As 2023 drew to a close and the world began to emerge from the inflationary shocks of 2022, uncertainties nevertheless still persist. Inflation is by no means under control and within central bankers’ targets,[1] and geopolitical risk, especially in the Red Sea and, unavoidably, the Suez Canal, offers the potential for more costly headaches ahead.

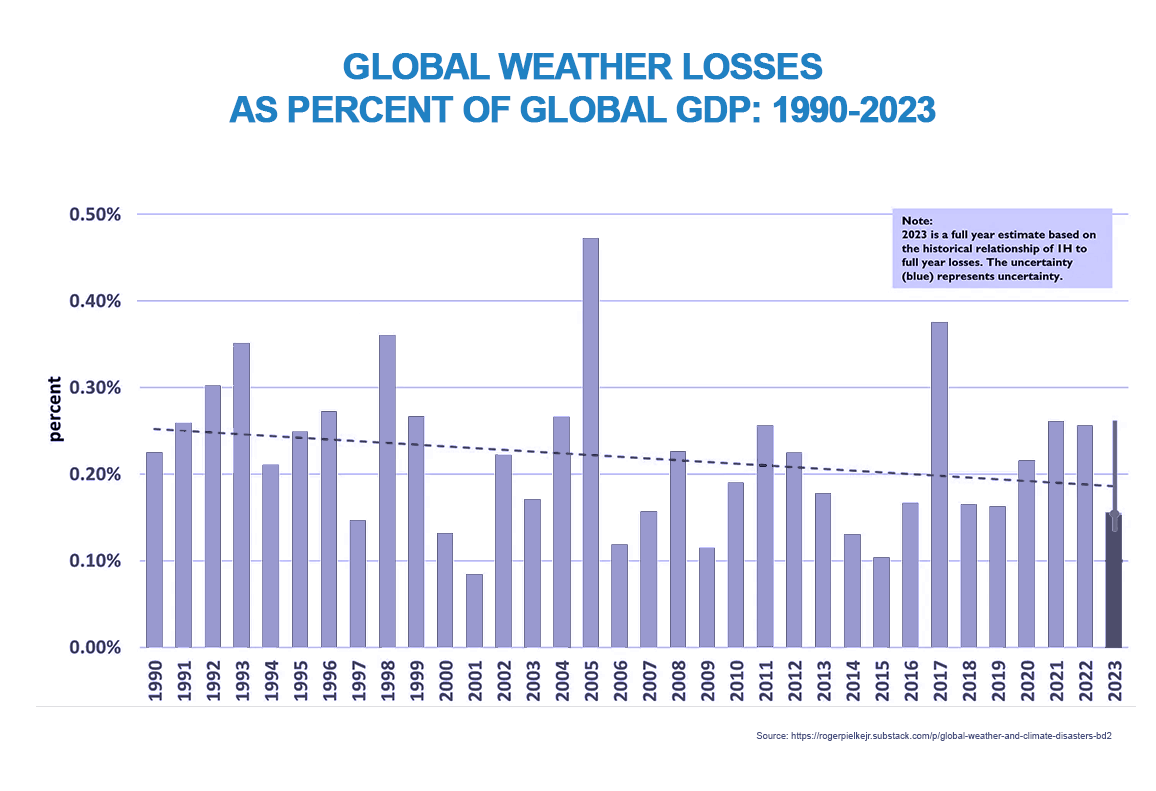

Dynamic risks such as extreme weather and cybercrime only add to market complexity. Even though the former is currently on a 30-year downward cost trend,[2][3] the whole point about decadal and inter-decadal natural variability is that it is unpredictable. Meanwhile, cybercrime costs are set to rise by 15% per annum[4] over the next few years, to reach US$ 10 trillion by 2025.

Headlines – 2023

Despite Swiss Re reporting that 2024 would see further rate hardening in property and catastrophe, as well as constraints on capacity given the imbalance between demand and supply,[5] the high inflation and high interest-rate environment has not, apparently, damaged insurers’ bottom lines. Investment in longer-term fixed-income assets has proven a boon for non-life insurers, with Swiss Re’s chief economist adding that, “non-life insurers’ profitability is set to improve strongly in the coming years as higher interest rates and rate hardening more than offset higher claims costs from persistent inflation”.[6]

In the reinsurance market, a notable improvement in earnings was reported for Q1–Q3 2023, with average net income returns on equity jumping to the 18%–21% range.[7] Better pricing and revenue growth in property and casualty reinsurance can take some of the credit for this, but improvements were also strongly influenced by lower natural catastrophe claims in 2023, especially as the US hurricane season – typically representing around 60% of global insured losses[8] – was significantly less damaging than initial catastrophe models had suggested.

