Morocco has long been a relative success story and outlier in the Middle East and North Africa (MENA) region in terms of insurance. Its penetration ratio – measured as the ratio between gross written premium (GWP) and GDP – sits above the emerging-market average of 3.4%.[1][2] Behind South Africa, it is often seen as the dominant insurance and reinsurance market on the African continent. This is also true of its agricultural-insurance sector – with premium volume estimated in the region of US$ 100 million, South Africa dominates a continental market with Morocco in second place, with up to US$ 40 million in premiums[3].

The Moroccan market still carries significant risk as well as opportunity; agriculture accounted for around 15% of GDP in 2020 and employs approximately 50% of the working population[4] in a country that is seeing worsening drought conditions significantly affect the output and yields of both food crops and cash crops.

The country’s agri-insurance sector has, in some shape or form, been around for a long time, but changing weather patterns and future climate change mean that innovative, affordable, and more effective models are likely to experience high demand if the right products are available.

Here, we assess the effectiveness of the distinct types of agri-insurance currently available and examine the alternatives that might help reduce risk to deliver better protection for agricultural production within Morocco’s changing climate.

Morocco: agri-insurance, climate & risk

Perhaps unsurprisingly given its importance, Morocco has a long history of agricultural insurance dating back to the middle of last century[5], but the African market as a whole is undeveloped when considered against giants in the agri-insurance sector such as the US and China, which dominate the global market with a share of around 50% of the sector[6]. Nevertheless, in terms of written premiums, Morocco is second only to South Africa when it comes to agricultural insurance on the continent, with an estimated US$ 20-40 million in premiums.

The need to develop Morocco’s agri-insurance market yet further is made more acute by the country’s worsening drought conditions. Situated between temperate mid-latitude and tropical climates with annual and decadal variability, its widely varying geographical regions – from an arid south to a humid north – make the custom of relying on a stable climate for guaranteed rainfall at the right time a precarious business.

