Connectivity is creating options for increasing levels of automation in mobility. Advanced Driver Assistance Systems (ADAS), such as emergency braking and lane departure warnings, have been available for years,[1] but as we move from assistance systems to automation systems, where will the next phase of connectivity and automation take us?

More importantly, what are the long-term implications of this evolution for the insurance industry? Here, we take a look at developments in autonomous vehicles, how they will affect auto-insurance and what insurers can do to keep pace and thrive.

Autonomous technology – the pace of evolution

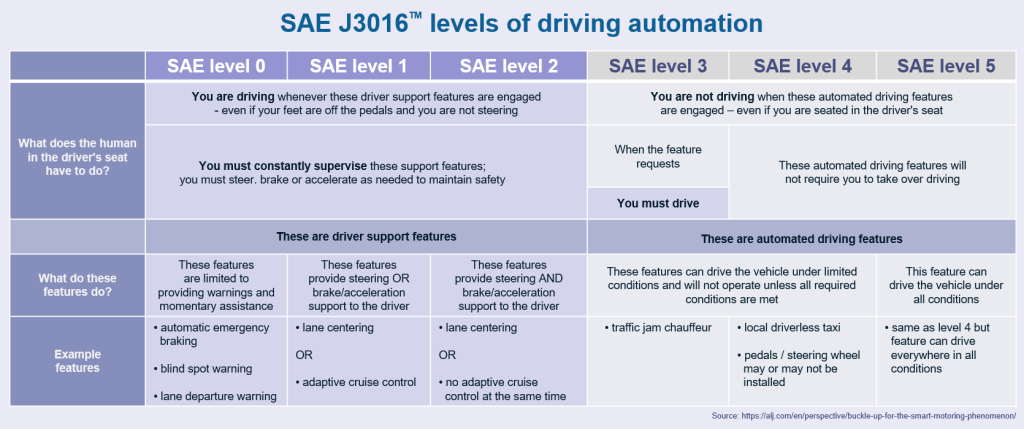

There are six levels of autonomous driving, from Level 0, at which the driver controls everything but can be given warnings and assistance, such as emergency braking, to Level 5, where the vehicle is completely self-driven in all conditions, offers no operator controls and, therefore, no option for human intervention.

Currently autonomous vehicles sit between Level 0 and Level 2, where at least two functions, such as cruise control or lane discipline, are automated but the driver must be prepared and capable to resume control if necessary. In the future, Level 3, described as ‘partial autonomy’, will relieve the driver of the need to monitor the vehicle, even if a driver is still required. Level 4 will be full autonomy but will allow for human intervention.[2]

Heavily restricted Level 3 capabilities are now permitted in certain jurisdictions. For example, automated lane-keeping systems are being permitted on UK roads, but their use is limited to 60 km/h or below, and on motorways only, with drivers required to stay alert and ready to resume control when prompted[3] by the vehicle or the environment. In other words, good for relieving the boredom of traffic jams but hardly what you would call ‘autonomous driving’.

Insurers and manufacturers will need to work closely with governments and others in the mobility sector to respond to the changing mobility landscape by introducing updated and appropriate regulatory requirements to support the use of autonomous vehicles. As things stand, regulatory progress is moving very slowly. In the UK, the Association of British Insurers’ (ABI) submission to the first Law Commission on automated vehicles stated that, “drivers should not be liable when the autonomous vehicle itself is in control”. It also expressed the opinion that any vehicle that required driver intervention in the event of an emergency should not be classified as an autonomous vehicle at all[4]. In Germany, for example, the 2017 Road Traffic Act does not currently allow for vehicles that do not have a steering wheel and control pedals.

Trials in controlled environments for further automation are already under way, but there are large technological and legal problems associated with the jump from Level 3 to Level 4. Each level up becomes exponentially harder, and Level 4 will require data processing power and redundancy way above those of lower automation levels – and way above the processing power of current production cars. Comparisons are often made to autopilot systems on aircraft, including common misconceptions about the number of human inputs required for these systems, their capabilities and the environments in which they operate.