As the January 2024 renewals approach, the market is expecting improved conditions compared to January 2023, with renewals expected to be “flat or slightly up” in January 2024, but within single digits.

In the MENA region, reinsurers continued to enjoy positive rate momentum at recent renewals, with favourable pricing trends set to continue into 2024, according to a new report from AM Best.[9] AM Best also notes, however, that, “the region is not homogenous, and countries are facing fresh and varying challenges, from supply-chain disruptions and inflationary pressures, to elevated economic, financial system, and political instability in certain markets”. It also draws attention to the fact that inflation in the region ranged from 0.6% in Oman to 38% in Turkey in 2023.

Core themes in 2023 and implications for 2024

Marine insurance and vessel safety in the EV sector

The 2023 loss of yet another car-carrier, the Fremantle Highway, to fire off the Dutch coast in late July, has added to growing concerns in the marine insurance sector around risks involved in the shipping of electric vehicles (EVs) and lithium-ion battery cells in general. The vessel was carrying around 4,000 vehicles, of which around 500 were EVs.[10] The fire caused significant economic damage, with industry insiders suggesting that the vessel would be written off as a constructive total loss.[11]

The issue was already high up the news agenda since the loss of car-carrying vessel Felicity Ace off the Azores in February 2022. That fire resulted in the total loss of the vessel, as well as freight losses of around US$ 400 million.[12] The vessel ultimately sank some 200-miles off the coast of the Azores two weeks after the fire took hold. The growing incidence of onboard fires, accompanied by a sharp rise in the shipping volumes of l-ion batteries, has seen the insurance industry adopt an increasingly sceptical view of automaker claims of a mere coincidence between the two.

Photo credit: © Netherlands Coastguard.

In 2023, fire accounted for nearly 20% of the value of all marine claims.[13] In 2022, eight vessels were lost to fire, with approximately 200 reported incidents. According to Allianz’s Safety and Shipping Review 2023, this was the highest for a decade. In the last five years alone, some 65 have been lost to fire, and whilst overall losses have declined by 65% in the last ten years – 100 vessels were lost in 2013, compared to only 38 in 2023 – losses due to fire have not followed the same trend. This coincides with a 35% rise in EV shipping volumes from 2022.[14]

Pre-emptive measures to mitigate the increasing risk posed by the transport of l-ion cells are therefore likely to become more urgent in 2024, as insurance companies begin to broaden and deepen conditions of carriage before car-carrying vessels can obtain cover in the future. Operators in the ropax car-carrying passenger ferry market are already beginning to ban EVs from carriage[15] because of the associated high fire risk. Inevitably, rising insurance costs for EV and l-ion cell shipping will further add to the upward cost pressures on already weakening EV sales, as OEMs scale back plans for EV manufacturing and dealerships slash prices to offload unwanted stock. In the UK, fleet commercial sales have grown, driven largely by generous but temporary taxpayer-funded subsidies and tax breaks. Yet, with EVs accounting for just 2.5% of total car stock, EV sales to the private retail market fell by nearly 15% in 2023. This fall is likely to be accompanied by a corresponding drop in the EV auto insurance segment during 2024 and 2025, where premiums have risen by more than 70% in 2023 on the back of persistently higher repair costs, expensive personal-injury claims and extended off-road time.

Geopolitical impact: marine insurance, supply chains and business interruption insurance – 2024

As alluded to in the introduction, political uncertainty persists in the Red Sea and Bab-al-Mandeb Strait regions. Several carriers, either suspended or rerouted transits through the Suez Canal[16] in mid-December, which previously carried around 30% of global container shipping volumes.[17] In a bid to reassure commercial shipping and keep trade routes and international supply chains free from disruption, a multi-national coalition, has been established to protect shipping transiting the Red Sea and Gulf of Aden from further attacks.[18] However, at the end of December 2023, some 350 vessels had diverted via the Cape of Good Hope, whilst live vessel tracking as of December 29, indicated that only around 15 vessels had reversed decisions to divert and looked set to turn back to the Red Sea/Bab-al-Mandeb Strait with plans to transit the Suez Canal.