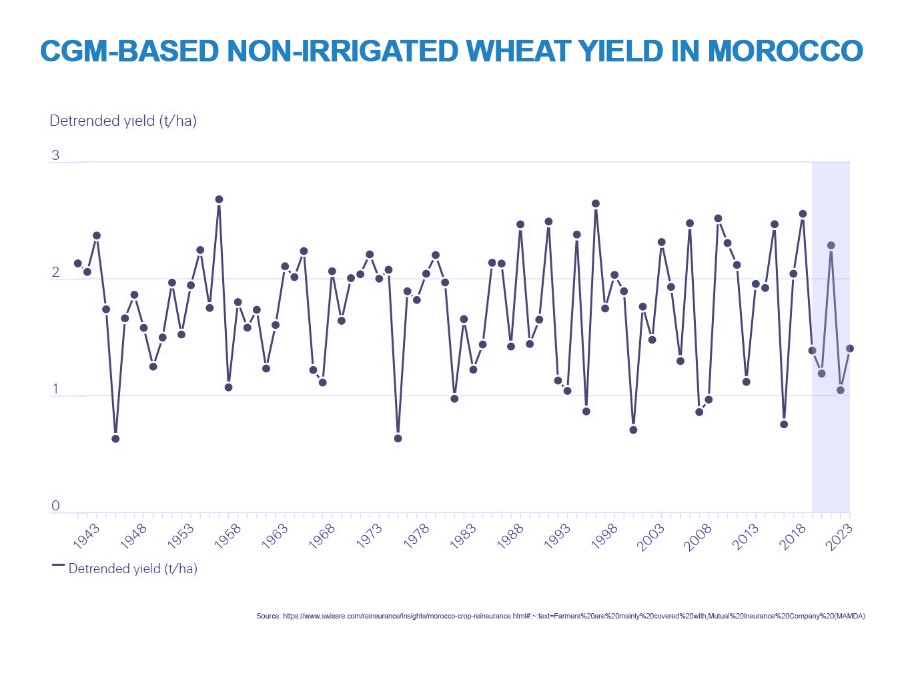

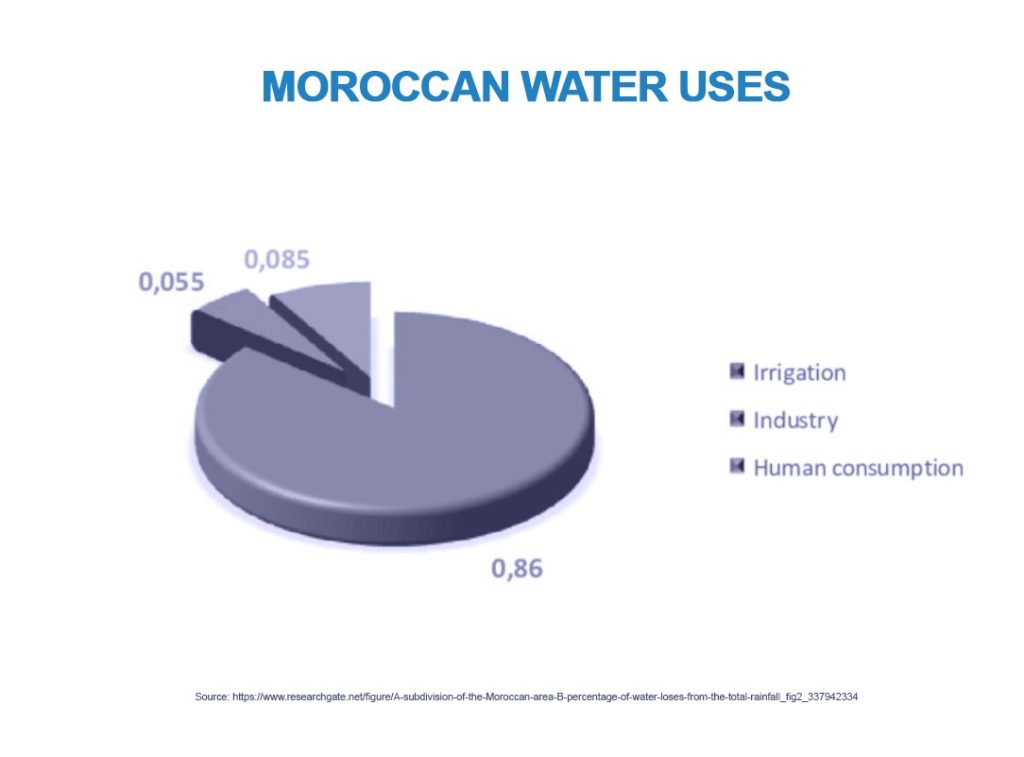

The 2023/2024 growing season has suffered from severe drought in an increasingly variable local climate, with Swiss Re estimating a provisional 40% reduction in ‘above ground biomass’ across wheat-growing areas – the dominant crop in Morocco – compared to the ten-year average[7]. In other words, the country has suffered widespread crop failure owing to heat and water stress. With only 10%–15% of agricultural land irrigated, Morocco’s dominant cereal crops rely heavily on rainfall. As Swiss Re notes, “contemporary yield variability has increased by 40% . . . Increasing variability in recent years coincides with increasing variability in seasonal rainfall”.

Insurance solutions: past, present & future

Agri-insurance has a long history in the region. Algeria established a form of agricultural insurance in 1907, such is the historic variability in the region’s climate and weather. Morocco followed a model adopted by Tunisia in 1963, and with the merging of three regional funds, today’s Mutuelle Agricole Marocaine d’Assurance (MAMDA or Moroccan Agricultural Mutual Insurance) was born.[8]

The Moroccan agri-insurance sector is now the second largest on the continent behind South Africa and is delivered through a public-private partnership between the Moroccan Agricultural Mutual Insurance Company and relevant government ministries. With premiums subsidized mainly by the government, cover consists of so-called indemnity-based multi-peril crop insurance (MPCI).[9] Originally designed and created to protect mid-western farmers in the US during the age of the Oklahoma dust bowl in the 1930s, MPCI has no shortage of detractors, given its complex structures, high administration costs and labour-intensive management. For example, MPCI is often offered under three separate unit structures, with a range of available plans under those structures, such as yield protection (YP), revenue protection (RP), area yield protection (AYP) and area revenue protection (ARP), among others[10]. Its defining characteristic is that the total sum insured is defined by expected yields to the producer. In other words, indemnity-based cover like MPCI pays out based on the difference between a guaranteed yield per acre (usually a proportion or percentage of total historical per-acre yield) and the actual yields achieved from a farmer’s harvest season. Typically, MPCI cover requires labour-intensive intervention and loss adjustment, with at least three inspections per harvest season at crop emergence, mid-season and pre-harvest. As such, it is an expensive product to administer and to purchase. As Swiss Re notes, indemnity insurance in Morocco “may have already reached the high end of the economic sustainability limits for farmers”. In other words, it is fast becoming prohibitively expensive.

Is parametric, index-based cover a viable alternative for Morocco?