The reality is that although an aircraft is more technically challenging than a car, the environment in which it operates is far less complex and random, given that aviation is highly regulated to accepted international standards. In many ways, flying is a highly sterile environment. Yet flying is still a highly fluid undertaking, with “automated” systems requiring constant human commands without having to react to dogs running into the path of a vehicle, bins being blown into the road by high winds, or the unpredictability of individual or herd human behavior. It is worth noting here that we have seen about fifty years of safe and elaborate automated aircraft systems in operation, but today 99% of all commercial jet landings are performed manually by a pilot.[5] Even that remaining 1% of auto-landings is limited to operating in winds of less than 46 kts,[6] and there is still no reliable automation available to perform an automatic take-off in modern aviation.

In the short to medium term, drivers will still need to be trained, qualified and fit to assume control whenever needed.

New ways of assessing risk

As more autonomous features gain legislative approval, situations in which autonomous features are in complete control will relieve drivers of responsibility for road safety. That may sound like a terrifying prospect, but Tesla estimates that road deaths could fall from one fatality per 100 million miles to one per 320 million miles under autonomous conditions.

It is, therefore, likely that more liability will be assumed by vehicle manufacturers and suppliers of the software, hardware and digital environment that drives them and keeps them safe. This will raise issues for auto insurers around the question of quantifying new risk and pricing coverage accordingly.[7] The likelihood is that, as these technologies evolve – and, crucially, evolve with uneven levels of adoption across society – some form of hybrid policy cover will dominate.

The challenge most jurisdictions have had to grapple with is assigning liability in the event of a collision. As the world transitions, it’s likely that manufacturers and/or software providers will assume liability when a vehicle is driving itself, within manufacturer’s guidelines. Whilst a vehicle is either fully or partially under the control of a human, however, the driver will still be liable, similar to traditional auto insurance policies. When automated technology is deployed within its recommended boundaries, liability is likely to shift to manufacturers.[8]

How will automation disruption affect auto insurers?

The Steven Institute of Technology in the US predicts that there will be as many as 23 million fully autonomous vehicles on US roads by 2035[9]. This will introduce levels of disruption never before seen in the automotive industry.