Transit via circumnavigation of the African continent usually signifies a 25% increase in journey time from Asia to the US east coast, with additional shipping and fuel costs, as well as increased marine insurance. As supply chain specialists Flexport report, “carrier costs for fuel and crew will increase meaningfully. Additionally, with any service disruption, global shippers should expect base rates to increase as well as additional fees such as a War Risk Surcharge, Emergency Bunker Surcharge, Emergency Surcharge, or a Peak Season Surcharge”.

The situation is fluid but considering that many carriers were already avoiding the Panama Canal due to low water levels from a local drought,[19] this is likely to have considerable impacts on global supply chains, leading to inevitable and ongoing claims from supply-chain and business interruption throughout 2024.

COP28: business as usual for the hydrocarbon and insurance industries?

At the UN’s COP28 annual climate conference in Dubai, a pragmatic approach was taken to phasing out fossil fuels and utilising transitional fuels, notably natural gas.[20]

As Bloomberg notes, “it opens an enormous backdoor to support the use of natural gas for years, if not decades, to come. So perhaps COP28 marked the sunset of the fossil-fuel era, only to herald the dawn of the “transitional fuel” era — in the form of transitional gas”.[21]

In a carefully worded statement, COP28’s final communiqué called for a transition, “away from fossil fuels in energy systems”. It is worth noting that it specifies “energy systems”, with no reference to transport, agriculture, domestic heating or plastics, where sequential fractional distillation requires the production of LPG and petrol before obtaining the distillates needed for plastics. The precise phrasing alludes to “transitioning away from” rather than “phasing out”, placing the onus squarely on the demand side rather than the production side.[22]

In addition, COP28’s call for an “orderly” transition allows OPEC+ countries – as well as the world’s largest oil producer, the US – supports the case that an “orderly” transition is required based on diversification, including continued investment in new oil fields. Given that around half the OPEC members are oil-producing jurisdictions in the MENA & GCC region, we can expect an increased appetite and capacity for hydrocarbon projects in the future as part of a broader vision of economic diversification.

Collapse of Net Zero Insurance Alliance cartel

In a sequence of events that surprised very few people, the insurance industry’s Net Zero Insurance Alliance (NZIA) continued to lose members during the course of 2023. UN climate envoy Mark Carney’s highly politicised climate-activist movement discovered to its surprise that it was not above the law, as it came into direct contact with the realities of US federal and state antitrust regulations.[23] US lawmakers raised concerns over an “illegal boycott” and a “collective agreement to fix prices” in violation of several antitrust laws at the federal and state level.[24]

In Q1 & Q2 2023, a trickle turned into a deluge; founding member Munich Re quit the alliance in March, followed closely by Zurich, Hannover Re and Swiss Re in the spring, with departures from Axa, Alliance and Lloyd’s of London, among others, hot on their heels. From a peak of around 30 members in early 2023,[25] NZIA now has just 11, with only two of its eight founders – Aviva and Generali – still listed as members.[26]

According to Moody’s assessment, “coordinating to deny insurance coverage to companies in certain carbon-intensive sectors could be deemed anticompetitive and in violation of antitrust laws because it could lead to higher insurance prices for these companies as a result of restricted competition for their business”. As reported in the Financial Times, several European governments had also expressed increasing concerns that a mass withdrawal from underwriting hydrocarbon projects could result in rising energy costs.

