The insurance and reinsurance industry are in the throes of a revolution in how clients and customers access their products and services. The digital disruption taking place across the sector is not unique to this market; entire other industries are experiencing a change in consumer demands, coupled with technological advances that have created intense competition from non-traditional players. The rise of insurtech and fintech digital platforms in the cloud that offer a secure and integrated customer experience has led the insurance sector to drastically rethink, and to seek to broaden its offerings, as insurtech disruptors are showing the established players exactly how to do it. As a result, legacy insurers are quickly learning how to extend their digital product portfolios and enhance appeal among clients in the sales, underwriting and reinsurance segments.

Whether in Asia or Africa, the alluring chance of a seamless consumer experience has given rise to runaway successes for fintechs, where digital wallets using blockchain technology allow users to make and receive payments without ever going near a legacy bank. The world’s first mobile-money network for P2P real-time merchant payments was developed in Kenya, and last year Kenyans completed over two billion fintech-enabled transactions.

Insurance and reinsurance companies are learning fast from the banking sector, where loans and bill payments are now often accompanied by the option of targeted insurance products within a customer’s digital journey through their organisation.

An overwhelming proportion of insurance decision-makers now believe that embedded insurance will move from being a ‘nice-to-have’ add-on to a ‘must-have’. While the sector understands that the vast majority of Gen Z consumers now expect personalisation and contextualisation in what they’re offered – and popular streaming services such as Netflix and Spotify seem to underline that expectation – the insurance industry is working towards making sure these new digital offerings are, indeed, contextualised to customers’ specific needs at that time. In addition, opinion suggests that these products must be seamlessly accessible within just three clicks to their digital basket. In a market shift tantamount to moving from a siloed product to an insurance ecosystem, the distribution models of old – insurers, MGAs, reinsurers – are facing their biggest challenge yet.

Is this new ecosystem a viable reality, an unproven vision for the future, or simply a wild fantasy? And if it’s becoming a reality, what technology will allow insurance and reinsurance companies to achieve an integrated and seamless digital portfolio of product offerings?

What is embedded insurance?

