Widespread vehicle connectivity is already a feature of both internal combustion engine vehicles (ICEVs) and the electric vehicles (EV) of the future, creating great potential for ever higher levels of automation in mobility.

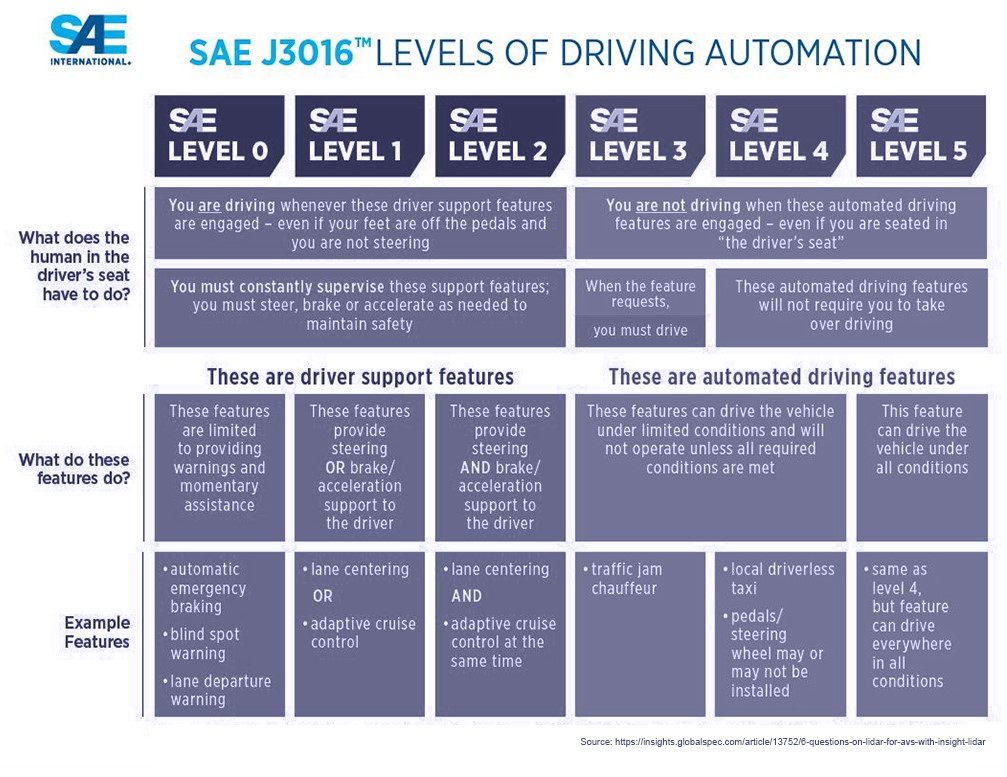

Advanced Driver Assistance Systems (ADAS) such as forward collision warning (FCW), autonomous emergency braking (AEB) and lane-departure warnings have been a feature of motoring for many years, but as vehicle design progresses from assistance to automation, what does the future look like for insurers?

Connected vehicles, autonomous vehicles and EVs: are they all the same?

The growth in connected vehicles incorporating digital communication and processing capabilities is often conflated with autonomous vehicles, or even with EVs. In truth, however, these terms are not necessarily interchangeable. At the moment, there are a number of petrol and diesel vehicles on the roads that are connected to their surroundings, with ‘smart motorways’ that can communicate potential hazards and obstructions further down the road to enabled vehicles via satellite communications. There are also several petrol and diesel models with low levels of automation that feature functions such as cruise control, forward collision warning (FCW), automated emergency braking (AEB) and automated lane discipline.

Whilst it is certainly true that modern EVs can be connected not just to their immediate surroundings, but to their OEMs and software suppliers too, with the ability to receive over-the-air software updates and fixes, connectivity does not necessarily give them any autonomous features. It is also true that the forthcoming autonomous vehicles will, by definition, be ‘hyper-connected’; safety and utility will rely on multiple redundancy and latency supplied by 5G and edge computing embedded in the smart city of the future. The auto industry defines these as connected-vehicle platforms, a digital chassis from which OEMs can sell value-add services to consumers.