Trends in oil and gas insurance for 2024

The UN’s COP28 climate gathering “calls on” the world to transition away from fossil fuels, but given the weak wording used in its final declaration – “calls on”, according to Bloomberg’s energy analyst, Javier Blas, represents “the weakest of all exhortations used in diplomatic language” – the 2024 trend in underwriting and investing in the oil and gas industry is likely to follow 2023 trends, which saw 24 of the world’s largest 30 insurers continue to underwrite new oil and gas projects.[27]

Despite high-profile announcements from some insurers in 2023 that they would withdraw from oil and gas, virtually all insurers continue to offer cover for new midstream and downstream infrastructure.[28] Whilst high-profile 2023 withdrawals from fossil fuels announced by Allianz and Munich Re’s 457 syndicate made headlines, they included special provisions for the exclusion of new upstream projects from their widely reported withdrawal from oil and gas. According to market intelligence monitor Insuramore, insurers and reinsurers earned over US$ 21 billion last year from insuring coal, oil and gas projects, with insurers in the Lloyd’s of London market representing the world’s largest underwriters of hydrocarbon projects, with over US$ 2 billion in annual premiums.

In short, there is a growing realisation that high investment returns and high premium income from an industry that continues to supply the vast majority of the world’s direct primary energy consumption,[29] trump even the most well-meaning gestures the industry may make to appease dominant political narratives.

Evolving risks in AI and cybercrime in 2024

As we reported earlier in 2023, the integration of artificial intelligence (AI) in insurance is attractive; automation is able to streamline routine tasks, allowing humans to concentrate on complex decision-making and crucial relationship management. Yet, the rapid adoption of AI has introduced a raft of new risks that demand innovative risk-management strategies.

Complex intellectual property (IP) issues are likely to continue to emerge, with IP owners already accusing AI tools of gathering training data without consent or permissions.[30] Cybersecurity has so far largely been overlooked as the hype surrounding AI’s potential capabilities has dominated the headlines. Nevertheless, cybercrime – including major hacks, cryptocrime and ransomware – was already a massive problem before the emergence of generative AI, costing a staggering US$ 8 trillion in 2023.[31] Now, that problem is enhanced even further; certain AI tools already have the capability to create code for so-called polymorphic malware, a type of malware that, under the cover of encryption, can replicate and mutate, proving highly evasive for cybersecurity professionals.[32]

In addition, insurers will need to keep a close eye in 2024 on risks around a lack of regulation and standardisation that currently characterises the AI market. In particular, as was noted at the recent AI Safety Summit in the UK, cybersecurity and biotechnology risks pose some of the biggest potential hazards. “There is potential for serious, even catastrophic, harm,” the summit noted, “stemming from the most significant capabilities of these AI models.”[33]

Insured losses: a perspective on hurricanes, extreme weather events and natural climate variability

After a relatively docile 2023 US hurricane season, insurers and reinsurers that have made an art of successfully pricing risk will continue to assess the IPCC’s ongoing reports on climate change in order to price risk effectively, to deliver long-term value for investors. Bearing in mind that US landfalling hurricanes (tropical cyclones) account for around 60% of global insured weather-related losses,[34] it is worth revisiting the IPCC’s most recent AR6 report, which states clearly that the science neither detects nor expects to detect a climate-change signal in tropical cyclones out to 2100.[35]

In October 2023, Lloyd’s of London’s Head of Markets, Patrick Tiernan, gave the industry a reality check as he reminded the market that repeated and dominant headlines blaming natural catastrophe losses on climate change were “wrong and lazy”. Much of the industry’s analysis, he claimed, was from a “vested interest perspective”, and reiterated the fact that, “it’s vital as an industry that we are on top of the latest science”.[36]

Not only is Tiernan correct when he observes that “there is no compelling upward trend”; he is also not alone in acknowledging what many in the industry already know: that the growth in human and economic assets in high-hazard locations, particularly when accompanied by high inflation, is primarily to blame for high losses. Indeed, industry analysis has identified, through a process of normalising losses not just for inflation but also for GDP and socio-economic factors, that by far the most damaging and expensive hurricane in US history, were it to make landfall with today’s assets, was the 1926 Great Miami hurricane, which would have caused US$ 262 billion in 2022 prices, around twice as damaging as Hurricane Katrina in 2005 (US$ 130 billion) and more than four times the US$ 62 billion losses from Hurricane Ida in 2021. Yet, in spite of apparently higher losses, the 30-year trend in global weather losses as a percentage of GDP is downward, underscoring the world’s collective success in preparing for unpredictable weather extremes through disaster risk reduction, even though we continue to place more, and increasingly more valuable, economic and human assets in harm’s way.