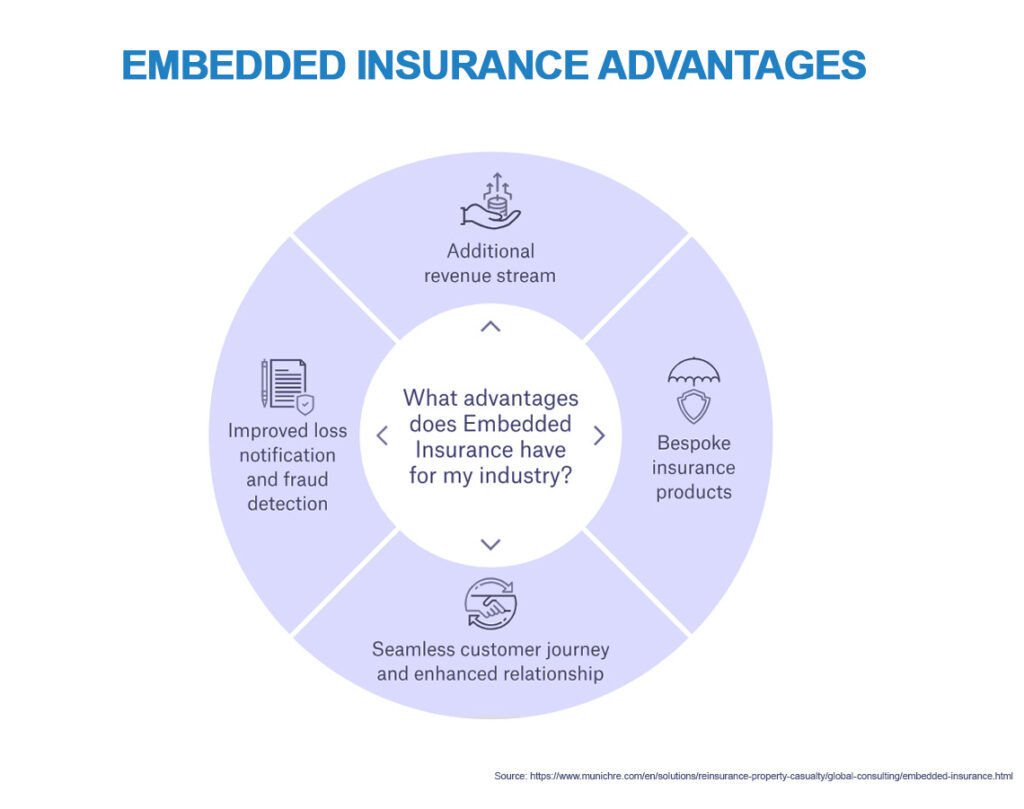

In short, it’s a technology-enabled innovation that addresses customers’ needs in real time and links all the touchpoints in their digital transit through an insurer’s organisation or digital platform to present a seamless customer journey. Policies are integrated into any variety of products or services that carry any sort of risk, financial or otherwise. For example, with three tiers of embedded insurance now common – integrated as part of added-service value, offered for purchase at point of sale, or a complimentary add-on to other service or product offerings – it is not unusual to find embedded cover in anything from bank cards to airline tickets.

In the case of the former, customers are given complimentary travel insurance automatically as soon as the cardholder completes any travel-related purchase. In the airline industry, UK low-cost carrier EasyJet offers embedded insurance via a partnership with Columbus for purchase during the check-out process tailored to your particular travel needs, whereby a flight to the Alps might generate tailored cover offerings for a family skiing trip.

Worth around US$ 160 billion in 2024, the embedded market is growing rapidly, with some estimates putting it at around US$ 700 billion by 2030. Within the next four years, around one-third of all insurance transactions will likely be carried out through embedded channels as clients and consumers flock to digital platforms that sidestep the time, effort and frustration they typically associate with finding suitable insurance.

The huge growth in Insurtech platforms offers enormous flexibility and ease-of-use for integrated-insurance customers; digital insurance ecosystems mean claims can often be made with just a few clicks, and sometimes entirely automatically. That’s to say, no filing for claims, no phone calls, no long delays to claims settlement, making integrated insurance even more attractive through the speed and efficiency now available in automatic claims processing and pay-outs.

The JENOA view

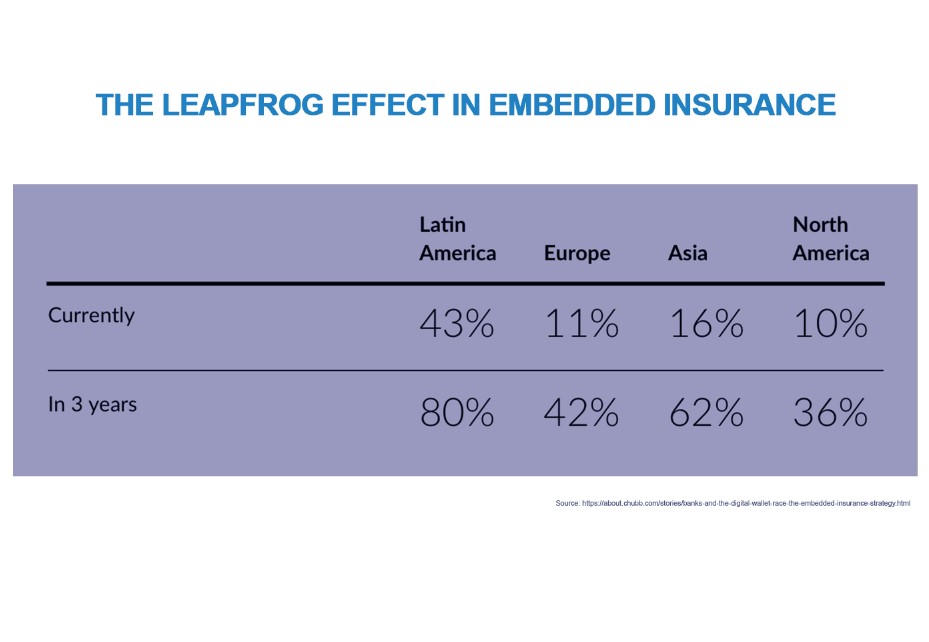

As things stand, the bulk of the growth in embedded transactions is happening in Latin America, with embedded-insurance revenue accounting for over 40% of all insurance revenue in the region, compared to just 10% in North America and 11% in Europe.