Already, we see so-called smart motorways in the UK with an array of sensors and radar technology, for example, the precursors to smart cities that will be able to connect to enabled vehicles and not only warn of hazards or obstructions on the road, but also take care of integrated navigation, traffic and congestion management and safety.

Current state of the market

The market for connected vehicles is estimated at around US$ 63 billion in 2023, and although estimates vary wildly looking to the future, the market is expected to reach between US$ 140 billion and US$ 225 billion by 2027/2028.[1][2]

Much of the growth in connectivity comes from a combination of advanced driver assistance systems (ADAS), onboard vehicle information and hazard-warning systems and entertainment.

The growth of integrated ADAS and early-warning systems in vehicles is a natural progression in regulatory jurisdictions around the world that are focusing on improving vehicle and road safety. Both the EU and Japan made autonomous emergency braking systems (AEBS) mandatory for all new cars and light commercial vehicles as of 2022, which the European Union estimates will save around 1,000 lives per annum in the EU.[3] At the moment, however, these are largely independent systems within a vehicle; they simply respond to a signal from sensors on the vehicle. If a sensor detects that a vehicle is too close to another vehicle or object, it will sound a forward collision warning, which in turn may activate autonomous emergency braking systems.

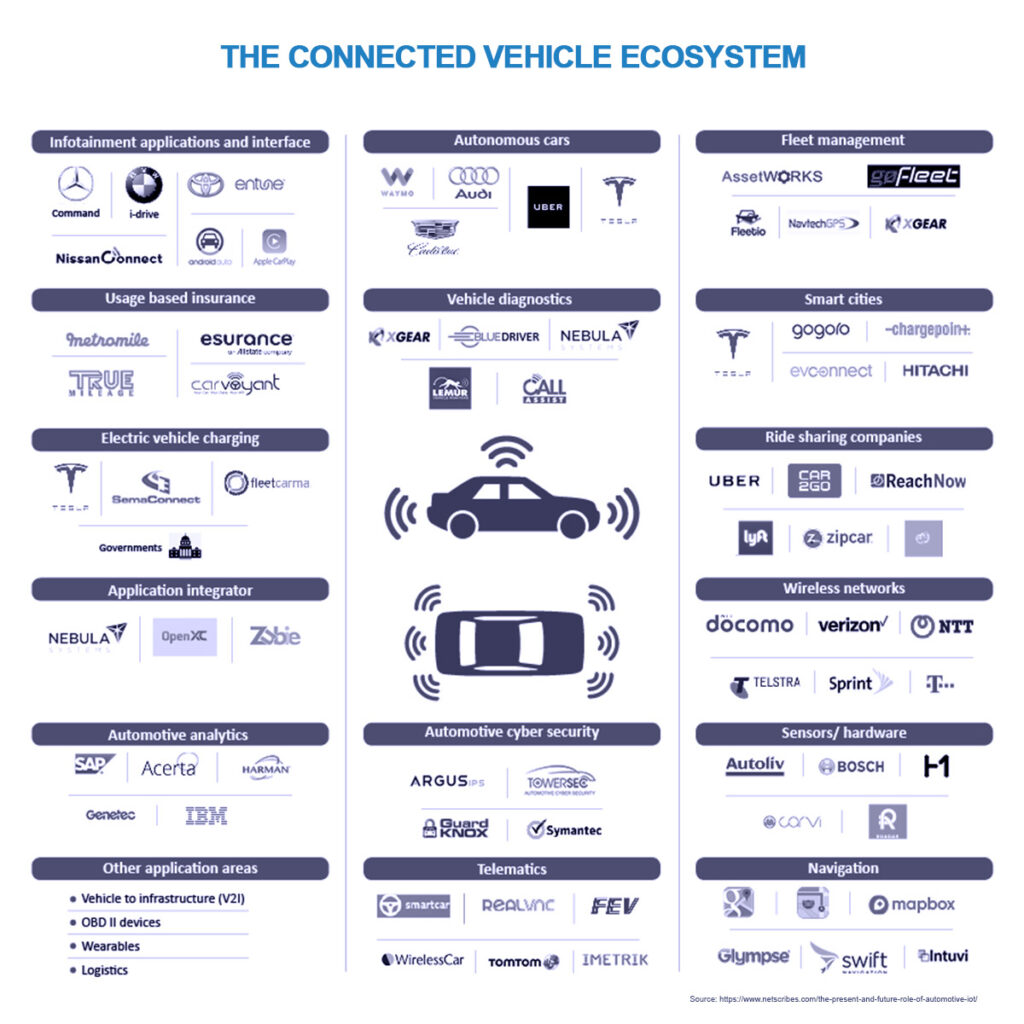

The inevitable evolution of the market, however, will lead to hyper-connectivity on a scale that sees vehicles simply as part of a greater digital ecosystem that encompasses traffic and parking management, navigation, traffic signaling and even connected cyclists and pedestrians. In short, vehicles will become part of city networking, with a continuous exchange of information and data via fixed devices, sensors, edge computing and automotive cloud services.[4]

Evolution of connected vehicles

Connected vehicles will connect to software and hardware services and devices via digital wireless networks. This includes other connected car technology such as entertainment and communications systems or parts of external infrastructure, including emergency centres and navigation aids.[5]