Parametric insurance relies on three specific elements: a measurable and predefined trigger that can be modelled with historical data, a specific index against which insurers and insureds can measure events, and an agreed limit.

As products continue to mature, parametric cover allows insurers to quantify the weather, and the widespread adoption of new technology means they can now automate and digitalize the process. Blockchain, for example, offers insurers the chance to embed automatic triggers into claims-payment systems. Policyholders are compensated for any pre-agreed breaches of the indices against which they may be insured, with blockchain technology enabling claims payments to be transferred automatically, often straight back to whichever bank has extended credit to the farmer. This can now be done within days, and sometimes minutes, of a trigger being met. Unsurprisingly, innovations like this have dramatically reduced claims delays, which means that agribusinesses and small farmers can access the finance they need to plant new crops quickly.

Elsewhere on the continent, especially in countries with widely varying topography and climate conditions, other types of cover are widely used. Malawi’s government received a payout in March this year through its index-based parametric cover with African Risk Capacity (ARC), a specialist extreme-weather and natural-disaster insurer offering cover and risk pooling across Africa.[11] Malawi’s parametric cover was triggered by this year’s El Niño-driven drought and came hot on the heels of payouts in 2022 after the country experienced its driest growing season in more than 40 years.[12] Heavily dependent on rainfall, only around 2% of the country’s rain-fed area under production is irrigated.[13]

Malawi’s example could be of particular interest to other countries like Morocco, which feature diverse geographical landscapes with widely varying climates and topographies. Malawi’s government chose a sub-national parametric risk-transfer model using so-called cluster policies – a policy encompassing a series or ‘cluster’ of individual contracts – to address the issue of localized extreme-weather events. In short, it aims to balance regional variability between cultivated land.

Can Malawi’s success with index-based cluster policies be replicated successfully in Morocco? The success of cluster parametric policies in Malawi means that its food and cash crops can receive payouts quickly in the event of extreme weather in localized areas. Under this type of disaster insurance, the country’s additional cash crops cultivated across a variety of topographies – cotton, ground nuts, legumes, sugar and tea – can all enjoy cover. With a similar diversity of both food crops and cash crops, Morocco’s production across a wide variety of farming systems – comprising irrigated, rainfed mixed, highland mixed, pastoral, arid and dryland mixed[14] – could benefit from a hybrid approach that incorporates innovative insurance cover for the most vulnerable crops – both food crops and cash crops – in the most vulnerable landscapes.

The JENOA view

Given recent experience in Morocco, where drought has obliterated approximately 25% of rain-dependent crops, with the remaining 75% suffering water & heat stress, there is arguably a need for a dual approach to mitigate weather-related risk. That approach is likely to combine insurance adaptation alongside agribusiness and government action to redouble efforts at water retention, expand irrigation and reduce reliance on seasonal rainfall.

Morocco’s exposure to the increasing frequency of increasingly severe drought calls for the sort of tailored model that parametric insurance can address, especially for the country’s highly vulnerable regions. As mentioned above, existing models are already reaching the upper limit regarding the economic viability of indemnity cover.

Opportunity exists to bring value to the entire chain by increasing the sustainability of agricultural insurance and reinsurance, as well as minimizing the traditional, expensive and delay-ridden loss-adjustment process. Unlike the traditional MPCI indemnity insurance that dominates this market, parametric models mean claims payments for agreed amounts are tripped automatically when a pre-agreed parameter exceeds a predefined threshold on its index.

Further action to reduce risk could be taken at farm level, with a transition to alternative crop varieties, or even alternative crops, better suited to local soil and meteorological conditions. So-called “crop wild relatives”, a term used by agri-business experts to describe the “undomesticated cousins of cultivated plant species”[15], offer some genetic diversity for farmers in Morocco to move to more drought-resistant varieties. Six drought-resistant varieties of wheat and barley have been developed in Morocco by the Global Crop Diversity Trust in partnership with the International Centre for Agricultural Research in the Dry Areas (ICARDA), and initial assessments show promising signs; they report that the crop wild varieties achieved better yield potential and yield stability in all environments without compromising quality.[16]

Government action on water preservation and infrastructure upgrades is already well advanced; its Generation Green 2020-2030 strategy provides support and finance for irrigation systems that can draw subterranean groundwater. Infrastructure improvements have seen new dams built, as well as sustained efforts to reduce losses in transport and distribution.