Although all regions are expected to see significant growth by 2028, Latin America’s share of revenue from embedded insurance products is expected to rise to a staggering 80% within the next three years. This surprising disparity in the regions owes much to the fact that Latin America and Southeast Asia were largely cash societies before the advent of widespread digitalisation, and it usually followed that the unbanked were also the uninsured or underinsured.

By way of comparison, Latin America is more or less on a par with the GCC for insurance penetration, where the insurance penetration index is far lower than in other developed economies around the world, with the ratio of gross underwritten premiums (GWP) as a percentage of GDP in the region at around 2% compared to the GCC’s 1.9%. This is well below the emerging-market average of 3.4% and the global average of 7.4%. Across the GCC, the UAE (3.2%) and Bahrain at (2.1%) have the highest penetration rates.

The upshot of all this is that emerging markets and underinsured regions are leapfrogging legacy banking and insurance entities to enthusiastically adopt digital insurance. This offers unrivalled potential for growth in the future. It also goes some way to explaining why insurance executives in underinsured regions where insurance infrastructure has typically been underdeveloped are more engaged with the growth and future potential of the embedded-insurance sector than those in Europe or the US.

Untapped future growth markets

Insurers should not limit their focus to geographical regions when it comes to chasing growth in the embedded sector; it is equally important to maintain focus on changing consumer preferences within shifting demographics.

And when it comes to demographics, there is no segment more important for this growth market than Gen Z. This is a segment that, by an overwhelming majority, reports that their loyalty will go to brands that treat them as individuals. That means personalised playlists on Spotify according to their taste or mood, for example, or personal recommendations on Netflix or Amazon. Clever insurance executives in the legacy insurance sector will understand that, for Gen Z, insurance is no exception. In addition, they expect simplicity – a maximum of three clicks from offering to basket – and have come to expect all products to be tailored to meet their specific needs or circumstances in a seamless environment.

What technology do you need to create an embedded insurance ecosystem?

The personalisation of insurance products is a powerful tool in the ultimate goal of a seamless journey for consumers and increasing margins on insurance products.