This evolving technology will continue to mature, to the extent that we will likely see high or full automation and enhanced V2X (vehicle-to-everything) connectivity, enabled by a higher penetration of 5G and 6G, by the 2030s. Vehicles will be completely ‘sentient’ not just of other vehicles, but also of all other connected transport users and static infrastructure.[6]

The connected vehicle will, in turn, rely on a connected-vehicle ecosystem encompassing everything that can, and will, communicate with vehicles through smart-city platforms; connected pedestrians, cyclists, traffic and environment management systems will be able to interact with vehicles via fixed or mobile devices and sensors. This ecosystem will process information on location, weather and driving conditions, parking availability, congestion and hazards. In short, connected vehicles will ultimately become part of inner-city networks with a continuous exchange of information and data via fixed devices, sensors, edge computing and cloud services.

As 5G grows and 6G wireless communication becomes more widely adopted, those ecosystems will turn hyper-connected vehicles into sentient machines that use data exchanges to autonomously enable everything from situational awareness to onboard entertainment and predictive maintenance.

Outside of technology, connected vehicles are also likely to appeal to luxury niche markets interested in the broad notion of sustainability; resource intensity, recycling, sources of battery minerals and rare earth minerals, and the distant but heavy social cost of battery production, are all high in consumers’ minds. Indeed, consumers are willing to pay more for sustainability, according to industry research; for example, 60% of sustainability-minded drivers are willing to pay at least 6% more for a sustainable vehicle, whilst a further 30% are willing to pay between 1% to 5% more.[7] There is, however, a slight sting in the tail of this report for OEMs; sustainability-minded drivers are open to certain trade-offs in a sustainable vehicle, with over 60% open to less-attractive, more-functional design (63%) or lower performance (62%). As Accenture’s report states, “sustainability-minded drivers are willing to accept trade-offs on factors that many in the automotive industry believe are critical, non-negotiable purchase criteria”.[8]

A further problem for OEMs is the diminishing brand loyalty associated with the sustainability consumer market; 97% of sustainability-minded consumers would happily switch brands in favour of a more sustainable vehicle.

What will connected vehicles mean for insurers?

