly down to the fact that the health sector has offset claims related to COVID-19, as expensive elective procedures were halted due to fears of contagion from in-person attendance. As one major US credit-rating agency noted, “what we didn’t foresee, neither did the insurance companies themselves, was the effect of this deferral of healthcare. People were afraid to go into medical facilities for fear of catching the virus”. As a result, they go on to say, the effect of that in the second quarter of 2020 was that it more than offset COVID-19-related claims.

It is conceivable that pandemics, or at least regional epidemics, could occur more frequently in the future because of more densely populated cities, as well as other public health and environmental factors. Whilst adjusting for advances in medical device, pharmaceutical and procedural innovations, the healthcare insurance industry will need to undertake more research and gather more reliable data to better estimate the likely frequency, severity and duration of any future global health emergencies, alongside improving insurability through better preparedness and improved public health.

High returns on a healthy future

Global healthcare is likely to continue growing at over 5% to 2028, with emerging markets showing potential for even higher growth. This will come on the back of a desperate need to overturn decades of underinvestment in healthcare in emerging markets.

Healthcare insurance the world over is rapidly changing and innovating to prepare itself for changing risk profiles, against the backdrop of increased demand among a growing urban middle class as well as a greater need for value-based outcomes.

Whilst developed markets will continue to show an increase in demand as populations continue to appreciate the value of medical insurance, investors in emerging markets can influence long-term positive outcomes. Greater competition provided by new market entrants will be enabled by the increasing digitalisation of the insurance market which will result in claims processing and cost efficiencies but are also liable to add further customer value through differentiation. This is good news not only for the customer but will also deliver greater returns for investors.

[1] https://www.fortunebusinessinsights.com/health-insurance-market-101985

[2] https://www.capgemini.com/wp-content/uploads/2022/03/Top-Trends-in-Healthcare-2022-2.pdf

[3] https://www.fortunebusinessinsights.com/health-insurance-market-101985

[4] https://www.capgemini.com/wp-content/uploads/2022/03/Top-Trends-in-Healthcare-2022-2.pdf

[5] https://www.capgemini.com/wp-content/uploads/2022/03/Top-Trends-in-Healthcare-2022-2.pdf

[6] https://www.fortunebusinessinsights.com/health-insurance-market-101985

[7] https://www.fortunebusinessinsights.com/health-insurance-market-101985

[8] https://www.fortunebusinessinsights.com/health-insurance-market-101985

[9] https://www.ubs.com/content/dam/WealthManagementAmericas/documents/emerging-market-healthcare.pdf

[10] https://www.ubs.com/content/dam/WealthManagementAmericas/documents/emerging-market-healthcare.pdf

[11] https://www.un.org/development/desa/en/news/population/2018-revision-of-world-urbanization-prospects.html

[12] https://sdgs.un.org/goals/goal3

[13] https://www.ubs.com/content/dam/WealthManagementAmericas/documents/emerging-market-healthcare.pdf

[14] https://www.ubs.com/content/dam/WealthManagementAmericas/documents/emerging-market-healthcare.pdf

[15] https://www.ubs.com/content/dam/WealthManagementAmericas/documents/emerging-market-healthcare.pdf

[16] https://www.itij.com/latest/long-read/role-reinsurers-world-health-insurance

[17] https://www.oecd.org/daf/fin/insurance/Conference-pandemic-risk-way-forward.pdf