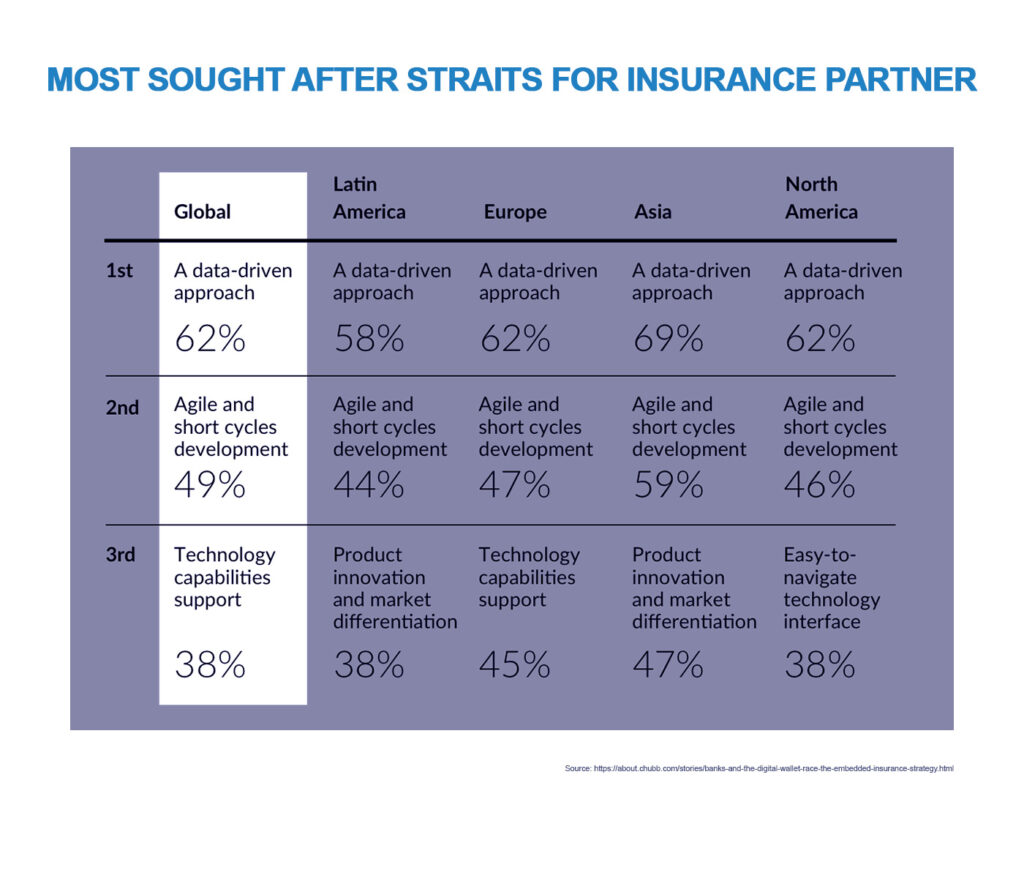

Building technology capabilities with a consumer-friendly digital journey in mind is far from impossible, but there are some technical necessities that insurers should follow closely, as well as strategic advice that insurers would do well to consider.

Application Programming Interfaces (API) are the principal technological enablers for embedded insurance. APIs are used to ensure a variety of systems and platforms can interoperate seamlessly. As a customer progresses through their digital journey with an insurer, APIs mean you can collect essential customer information and begin making suggestions to tailor cover specifically to the customer. There are, however, four key elements of the embedded-insurance technology stack that insurance organisations should focus on: seamless integration, scalability and flexibility, security and compliance, and strategic partnerships.

- The first – seamless integration – is crucial because the all-important timing and relevance of an insurance offering to a customer at the moment of need is dependent on the trouble-free integration of a variety of systems and ecosystems, from smart devices to fintech platforms and e-commerce websites. Microservices architectures and APIs will be key to ensuring secure data flows between them all.

- Scalability and flexibility are vital because no insurer can accurately predict increased loads as a result of unexpected growth or unpredicted spikes in demand. Cloud solutions are the obvious answer here, because cloud providers can respond to increased loads by dynamically adjusting resources instantly in response to changes in demand and data volumes.

- Thirdly, security and compliance for embedded insurance is paramount; the exchange of personal financial data means the technology must offer secure protections against data hacks in the form of, for example, multi-factor authentication.

- Platforms in the cloud tend to be more reliable in this respect than on-premise infrastructure. For example, Microsoft’s cloud platform, Azure, leverages the corporation’s staggering USD$1 billion-per-annum investment in security, including the 3,500 security experts who keep the platform secure.

- The final important building block to enabling success for insurers in this segment is predicated on building strategic partnerships to ensure that your embedded insurance functions flawlessly and as designed. Strategic partnerships with key organisations offer insurers and joint-venture partners across all verticals the chance to develop new markets and monetise new relationships by crafting an attractive joint value proposition for customers. Collaborating to deliver a product and service that drastically enhances the customer experience – making them feel valued with easy access to tailor-made cover – drives profitability, brings external expertise into your organisation and mitigates risk.

What does this mean for MENA clients, and how can JENOA help?

JENOA has significant experience and expertise helping insurance and reinsurance players in the MENA region face a multitude of challenges. By offering access to the Lloyd’s of London market in addition to all reinsurance hubs around the world, JENOA can leverage established Lloyd’s capabilities alongside international reinsurance to offer risk mitigation and strategic advice to clients as we help them prepare for and react to rapid change and digitalisation in the sector. Our strategic partnerships are well placed to advise on building and exploiting joint ventures across multiple verticals, and with a strong focus on insurtech, our end-to-end digital brokerage offers a much broader reach into markets in MENA and further afield with expertise in disrupted markets.

Seamless journeys to enhanced revenue

The rapid pace of technological advances in the insurance and reinsurance industry has taken many by surprise. However, players in the MENA market have little to fear from disruption, given the vast potential to rapidly fill an insurance protection gap in the MENA region that has resolutely eluded legacy insurers so far.

With MENA’s insurance penetration index stuck below 2%, the chance to close that gap with the help of enhanced Islamic takaful offerings across the sector gives players in the region unrivalled potential for broadening and deepening their customer base across a region where high smartphone penetration and a large digital-native Millennial and Generation-Z demographic offer huge potential for insurers to grow their business in the GCC and a platform from which to further expand into digital cross-border growth in the wider under-served MENA region.