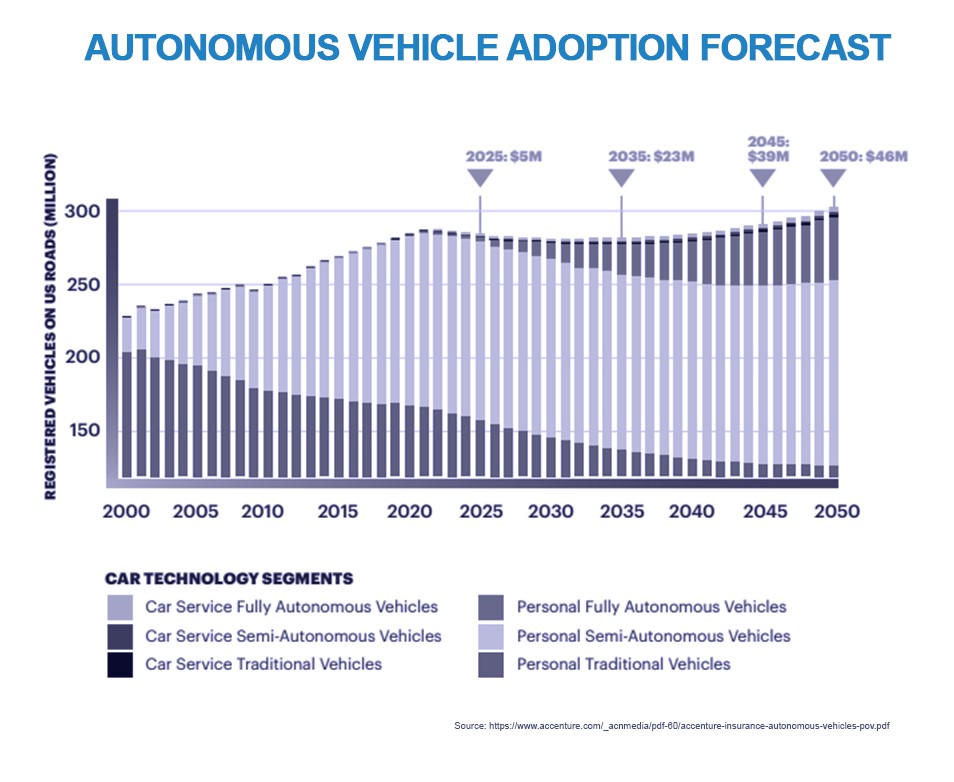

Under the assumption that increasing levels of connectivity will ultimately lead to widespread automation, what will the future look like for insurers?

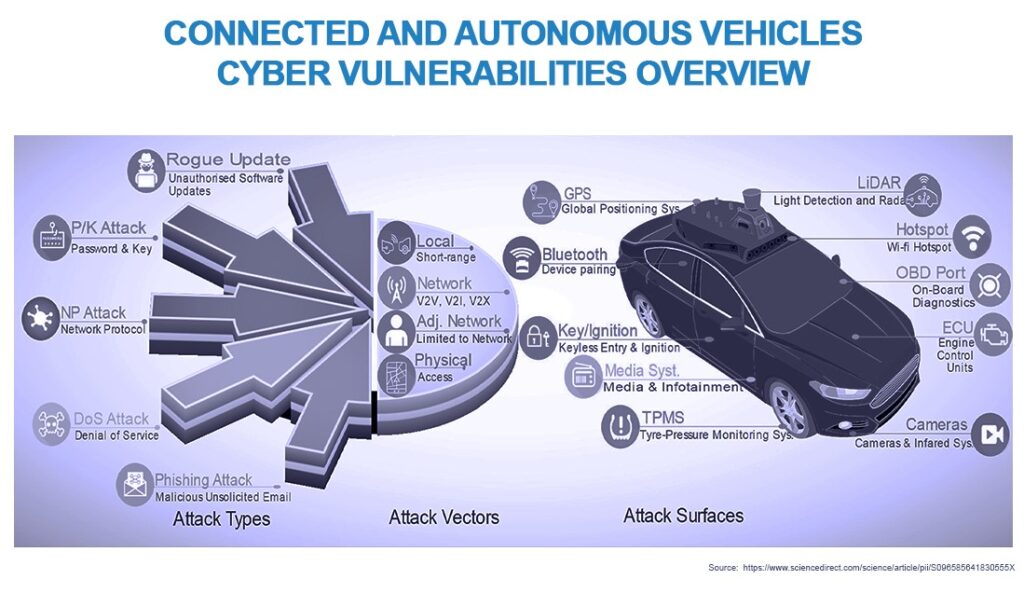

These radical changes are not without opportunity for insurers, and most of those, fall under the umbrella of just three categories; product liability, cyber security and infrastructure insurance.

Industry estimates suggest these three categories alone could deliver revenues of US$ 15 billion.[9]

- Product liability: With the opportunity for human error ostensibly ‘removed’ from the equation under full automation and connectivity, collisions will likely be the result of product and infrastructure failure. This, however, is more complex than it may sound; OEMs are unlikely to face liability alone, as tier 1 and tier 2 suppliers – those providing Edge, 5G and other safety-critical wireless technology – will require cover against catastrophic malfunction resulting from algorithm defects and software bugs, for example. In addition, hardware failures such as defects in radar and lidar – crucial to smart-transport systems – will require cover, whilst loss of vision in one or more on-board cameras also poses liability to providers.