As a long-term climate collaborator with the reinsurance industry notes, “it is important for people to understand that what has been observed in terms of hurricane landfalls and losses of recent years is fairly typical of what has been seen over the past century. Whatever climate signals scientists might tease out of the historical records” – and the IPCC’s AR6 report offers little by way of a climate signal for the vast majority of weather phenomena even under implausible RCP8.5 high-emissions scenarios – “the impact of hurricanes on society is overwhelmingly determined by how we build, where we build, what we build, what we place inside, and how we warn, shelter, evacuate, recover and so on. That is in fact good news, because it tells us that the decisions we make (and don’t make) will determine the hurricane disasters of the future”.

The Türkiye/Syria earthquakes in early 2023 – the costliest single event of 2023 – have reminded the industry that the world still faces vulnerability from unpredictable natural catastrophes outside of weather and climate. Regarding extreme weather and natural decadal and inter-decadal climate variability, however, we are likely to continue to experience decreasing vulnerability in relation to extreme weather, and lower losses as a proportion of GDP over decadal and inter-decadal timeframes.

Insurers that remain profitable will be the ones that understand and price for natural decadal and inter-decadal variability in extreme weather. As a case in point, the single biggest event from weather-related losses in the US in H1 2023 came from hail, for which the IPCC’s AR6 report detects no emerging climate-change signal out to 2100.

How is 2024 and beyond shaping up?

Fitch Ratings forecasts “an improvement in underlying profitability for the global reinsurance sector in 2024”, and its sector outlook marks an expected improvement in 2024.

It is predicting single-digit renewals for January, having established that capacity is sufficient to meet demand in 2024, and there will be less upward pressure on renewals compared to January 2023. Price rises in 2024 are likely to be most pronounced in political risk, terrorism and political violence lines due to higher levels of unrest globally.

Higher profitability is also likely to be achieved by insurers and reinsurers that can successfully balance the potential and opportunities offered by AI and machine learning, neural networks and natural language processing with the considerable risks associated with emerging capabilities that few are able to accurately predict. Nevertheless, streamlined insurance processes through AI could allow insurers to redeploy relatively expensive human resources to more productive occupations.

The importance of the oil and gas industry – as tacitly acknowledged in the recent COP28 declaration – is likely to translate into high investment returns and high premium earnings for the 80% of global insurers and reinsurers among the top 30 that remain committed to supporting upstream, midstream and downstream hydrocarbon projects into the future, especially as natural gas has now been officially and very publicly recognised as a necessary “transitioning fuel”.

COP28’s acceptance of the need for fossil fuels well into the future is likely to enhance potential investment and premium earnings for regional MENA, GCC and global insurers and reinsurers for decades to come. This scenario will also offer new investment and premium potential in the carbon capture and storage (CCS) industry of the future, where existing capacity to abate hydrocarbon carbon-dioxide emissions will need to be scaled up by at least two orders of magnitude – or around 100–300 times existing capacity – in order to abate emissions from the continued requirement for fossil fuels.

In the shorter term, whilst the insurance and reinsurance industry cites inflation and interest-rate volatility as their biggest barriers to growth going into 2024 in a recent Willis Towers Watson poll,[37] non-life profitability will rise to around 10% return on equity, which represents a major improvement on the ten-year average of under 7%. Higher interest rates will benefit higher investment returns, contributing to an overall improvement in profitability, whilst underwriting will be helped by falling inflation and improved terms and conditions, which themselves will offset the effects of inflation on claims costs.

[1] https://www.bankofengland.co.uk/monetary-policy/inflation

[2] https://rogerpielkejr.substack.com/p/global-weather-and-climate-disasters-bd2

[3] https://www.undrr.org/monitoring-sendai-framework

[4] https://cybersecurityventures.com/cybersecurity-almanac-2023/

[5] https://www.insurancetimes.co.uk/news/general-insurers-profitability-to-lag-behind-cost-of-capital-in-2023-swiss-re/1445561.article

[6] https://www.insurancetimes.co.uk/news/general-insurers-profitability-to-lag-behind-cost-of-capital-in-2023-swiss-re/1445561.article

[7] https://www.insurancebusinessmag.com/uk/news/breaking-news/fitch-ratings-discloses-assessment-of-large-global-reinsurers-468587.aspx