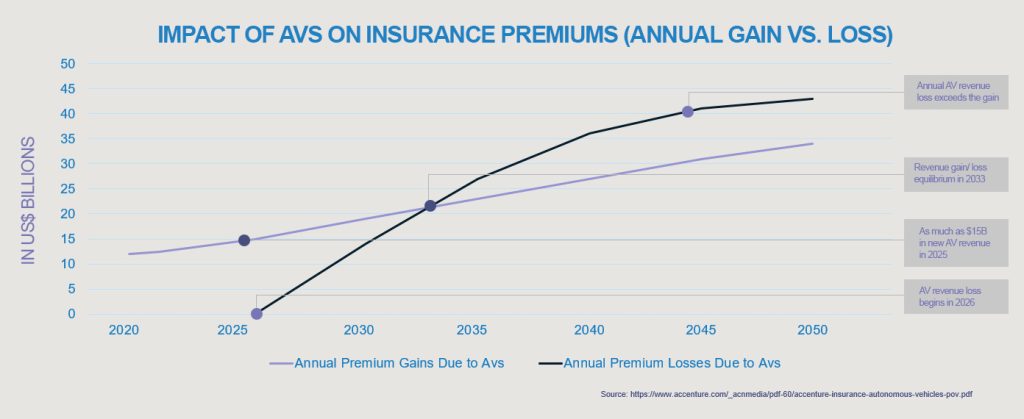

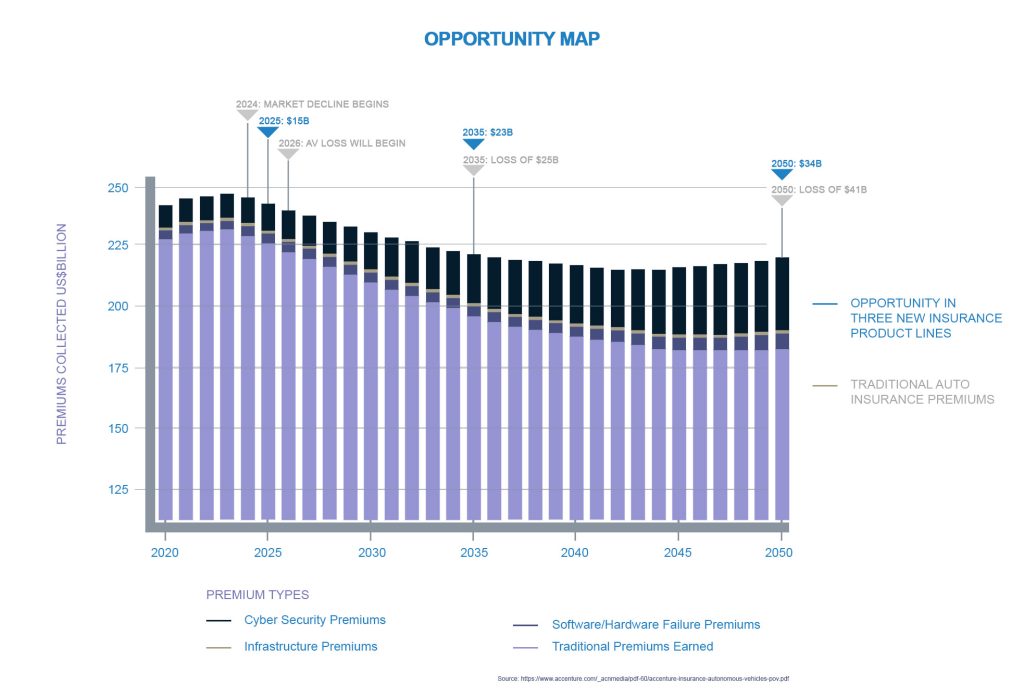

The revolution in mobility enabled by autonomous vehicles presents an existential risk to traditional insurance models, but that disruption is likely to be far from fatal. Although estimates imply that by 2035, the reduction in premiums could be as high as US$ 25 billion,[10] there are also significant opportunities associated with this mobility revolution.

As the switch to autonomous vehicles gathers pace, it could bring over US$ 80 billion in new premium revenue in the US alone. In addition, it could see claim frequency drop significantly when compared to claims for vehicles driven by humans, although this alone is unlikely to compensate for lost policy revenues[11].

In addition, as the landscape develops, so too will models of ownership. Some predict that the traditional owner/operator model will give way to manufacturer-owned vehicles or ride-sharing companies. That model will, in turn, mean that insurers will cover fewer but much larger individual risks in the form of entire products or services.

What should insurers be doing now?

The existential threat posed to traditional auto insurers is reason enough to start planning now for a very different landscape in the medium term. There are four specific areas on which insurers should be concentrating.

- Update actuarial modelling processes: Adapt existing modelling to reflect the evolution of autonomous motoring and the various levels of automation as they are tested and approved by law. Insurers should layer up their modelling techniques so that they are ready for each new level of autonomy as it comes, especially where the full Level 3 and beyond is widely adopted. This is both a local and global challenge; behavioural and traffic density data, for example, is liable to be localised, so the modelling processes will need to take account of possible silo-ing.

- Make friends in the partner ecosystem: We have already mentioned how the connected vehicle ecosystem, essential for autonomous mobility, will rely on a range of providers for software, hardware, broadband and 5G, as well as edge and cloud computing. Start mapping out the partnerships and relationships that are essential for you to access data, both for claims and for the ability to analyse claims data for pricing policies. This also presents opportunities for new product development covering infrastructure such as charging stations.

- Invest in big data and analytics expertise: Data is power and the quality of access to data generated by autonomous vehicles and the connected vehicle ecosystem will depend on partnerships that insurers make now. The industry will need access in order to analyse vehicle data and, although ownership will rest with the vehicles and ecosystem communications that generate it, mutually beneficial partnerships are worth establishing to avoid long struggles for control.