Parametric alternatives to traditional indemnity cover have enjoyed widespread success elsewhere in the world, too; Australia’s arable and fruit farmers are using parametric products to cover periods of maximum vulnerability in a crop’s development cycle, and in Spain, olive farmers and olive oil producers make use of tailored parametric products to mitigate seasonal yield shortfalls caused by heat stress and water shortages.[17] These examples help demonstrate how parametric insurance is establishing itself as an indispensable complement to traditional indemnity products in the sector. As a result, it is likely that agribusinesses that depend on the ability to bounce back quickly from extreme-weather losses will come to rely on the quick and automatic settlement of parametric cover to protect themselves against the financial effects of extreme weather.

The Moroccan and wider African re/insurance sector is a crucial piece of the overall agricultural system in Morocco, given its ability to help reduce risk in food security. Agricultural insurance should be positioned as a cost-effective, easy and viable option for mitigating the effects of extreme weather, and it constitutes a vital financial safety net for farmers and agribusinesses facing crop failure.

What does this mean for MENA clients?

By offering access to global insurance market, in addition to Morocco’s developing reinsurance capacity, we can develop solutions to support these emerging opportunities in the agricultural and weather-based insurance sector, both in North Africa and the rest of the MENA region. Our strong focus on data-driven insights, allows us to analyze the risk exposure in order to build sustainable long-term solutions.

This enhanced approach to tailored insurance products, helps clients meet multiple and often complex requirements, where there is a need to depend on reliable, independent data-backed indices & triggers, which are modelled on reliable historical data.

Changing needs and adaptation

Insurance adaptation in Morocco is arguably a priority when even subsidized costs undermine the sustainability of agricultural insurance and reinsurance. Increasingly unaffordable indemnity-based cover, whilst it may have its place, is fast becoming ill-suited to the needs of Morocco’s evolving agricultural sector and its changing climate.

The growth in the popularity of parametric insurance has been enabled by technology that underpins automatic index-based products. These require no ongoing loss adjustment during the growing season, no claims filing, and no out-of-pocket expenses.

Insurance adaptation and farm-level reform are vital in a dynamic market and climate such as Morocco’s. After all, business continuation and the need to feed entire populations after weather losses and crop failure depend on affordable products, effective cover, and fast payouts.

[1] https://www.sanlam.com/downloads/capital-market-days/2023/Morocco-deep-dive.pdf

[2] https://argaamplus.s3.amazonaws.com/68f88da4-b648-41f9-bb31-47ebb3414cb6.pdf

[3] https://www.sanlam.com/downloads/capital-market-days/2023/Morocco-deep-dive.pdf

[4] https://www.commercialriskonline.com/morocco-top-of-the-rankings/

[5] https://www.atlas-mag.net/en/article/agricultural-insurance-in-maghreb-and-the-middle-east

[6] https://faberconsulting.ch/files/faber/pdf-news/20230530_FABER_Release_EN.pdf

[7] https://www.swissre.com/reinsurance/insights/morocco-crop-reinsurance.html#:~:text=Farmers%20are%20mainly%20covered%20with,Mutual%20Insurance%20Company%20(MAMDA).

[8] https://www.atlas-mag.net/en/article/agricultural-insurance-in-maghreb-and-the-middle-east

[9] https://www.swissre.com/reinsurance/insights/morocco-crop-reinsurance.html#:~:text=Farmers%20are%20mainly%20covered%20with,Mutual%20Insurance%20Company%20(MAMDA).

[10] https://greatamericancrop.com/crop-insurance/multiple-peril-crop-insurance

[11] https://www.arc.int/

[12] https://www.artemis.bm/news/malawi-to-receive-parametric-drought-insurance-payout-from-arc/

[13] https://www.land-links.org/country-profile/malawi/

[14] https://www.yieldgap.org/morocco

[15] https://www.fitchsolutions.com/bmi/agribusiness/morocco-new-drought-resistant-grain-varieties-enhancing-food-security-changing-climate-20-03-2023?fSWebArticleValidation=true&mkt_tok=NzMyLUNLSC03NjcAAAGWaxF1cdNiBJyeUKsBS4HEjNgnJRqV7cjvuKcz2iDqIhH9KXK2l1KQ

[16] https://www.fitchsolutions.com/bmi/agribusiness/morocco-new-drought-resistant-grain-varieties-enhancing-food-security-changing-climate-20-03-2023?fSWebArticleValidation=true&mkt_tok=NzMyLUNLSC03NjcAAAGWaxF1cdNiBJyeUKsBS4HEjNgnJRqV7cjvuKcz2iDqIhH9KXK2l1KQ

[17] https://www.reinsurancene.ws/spanish-farmers-renew-meteo-protect-weather-cover-following-2017-heatwaves/