- Cyber security: OEMs are likely to require insurance against passive and aggressive attacks, including criminal acts such as hacking and remote vehicle hijacking, as well as cyber ransomware. This threatens to hold connected vehicles hostage until a payment is made to unlock or unfreeze software. Worse still, appropriate cover for situations in which bad actors override safety systems to cause widespread damage or destruction to people or property will be crucial. Given the importance of personal information in subscription services and proof-of-identity situations, information and identity-theft cover will also feature heavily in future insurance services.

- Infrastructure insurance: Infrastructure insurance is likely to account for revenues in the region of US$ 500 million once adequate operational smart-city infrastructure is in place. A fixed connected-vehicle ecosystem, after all, could be liable for any connected-vehicle failures, and chief among them will be 5G and 6G Edge computing devices. These devices are critically important, because they overcome communications latency problems by processing safety-critical data in the required sub-1 millisecond reaction time needed to keep all users – inside and outside the vehicle – safe from harm.[10]

Changing risk

The prospect of a gradually changing transitionary landscape between human-driven and autonomous vehicles, where both coexist for some time, will raise challenging scenarios for insurers as they address completely new interaction risks, attempt to quantify them and price coverage accordingly.[11]

The most obvious scenario is that some form of hybrid policy cover will dominate over the coming decades. Technologies will evolve with uneven levels of adoption across society, and this is why various jurisdictions have been grappling with the thorny issue of assigning liability in the event of malfunction, damage and collision, especially when connected vehicles share the highways with older analogue models.

As technology evolution progresses over the course of the coming decades, OEMs and tier 1/ tier 2 providers will likely assume liability when a vehicle is driving autonomously, within manufacturers’ guidelines.[12] When it is fully or partially under human control, the owner will remain liable, as has been the case with traditional auto insurance.

Connectivity & automation is not terminal for insurers

More likely an evolution rather than a revolution, insurers will find opportunity in the emerging connected-vehicle market as that evolution progresses over the coming years.

With changing risk profiles, split liabilities and innovative models of ownership and subscription likely to emerge, the landscape will evolve way beyond traditional auto insurance, with greater levels of cover needed for more and more participants in the automotive supply chain.

What is clear is that substantial revenues will be available for insurers that prepare for this new model of auto insurance.

At JENOA we offer a range of Insurance solutions working hand in hand with insurers, reinsurers and distributors of the technology & vehicle. This ranges from Product Liability, Product Recall, Extended Warranty both for hybrid & electric vehicles and their battery. We are also worked directly with OEMs on developing telematics solutions for target geographical markets.

Our Auto affinity clients are based across Europe, Asia including China and also the Middle East.

Please get in touch with Brian Armstrong or Mahboob Khan, if you would like to discuss a bespoke solution for your business.

[1] https://www.mordorintelligence.com/industry-reports/connected-vehicle-market

[2] https://www.alliedmarketresearch.com/connected-car-market

[3] https://unece.org/sustainable-development/press/un-regulation-advanced-emergency-braking-systems-cars-significantly

[4] https://www.bmw.com/en/innovation/connected-car.html

[5] https://www.bmw.com/en/innovation/connected-car.html

[6] https://www.huawei.com/it/technology-insights/publications/winwin/plus-intelligence/in-safe-hands

[7] https://newsroom.accenture.com/news/two-thirds-of-consumers-are-sustainability-minded-drivers-accenture-report-finds.htm

[8] https://newsroom.accenture.com/news/two-thirds-of-consumers-are-sustainability-minded-drivers-accenture-report-finds.htm

[9] https://www.accenture.com/_acnmedia/pdf-60/accenture-insurance-autonomous-vehicles-pov.pdf

[10] https://www.huawei.com/uk/technology-insights/publications/winwin/plus-intelligence/in-safe-hands

[11] https://www.marshmclennan.com/insights/publications/2019/jul/the-autonomous-vehicle-revolution–how-insurance-must-adapt.html

[12] https://www.pinsentmasons.com/out-law/analysis/car-insurance-evolve-autonomous-vehicles