[8] https://rogerpielkejr.substack.com/p/a-remarkable-decline-in-landfalling

[9] https://www.theinsurer.com/reinsurancemonth/mena-reinsurers-to-benefit-from-positive-pricing-momentum-into-2024-am-best/

[10] https://gcaptain.com/boskalis-ceo-says-fremantle-highway-fire-started-in-upper-vehicle-decks/

[11] https://www.tradewindsnews.com/casualties/dutch-to-tow-burned-out-car-carrier-fremantle-highway-to-port-of-refuge/2-1-1493220

[12] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/scorched-cars-burn-insurers-facing-higher-risks-from-electric-vehicle-transport-69252443

[13] https://www.insurancebusinessmag.com/uk/news/marine/ship-fires-still-top-concern-for-shipping-industry-454294.aspx

[14] https://www.gartner.com/en/newsroom/press-releases/2023-09-07-gartner-forecasts-15-million-electric-cars-will-be-shipped-in-2023

[15] https://ferryshippingnews.com/a-bold-decision-only-fossil-fuel-powered-vehicles-allowed-on-havila-voyages-ships/#:~:text=Havila%20Kystruten%20has%20decided%20only,on%20board%20the%20hybrid%20vessels

[16] https://container-news.com/major-box-carriers-pause-container-ship-traffic-through-red-sea/

[17] https://www.fitchratings.com/research/corporate-finance/higher-shipping-freight-rates-to-offset-costs-of-re-routing-from-suez-21-12-2023

[18] https://www.flexport.com/blog/global-ocean-carriers-halt-red-sea-transits-what-to-expect/

[19] https://mohawkglobal.com/global-news/ocean-carriers-re-route-due-to-panama-canal-red-sea-concerns/#:~:text=Shipping%20lines%20have%20begun%20changing,ongoing%20conflict%20in%20the%20region

[20] https://www.bloomberg.com/opinion/articles/2023-12-13/climate-emergency-does-cop28-mark-the-beginning-of-the-end-for-fossil-fuels

[21] https://www.bloomberg.com/opinion/articles/2023-12-13/climate-emergency-does-cop28-mark-the-beginning-of-the-end-for-fossil-fuels

[22] https://www.bloomberg.com/opinion/articles/2023-12-13/climate-emergency-does-cop28-mark-the-beginning-of-the-end-for-fossil-fuels

[23] https://attorneygeneral.utah.gov/wp-content/uploads/2023/05/2023-05-15-NZIA-Letter.pdf

[24] https://attorneygeneral.utah.gov/wp-content/uploads/2023/05/2023-05-15-NZIA-Letter.pdf

[25] https://www.reuters.com/business/insurers-climate-alliance-loses-nearly-half-its-members-after-more-quit-2023-05-30/#:~:text=The%20NZIA%2C%20which%20was%20formed,and%2030%20in%20late%20March

[26] https://www.unepfi.org/net-zero-insurance/members/

[27] https://www.energymonitor.ai/finance/risk-management/insurers-double-down-on-fossil-fuel-projects-despite-record-climate-disaster-payouts/?cf-view

[28] https://www.energymonitor.ai/finance/risk-management/insurers-double-down-on-fossil-fuel-projects-despite-record-climate-disaster-payouts/?cf-view

[29] https://ourworldindata.org/grapher/global-primary-energy

[30] https://www.farrer.co.uk/news-and-insights/getty-gets-tough-on-london-based-ai-firm/

[31] https://cybersecurityventures.com/cybersecurity-almanac-2023/

[32] https://www.britinsurance.com/news/how-ai-has-changed-the-threat-landscape-in-2023

[33] https://www.gov.uk/government/publications/ai-safety-summit-2023-the-bletchley-declaration/the-bletchley-declaration-by-countries-attending-the-ai-safety-summit-1-2-november-2023

[34] https://rogerpielkejr.substack.com/p/a-remarkable-decline-in-landfalling

[35] https://www.ipcc.ch/report/ar6/wg1/chapter/chapter-12/

[36] https://www.insurancenews.com.au/daily/a-little-bit-lazy-lloyd-s-chief-criticises-climate-change-claims-narrative

[37] https://www.wtwco.com/en-gb/news/2023/11/insurers-predict-interest-rates-bridging-the-talent-gap-and-digital-transformation