- Develop new business models: In the past, traditional auto insurers have generated revenue from large numbers of personal auto policies. Automation will see liability shift away from the owner/driver completely; therefore, hundreds of auto insurers will give way to just a small number of large commercial carriers and the survivors will have to pivot to become large insurers writing policies on small numbers of very large risks. The transition period will be, however, be important for insurers, as customers’ product needs will likely vary according to their phase of evolution. Insurers should start planning and developing models for technology-driven risks such as cyber security (see below) that simply don’t feature in existing road-going vehicles.

Where will the survivors’ revenue come from?

Once you have engineered human error out of motoring you can be forgiven for thinking you have removed risk from insurance. There are, however, plenty of risks, even after removing the human element. These opportunities come in three main categories: cyber security, product liability and infrastructure. In a recent Accenture report it is estimated that these three together could produce revenues of US$ 15 billion.[12]

- Product liability: When you remove human error, any collisions are, by definition, down to product failure. Liability, however, will not be exclusively limited to manufacturers; risk will need to be covered for all the tier 1 and tier 2 suppliers to insure against the malfunction of internet and 5G connections, software bugs, system memory overflows or failures and algorithm defects. In addition, hardware failures covering sensor and circuit failures, defects in radar and lidar, as well as loss of vision in one or more on-board cameras all pose some liability to providers and will, therefore, require cover.

- Cyber security: Insurers will need to cover vehicle theft and cyber ransomware. The latter threatens to hold connected vehicles hostage until a payment is made to unlock or unfreeze software. It is likely that manufacturers will also demand insurance against criminal acts, such as hacking and remote vehicle hijack.

In addition, because all systems will be reliant on personal information – from owner proof of identity to subscription services – coverage for identity theft and the theft and misuse of personal information will be paramount.

- Infrastructure: Everything that is fixed within a modern digital urban landscape that manages, drives and assists connected autonomous mobility could be liable for autonomous vehicle failure. These liabilities include cloud computing server malfunction, as well as system level communications problems and 5G edge computing devices that overcome latency problems by processing safety-critical data in less than a millisecond[13]. It is estimated that infrastructure insurance could offer revenues of some US$ 500 million.

Do not sit back and relax

The landscape for insurers in a future autonomous world is almost unrecognisable from the traditional auto insurer model. The disruption automation will cause, however, is not terminal for insurers who are ahead of the game.

The reward? A new model of auto insurance that can offer substantial revenues as liabilities shift from insuring individuals to covering entire products and services.

[1] https://www.thatcham.org/what-we-do/car-safety/autonomous-emergency-braking/

[2] https://www.accenture.com/_acnmedia/pdf-60/accenture-insurance-autonomous-vehicles-pov.pdf and https://alj.com/en/perspective/buckle-up-for-the-smart-motoring-phenomenon

[3] https://www.bbc.co.uk/news/technology-56906145

[4] https://www.pinsentmasons.com/out-law/analysis/car-insurance-evolve-autonomous-vehicles

[5] https://ec.europa.eu/research-and-innovation/en/horizon-magazine/few-aeroplanes-land-automatically-new-systems-could-make-norm

[6] https://ec.europa.eu/research-and-innovation/en/horizon-magazine/few-aeroplanes-land-automatically-new-systems-could-make-norm

[7] https://www.marshmclennan.com/insights/publications/2019/jul/the-autonomous-vehicle-revolution–how-insurance-must-adapt.html

[8] https://www.pinsentmasons.com/out-law/analysis/car-insurance-evolve-autonomous-vehicles

[9] https://www.accenture.com/_acnmedia/pdf-60/accenture-insurance-autonomous-vehicles-pov.pdf

[10] https://www.accenture.com/_acnmedia/pdf-60/accenture-insurance-autonomous-vehicles-pov.pd

[11] https://www.accenture.com/_acnmedia/pdf-60/accenture-insurance-autonomous-vehicles-pov.pd

[12] https://www.accenture.com/_acnmedia/pdf-60/accenture-insurance-autonomous-vehicles-pov.pdf

[13] https://www.huawei.com/uk/technology-insights/publications/winwin/plus-intelligence/in-safe-hands